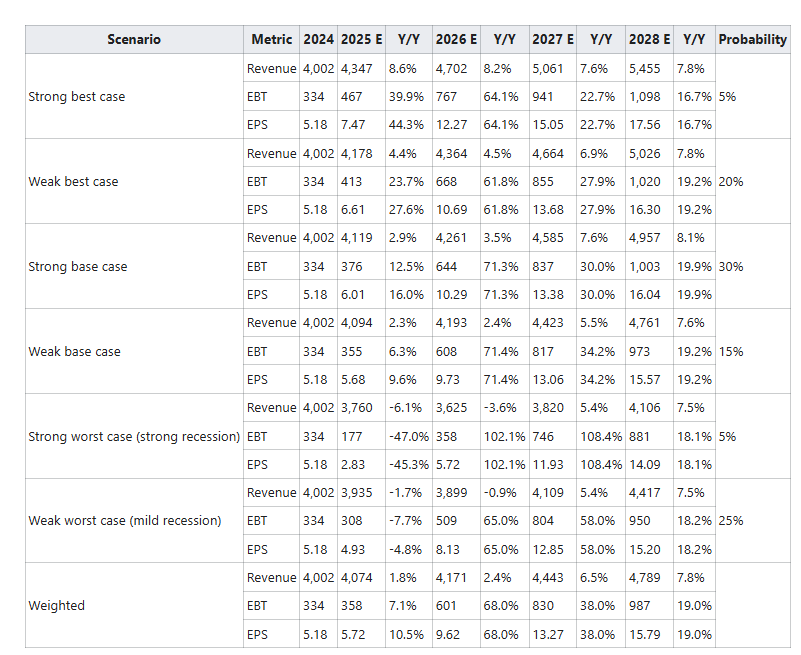

Scenario model under Trump’s tariffs (confidence level: 65%)

These valuation model estimates are based on the following assumptions:

- Travel demand is non-discretionary: Consumers are already cutting back on travel due to macro uncertainty. However, expected increases in new car prices may drive some consumers to use rental cars while delaying purchases.

- Tariffs will increase the residual value of Sixt’s U.S. vehicles: At the end of 2024, 87% of Sixt’s North America fleet consisted of risk vehicles. U.S. used car prices fell 2.3% in 2024, and Sixt’s U.S. depreciation expenses more than doubled to €284 million. This makes North America the main driver of Sixt’s depreciation costs. Cox Automotive estimates that tariffs could increase used car prices by 2.8%, likely reducing depreciation expenses.

- Sixt will be impacted by a recession, but not severely: In the 2009 recession, Sixt’s revenue declined 10%, compared to 17% at Hertz and 14% at Avis. Current estimates suggest any potential recession will be milder than 2009.

- Car rental companies tend to reduce expenses during downturns: Sixt and peers historically cut fleet and personnel costs during macro slowdowns to preserve margins.

- Tariffs will weaken international inbound travel: Inbound demand supported Sixt’s Germany and Europe revenue in 2023–2024, when there was macro slowdown. However, tariffs are expected to negatively affect travel volumes, especially from the U.S.

- Premium positioning offers pricing resilience: Sixt’s average revenue per unit (ARPU) is estimated to be 30–40% higher than that of Hertz or Avis. This premium mix gives Sixt better protection against pricing pressure in a demand slowdown.

Based on these estimates, Sixt is somehow positioned to withstand a macro slowdown. While a macro slowdown would weigh on travel demand, the impact on earnings would be partly offset by the increase in residual values. Given the low probability of a severe recession and the company’s structural advantages- including premium positioning and fleet flexibility- the downside to earnings appears limited. Therefore, I would recommend a buy considering the attractive valuation.

Revenue: €4,202-€4,402 (+5% to 10%)

EBT: €420-€440 (+25.8% to 31.8%)