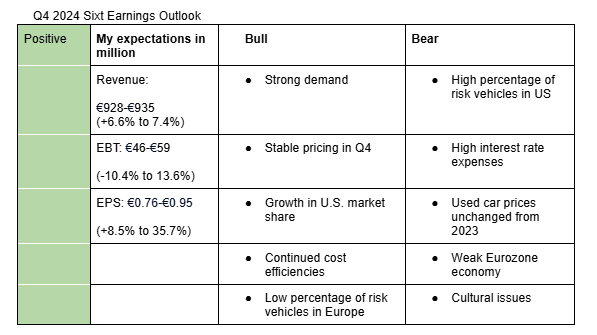

I am positive on Sixt’s Q4 2024 earnings. My estimates take into account the strong demand, stable pricing, reduced number of risk vehicles, especially in Europe and continued expansion in North America. Here is a description of my bullish and bearish points:

Bullish sentiments:

- Strong demand during Q4: Competitors such as Avis Budget and Hertz witnessed strong demand during the quarter that has continued into Q1, thanks to the holiday season. Similarly, growth in tourist visits in Europe and North America was stronger in Q4 compared to Q3.

- Stable pricing: Avis Budget and Hertz witnessed stable pricing during the quarter. For instance, Hertz saw a 150 basis points improvement in pricing in Q4 compared to Q3 while Avis said pricing improved sequentially throughout the quarter.

- Strong growth in the US market: Sixt has been growing strongly in the US market. The financial issues that faced its competitors, especially Hertz provides it with an opportunity to further take up market share. In an interview with BTN, Sixt head of North America Tom Kennedy sounded very positive about their growth trajectory in the US.

- Continued cost efficiencies: I expect the cost efficiencies such as the ‘Car Gates’ to help the company further in Q4, especially when it comes to personnel costs.

- Low percentage of risk vehicles in Europe: Sixt’s percentage of risk vehicles was reduced to only 2% in Q3 2024. This means that the number of vehicles that Sixt needs to dispose of in Europe in order to achieve favorable conditions is now low. As such, growth in depreciation costs in Europe is likely to decelerate significantly in Q4 from Q3.

Bearish sentiments

- High depreciation cost in the US: Sixt has a high percentage of risk vehicles in the US compared to Europe. At the end of Q2, the percentage of risk vehicles in the US stood at 75%, though the company said (page 15) there was a significant improvement in Q3.

- Used car prices were unchanged compared to 2023: Used car prices in the US only stabilized in Q4 2024 compared to the same period in 2023. In Europe, used car prices are still down year-over-year. Similarly, Hertz and Avis reported depreciation costs in Q4 that is still elevated. High percentage of risk vehicles in the US coupled with no much improvement in the prices of used cars means Sixt is likely to report high depreciation costs in the region again.

- High interest rate expenses: Interest rates in the US, currently standing at a range of 4.25%-4.5%. Although, it has moved down to 2.75% in Europe, it will probably takes some time for for the effects to reflect on Sixt’s financial result.

- Weak Eurozone economy: Germany’s GDP contracted again in Q4 by 0.1% while Euro area GDP showed no growth. This is likely to weigh on Sixt’s revenue growth in Q4.

- Cultural issues: The recent departure of Sixt’s CMO Tobias Seitz may indicate that the cultural issues we identified last quarter are still there. Reports indicate that Seitz creative freedom at the company was less than he had anticipated. Such cultural issues may affect the operational performance of the company.

N/B: Here are the management and analysts expectations;

Q4 2024 management outlook for EBT: €58 million (+12.3%)

Q4 2024 analysts estimate for EBT: €56.3 million (8.9%)

Q4 2024 analysts estimate for revenue: €919.6 million (+5.6%)

2025 analysts estimate for EBT: €464 million (+37.2%)

2025 analysts estimate for revenue: €4,236 million(+7.3%)