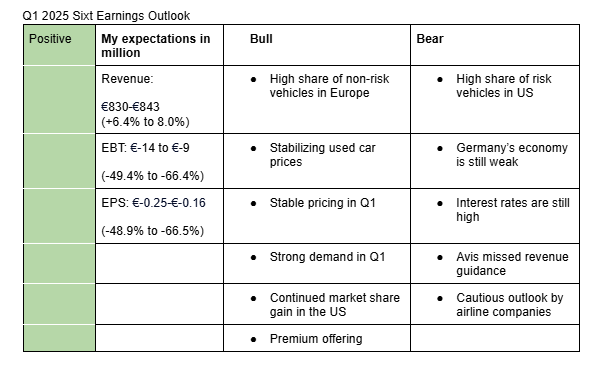

I am positive on Sixt’s Q1 2025 earnings. My estimates take into account strong rental demand, stable pricing, continued expansion in North America, the premium nature of Sixt’s offerings, stabilizing used car prices, and the company’s fleet composition. Below, I explain the key bullish and bearish factors affecting the quarter.

Bullish factors

-

High share of non-risk vehicles in Europe: Sixt’s share of non-risk vehicles in Europe stood at 99% at the end of 2024. This means that Sixt is now in a better position to dispose off its used vehicles in Europe than in Q1 2024.

-

Stabilizing used car prices: Used car prices were up 0.3% q/q in US and down 0.25% y/y in Q1 2025 in the US. In Europe, used car prices were up 1.1% y/y in March. Similarly, Avis confirmed stronger residual values during its Q1 earnings call.

-

Stable pricing in Q1: Avis said pricing fell 2% during the quarter, but was up sequentially. Stable pricing trends mean Sixt likely maintained rental rates, positively impacting Q1 revenue.

-

Strong demand: Avis pointed out that demand in Q1 developed largely as expected. It pointed out international travel as a strong lever during the quarter. It also added that bookings are currently strong. Airline companies also pointed out that international travel was strong during the quarter and business travel was stable.

-

Continued market share gain in North America: Sixt’s North American revenues continue growing at double-digit rates. Competitors (Avis, Hertz) significantly rotated their fleet in 2024 leading to reduced fleet. The fleet rotation at Avis continues until the end of 2025, offering Sixt further opportunities to capture market share.

-

Premium offering: Sixt’s premium positioning commands 30%-40% higher average revenue per unit compared to Avis and Hertz, according to S&P Global. This premium focus provides resilience amid macroeconomic uncertainty caused by US tariffs.

Bearish factors

- High share of risk vehicles in the US: At the end of 2024, Sixt’s share of risk vehicles in North America stood at 87%, up from 75% in 2023. This means that its depreciation costs in North America are likely still elevated.

- Germany’s economy is still weak: Germany’s GDP was down 0.2% y/y in Q1 2025. This is likely to weigh on Sixt’s revenue growth in Q1 2025.

- Interest rates are still high: Interest rates in the US, currently stands at a range of 4.25%-4.5%. Although it has moved down to 2.25% in Europe, it will probably take a while for the impact to reflect in Sixt’s financial result.

- Avis missed revenue estimate: Avis missed revenue estimate by around $100 million in Q1 2025. It cited one less year due to leap year in 2024 and Easter moving into April 2025 as the reasons for the miss. However, the larger miss than in the previous quarter ( $20 million) could signal underlying market softness.

- Cautious outlook by airline companies: Airline companies are cautious on Q2 and 2025 outlook due to uncertainty posed by the tariffs. This could impact Sixt’s outlook for the full year. Sixt is guiding revenue in the range of €4,202 to €4,402 (+5% to 10% y/y) and EBT in the range of €420.2 to €440.2 for FY2025.

Here are analysts estimates for Q1 2025 and FY2025:

Q1 2025 analysts estimate for EBT: -€14.62 million (-46.6%)

Q1 2025 analysts estimate for revenue: €830.8 million (+6.5%)

2025 analysts estimate for EBT: €449.2 (+34.5%)

2025 analysts estimate for revenue: €4,264 million(+6.5%)