Q1 2024 US Auto Industry Summary:

A cautious outlook for the US industry, with sales growth decelerating, prices declining, inventory increasing back to normal levels of days of supply already, delinquencies and defaults still highest since the 2008 crisis, and rates still high and not expected to be cut relatively soon.

According to COX Automotive, the biggest risk for the industry right now is rates staying high for longer, because rational consumers will postpone buying until rates are lower, and dealers would need to work harder (higher incentives) for them to buy now.

Sales

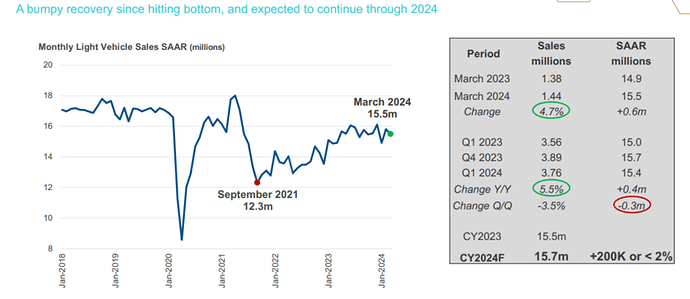

- Light Weight Vehicle Sales increased 5.5% in Q1 2024 to 3.76 Million.

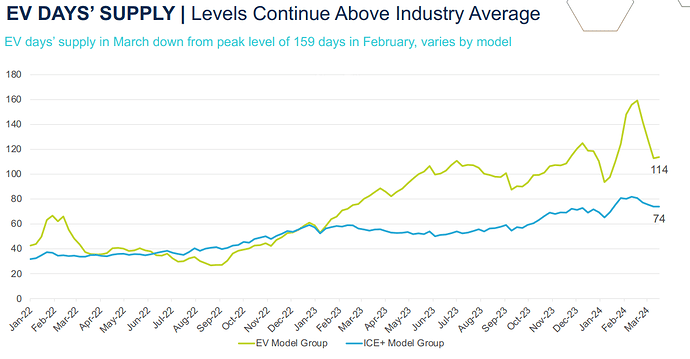

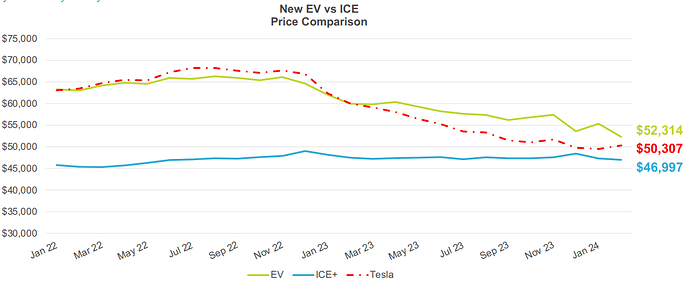

- Americans bought 268,909 new electric vehicles. EV share of total new-vehicle sales in Q1 was 7.3%, a decrease from Q4 2023. The growth rate has slowed notably. Sales in Q1 rose 2.6% year over year, but fell 15.2% compared to Q4 2023.

- Used car retail sales grew 3% Y/Y in Q1 2024 to 4.37 M.

Sales By OEM (include some big trucks)

Inventory

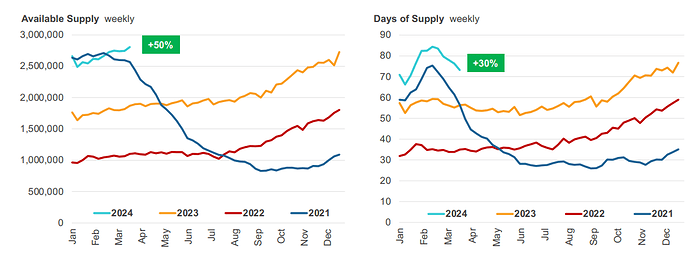

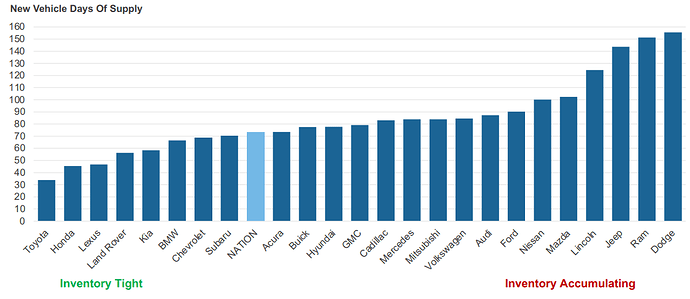

- Currently 940,000 more new units than last year, days of supply at 73 days, +30% year over year.

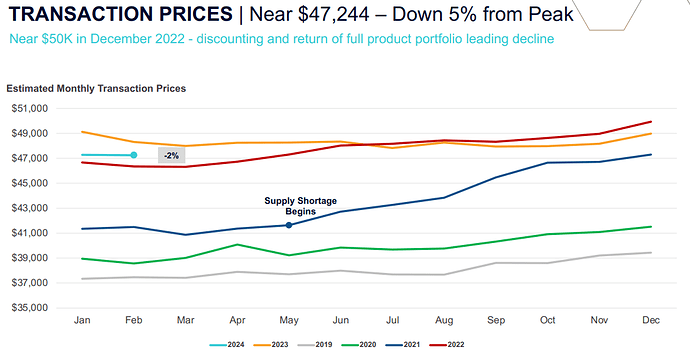

Days of supply normalizing, back to the pre-pandemic range of 60-80 days, if inventory continues to increase (as is expected to do by Cox to reach ~3M later this year) it could create additional pressure on prices. - Contrary for used vehicles, supply is getting tighter (~40 days of supply, and -20% from 2019 levels), but interesting prices are still declining during Q1 2024.

Supply for used cars are expected to continue to be constrained due to lower production and lower leasing activity in 2021/2022.

Days of supply are different by the manufacturer. Higher discounts and incentives are expected for the ones with a day of supply greater than 80 days. (VW is on the high side)

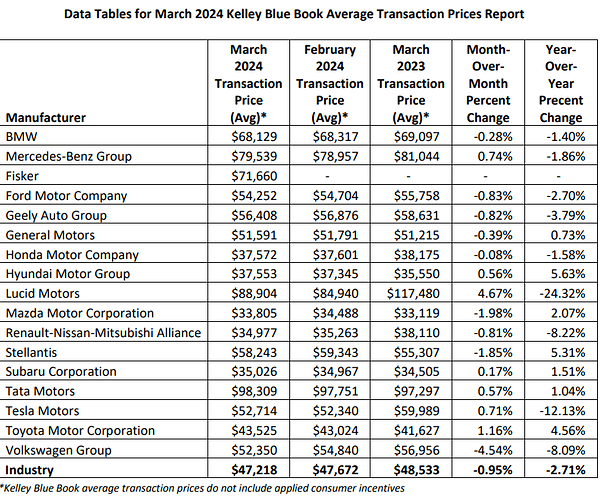

Prices

-

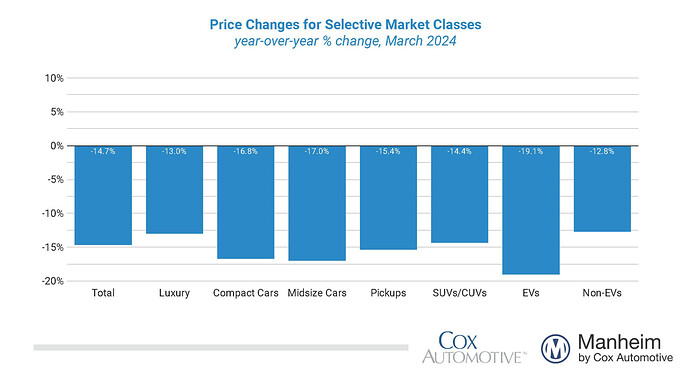

Used Vehicle Value Index (MUVVI) fell to 203.1 in March 2024, a decline of 14.7% from a year ago. Down 21% from the peak.

-

The average price for new vehicles was down 2.6% year over year. And are ~5% down from the peak.

-

The average transaction price for a new EV in Q1 was $55,167, a 9.0% decrease compared to Q1 2023 and down 3.8% quarter over quarter

Average transaction prices by Manufacturer

Affordability and Credit

- In March, 1.88% of auto loans were severely delinquent, the highest rate for March, dating back to at least 2006.

- 7.25% of subprime loans were severely delinquent in March, highest rate for March dating back to at least 2006.

- Defaults increased in March by 8.5% from February and were up 33.4% year over year. The year-to-date default rate is 3.23%, which is equivalent to the default rate in 2010.

- Credit access is tighter than a year ago in all channels and most lender types.

- Affordability has improved, from 41 weeks of income to purchase in the peak to 36.9 in March 2024, but still lower than before COVID.

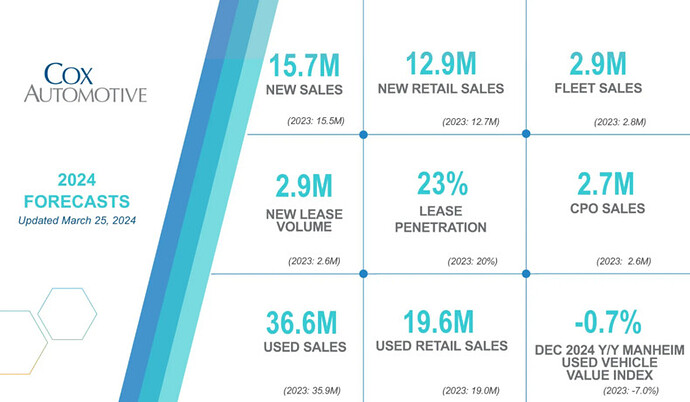

Forecast

Cox updated its 2024 Forecast

- 1.3% Y/Y growth for new sales

- 1.94% Y/Y for used car sales.

COX Automative Q1 2024 presentation: https://www.coxautoinc.com/wp-content/uploads/2024/03/Q1-2024-Cox-Automotive-Industry-Insights-and-Forecast-Call-Presentation.pdf

Q1 2024 Cox Automotive Industry Insights Webcast Replay Available - Cox Automotive Inc.