Q2 2024 Economic Outlook Update

(Disclaimer: The estimates or forecasts in the GDP model are still complete guesstimates. They serve as a visual representation of how the most likely outcome imo could look like)

In my previous outlook, I noted that a recession didn’t appear imminent, though we could begin to see pockets of weakness emerging in the economy. Since then, this has played out as expected, particularly with increasing signs of softness in the labor market.

Looking ahead, I anticipate this trend will persist in the short term with a gradual economic slowdown. However, despite this deceleration, I still expect the economy to grow at a good pace this year, meaning I do not yet foresee a clear or imminent recession based on the current data. (next 3 months)

NBER business cycle indicators also don’t point to an imminent recession, or a recession currently underway.

However, I still believe a recession is the most likely outcome over the medium term (I modeled it in 2025, but could very well be between 2025-2026), as growth conditions have become more challenging rather than improving, in my view. While the Fed is cutting rates this month, I don’t expect the economy to react immediately. There are lags in the effects of rate hikes, there are also lags in the impact of rate cuts.

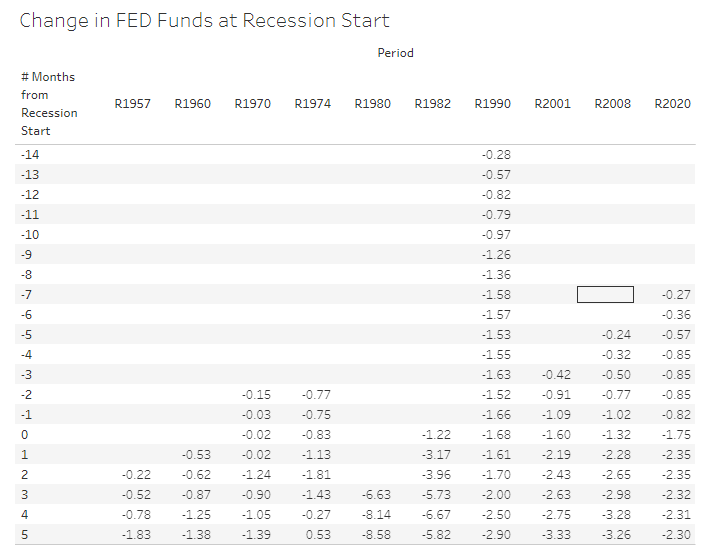

The table below illustrates that in most recessions, particularly since 1990, the Fed had already cut rates by more than 100 basis points before the recession started, yet these cuts did not prevent the recession. (As an example the FED started easing in September 2007, the recession started in January 2008 with 125bps of easing already, and the deep part of the recession until September 2008 with 350bps of easing done)

Given how accustomed the economy was to prolonged periods of ultra-low rates, the lag effect of rate cuts this time could potentially be even longer.

I have also updated my probabilities since I don’t think the risks of inflation reigniting currently are as high as they appeared to be at the beginning of the year:

- Continued slow contraction process, mild recession in 1-2 years: 60%

- Soft landing, the economy experiences sustained (years) positive growth at or above trend, and inflation falls back to 2% without problems: 15%

- Financial or credit shock leading to a very severe recession: 10%

- Continued growing economy with inflation setting above target 3-4%: 10%.

- Acceleration of the economy with inflation increasing again (Would eventually end up in more hikes, and a more severe recession down the road): 5%

I still think higher credit costs for longer even if the FED starts cutting rates, the upcoming credit maturities (in all sectors), and geopolitical tensions as the biggest risks for the economy.

And, I still see the fiscal spending/deficits as the major factor that could offset any private weakness and avoid a general recession, with its own set of consequences eg. Inflation. And I also see AI as a potential upside risk, since the productivity gains could help offset weakness in private incomes and margins.

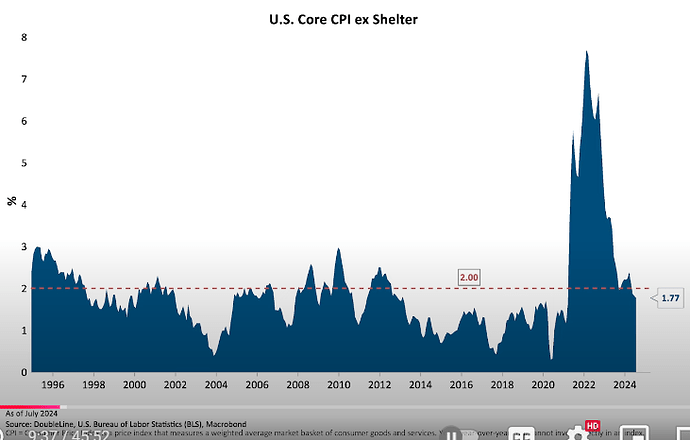

GDP

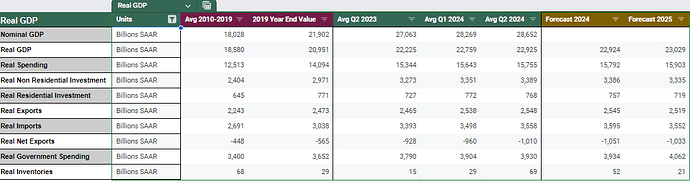

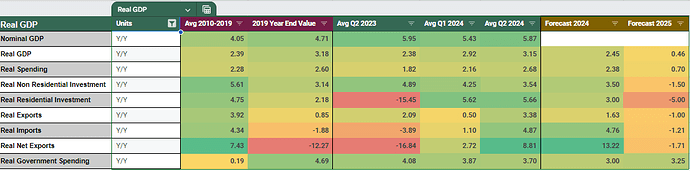

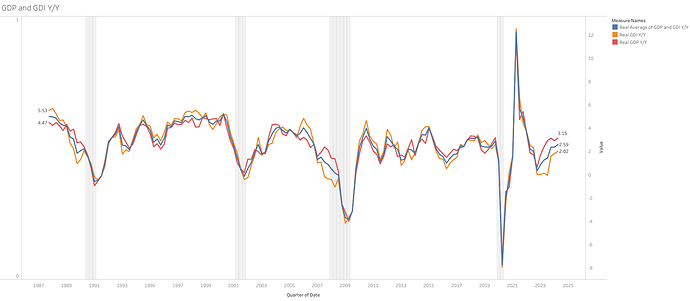

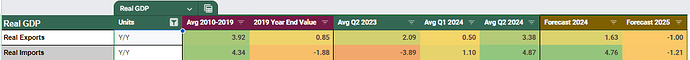

Here are the latest developments and forecasts for Real GDP.

- All real GDP components continue to grow at a healthy pace, with any slowdown happening very gradually. As a result, I expect a solid growth rate for 2024, though slightly lower than the 2.54% Y/Y observed in 2023.

- My projections indicate that GDP may experience mild weakness in 2025. While I still anticipate growth, it is likely to occur at a slower pace.

- This weakness is expected primarily due to an expected modest rise in unemployment, which could weigh on incomes and corporate profits.

- Key areas of concern for me include the housing market, durable goods, nonresidential investment to a lesser extent, and inventory levels, which I anticipate will contribute to the overall slowdown.

The expectations reflect the annual average, it’s common during downturns to experience one or two-quarters of significantly weaker numbers, while the others are less impacted.

I’ve also modeled a potential recession in 2025 as a reference point, but I wouldn’t rule out the possibility of it occurring sometime between 2025 and 2026. So, as I mentioned my forecasts are not to be taken as accurate predictions, just a way to understand my current thinking.

I will explain my reason for my current expectations for each component in their own individual section.

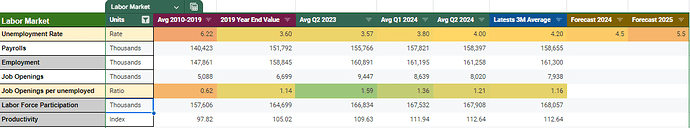

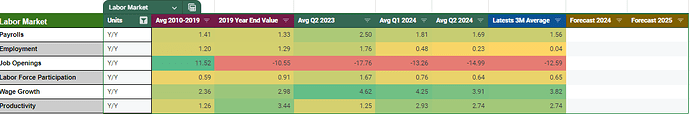

Labor Market

In my view, the labor market is approaching a critical turning point. Currently, more data points to underlying weakness than strength, and I see no clear signals that could stop this trend aside from potential rate cuts by the Federal Reserve.

However, given the lags in monetary policy transmission and the likelihood that rates will remain still elevated for some time even with some cuts, I expect the economy will take time to respond to any easing.

As a result, I anticipate a continued deterioration in the unemployment rate, potentially reaching around 5% by 2025. This remains relatively mild compared to historical recessions, where unemployment rises on average by over 300 basis points from the cycle lows.

Main contributors to my view:

- Employment growth remains flat, and the hiring rate is now weaker than in 2019. A continued increase in labor supply would continue to trigger a significant rise in unemployment.

- Job openings per unemployed worker are declining rapidly, reaching levels in July below those seen in 2019, signaling weakening labor demand.

- Full-time employment is shrinking, while being offset by a rise in part-time jobs due to economic reasons. This shift could eventually lead to saturation in the part-time job market.

- Higher interest expenses for companies refinancing at higher rates will continue to put pressure on margins, especially for small companies, which in turn are the major contributors to employment.

- Employers have already begun reducing hours worked and cutting temporary employees, which could ultimately lead to layoffs, which imo is the last resort for companies looking to reduce costs.

- Significant job revisions to previous reports suggest the labor market may be weaker than originally estimated, a level of revisions not seen since the crisis of 2008.

- Historically, an unemployment rise of the current magnitude (0.8%) has often preceded a recession, with increases rarely stopping below ~1% rise, and typically extending to over 200 basis points.

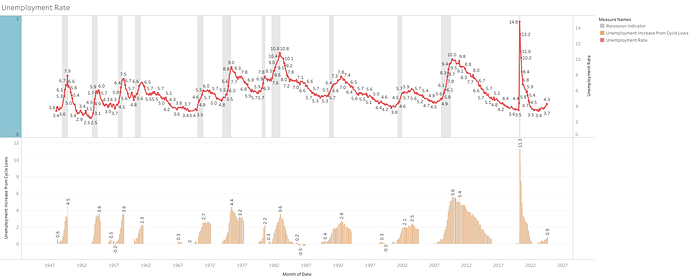

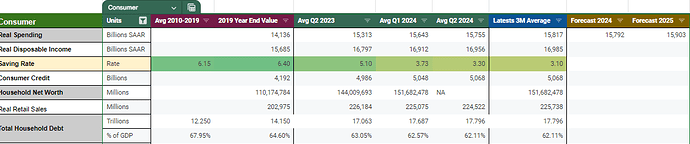

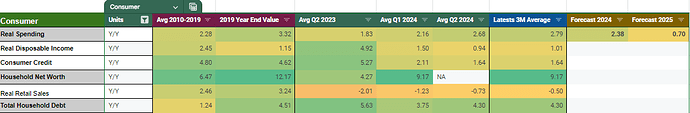

Consumer

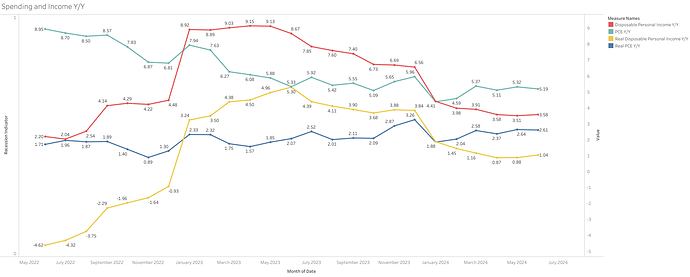

Consumers have demonstrated surprising resilience despite a weakening labor market and tight credit conditions. However, much of this resilience originates from current overspending, with consumer spending growth outpacing income growth. This situation is fragile imo, as further declines in wages and income could trigger a reduction in spending, especially since the saving rate continues to fall to historically low levels.

For 2025, I anticipate a weaker consumer outlook, particularly in spending on durable goods and big-ticket items. However, I expect continued resilience in services spending. Since services account for the largest share of consumer expenditures, overall spending growth is likely to remain positive despite these challenges.

My assumptions for an expected slowdown in consumer spending are based on:

- I don’t foresee a pickup in consumer income given the current softening of the labor market; instead, we may experience further weakness in incomes moving forward if unemployment continues to increase.

- The savings rate is at a historically low level, and when combined with sluggish income growth, this paints an unsustainable picture for consumer spending in the future, since the buffer is very low.

- Major retailers are already signaling shifts in consumer behavior in their earnings reports: consumers are becoming more value-conscious, opting for smaller, essential items, and showing increased caution toward discretionary spending.

- Even with potential interest rate cuts, I don’t expect a huge pickup in consumer credit. Delinquency rates are increasing even before any significant economic weakness, so credit conditions for consumers are likely to remain tight as credit risk rises. Current credit weakness is especially on non revolving credit (autos/student loans)

- Personal bankruptcies are increasing at a rate of ~15% Y/Y, still below 2019 levels, but the trend is likely to persist due to higher rates.

- Interest rate cuts will reduce the income consumers are getting from their assets, but since wealth is very concentrated on the wealthy, the impact is most likely small.

- Consumers still have substantial wealth accumulated post-COVID, which could cushion the impact of weaker income, and one of my main reasons for expected a milder weakness. However, this wealth is unlikely to fully offset the income weakness imo because 1) wealth distribution in the U.S. is highly concentrated in the top 90%, and 2) any downturn in equity or real estate markets could exacerbate the spending pullback through the wealth effect.

- The consumer debt burden’s significantly improved since 2008 will not allow for a similar situation as 2009 this time either, at least for the consumer.

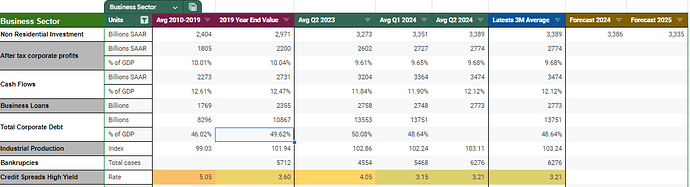

Businesses

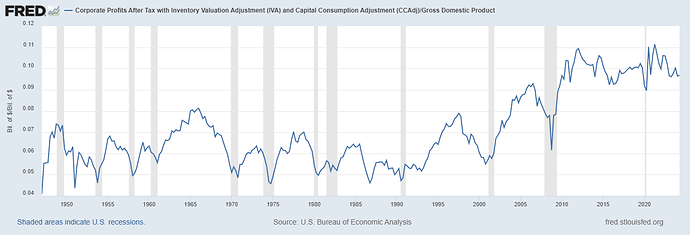

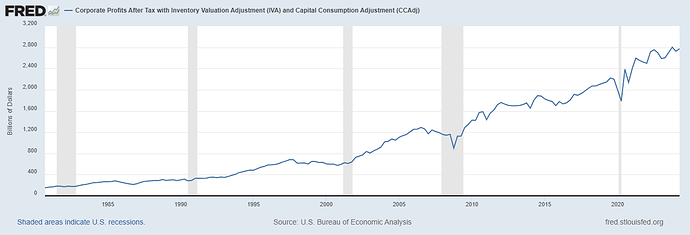

While corporate profits are near all-time highs, the corporate profits as a % of GDP (referenced as the profit margin for the whole economy) are declining and currently below 2019 levels, the same trend for corporate net cash flows.

While this ratio is still significantly higher than what the economy experienced before 2010, in the last decade companies got used to these high levels of margins, and any continued preassure on them will be met by additional cost-cutting measures to try to defend them imo.

I do expect margins to compress or come under pressure a bit more from here, and hence corporate non-residential investment to slightly fall in 2025. These are my main reasons for this:

- Rising unemployment and a slowdown in consumer spending are expected to exert downward pressure on revenues in several sectors. Will also reduce the pricing power for companies, at least temporarily.

- Even with anticipated rate cuts, borrowing costs will remain elevated compared to pre covid levels, and corporate debt maturities will force some companies to refinance at higher interest rates, leading to increased interest expenses, especially for small companies.

- Credit spreads are currently highly compressed, and any further weakening in the economy or labor market is likely to push spreads higher as credit risks rise. This could offset the benefits of lower rates, keeping borrowing costs higher despite monetary easing (a pattern seen in recessions or growth scares)

- Elevated interest rates are also dampening credit, reflected in the sluggish growth of business loans. We can expect continued weakness in interest-sensitive sectors such as manufacturing and real estate.

- Corporate bankruptcies last quarter surpassed 2019 levels and are accelerating rapidly, a trend likely to persist given the high leverage accumulated during the near-zero interest rate era, and the higher level of rates now.

- Small businesses continue to face challenging conditions, with capital expenditure plans remaining below pre-pandemic (2019) levels.

- A bright spot for the sector is that productivity growth, remains above the 2010-2019 average (but not by much either). This could help mitigate some revenue and cost pressures. For these reasons, while I anticipate investment weakness, my forecast points to only mild decline (typically over 4% contraction seen in past recessions)

- Balance sheet liquidity remains relatively strong compared to 2019, providing some cushion for businesses. However, unlike consumers who have deleveraged significantly since 2008, the business sector hasn’t yet reduced significantly its overall debt burden.

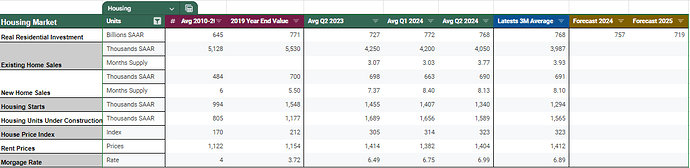

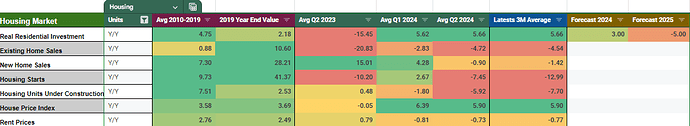

Housing

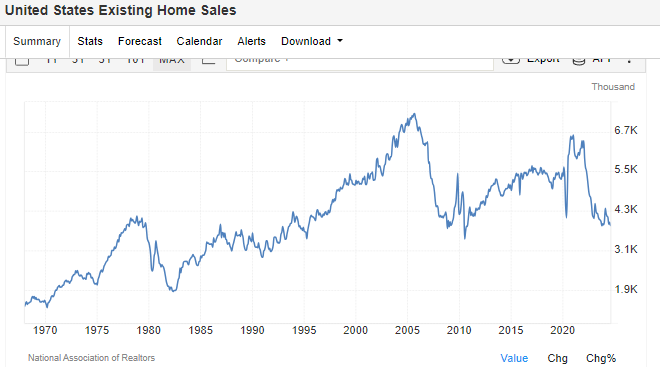

The housing market is clearly in a challenging position right now, with both demand and construction activity at very low levels.

While I believe future rate cuts could help stimulate demand, the recovery will likely be very gradual and won’t happen immediately.

Although residential investment represents a small share of GDP, it is one of the most leading components within GDP.

I am expecting a slow recovery within this sector this and next year due to these reasons:

- While future rate cuts will help stimulate the housing market, the majority of homeowners with existing mortgages have rates below 4% and are unlikely to move, even if mortgages fall to ~5%. This “lock-in” effect means most will continue holding onto their properties unless rates decrease more significantly, limiting inventory growth and keeping sales subdued.

- Mortgage rates have declined by over 150 basis points to ~6% since their peak in October 2023, yet mortgage purchase demand has barely budged, continuing to hover at levels not seen since the 1990s.

- Housing affordability in the U.S. remains critically low, with high prices continuing to outpace income growth. Although lower rates will help improve affordability slightly, they are unlikely to solve the broader issue unless home prices fall dramatically or incomes rise substantially.

- Expectations of a continued softening of the labor affecting consumer incomes and very low consumer sentiment currently demand will continue to struggle from this angle too.

- The expectations for lower home prices and lower rates could potentially delay buying activity for the consumer.

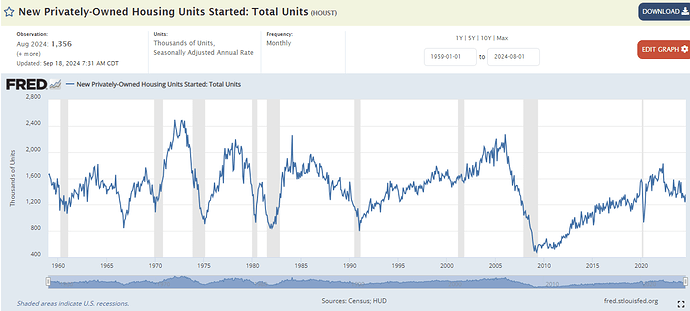

- The housing construction sector remains weak, with new housing starts declining. This has led to a reduction in housing units under construction, a trend that, if it continues, could result in fewer construction jobs and reduced spending in the construction sector.

- Housing inventory is already increasing, and rents are declining. This won’t incentivize much new investment if the current low demand doesn’t meet the continued supply increase.

- Despite the challenging outlook, a repeat of the 2008 housing crisis is unlikely. Mortgage delinquencies remain very low and credit quality have improved significantly. Even if more supply continues to enter the market as rates fall and home prices decline, these factors make a significant housing crash less probable, but could trigger a significant wealth effect in spending tough.

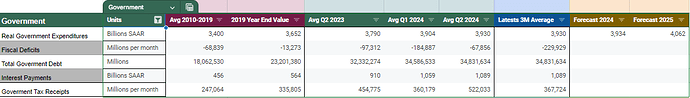

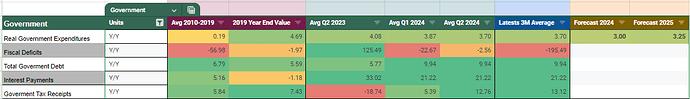

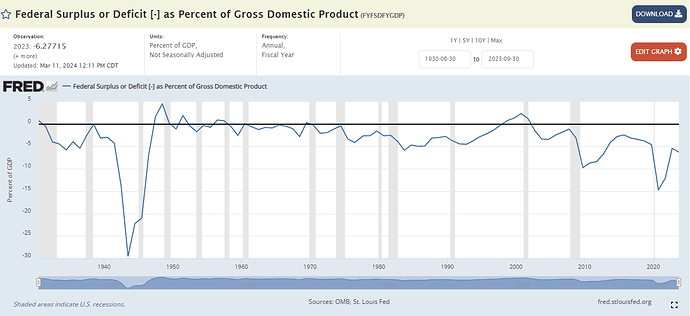

Government Spending

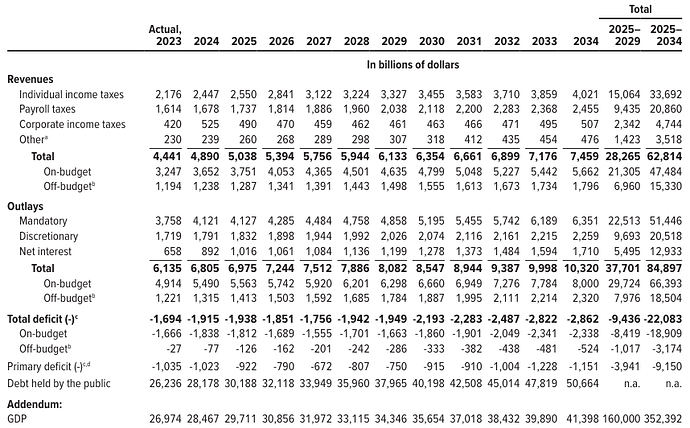

Running large fiscal deficits has become the norm in the US, and I don’t really see this trend reversing anything soon, that’s why I expect government spending to continue to grow above the historical averages, and even accelerate even inside economic weakness, since the government since very determined to try to avoid any private downturn.

- Both presidential candidates’ policies don’t have any fiscal austerity in mind.

- COB projections show 11% increase in outlays in 2024 and 3% in 2025, and ~4% after that. So, declining government spending is not expected in any year.

- While rate cuts will start to help with interest expenses, they are still expected to continue to increase over time as rates are expected to remain higher than prepandemic.

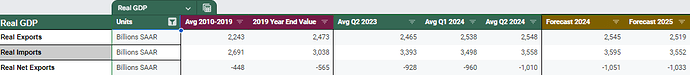

Trade

Imports are currently outpacing exports, driven by global economic weakness and the resilience of the U.S. economy

I’m uncertain about the impact of a potential US economic downturn on current trade dynamics. At this point, I anticipate weaker domestic demand, which could lead to a reduction in trade deficits in 2025 (has been the case in most recessions). However, further research is needed to get a clearer understanding, especially since global economic factors and trade policies will play significant roles in shaping the outcome.

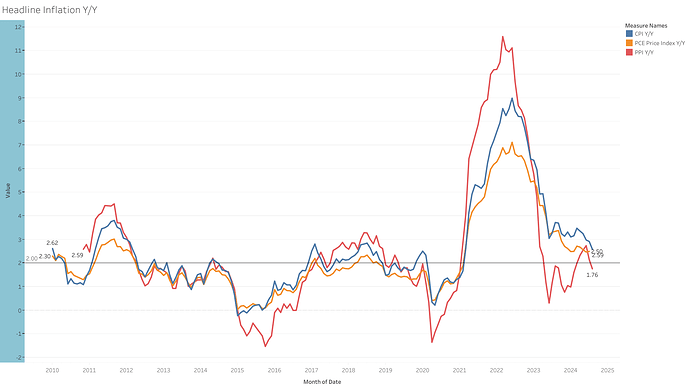

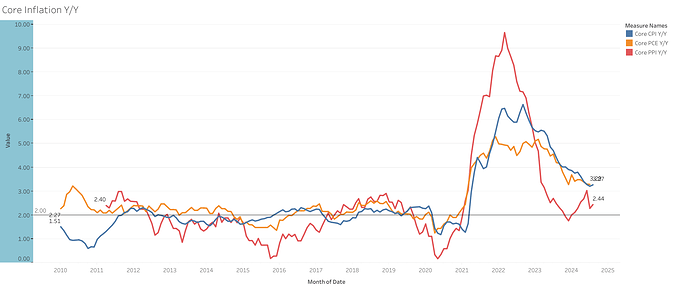

Inflation

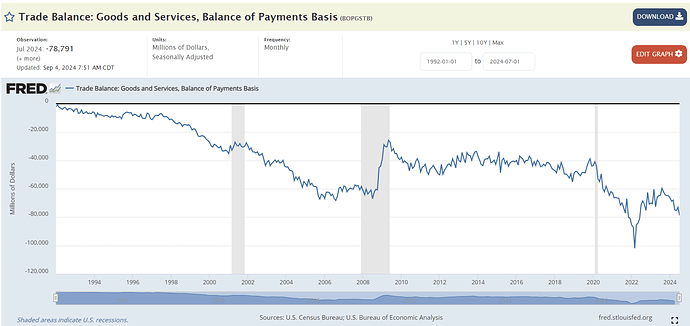

Despite the scare at the beginning of the year, inflation in the last few months has continued in a downward trend, with very soft month-over-month increases. As I reported in the last CPI release, shelter continues to be the major problem for inflation, which is well known to be an extremely lagged component.

All core CPI excluding shelter is already below the 2% target, with core goods being the primary driver of disinflationary pressure until now.

For the short/medium term, I expect overall inflation to continue coming down to the 2% target. However, for the long term, I am not so confident since, in my opinion, the US government debt problems will most likely be resolved in part with money printing and above-target inflation.

Reasons:

- While very slowly, shelter inflation which accounts for most of the current inflation is expected to continue to moderate, since current rents prices are already negative Y/Y.

- China’s weak economy is expected to continue to export deflation or very low inflation.

- A weaker labor market, will continue to put downward pressure on wages, lowering cost on the services sector.

- An overall weaker economy is expected to reduce the pricing power for companies.

- Geopolitical and supply chain issues seem under control for now, but these remain one of the most uncertain and potential risk for the economy and inflation.

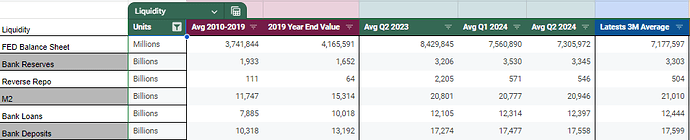

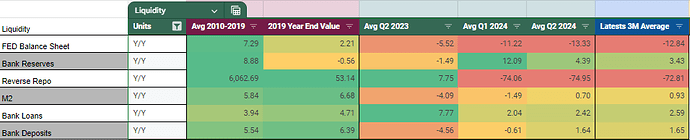

Liquidity

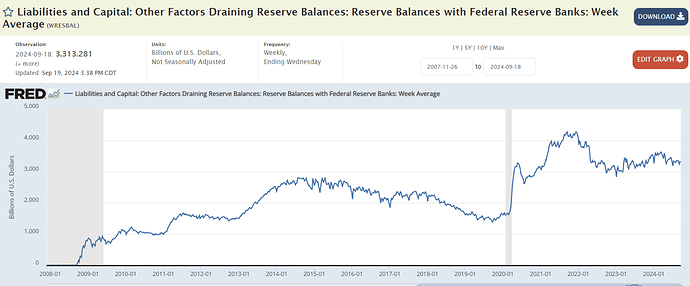

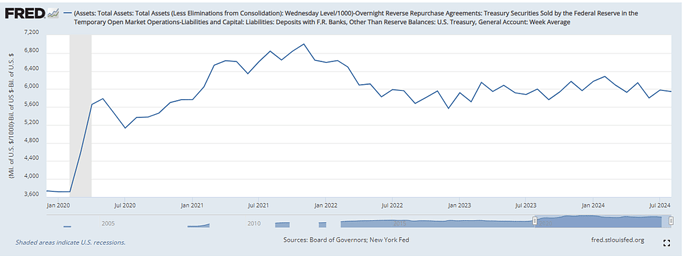

Despite the FED balance sheet runoff, the liquidity conditions have been generally benign since last year’s banking crisis in March.

The drawdown in the reverse repo facility was a key source of liquidity source, but this tailwind has since faded as the reverse repo balance has stabilized at around $300- 400 billion, a relatively low level. With the Federal Reserve not expected to end quantitative tightening (QT) soon, liquidity conditions are likely to remain uncertain moving forward. However, I do not anticipate a crisis in this area.

Bank reserves have become a critical metric to monitor, as they are also a key indicator the Federal Reserve appears to be focusing on when assessing whether to continue or pause QT. While reserves have started to decline again, they remain at relatively elevated levels, suggesting no immediate danger. (they were at 3 Trillion in march 2023 banking crisis, today at 3.3 Trillion.

That said, the liquidity landscape is highly complex, involving both domestic and global flows, and will require for me further in-depth research to fully grasp the whole picture. Given the complexities of these dynamics, much remains uncertain for me for now, and I cant say I am very confident no problems could arise from here.

Monetary Policy

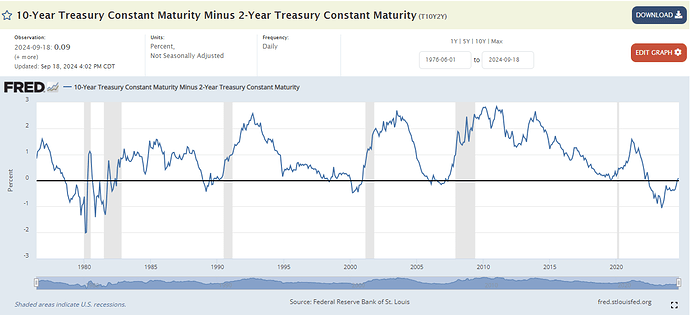

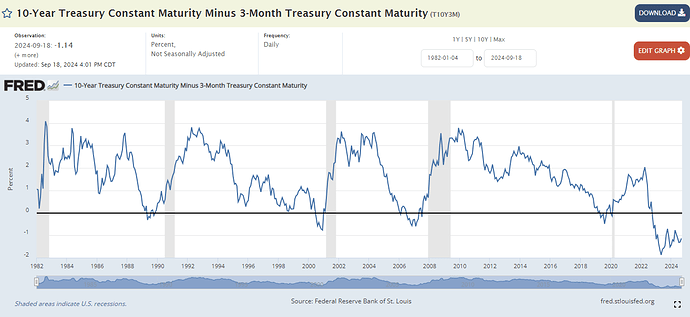

Given my outlook on the economy and inflation, I anticipate the Federal Reserve will lower interest rates by 200-300 basis points over the next two years, to a level of 2-3% fed funds rate. However, the exact timing and extent of these cuts will largely depend on the depth and speed of any potential economic downturn.

It’s important to note that government bond yields and mortgage rates have already priced grand part of these anticipated cuts, meaning any additional significant easing in market yields (the ones the matter for the economy) would require the Fed to cut rates more aggressively than the market currently expects.

The 10/2 years yield curve has started to uninvert, which historically has been a reliability signal that economic weakness is not that far along. Still very mild positive slope, so is still not confirmed if it will hold.

The 10-year/ 3 month yield curve remains negative.