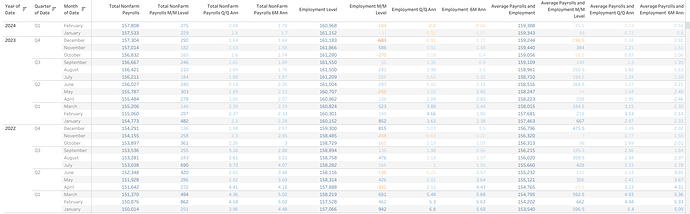

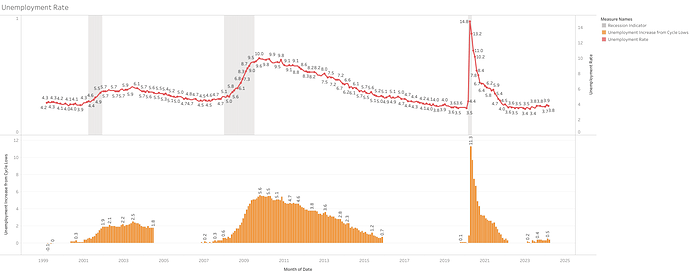

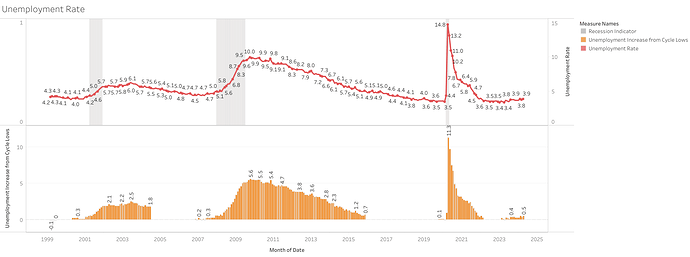

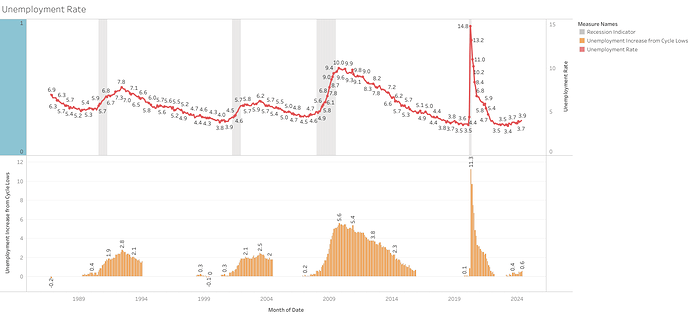

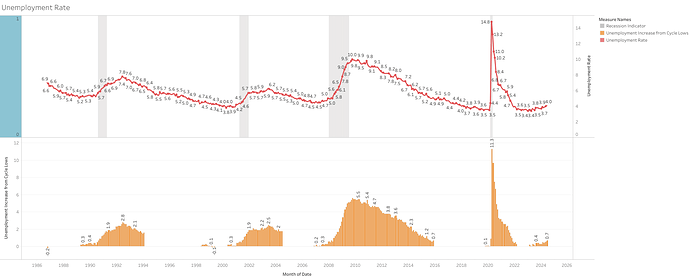

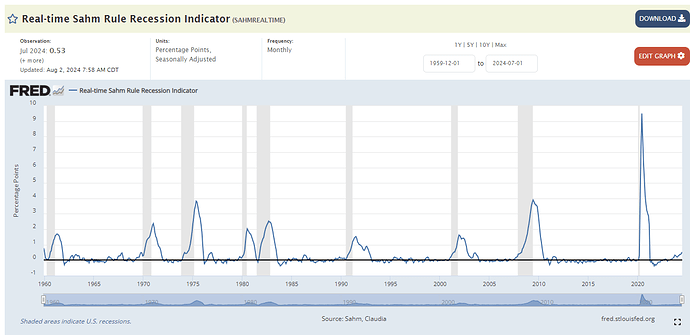

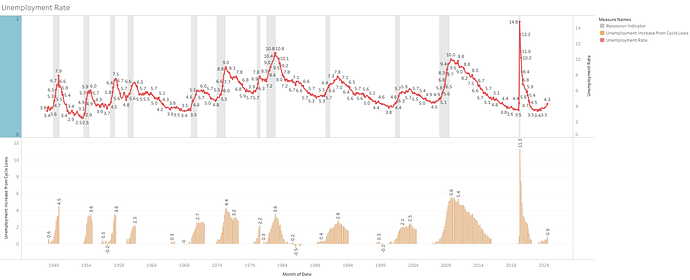

Unemployment Rate up almost 1 percent from the cycle lows (3.4%)

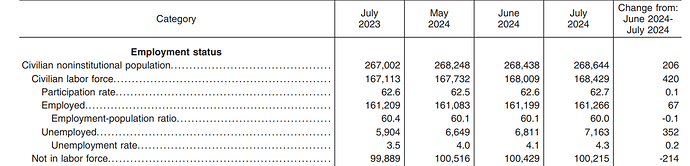

- U6 unemployment (which includes marginally attached workers and those working part-time for economic reasons) had a bigger increase during the month of 0.4% getting to 7.8%, up 1.3% from cycle lows.

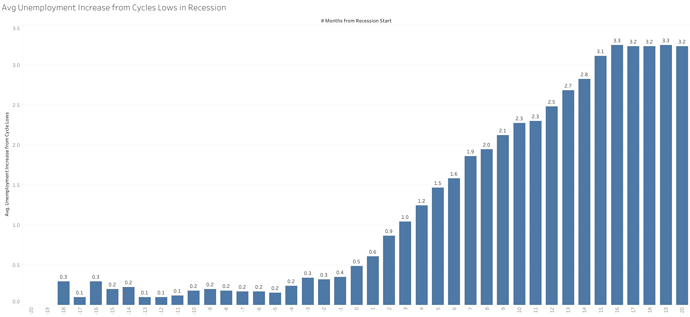

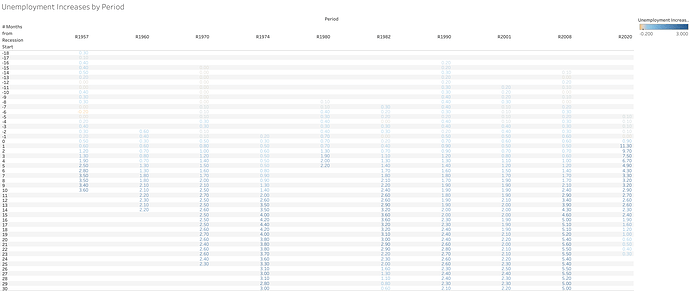

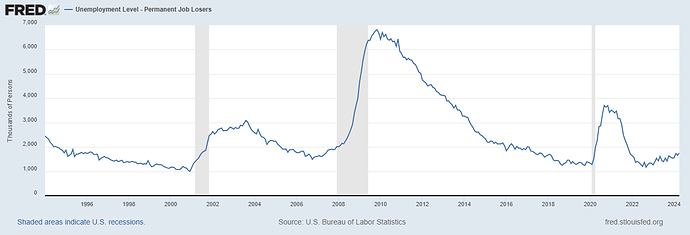

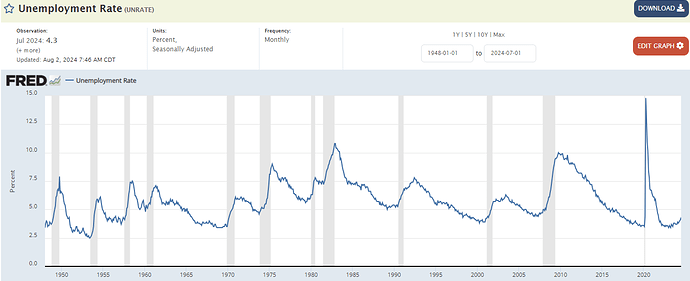

- At a 0.9% increase in unemployment, the economy was already well into recession in past cycles since 1948. Unemployment has usually gone up in most cases by ~2-3% from the lows (2008 was an over 500 bps increase).

I have seen people argue that ~4% unemployment is still low for a recession to happen or to worry about, that’s wrong thinking imo.

There have been recessions starting at different levels of unemployment, and ~4% at the start is common to see actually. Recessions are declared by the increase from the lows in unemployment (and other indicators), and not the starting level.

Eg. 2008 starting at 5% unemployment rate (4.4% cycle lows) was a pretty severe recession compared to others starting at similar levels or worse.

Obviously, an economy with ~4% unemployment vs one with 7% is a much more robust economy overall, but this does not prevent temporary problems from arising, even severe ones.

I am not saying this is what will happen, just that an open mind about all of this is needed.

The unemployment rate this month came from both labor force expansion and an unemployment increase.

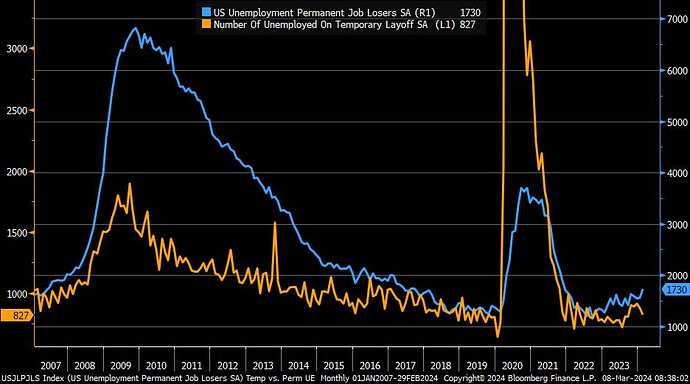

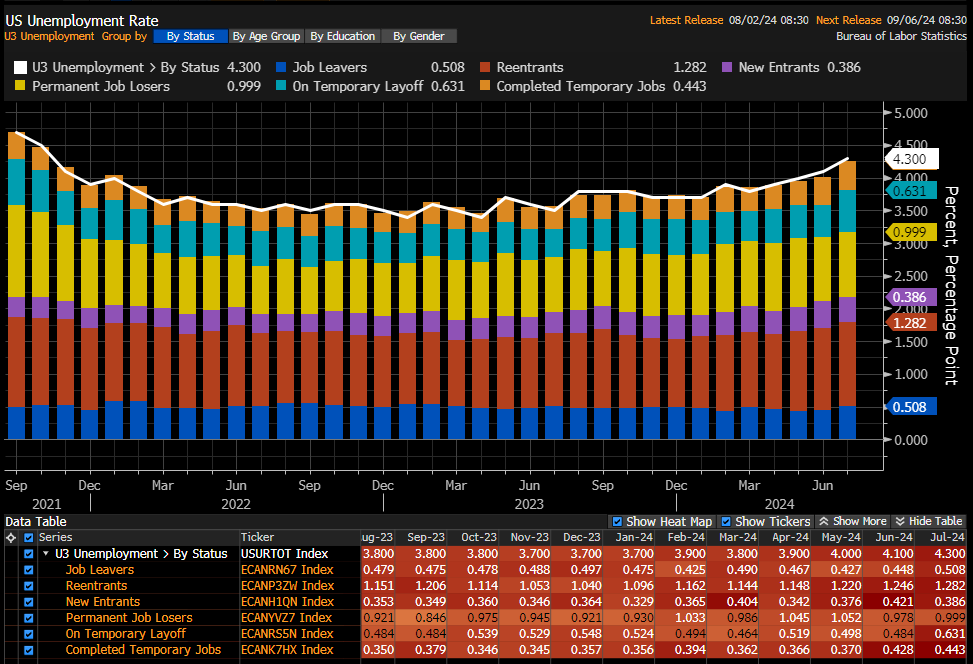

However, it seems reentrant or new entrant is not the primary reason for unemployment increasing this month, rather people leaving or on temporary layoff.

A reversal in unemployment in the coming months, making this month a temporary increase, will be dependent if these people can enter employment again relatively soon or not. So, while the increase in July 2024 is worrisome, additional confirmation is probably needed in the coming months to be sure.

I would take a more cautious stance going forward, but probably overreacting is not the best as the market is doing.

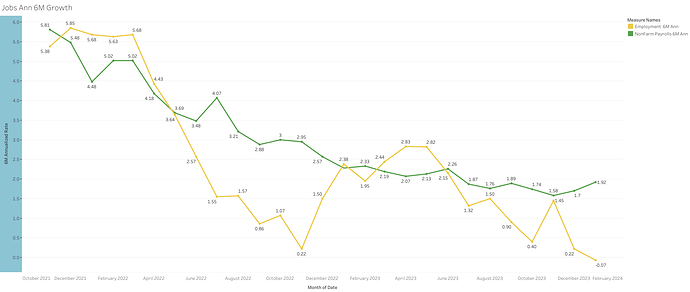

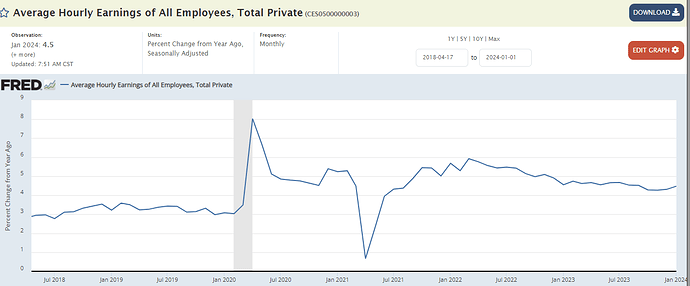

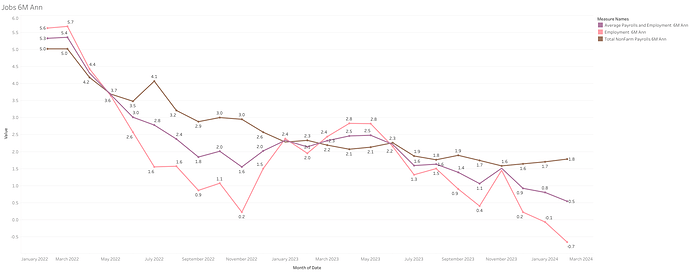

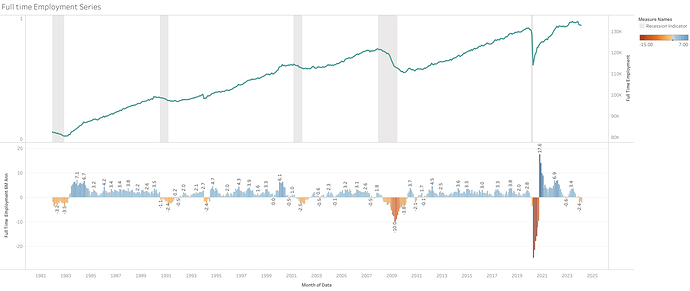

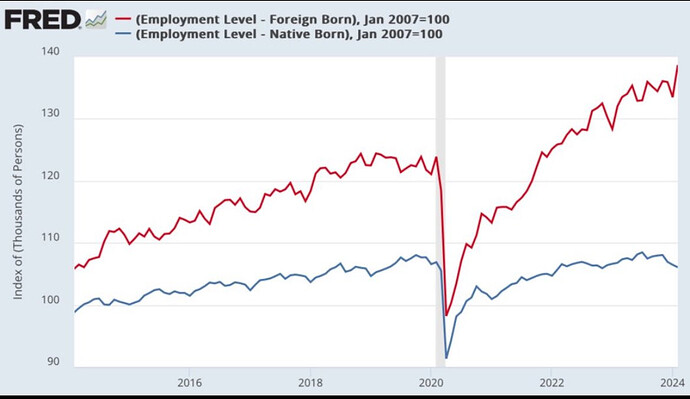

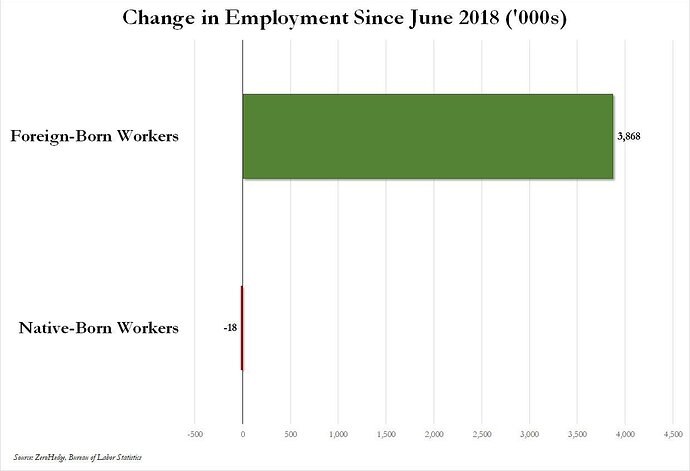

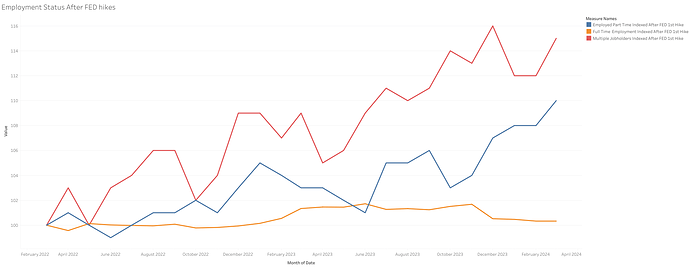

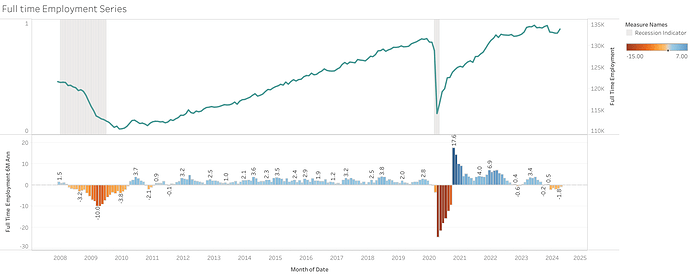

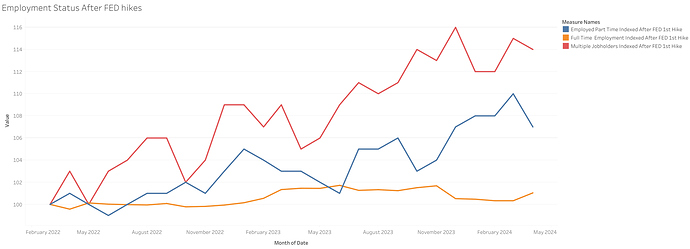

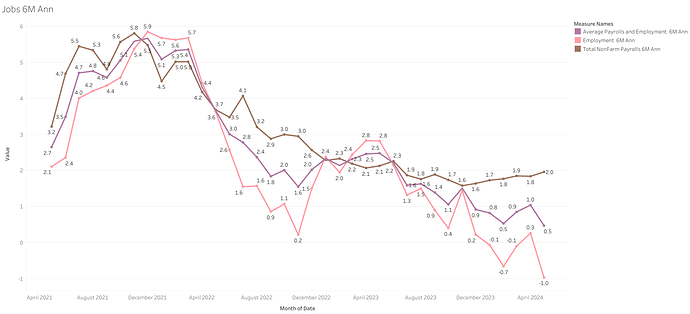

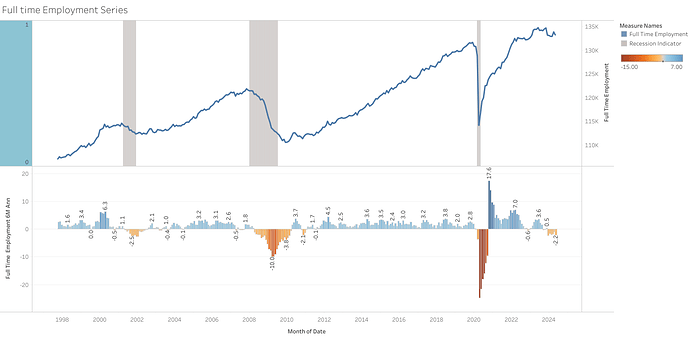

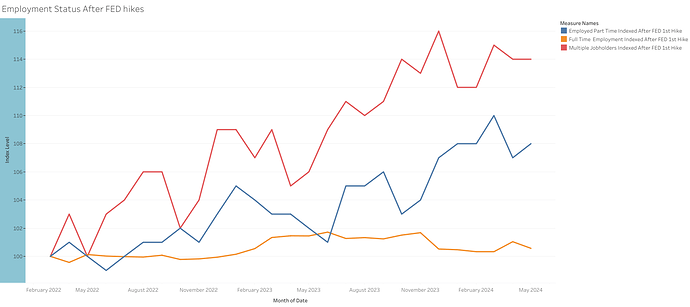

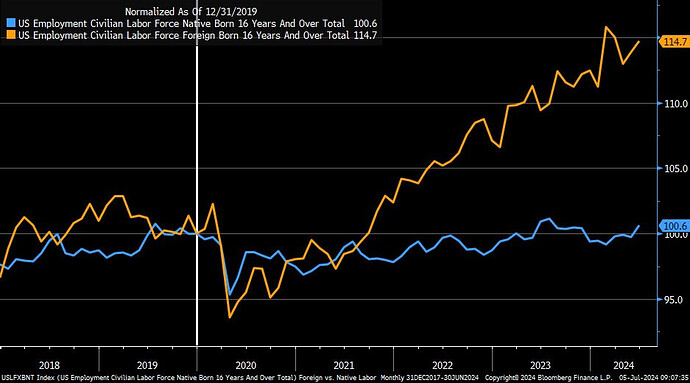

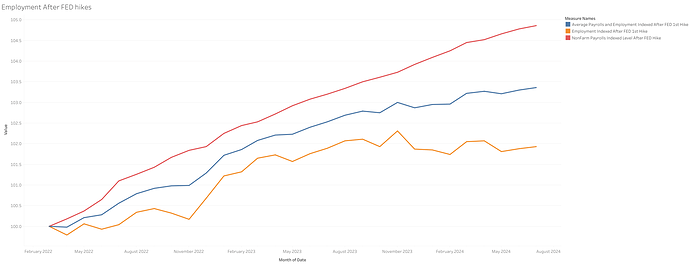

Job gains and employment continue to paint a very different picture. The main reason continues to be most likely a decline in full-time, for more part-time jobs for economic reasons.

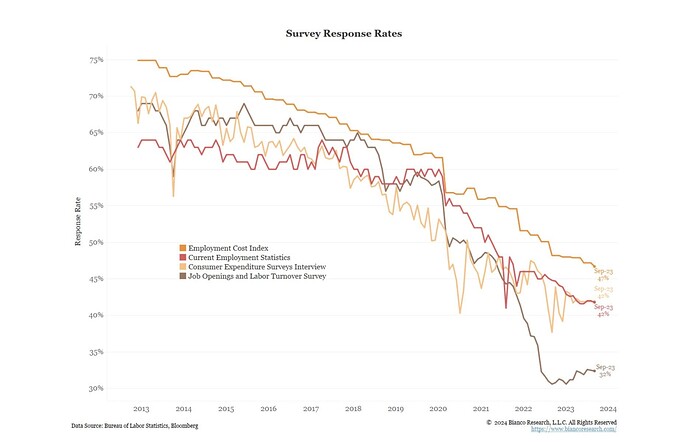

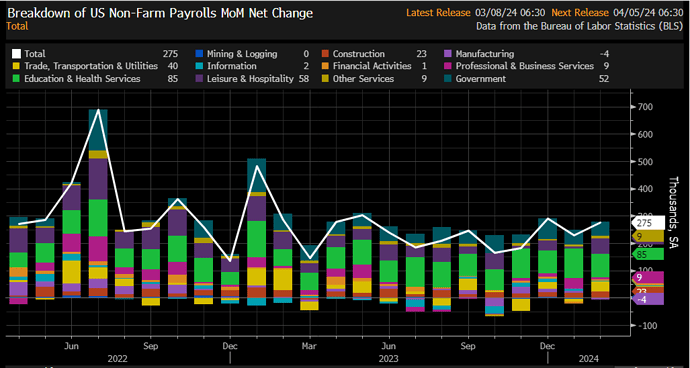

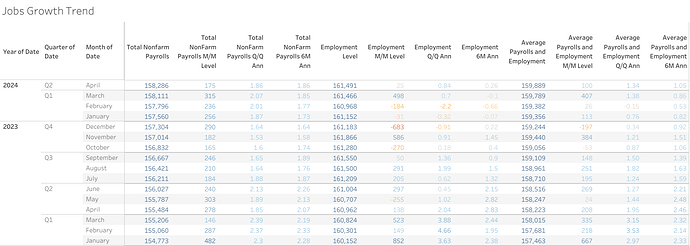

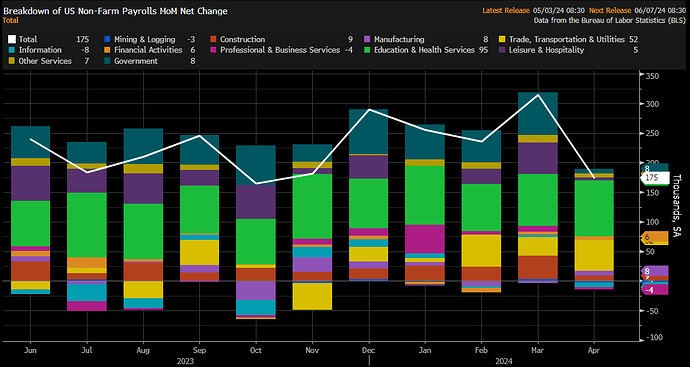

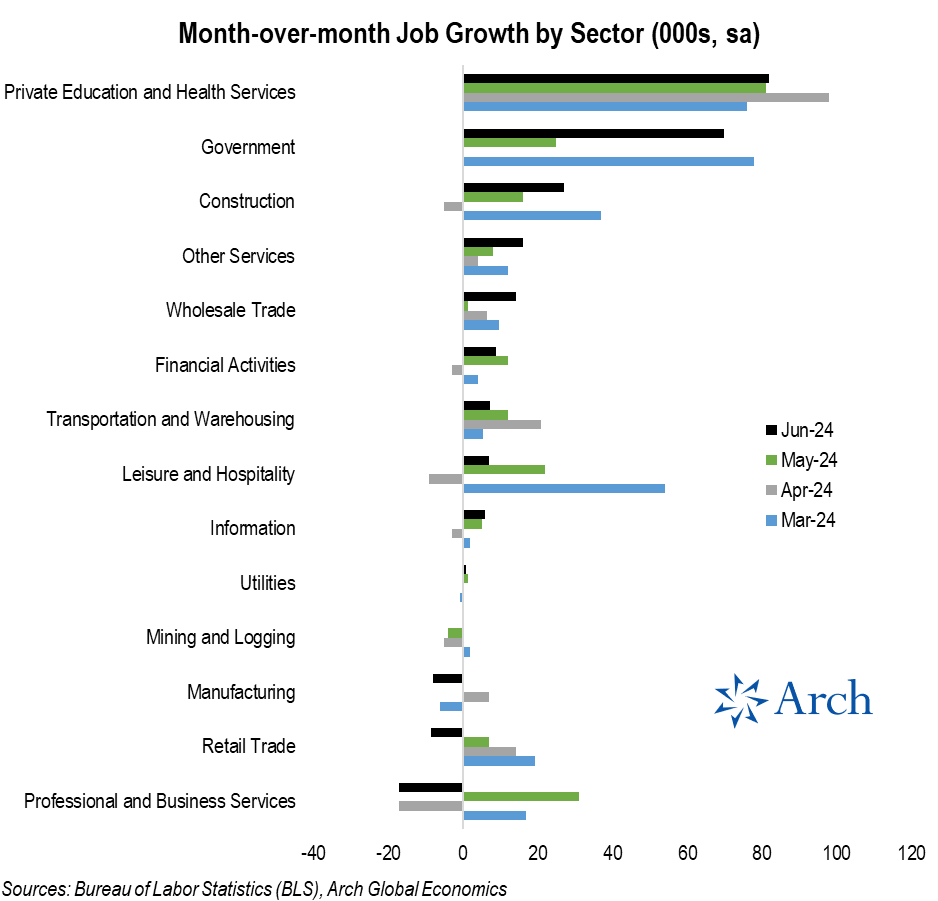

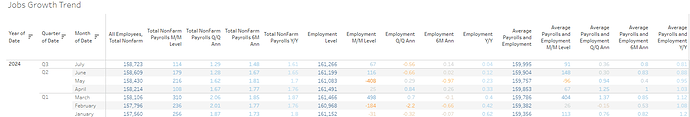

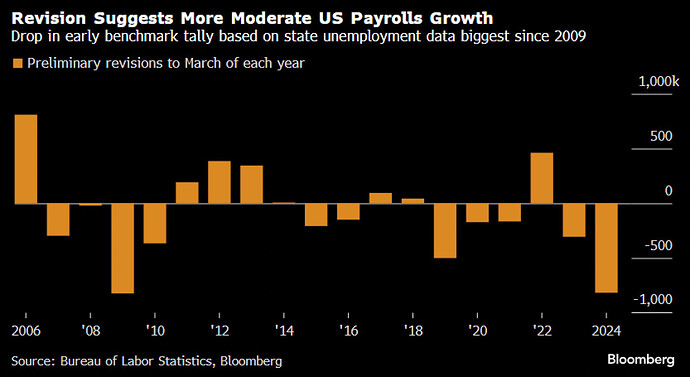

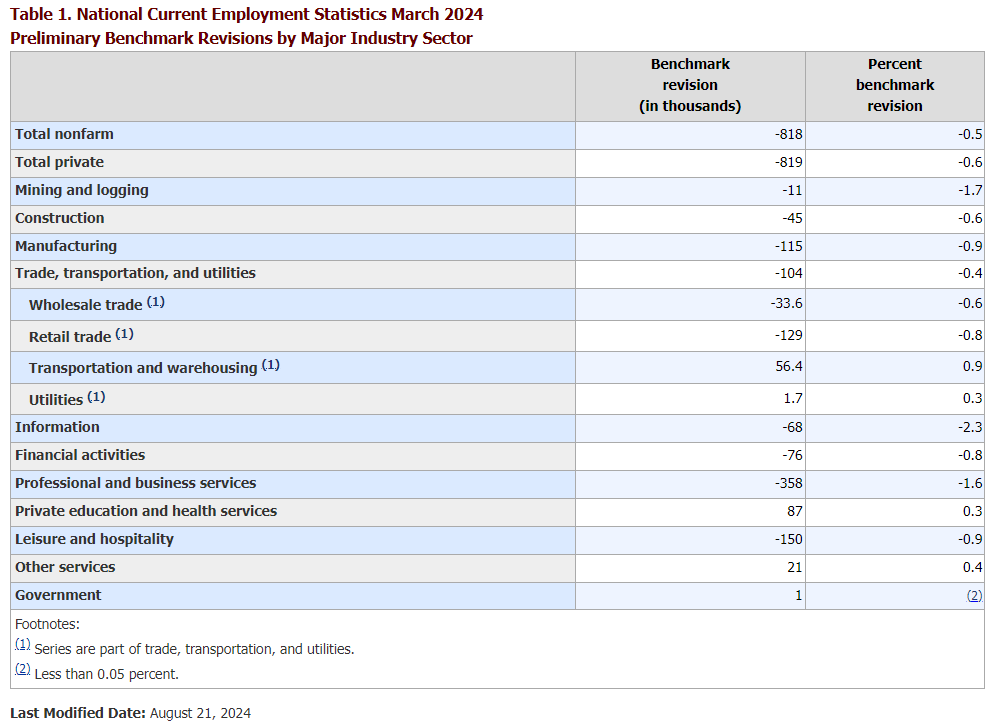

We will also get payrolls benchmark revision on August 21, 2024 to determine too if payrolls have overstated the numbers the past year or not.

- Payrolls have added ~2.5 million jobs in the last year, and employment has only increased by 57K, basically flat.

- Full-time employment has declined by 500K in the last year. Part-time for economic reasons has increased by 558k.

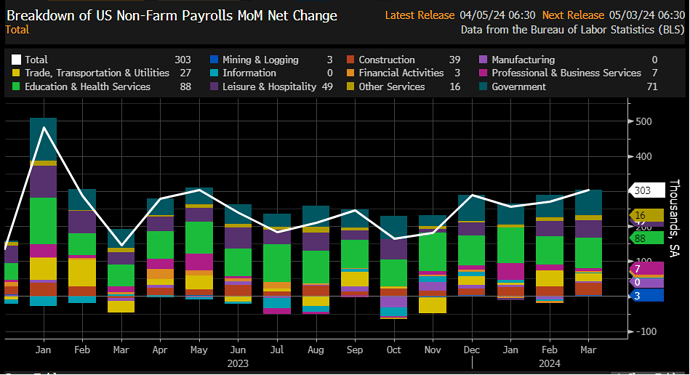

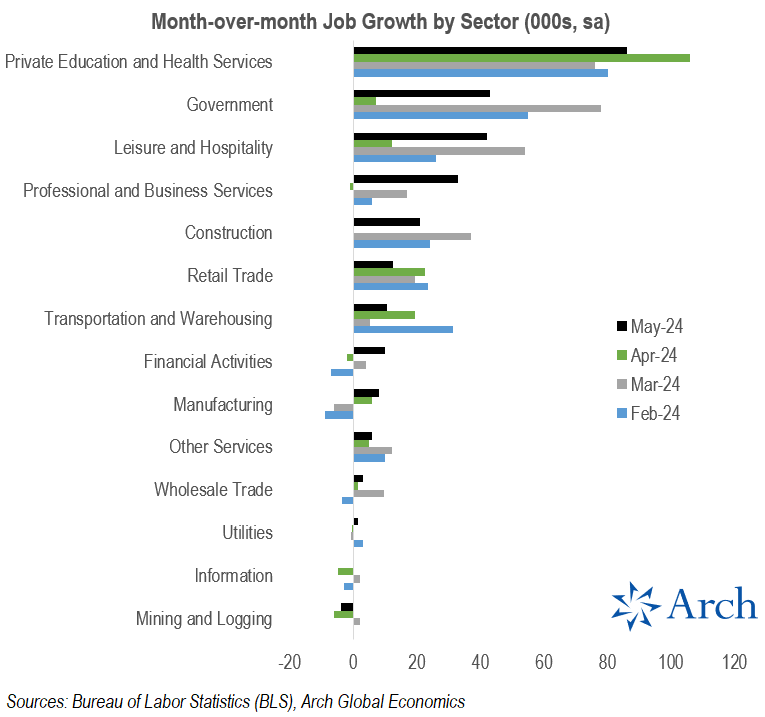

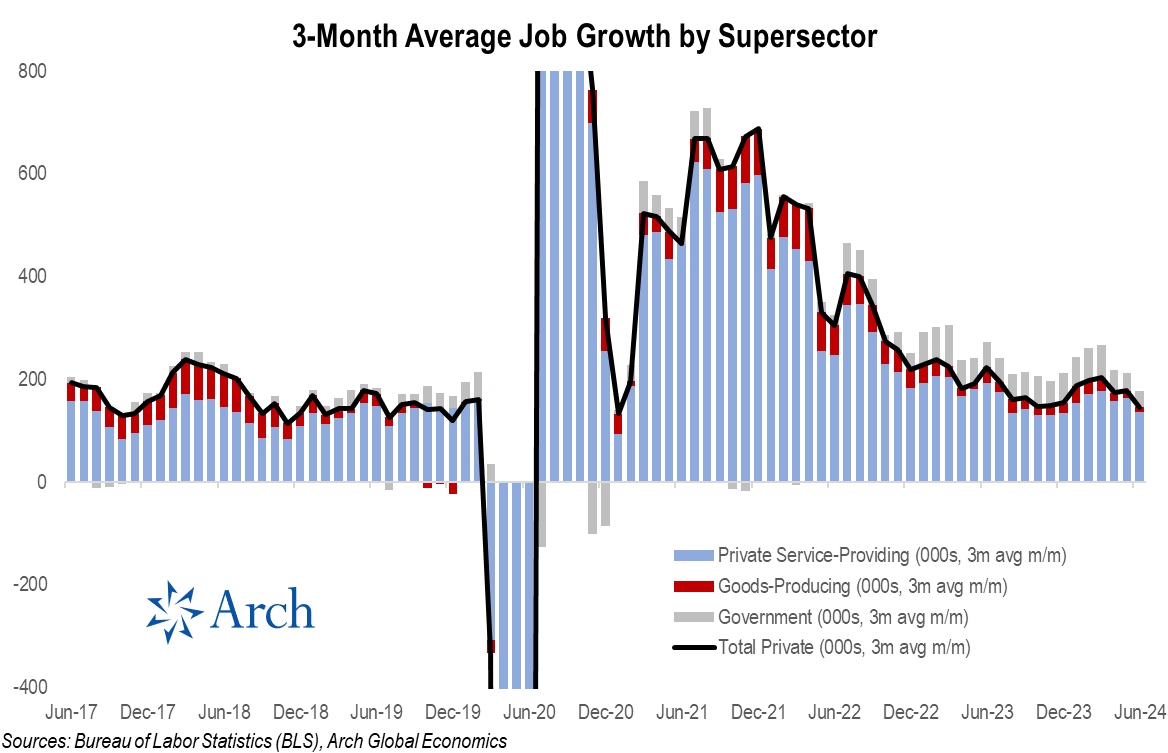

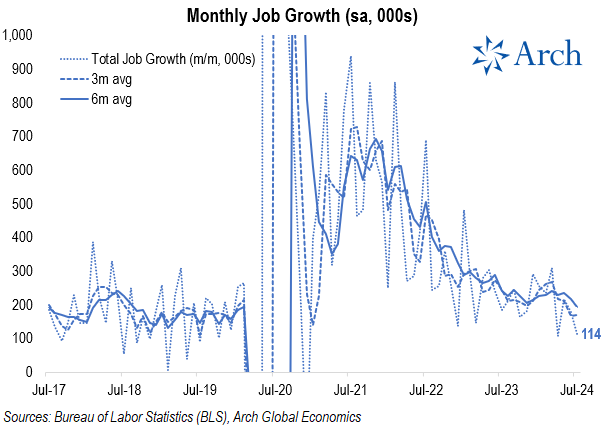

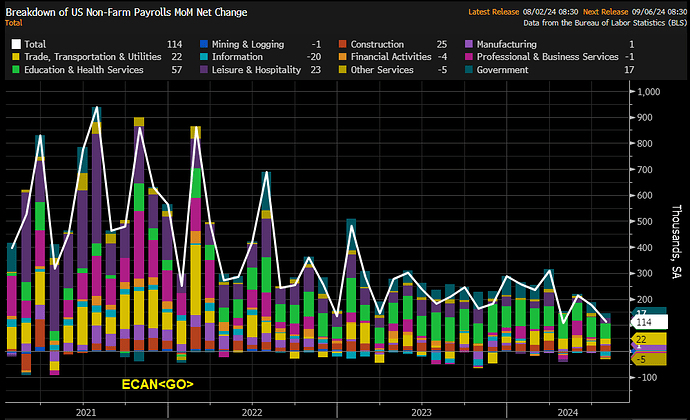

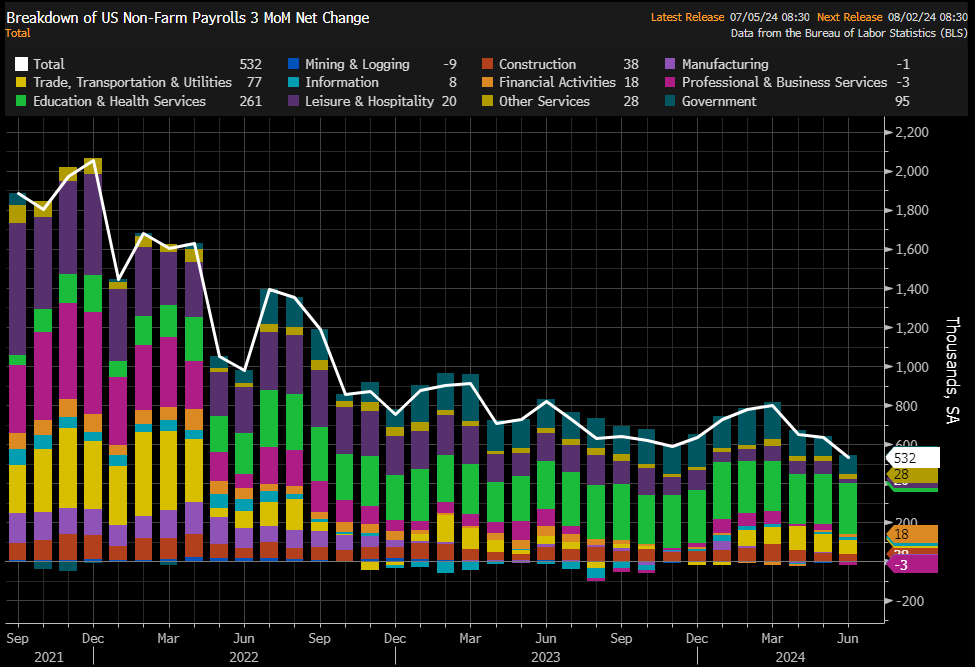

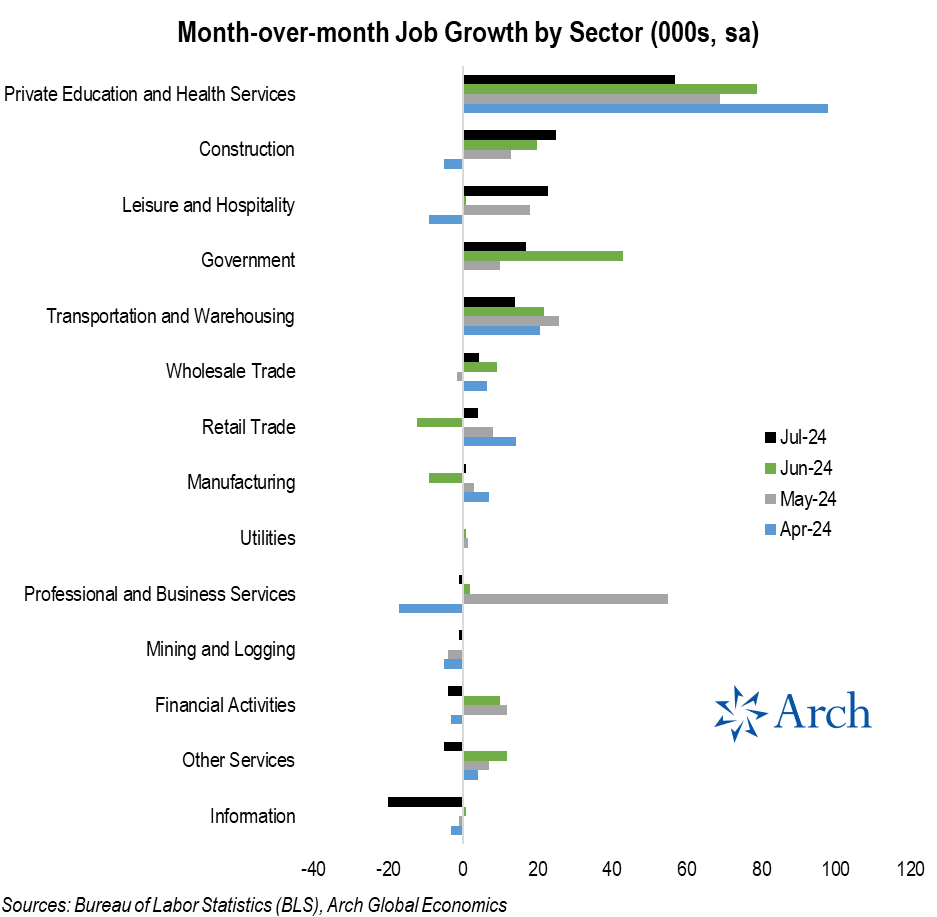

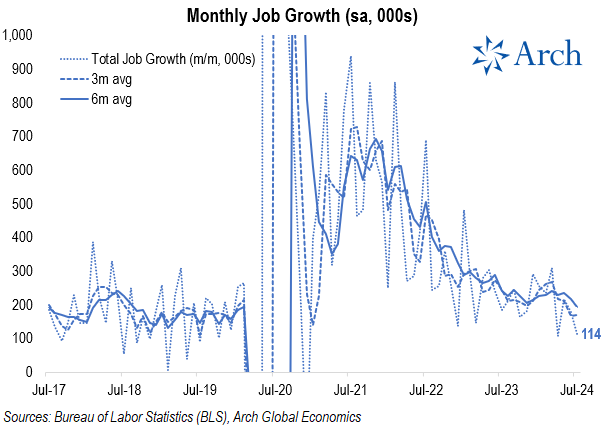

Despite this, the growth rate in the job gains has also declined significantly. And the role of government and noncyclical industries has been increasing.

Sources:

Data

Tableau