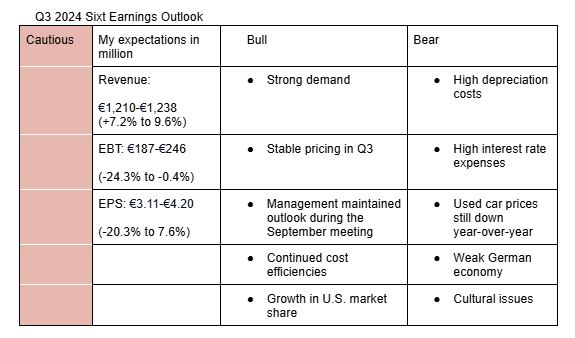

I am cautious on Sixt’s Q3 2024 earnings. My estimates take into account current industry trends, growth in U.S, recent management guidance and macro environment. Here is a description of my bullish points:

- Strong demand: Avis Budget said in their Q3 earnings call that car rental demand was robust during the quarter. Additionally, airline companies reported healthy demand for air travel in Q3.

- Stable pricing during the quarter: Sixt, Avis, and Hertz are involved in fleet rotation following a slump in residual values of used cars. As a result, I expect pricing to have been stable during the quarter. Avis said in the earnings call that pricing improved sequentially during the quarter compared to the same period last year.

- Recent management guidance: During a September 24 meeting with investors, Sixt reiterated its guidance for 2024. If things had gotten worse during the quarter, they would have likely updated the forecast.

- Cost efficiencies: I expect cost efficiencies initiated at the company such as the “Car Gates” technology to continue paying off.

- Continued market share gain in U.S: As its competitors (Avis and Hertz) rationalize fleet in U.S, Sixt gets a chance to take market share from them. For instance, they opened more branches in U.S during the quarter.

Here is a description of my bearish points:

- High depreciation costs: Sixt’s fleet rotations will probably not pay off until next year given that it usually holds vehicles for 6 to 12 months before selling them. Similarly, Avis’s depreciation of rental vehicles as a % of U.S revenue only fell to 23.22% in Q3 from 23.68% in Q2.

- Hight interest rate expenses: Though the key interest rates set by the ECB and the Fed is on a downward trend, it will probably take sometime for the effects to reflect on Sixt’s financial result.

- Used car prices: While used car prices are starting to normalize, they are still down year-over-year.

- Weak German economy: Germany’s economy hasn’t shown any signs of recovery yet. This reduces discretionary spending such as travel spend. As such, I expect its Germany revenue growth to have decelerated further during the quarter.

- Cultural issues: Sixt is experiencing high turnover in Germany. This could impact the operational performance.

N/B: Here are the management and analysts expectations;

2024 management outlook for EBT: €340-€390 million (€365 million or -21.4% at the midpoint)

Q3 2024 analysts estimate for EBT: €254.9 (3.2%)

Q3 2024 analysts estimate for revenue: €1,226 (+8.6%)

2024 analysts estimate for EBT: €355.1 million (-23.5%)

2024 analysts estimate for revenue: €3,943 million(+8.9%)

My 2024 estimates include revenue of €3,956 (+9.3%) and EBT of €354 (-23.8%)