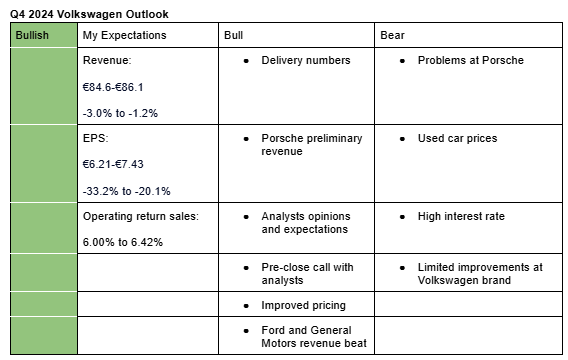

I am bullish on Volkswagen’s Q4 2024 earnings. My estimates are based on vehicle delivery numbers, insights from the recent pre-close call with analysts, further pricing tailwinds in Q4, and Porches’ preliminary results. Here is a description of by bullish and bearish sentiments:

Bullish sentiments,

- Delivery numbers: Volkswagen’s 2024 delivery numbers came in line with management’s guidance of 9.0 million.

- Porsche’s preliminary revenue: Recently, Porsche announced that its revenue for 2024 is unlikely to deviate much from their guidance of €39 to €40 billion.

- Analysts opinions and expectations: Analysts expect Volkswagen to beat its guidance for 2024.

- Pre-close call with analysts: During the recent pre-close call with analysts (page 8), Volkswagen reiterated its outlook for 2024, signaling that the downside risk is low.

- Improved pricing: There is a possibility that pricing at individual brands such as Porsche and Audi improved further in Q4 due to pricing tailwinds from new models such as Audi A6 e-tron, Audi Q6 e-tron and refreshed models such as Audi A6, Audi Q5, Tiguan, etc. Similarly, new vehicle pricing was stable in the US during the quarter.

- Ford and General Motors revenue beat: Both General Motors and Ford reported revenue for Q4 that topped analysts estimates, suggesting that the US market could have performed better than expected. General Motors specifically stated that demand and pricing were strong during the quarter.

Bearish sentiments;

- Problems at Porsche: Porsche is facing challenges such as reduced demand for EVs, especially in China, supply chain issues and high costs. As a result, it now targets 2024 operating return on sales to come in at the lower range of its previous guidance which stands at 14% to 15%.

- Used car prices: While used car prices have stabilized in the US, they are still down year over year in Europe.

- High interest rate: While the ECB has lowered key interest rates to 2.75%, it will probably take some time for the changes to be reflected in Volkswagen Financial Services’s (VFS) books. High interest rate expenses coupled with unfavorable used car market will reduce VFS’s operating profit. As such, it’s unlikely that VFS will achieve its operating profit, which it had guided to come in at 3.2 billion euros in 2024.

- Limited improvement at the Volkswagen brand: Reports indicate that Volkswagen brand’s operating return on sales will take a while to improve despite the initiated cost measures. As such, I expect limited improvement in its operating return on sales in Q4 compared to Q3.

N/B: Here are the analysts estimates and management guidance for Q4 2024 and 2025:

Analysts estimates for Q4

Revenue: €83.9 billion (-3.8% y/y)

Operating return on sales: 6.37%

EPS: €7.30 (-21.5%)

Analysts' estimates for 2025

Revenue: €326.5 billion (+1.5%)

Operating return on sales: 6.21%

EPS: €26.87 (+12.0%)

Management outlook for Q4 2024

Revenue: €82.72 billion (-5.1%)

Operating return on sales: ~6.06%