This topic will be focused on gathering insights and developments about automotive used car prices in the short and long term that can help us create and incorporate better inputs into the valuation models.

Q2 2024 Cox Automotive Insights into Used Car Market and Prices in the US

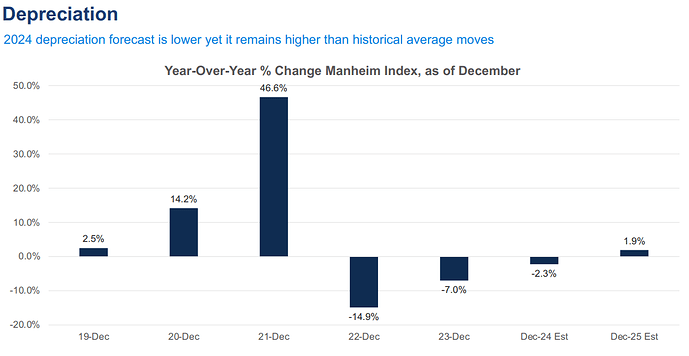

@Aron Cox now expects a 2.3% decline in used car price index in 2024, vs their forecast of -0.7% at the end of Q1.

They started the year forecasting a 0.5% increase, so deterioration has continued to worsen in Q2 2024.

Used car price index declined by -3.44% in Q2 2024 vs -0.45% in Q1 2024.

They expect however about a 1% increase in the second half of 2024 and a 1.9% increase on 2025.

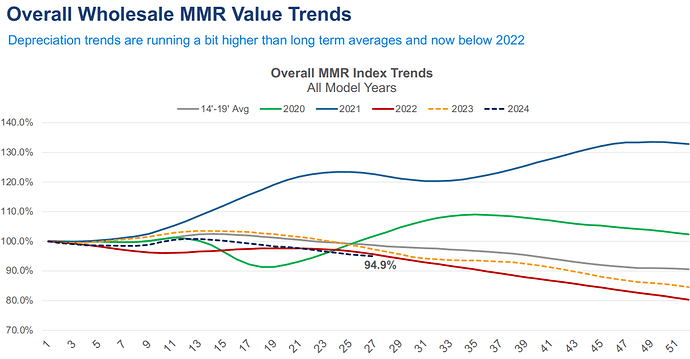

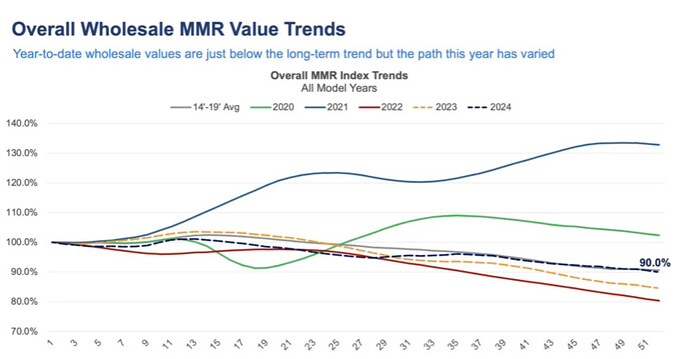

Overall wholesale values (1 to 10 years olds) have fallen 5.1% during 2023, 2.3 points lower than last year, and 3.8 below 2014-2019 averages. Value depreciation has flattened at the end of June according to Cox.

- Values for 1-year-olds have fallen the most by 5.9% during 2024, due to new vehicle supply increases. Values are at $36.4K, 11% lower than 2023, but still way higher than 2019.

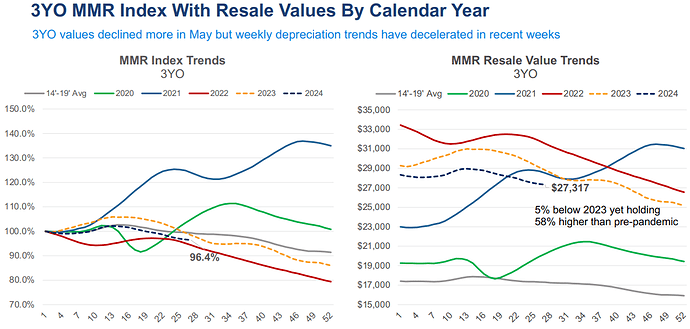

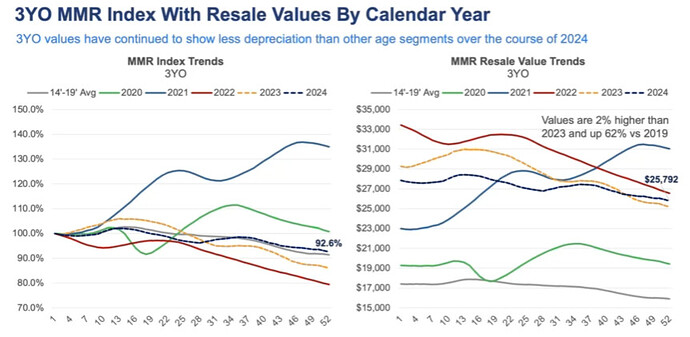

- 3 years old values declined only by 3.6% during 2024, at $27.3K there are 5% below 2023 values.

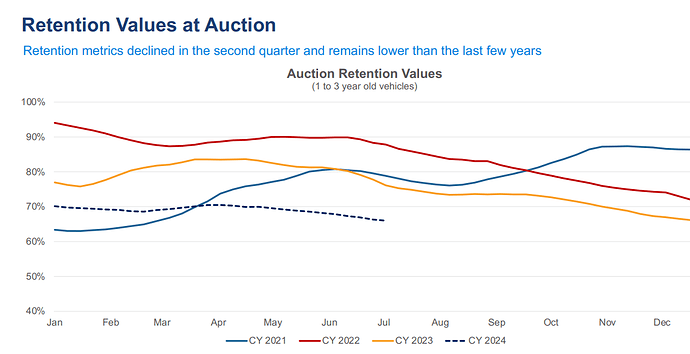

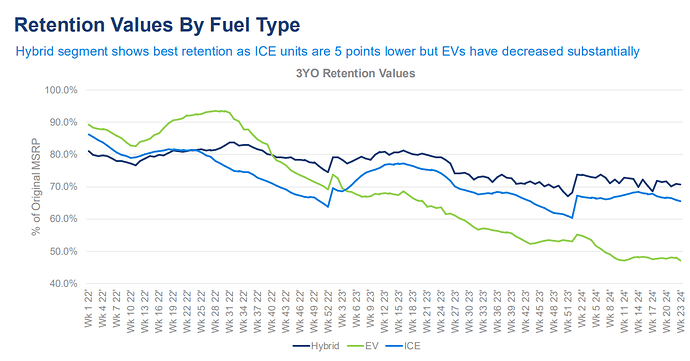

Retention values (% remaining of original MRSP) for 1-3 years old haven to 66% in the 1H2024.

- Q2 declined by 4% vs a flat Q1, a bit higher than normal for this part of the year.

- Hybrids hold value better than ICE units, and EVs underperform both types.

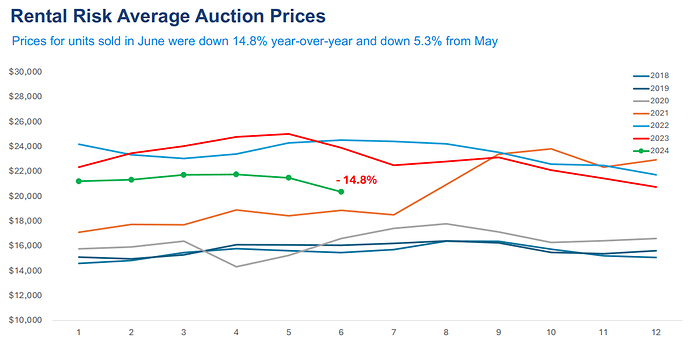

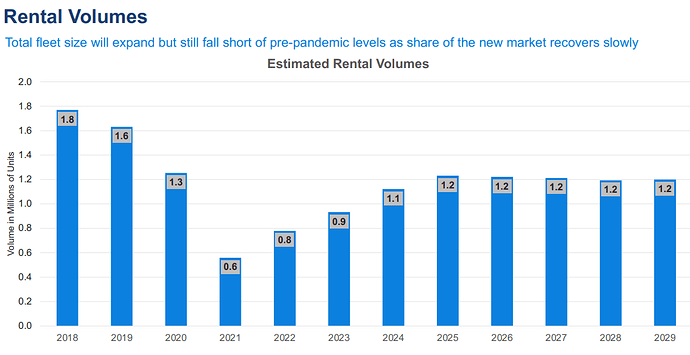

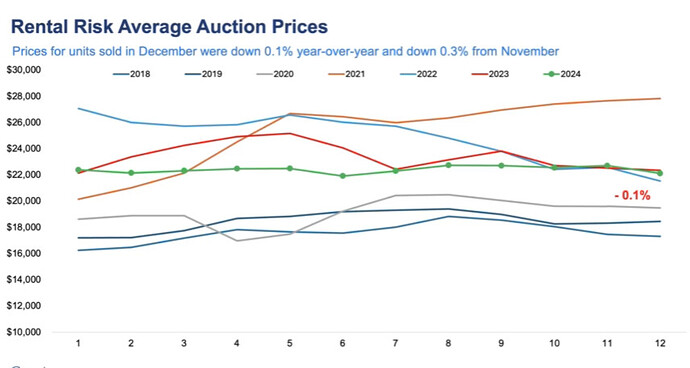

Auction prices for rental units have been trending down during the year, and accelerate during June, with al most 15% Y/Y as of June

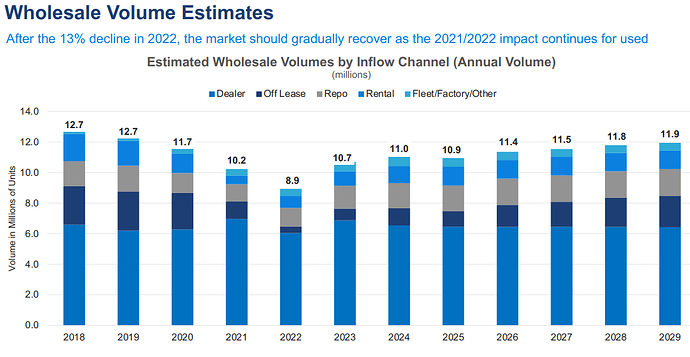

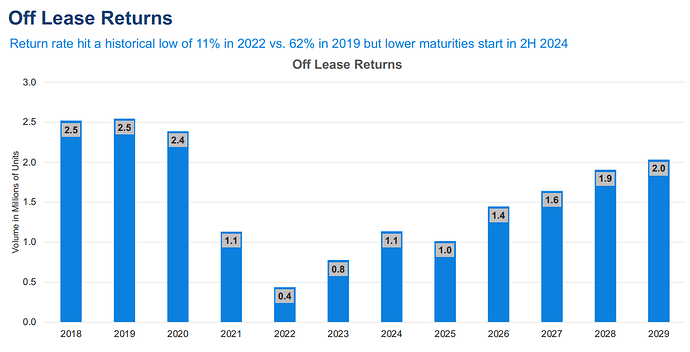

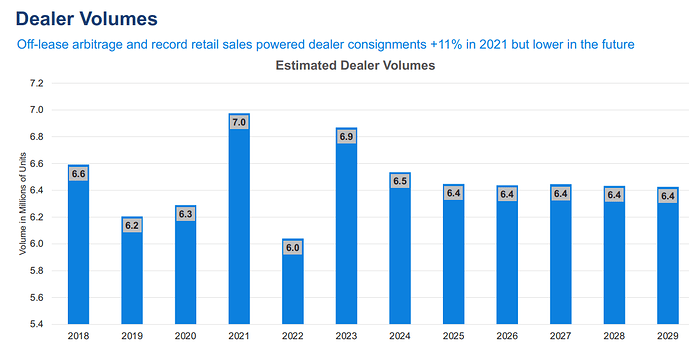

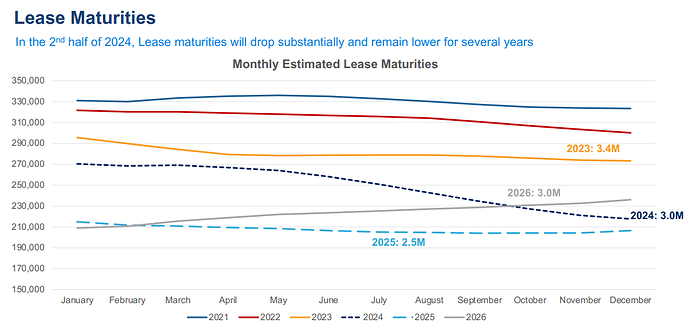

Supply for the used vehicle market is expected to remain tight for the next few years, not returning to the 2019 levels.

Lower leased maturities will play a key role in this.

Why do they expect prices of used car to rise in h2 2024 and 2025? Do they name reasons why they think the used car markets will stay tight?

Do you know how important in numbers lower lease maturities are? (From the Off Lease Returns Chart it’s not clear how much of the trajectory is coming from return rate vs lower maturities)

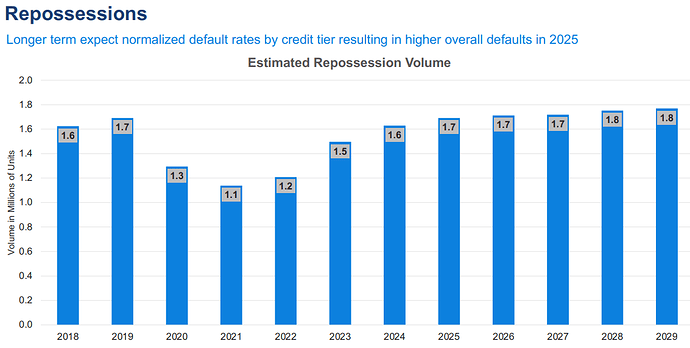

Ps: Not extremely important topic: According to your chart it appears repos have been lower then usual as recent as 2023. Do you trust Cox data more by now or do you still believe that someone like Lucky might have a good point? If there was an problem in the repo market we would see that with other data like e.g. rising supply of used cars, correct?

Regarding prices, they didn’t provide many reasons, mainly citing tight supply and a return to normal price trends.

For the second half of 2024, they mentioned that they started to see some flattening at the end of June, and that historically this period sees an increase of about 1%, so to be taken with a bit of skepticism.

They also indicated that the market is expected to return to more normal or average movements, with a historical annual increase of 2.3%, so 2025 would still be below average.

Cox has consistently understated the decline recently, so it would be prudent to use or think about more conservative numbers.

About the tight supply, the main reasons include the shortage of new vehicles, lower sales of new vehicles, and reduced leased penetration rates in 2021/2022. These factors will continue to impact the supply of used vehicles for some more years.

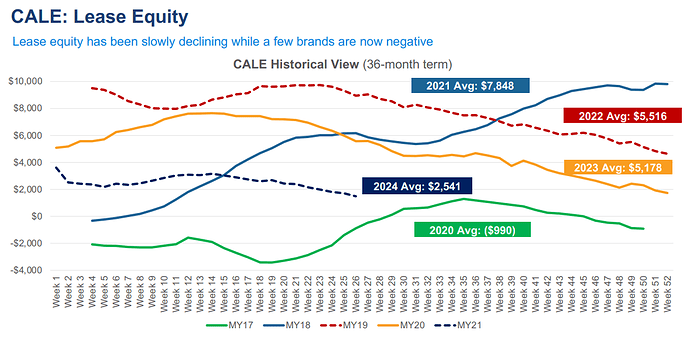

The decline in lease returns until now has primarily been due to the drop in return rates, which fell from 62% to 11% in 2022. They anticipate lease return rates to rise, they were 23% in 2023, as lease equity returns to normal.

However, they now expect lease maturities to be significantly lower, starting in the second half of 2024, with a projected decline of 11% in 2024 and 17% in 2025, before beginning to rebound in 2026.

Although lease penetration levels are increasing, they remain below historical averages, and maturities are not expected to reach 2020 levels even by 2027.

I haven’t done any analysis on repossessions to know for sure.

However, I don’t trust Cox’s forecasts much, as I believe currently they tend to be optimistic. Since repossessions make up only a small portion of the supply, I don’t think they are very relevant to the overall supply situation. To be fair, Cox did mention that their outlook could change if there is a significant economic shock.

Thank you. Good overview of the topics and good context of Cox projections. Do you believe by now their methodologies and raw data itself is largely accurate and trustworthy or are you still skeptical about that?

I still have a level of distrust and skepticism toward Cox Automotive due to its potential self-interest in presenting biased reports or outlooks. They might have incentives to report more favorable numbers or outlooks, downplay or even hide issues going under the surface because of the nature of their business. They are a major player in most parts of the industry, and they know they have influence.

Their past forecasts have often been inaccurate, they have been consistently downplaying the decline in prices.

They only frequently report that the decline was more significant than they anticipated, but express optimism that the situation will improve moving forward.

However, I don’t have any knowledge about their methodology (don’t know if it’s even available), I just know they use their own systems to create the data and insights. So I can’t really judge how good of a job they do or not.

Unfortunately, there are no other institutions providing research at the same level of detail in the automotive industry for comparison. Thus, we must rely on Cox Automotive’s insights and hope their reports are reasonably accurate. Because is not that I think that they report completely incorrect numbers, I am more skeptical about whether they fully disclose issues as they arise.

Q2 2024 European Used Car Prices

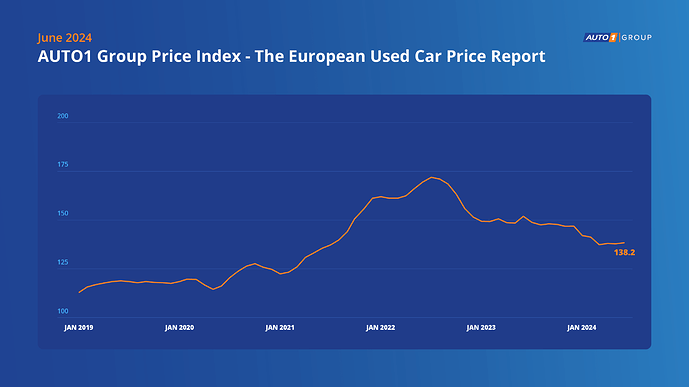

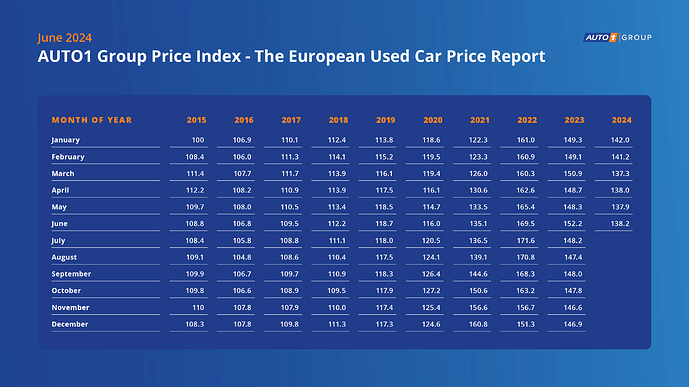

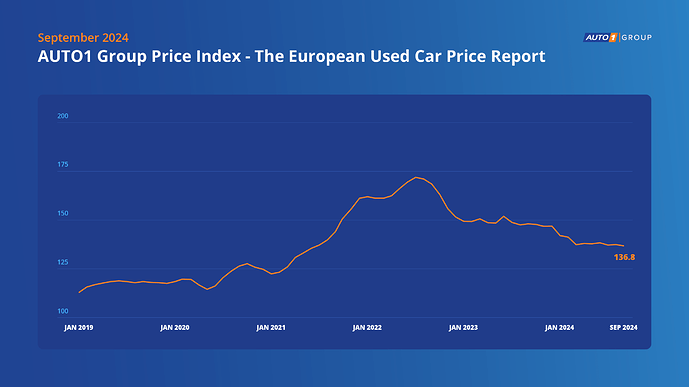

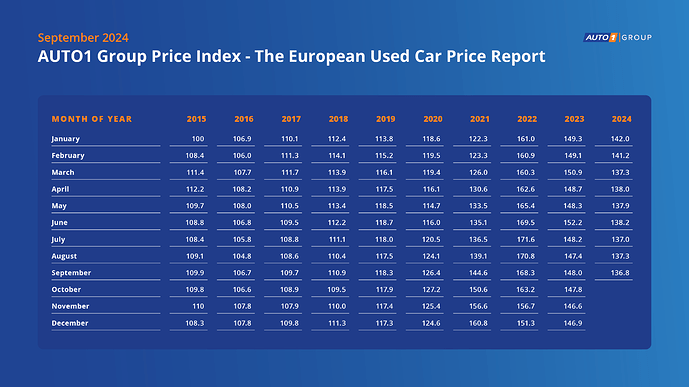

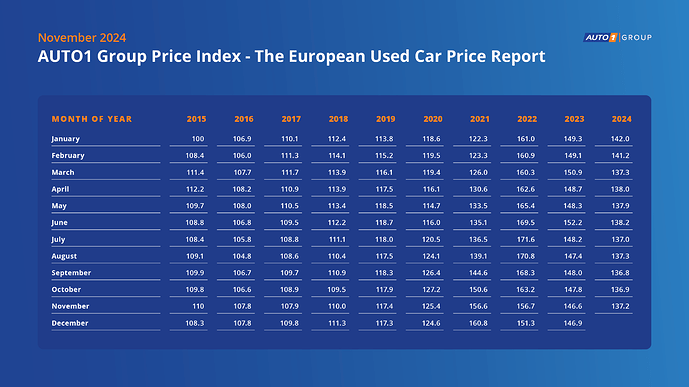

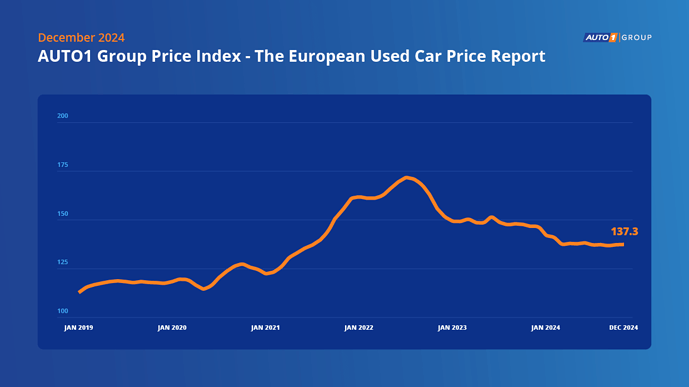

Y/Y used prices continue to show a decline, with used car prices falling by 9.2 % from June 2023 (152.2) to June this year (138.2), according to AUTO1 index.

- Q2 2024 increased by 0.65% Q/Q vs -6.53 in Q1 2024.

- Year-to-date, the index moved from 142.0 in January to 138.2 in June, reflecting a 2.7 % decrease, and a -5.92% from December level.

- Used car prices are still 16.6 % higher than before the COVID-pandemic, measured in June 2019 when the index was 118.7.

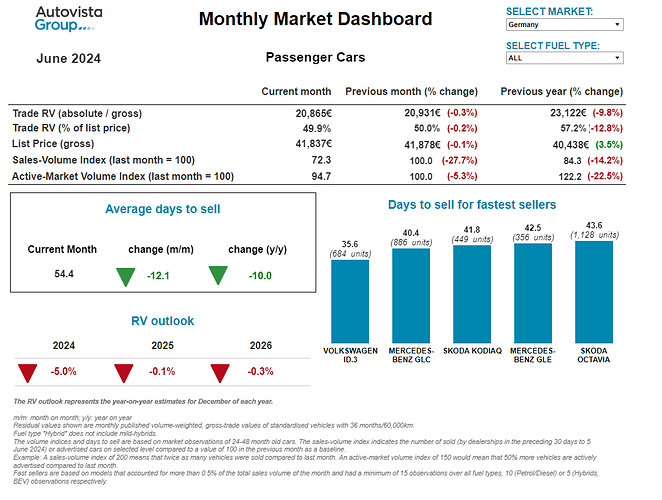

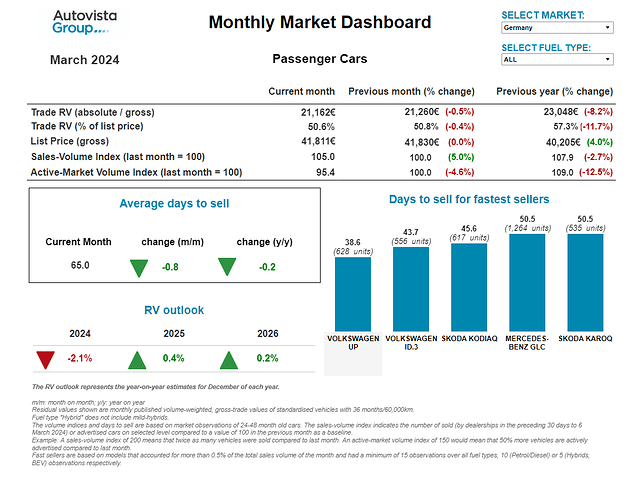

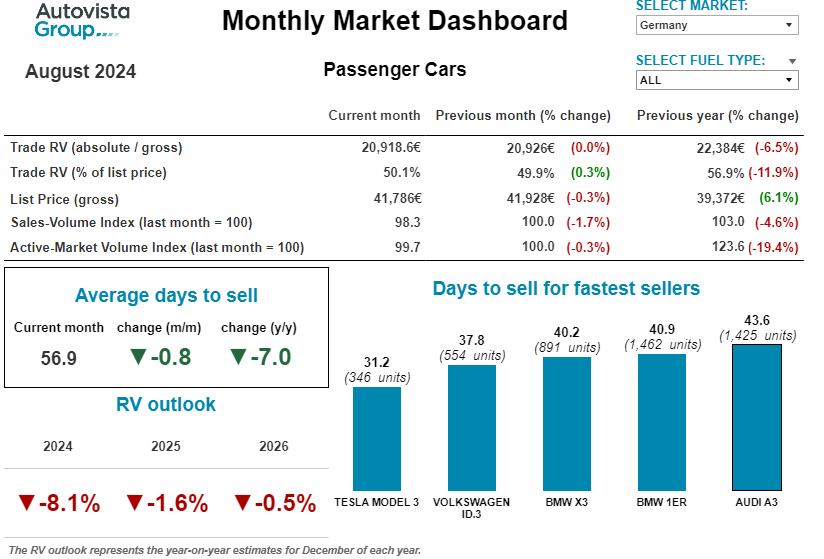

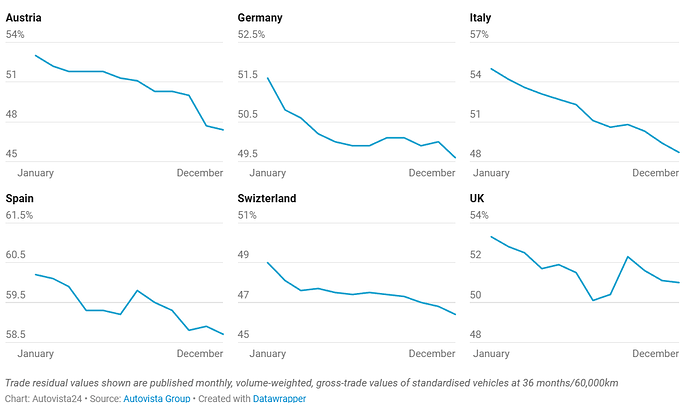

Residual values, according to Autovista Group (part of J.D. Power), continue to decline.

- In June, the average value of a three-year-old car at 60,000km, presented as a percentage of retained list price (%RVs), fell to its lowest point so far in 2024. Year-on-year %RV declines ranged between 3.1 percentage points (pp) and 12.4pp across Austria, Germany, Italy, Spain, Switzerland and the UK.

- A drop in demand compared to May hindered sales, as highlighted by the sales-volume index (SVI). This overall slump was compounded by a poor BEV performance across major European used-car markets.

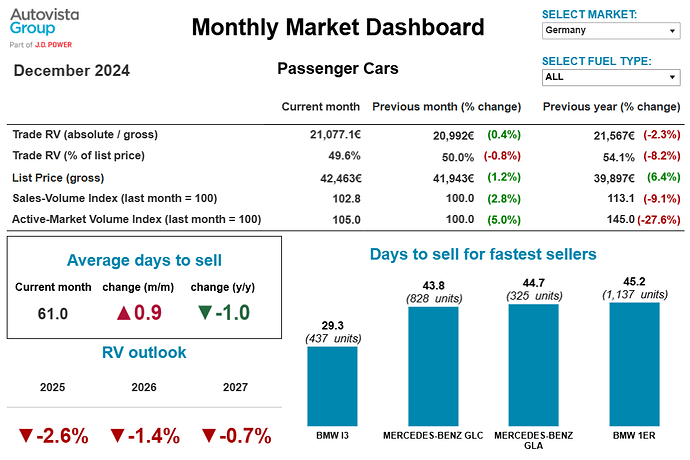

Interactive Dashboard for major markets here. @Aron, I think could be useful to you since is also reported by fuel type, and include forecasts. Is the first time I have encountered this data, so don’t have an indication of how trustworthy/useful could be or not.

But compared to the US, Germany’s residual values significant decline Y/Y, is in line with what the US market is seeing in 2024 too, with EVs underperforming most segments.

I am including here only Germany example (all fuel types), showing a 9.8% Y/Y decline in residual values (-16% EVs, -5.5% ICEs) and a decline in forecasts from March to June 2024.

According to Autoscout24, used car prices in Germany fell by 0.1% month-over-month in July after growing by 0.2% in June.

@Aron is this Germany only or all of Europe?

That’s for Germany only

Q3 2024 Used Car Pricing Update

As of Q3 2024, I still expect a more stable pricing environment for used car prices in the next two years at least, in both US and Europe, these are some of my reasons:

- There will be a shortage of used vehicles, particularly younger, high-quality models, due to the underproduction of new cars 2-3 years ago.

- The number of returned leased vehicles will significantly decrease between the end of 2024 and 2026.

- The average age of used cars on the market is increasing, which places additional pressure on the availability of younger, low-mileage vehicles.

- Negative equity is rising among consumers, particularly those who purchased cars at a premium 2-3 years ago. This limits their ability to trade in their vehicles, further constraining the supply of younger used cars.

- Given the high price of new vehicles and consumer affordability issues, more buyers may opt for used cars instead of new ones.

- Given that prices remain elevated compared to 2019 levels, interest rates are higher, and consumer strength has weakened since 2021/2022, I don’t anticipate that the undersupply will lead to further significant price increases, but rather to a more balanced and stable market environment

The main risks to my expectations are:

- A much sharper-than-expected economic downturn could impair consumers’ ability to purchase both new and used vehicles

- A higher-than-expected default rate and repo rates could increase supply more than expected, pressuring prices down.

- Geopolitical issues significantly impacting supply chains again.

USA Q3 report

Cox report notes:

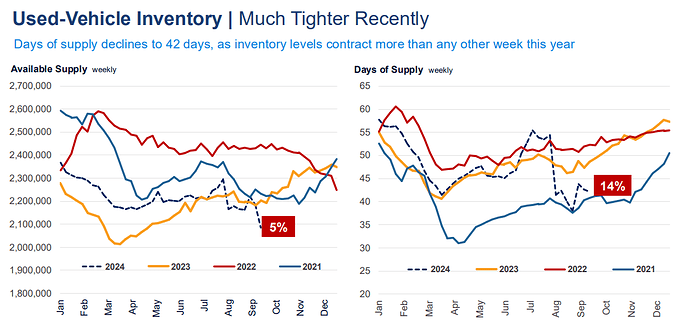

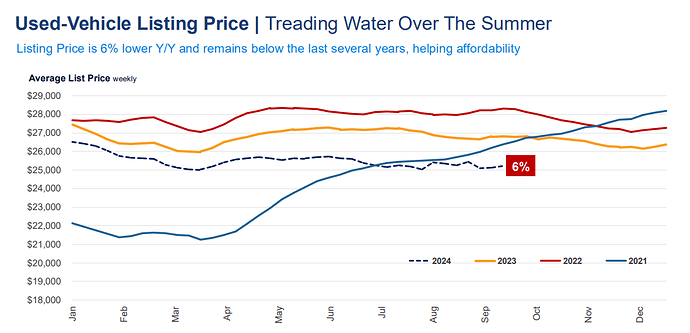

- Undersupply of used inventory will continue due to a decline in off-lease maturities, which will keep prices more stable

- Used inventory down 5% Y/Y, and used days supply inventory at 42 days, very low at 2021 levels (-14% Y/Y)

- Cox is forecasting now only a -0.6% Y/Y for 2024 since Q3 2023 saw more stability in pricing, they probably expect some for upside in the reminder of the year.

- Prices have increased since June 2023, and the pace of decline Y/Y is softening

- Used sales still 3% YTD

Europe Q3 report

According to AUTO1, European used car prices have been stabilizing since march 2024.

- Year-to-date, the index has decreased from 142.0 in January to 136.8 in September, reflecting a 3.7 % decline.

- On a year-over-year basis, used car prices have dropped by 7.6 % from September 2023 to September this year.

Autovista Group, sees a more stable environment for residual values in 2024 and 2025

- Germany’s Sales index dropped by 1.7% month on month and 4.6% year on year.

- Active market volume index of two-to-four-year-old passenger cars decreased by 0.3% compared to July. However, this means that the supply volume of passenger cars in this age bracket dropped by 19.4% compared to the previous year.

‘Despite weaker demand, the average RV of a 36-month-old car remained rather stable. On average, models had a %RV of 50.1%. This equated to a marginal month-on-month increase of 0.2pp, but a considerable decline of 6.8pp year-on-year, showing that pressure on RVs is increasing,’ said Madas.

‘As demand weakens and supply persists, RVs can be expected to come under even more pressure. This year, %RVs are expected to fall further, dropping by 8.1% when compared with December 2023. In 2025 and 2026, %RVs are expected to experience a marginal decrease,’ he forecast.

Q2 2024 Insights about Used Vehicle Depreciation from Car Rental Companies

Hertz

Hertz’s strategic focus on fleet rotation is directly aimed at mitigating high depreciation costs incurred from purchasing vehicles at inflated prices during the pandemic. The company expects significant improvements in its depreciation expenses by 2026, with fleet optimization playing a critical role in overall cost management and operational efficiency

- North Star DPU metric of the low $300 range

- The deals we are consummating today for vehicles to be delivered later this year and into 2025 have DPU rates below $325

- By early 2026, we expect average depreciation per unit, or DPU, in the low 300s per month

- We expect that the fleet refresh will push through a little more than $1 billion of non-cash depreciation through the P&L from Q3 of this year through probably the end of 2025

AVIS

- Exited approximately 70% of our anticipated full-year fleet sales by May. This aggressive fleet reduction will help mitigate depreciation pressures.

- Straight-line depreciation increased from approximately $280 per unit per month to nearly $330 with U.S. rental car being within our previous call guidance

- Believe, over time, our depreciation rate will begin to normalize as we sell the higher-priced vehicles and replenish them with the new lower-priced vehicles

- Avis expects the total company net depreciation per unit per month to approximate $350 for the remainder of the year

Cool insights, thank you. I especially liked how detailed your reasoning behind your used car price expectations is.

November 2024 Used Vehicle Pricing Update

US

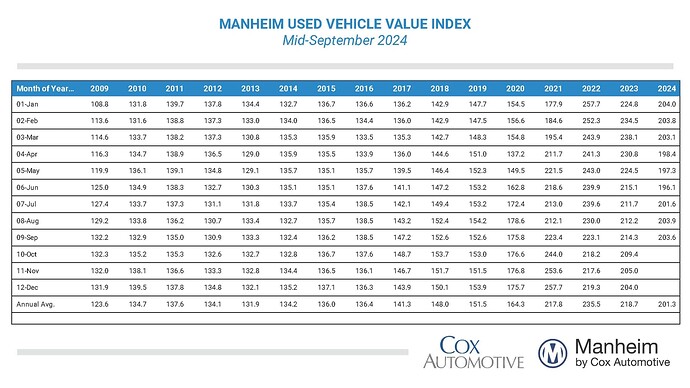

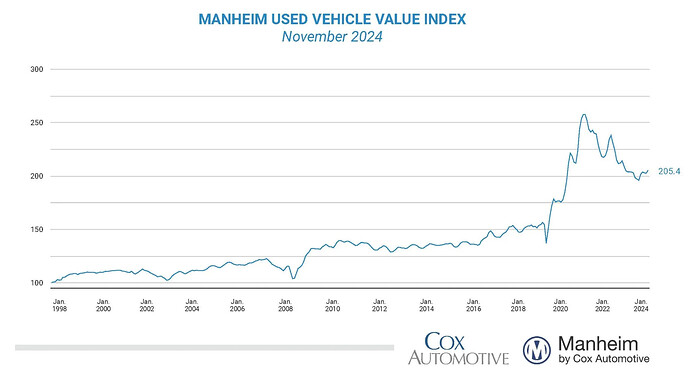

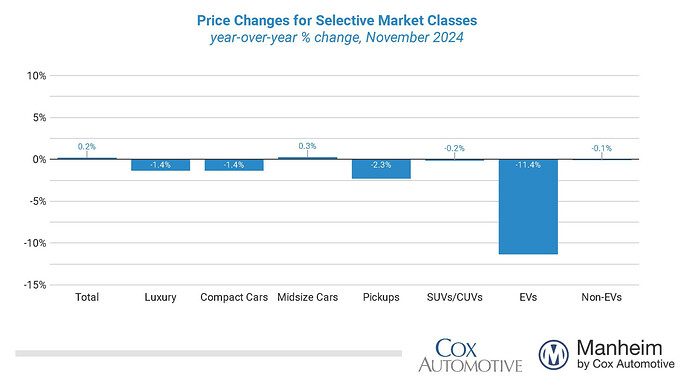

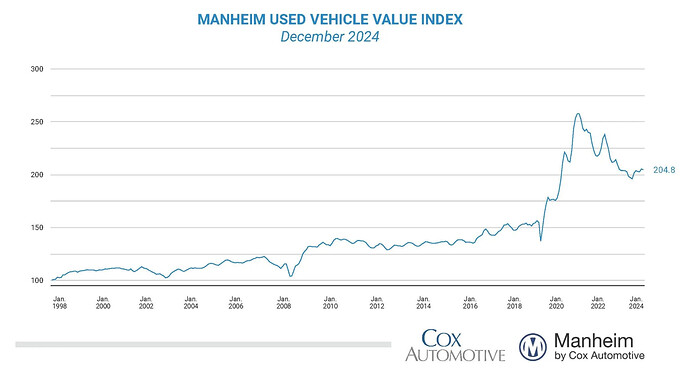

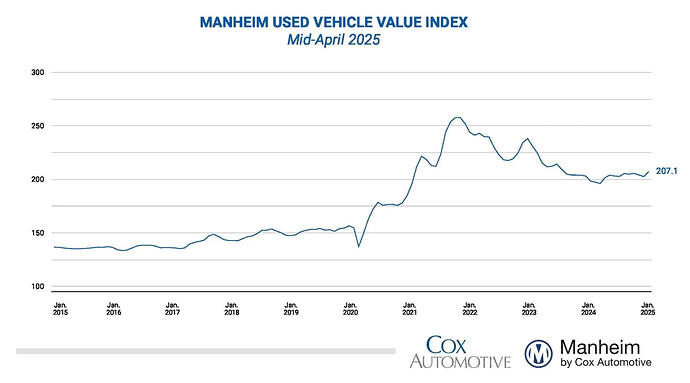

The Manheim Used Vehicle Value Index (MUVVI) rose to 205.4, an increase of 0.2% from a year ago.

- Over the past four weeks, the Three-Year-Old Index fell 0.9%. This decline is milder than the 1.2% average decrease seen during the same period from 2014–2019, particularly earlier in the month.

- The average price for rental risk units sold at auction in November increased 0.8% year over year. Rental risk prices also rose by 0.7% compared to October.

Europe

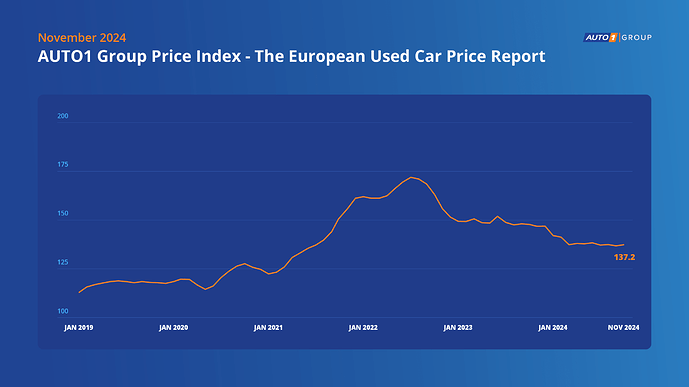

The AUTO1 Group Price Index indicates that used car prices remained stable in November 2024, with the index moving slightly from 136.9 in October to 137.2 in November, reflecting a minimal rise of 0.2 %.

- On a year-over-year basis, used car prices have dropped by 6.4%

- Year-to-date, the index has decreased from 142.0 in January to 137.2 in November, reflecting a 3.4 % decline.

Q4 2024 Used Vehicle Pricing Update

United States

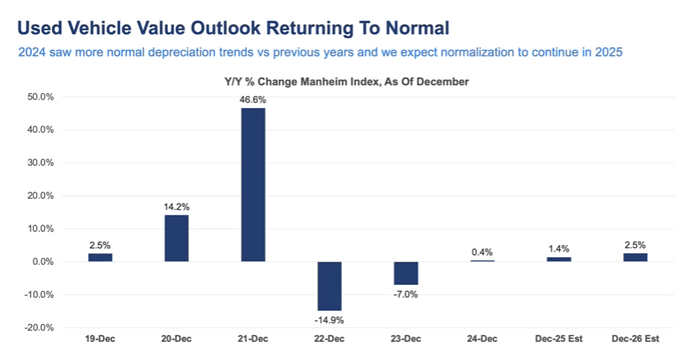

Used Car Prices have stabilized and even increased since the second half of 2024 (4.44% since June). My latest assessment for a more stable and normal environment for the next few years is playing out as expected and has not changed since then.

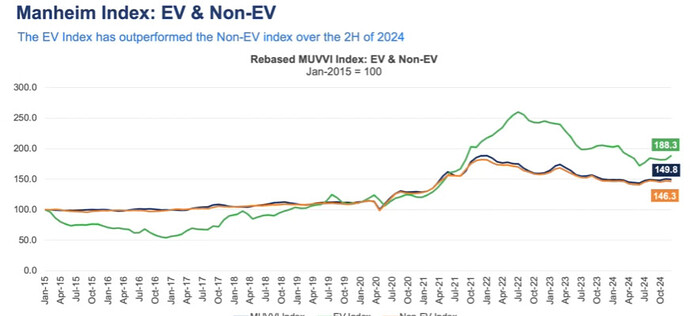

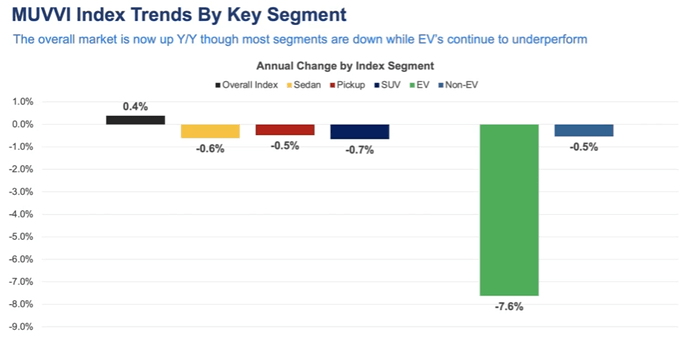

The Manheim Index ended the year up 0.4% from last year, below the long-term average increase of 2.3%.

- EV used values may have found a bottom, 2H 2024 increased by 9.4% vs 4% non-Evs.

Cox expects a 1.4% increase in 2025 and 2.4% in 2026.

Inventories ended the year at 10.2% y/y, and sales 13% y/y.

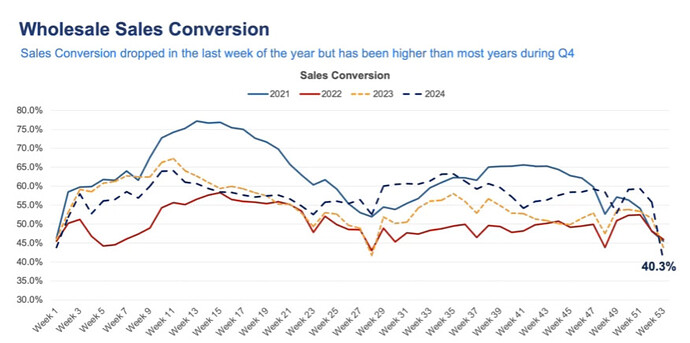

- Sales conversion increased in 2H2024, indicating buyers are now more willing to pay the prices offered

1-10 years old units depreciated by 10%, only 1 point above long-term average

- 3-year units depreciated by 7.4%, ended the year a point higher than what is normal

- Rental Prices were down 3% q/q, but December ended only down-0.1 y/y

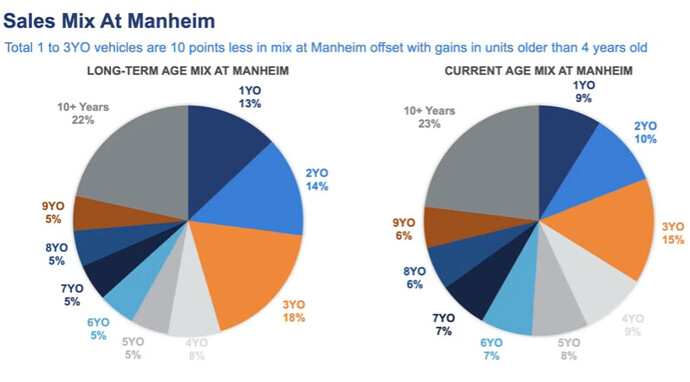

- Younger vehicle share has declined due to the shortage 3 years ago

Europe

Compared to December 2023, used car transaction prices dropped 6.5% in December 2024. Despite this decline, they remain 17.1% higher than pre-COVID levels (December 2019 index: 117.3).

- Used car prices decreased by 3.3% throughout 2024 (from 142.0 in January to 137.3 in December). They have remained mostly stable all of 2024.

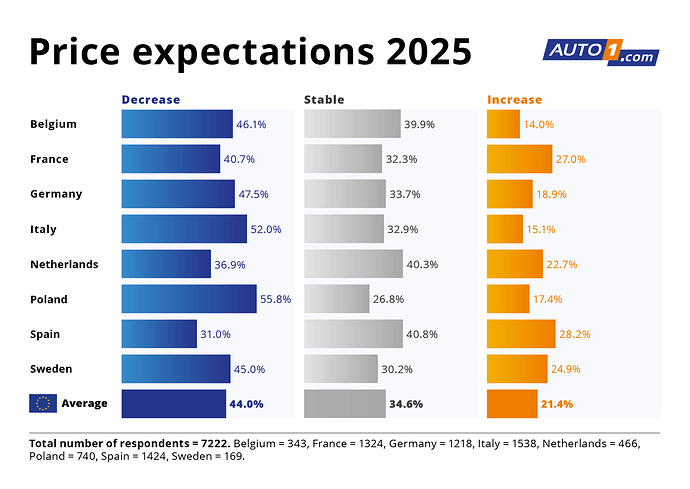

44.0% of survey respondents expect used car prices to continue declining in 2025, this figure is down from 56.9% the previous year

- Over 34.6% of dealers now believe prices will remain stable, and more than 21% expect them to rise—both figures marking a more optimistic outlook compared to last year.

- The majority of dealers (58.3%) view current prices as neutral for their operations. Marginally lower prices have improved consumer affordability, driving increased market activity.

After inflated RVs in 2021-2022 and the start of stabilization in 2023-2024, RVs are forecasted to continue declining but at a slower pace. This decline is a correction toward pre-pandemic norms, driven by increased supply and moderated demand.

- RVs in countries like Germany (-2.65), Italy (-3.7%), and France (-2.9%) are expected to see sharper declines in 2025 than markets like the UK (-1%) and Spain (-1.4), where values may remain comparatively resilient due to structural factors like stronger demand or unique supply challenges.

@Magaly I think if auto tariffs come through this should have an positive effect on used car prices in the United States and this could be a good aspect for Sixt. (It will also have a negative affect for new cars that Sixt needs to buy). Do you think this would likely happen? If yes tag Aron after your research and then let me know your final findings or recommendation. (As always: If substantial I might want to change my position)

Note: In general it is always good if you and Aron always start to think about those kind of portfolio impacts, research & model them and then issue your recommendations to me.

I have already thought about it, just not the time to work on it yet, and have not seen much about used prices yet either. But my guess is also that there will be some substitution for used cars also.

I also thought about that fact that Automobile industry in usually a significant part on ad spending, and it could have implications on it also. Which I also have not worked much either

Auto Tariffs Could Increased Used Prices by 2.8% y/y, according to Cox

- Consumers will get priced out of new vehicles and must trade down to used vehicles, which puts more upward pressure on the value of used vehicles.

- If we see higher used values, that will raise the value equation (higher Cox Automotive Lease Equity or CALE) of off-lease units – which are already in short supply – and even less of them could come back to the used-vehicle supply chain.

- Used car prices has decreased ~2% in Q1 2025, so the increased in expected to come on later quarters

“Tariffs are likely to be fairly inflationary for used vehicles. Our initial estimates on wholesale values could rise 2.2% this year (using a blend of our scenario outcomes) but may not rise quite as fast in 2026. However, there’s likely more inflationary pressure this year as consumers trade down, so it’s possible that values end up rising 2.8% year over year by the end of December (all else being equal).

@Aron as Moritz pointed out, used car prices will most likely also go up, similar to what happened in 2021. Cox is already increasing its outlook from 1.4% at the end of 2024, to 2.8% now. It’s better to start including it on some Sixt scenarios.

Used Car Prices Q1 2025 Update

- US prices of used vehicles remained stable, increasing 0.30% q/q, and -0.25% y/y in Q1 2025

- In the first half of April, however, they increased demand by 2.22% m/m and 4.3% y/y after consumers started to pull forward due to tariff increases.

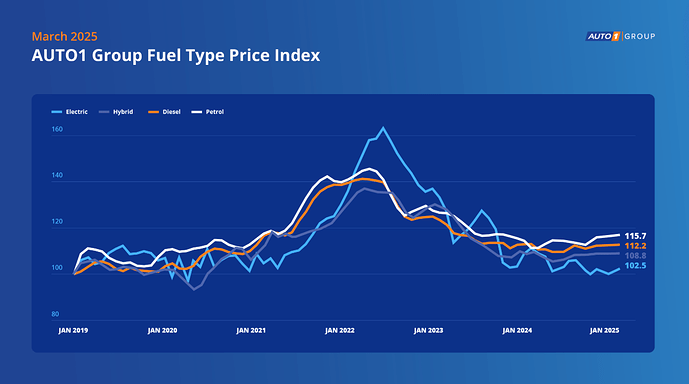

- In Europe, used car prices increased by 1%. This trend reflects recently higher demand in the used car market and is mainly driven by the price increases of petrol and diesel vehicles

- Year-over-year, used car prices have increased by 1.1 % compared to March 2024. Used car prices remain 19.5 % higher than before the COVID-19 pandemic.

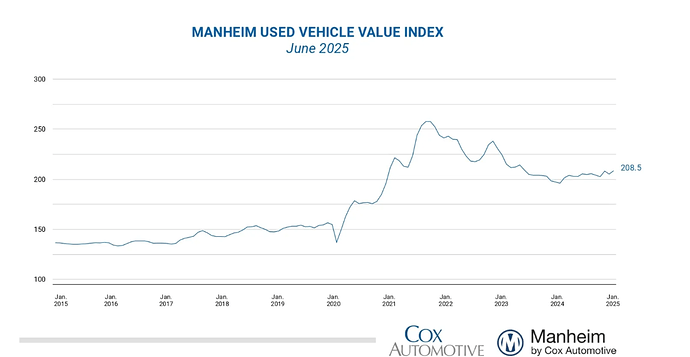

U.S. used-car prices continue to surge, with the Manheim Used Vehicle Value Index up 6.3% year-over-year in June