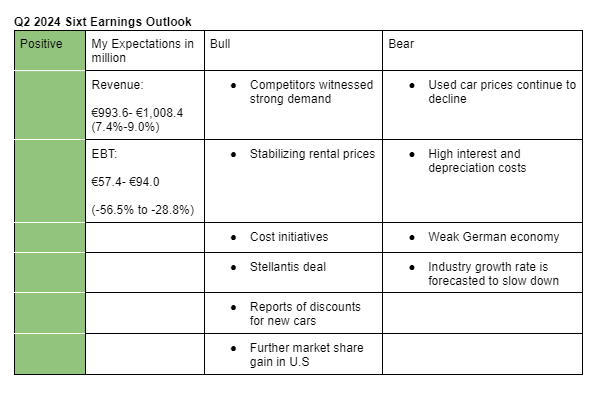

I am positive on Sixt’s Q2 2024 earnings. My estimates take into account current industry trends such as demand, rental pricing and prices for used cars. Here are my bullish points;

- Sixt’s competitors; Hertz and Avis group pointed out that they witnessed strong demand and stabilizing pricing during the quarter. Additionally, the travel industry continued to grow strongly in Q2.

- Hertz said in its earnings call that it was able to negotiate for reduced prices for new fleet. This comes after reports that Tesla was offering rental companies steep discounts for new fleet. This would encourage other players to do the same; hence we can expect depreciation costs to reduce as we approach the end of the year.

- I believe that Sixt got a better deal from Stellantis for the supply of 250,000 vehicles. For instance, depreciation risks could be lower for these vehicles. Already, 30,000 vehicles have been delivered.

- Sixt already initiated some cost cutting initiatives such as a technology that would reduce the number of staff that check for damages in Vehicles. This could offset some depreciation costs going forward.

- Hertz and Avis said they concentrated on value over volume during the quarter. That means some demand were up for grabs for the likes of Sixt which is trying to expand in U.S.

My bearish sentiments include;

- Used car prices continue to decline in U.S and Europe. As such, I expect residual values of Sixt’s fleet to continue falling.

- Hertz and Avis reported a sharp rise in depreciation costs and fleet expenses (caused by high interest rate environment) in Q2.

- Germany’s economy slipped into contraction territory again in Q2. That would lower consumer spending habits such as travel.

- Growth of travel and tourism industry is forecasted to decelerate going forward. As such, there is some uncertainty over performance in the second half though Hertz and Avis expects demand to hold up. My estimates for 2024 includes a revenue of €3,903 million (+7.8%)and EBT of €406 million (-12.6%).

N/B: Here are the management and analysts expectations;

Q2 2024 management outlook for EBT: €60-€90 million (€75 million or -43.2% at the midpoint)

2024 management outlook for EBT: €350-€450 million (€400 million or -13.9% at the midpoint)

Q2 2024 analysts estimate for EBT: €63.3 million (-52.2%)

Q2 2024 analysts estimate for revenue: €991.2 million (+7.1%)

2024 analysts estimate for EBT: €376.5 million (-18.9%)

2024 analysts estimate for revenue: €3.923 billion (+8.4%)