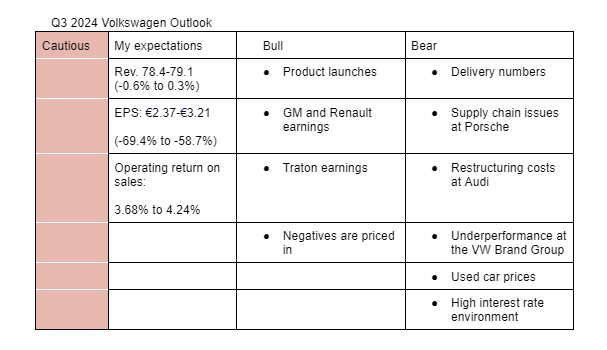

I am cautious on Volkswagen’s Q3 2024 earnings. My estimates take into account Q3 2024 delivery numbers, restructuring costs at Audi, continued supply chain problems at Porsche, underperformance at Volkswagen Brand Group Core, among others.

Here is a description of my bullish points;

- Product launches in 2024: I expect the product offensive particularly at Porsche and Audi to keep prices stable during the quarter. Almost all the new models come with a premium over that charged for the old models.

- GM and Renault earnings: GM and Renault earnings benefited from stable pricing during the quarter.

- Traton earnings: Traton Q3 2024 earnings topped estimates.

- Negatives are priced in: Most of the bearish sentiments in the table above are already priced in. Therefore, I don’t expect the stock to react excessively negative if the earnings miss analysts estimates.

Here is a description of my bearish points;

- Delivery numbers: Volkswagen Q3 2024 deliveries fell 7.1% in Q3 2024 versus growth of 2% for the full year that was initially guided by the management.

- Supply chain issues at Porsche: During the Q3 2024 pre close call, Volkswagen said Porsche continued to be impacted by the supply chain issues. The supply chain issues will lead to more production costs.

- Restructuring costs at Audi: During the Q3 2024 pre close call, Volkswagen said Audi booked the 1.3 billion euros (page 16) restructuring charges associated with the Brussels plant. This impacts Audi’s operating return on sales.

- Underperformance at the Volkswagen Brand: There have been reports that Volkswagen Brand’s restructuring measures are not going according to the plan. Volkswagen also said recently that market developments have downgraded expectations at the Volkswagen Brand.

- Used car prices: While used car prices are stabilizing, they are still down year over year. This will be a drag on Volkswagen Financial Services (VFS) operating results.

- High interest rate environment: While key interest rates are trending downwards in Europe and U.S, it will probably take sometimes before this is reflected on the books. As such, VFS could still book a high interest rate expense in Q3. Additionally, VFS recently lowered their 2024 operating profit guidance to 3.2 billion euros from 4 billion euros.

N/B: Here are the analysts estimates and management guidance for 2024:

Analysts estimates for Q3

Revenue: EUR 79.53 billion (+0.87% y/y)

Operating return on sales: 3.7%

Analysts' estimates for 2024

Revenue: EUR 320.5 billion (-0.6%)

Operating return on sales: 6.6%

Management outlook for 2024

Revenue: EUR 320 billion (-0.7%)

Operating return on sales: ~5.7%