Main Article: Travel and Tourism Industry - InvestmentWiki

My current assessment of the travel industry:

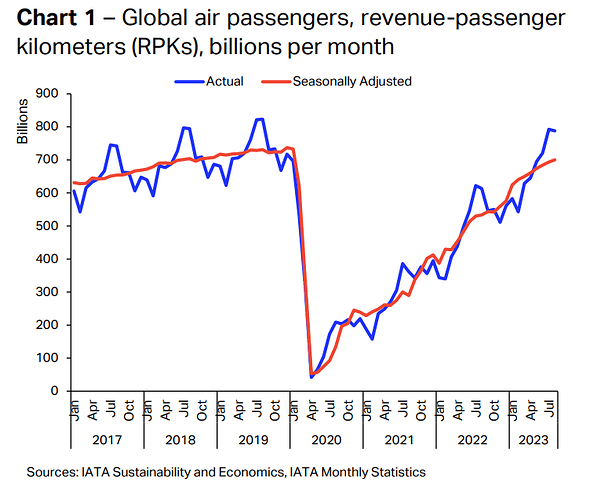

The industry seems to be still in a good position, with still strong growth in air travel and international tourism, though growth rates slowing from Q1 to Q2.

Is expected to continue to be this way for the rest of the year, especially in the summer season. Obviously assuming no significant economic slowdown in 2023.

Some insights:

- Air passenger traffic growing significantly still, international and domestic. May marked the first month that the global passenger load factor was fully restored to 2019 levels. Moreover, the available seat capacity recovered to 96.1% of pre-crisis levels.

- International tourist arrivals reached 80% of pre-pandemic levels in the first quarter of 2023, growing 86% y/y (Q2 still not available)

- In the US, car rental spending for businesses, more than doubled in Q2 2023 compared to the year prior, and also grew compared to Q1 2023. Though avg length of rental is declining. Prices probably have increased significantly, because spending is significantly higher since 2019.

- Forecast points to continued positive growth in coming years, but at a slower growth rate than 2022/2023.

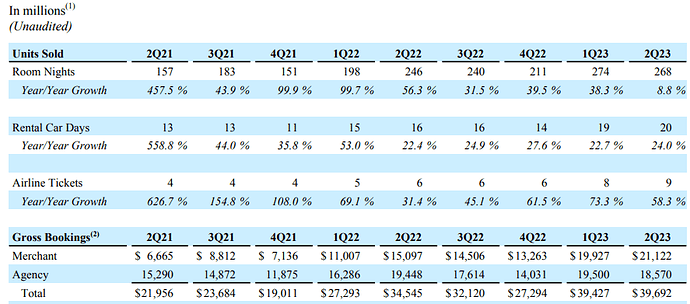

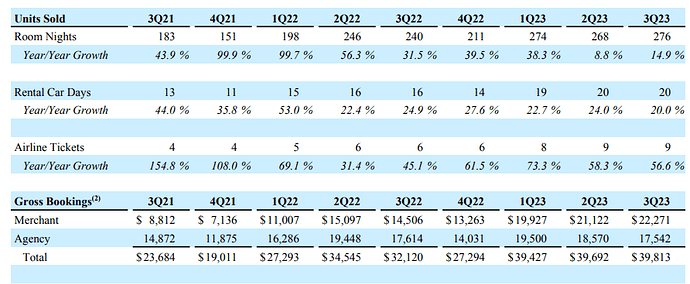

- Bookings.com had a better-than-expected quarter, due to resilient demand

“In the second quarter, we continued to see robust leisure travel demand, which helped drive stronger than expected room nights and gross bookings results in the quarter,” said Glenn Fogel, Chief Executive Officer of Booking Holdings. “We have seen these strong trends continue into July, and we are currently preparing for what we expect to be a record summer travel season in the third quarter. We are particularly excited about our recently announced generative AI-enabled travel assistants at both Priceline and Booking.com, and look forward to learning which elements customers value the most.”

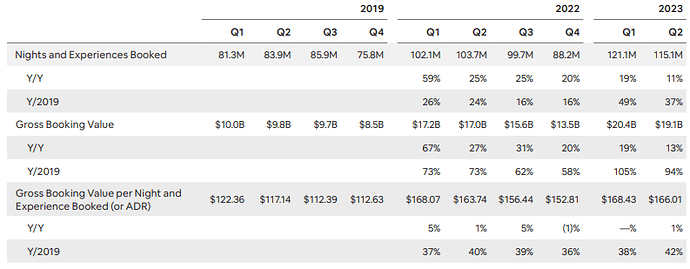

- Airbnb reported mixed results, especially because nights booked are decelerating more than expected, but still with positive growth.

https://s26.q4cdn.com/656283129/files/doc_financials/2023/q2/Airbnb_Q2-2023-Shareholder-Letter_Final.pdf

Good summary and very cool Wiki article with a lot of interesting insights to understand the travel industry.

I wonder if we eventually can figure out how insights from those data points transform into the revenue of car rental or other tourist-related companies.

Would be interesting to establish correlations and see how strong they are between e.g. rise in travel and revenue increase for car rental companies.

The travel industry still growing nicely. The growth rate is declining, for the extreme highs, but is still over 20% y/y. Almost at 2019 levels, passenger traffic at 95.7% of 2019 levels.

Growth is expected to continue moderate.

- Industry-wide revenue passenger-kilometers (RPKs) increased 28.4% year-on-year (YoY) in August. Compared to 2019 levels, passenger traffic recovered to 95.7%.

- Available seat-kilometers (ASKs) rose at a slower annual pace of 24.9%, lifting passenger load factors (PLFs) close to pre-pandemic levels. The PLF in August was 84.6%, 1.1 ppts lower than the PLF for the same month in 2019.

- Domestic passenger traffic grew 9.2% over pre-pandemic levels.

- The recovery of international RPKs remained at 88.5% of 2019 levels. Regions experienced different outcomes while Asia Pacific carriers continued to restore international traffic.

- Ticket sales data signaled unwinding domestic demand while international bookings remained on the same positive trend.

https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-market-analysis---august-2023/

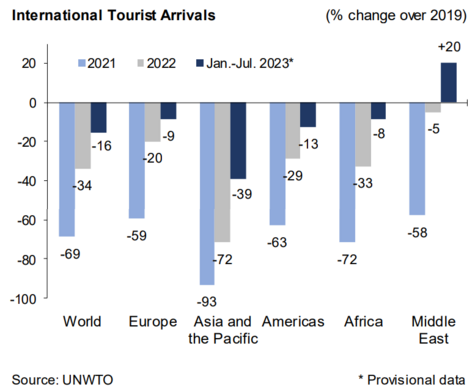

The September report from WTO, also showed high growth (43% y/y) in international tourism still, at least as of July. Still 16% below 2019 levels.

- An estimated 700 million tourists travelled internationally between January and July 2023, about 43% more than in the same months of 2022, though 16% fewer than in 2019.

- Europe welcomed 375 million of those travellers, 54% of the world’s total.

- After reaching 80% in Q1 2023, international tourist arrivals hit 85% of pre-pandemic levels in Q2 2023 and 90% in July 2023, backed by continued pent-up demand.

- Hotel bookings doubled in January-August 2023 compared to the same period last year (Sojern). Global occupancy rates in accommodation establishments reached 70% in August, slightly above the 66% rate in August 2022 (based on STR data).

- The challenging economic environment could weigh on spending patterns over the remainder of the year, with tourists increasingly seeking value for money, travelling closer to home and making shorter trips.

https://tourismanalytics.com/uploads/1/2/0/4/120443739/unwto_tourism_barometer_september_2023.pdf

Airlines Q3 3023 results summary:

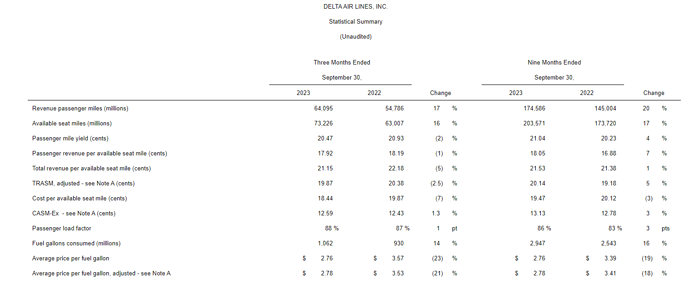

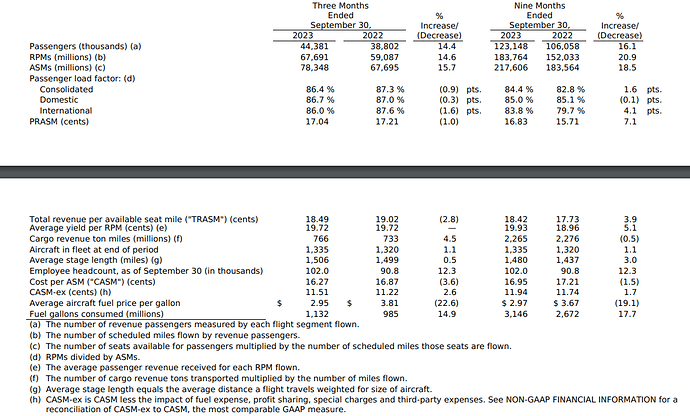

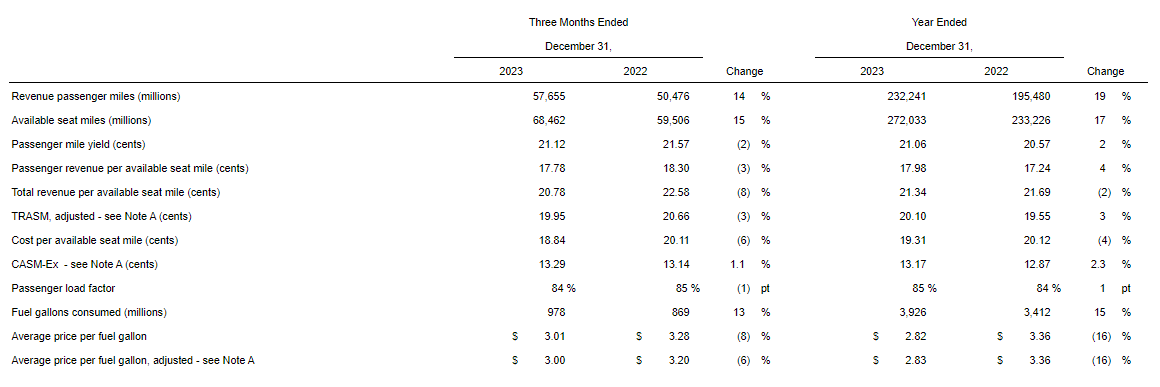

Delta Airlines

Says they continue to see strong demand, especially in the transatlantic segment. While demand is strong, revenue per available seat mile and passenger yield are down y/y and q/q in Q3.

They mentioned their is some discounting happening in the industry, but their fares are holding up well due to the premium segment.

Robust demand for travel on Delta is continuing into the December quarter where we expect total revenue growth of 9 percent to 12 percent compared to the December quarter 2022 with total unit revenue (TRASM) expected to decline 2.5 percent to 4.5 percent. Within this outlook, Domestic and Transatlantic trends are consistent with the September quarter on a year-over-year basis, while unit revenue trends in the Pacific and Latin America are expected to modestly decelerate given capacity growth related to China re-opening and investment in our LATAM JV

Business travel continues to see increased growth

Our recent corporate survey indicates continued growth in business demand with a significant majority of companies expecting their travel to stay the same or increase as we move into 4Q and into '24. SME and hybrid travelers are producing margins in line with corporate travelers and demand from these travel remains well above 2019 levels.

Domestic demand expected to moderate

Domestic demand remains steady and initial bookings for the peak holiday periods are strong. The ongoing UAW and actor strikes are having a modest impact and we have incorporated those into our outlook. As we move through the fourth quarter, our Domestic capacity growth moderates and, in the first quarter of 2024, we expect domestic capacity to be flat to slightly down year-over-year.

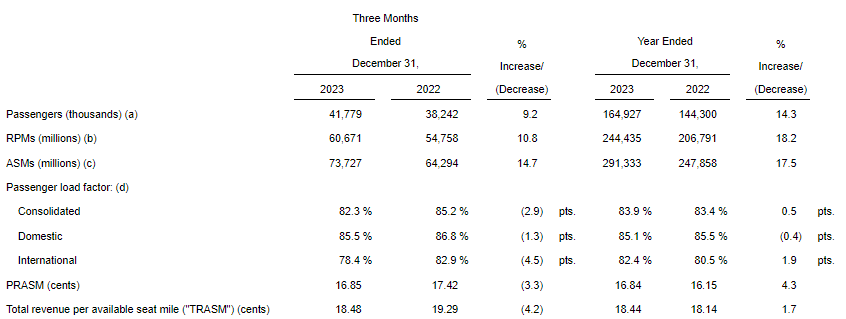

United Airlines

Very similar history to Delta Airlines.

Total third-quarter top line revenue was up 12.5% year-over-year, a record revenue quarter and near the high end of guidance. United experienced a strong and steady domestic demand environment in the quarter, with 9% revenue growth year-over-year, outpacing second quarter results. The company saw strength in close-in bookings in August and September with both months well ahead of year-over-year demand.

In the international space, profits were at record highs in both the Atlantic and Pacific regions. Revenue in the Atlantic region was up 15% versus the same quarter in 2022, and 70% versus the same quarter in 2019. Pacific revenue exceeded third-quarter 2019 levels despite capacity remaining 24% below third-quarter 2019. Domestic revenues in the quarter were second highest all-time and the domestic system remains solidly profitable.

Q4 still expected to have healthy growth.

Turning to our outlook for the fourth quarter. We expect total revenue to be up approximately 10.5% on approximately 15.5% more capacity. This implies TRASM will be down around 4.5% year-over-year. United’s Q4 unit revenue expectations are consistent with Q3 adjusted for stage.

Demand for the Atlantic and the Pacific was truly outstanding, and we see that trend continuing into the fourth quarter. Third-quarter domestic PRASM results were consistent with our year-over-year performance in the second quarter down 2.1 points. In other words, we saw no real change in our domestic trends in the quarter-over-quarter review. Our focus on prudent gauge growth centered in our hubs resulted in strong positive marginal revenue on our incremental capacity.

https://www.united.com/en/us/newsroom/announcements/cision-125299

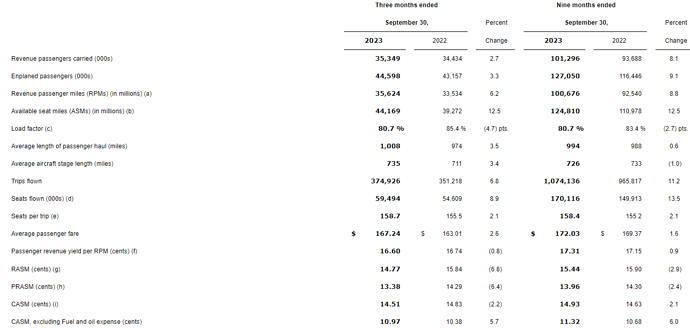

Southwest Airlines

Soutwest also mentioned healthy demand, they have a bit more weakness but mentioned this is because they need to have a adjustmnent to match the network to demand trends better, as demand patterns will moderate back to prepandemic.

They do mentioned their promotional activity as being slightly more than normal, but fares still holding ok.

The Company’s third quarter 2023 revenue performance was a third quarter record due to strong leisure demand. While the Company experienced lower-than-expected close-in bookings in both August and September, impacted by seasonal trends, overall demand remained stable throughout the quarter. Third quarter 2023 managed business revenues performed largely as expected, as the Company continued to gain business travel market share.

Outlook

Moving to the fourth quarter, we are seeing a continuation of healthy leisure booking demand and stable business travel patterns. As a result, we expect a nominal sequential increase in operating revenue, resulting in record fourth quarter revenue and passengers which would bring us to three consecutive quarters of record operating revenue. October performance has been strong to date and bookings for the holidays as a whole are also strong.

RASM however continues to be impacted by higher than seasonally normal capacity, driven by our network restoration plan, a larger than normal investment in development markets, and business travel that while improving is still below historical levels.

They point out the RASM ( revenue per available seat mile) weakness is not about demand, but a mismatch in networks and demand trends.

it’s not about there is a demand problem. So again, Southwest, we’re seeing, again, record operating revenues, record passengers, record Rapid Rewards participation on revenues, record retail spend on our card, record new members, on and on and on, and we’re expecting record operating revenues and passengers again in the fourth quarter.

So it’s not as if we’re not generating demand. Southwest is generating a strong demand. It’s about getting that aligned more precisely with the new travel patterns

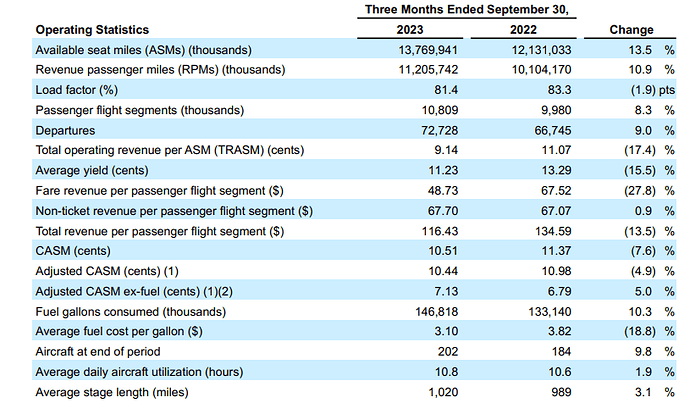

Spirit

Spirit very different story, a lot of weaknesses in most of its metrics.

Softer demand for our product and discounted fares in our markets led to a disappointing outcome for thethird quarter 2023. We continue to see discounted fares for travel booked through the pre-Thanksgiving period. And, unfortunately, we have not seen the anticipated return to a normal demand and pricing environment for the peak holiday periods. Given these continued trends, we are evaluating our growth profile and our competitive position.

In addition to a softer-than-expected demand environment, we continue to be challenged by higher fuelprices and NEO engine availability issues and are expecting our margins in the fourth quarter will be lowerthan we reported for the third quarter 2023.

Accommodation Q3 2023 earnings summary:

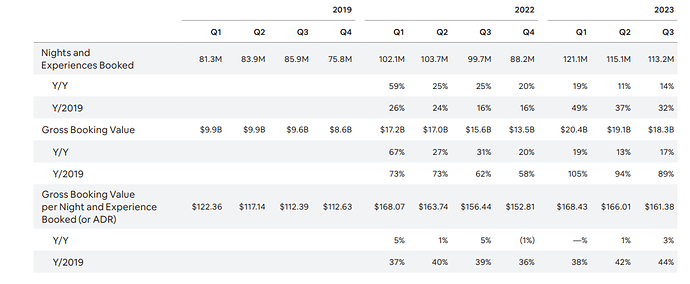

AirBnb

Airbnb has mentioned seeing some softness in demand for Q4 compared to Q3, but early to say if it will continue during the quarter.

- Earnings: $6.63 per share.

- Revenue: $3.40 billion, vs. $3.37 billion expected

The company guided to $2.13 billion to $2.17 billion in fourth-quarter revenue, 12% to 14% y/y. That was less than the $2.18 billion that analysts polled by LSEG had been expecting.

Q3 was a record-breaking summer travel season for our business. We are seeing greater volatility early in Q4, and are closely monitoring macroeconomic trends and geopolitical conflicts that may impact travel demand. We currently expect our nights booked growth in Q4 2023 to moderate relative to Q3 2023. Meanwhile, we expect ADR in Q4 2023 to be stable to slightly up compared to the same period last year.

Nights demand has softened in Q4

In terms of the nights guide, we’re just seeing some variability in our nights demand here early in the quarter and so we’re just being cautious with that guide. And so we’re not being specific on it but anticipate nights to be a few points below – nights growth to be a few points below Q3.

What we’re seeing is a little bit of softness in our overall kind of demand relative to Q3, we call out kind of the macroeconomic and geopolitical just because that is what’s, I think, driving any volatility that’s out there

There’s not a specific region where we’re seeing it. I think maybe the biggest thing we’ve seen is that it’s more broad-based on a global basis right now which is why we’ve kind of called out the macroeconomic and potential geopolitical issues as a potential driver to it.

Booking Holding

Booking still sees a healthy demand

“We are pleased to report record quarterly room nights, gross bookings, revenue, and net income driven by a strong summer travel season,” said Glenn Fogel, Chief Executive Officer of Booking Holdings. “We are encouraged by the resilience of leisure travel demand, and we remain focused on executing against our key strategic priorities, which helps position our business well for the long term.”

Overall, we continue to see resiliency in global leisure travel demand. And as we take a very early look ahead to 2024, we see strong growth on the books for travel that will take place in the first quarter of next year, though a high percentage of these bookings are cancellable. Given current trends, we expect customers and consumers will continue to prioritize travel over other discretionary spend in 2024.

So we say – and we’ve said this several times, several quarters [indiscernible], the same question keeps coming up in different forms of – do we see any softening? Do we see anything decline? Do we see a decrease in star rating? Do you see a decrease in length of stay and things like that. We say no. And that’s what we’ll be – no and no.

From World Tourism Organization

- International tourism recovered 88% of pre-pandemic levels in 2023 with an estimated 1286 billion arrivals (1.3 billion), up 34% from 2022.

- International tourism receipts reached USD 1.4 trillion in 2023 based on preliminary estimates, about 93% of the USD 1.5 trillion earned by destinations in 2019.

- Total export revenues from tourism (including passenger transport) are estimated at USD 1.6 trillion in 2023, almost 95% of the USD 1.7 trillion recorded in 2019.

- Tourism direct gross domestic product (TDGDP) climbed to USD 3.3 trillion in 2023 according to provisional estimates, about 3% of global GDP, similar to 2019 values.

Forecast:

- International tourism is expected to recover pre-pandemic levels in 2024, with initial estimates pointing to 2% growth above 2019 levels, and 16% from 2023 (~1,495 M tourists)

https://webunwto.s3.eu-west-1.amazonaws.com/s3fs-public/2024-01/barometer-turism-data-ppt-jan24.pdf?VersionId=ua6xuwZCeveZWEzbIFVP5eXUmGszXhXs

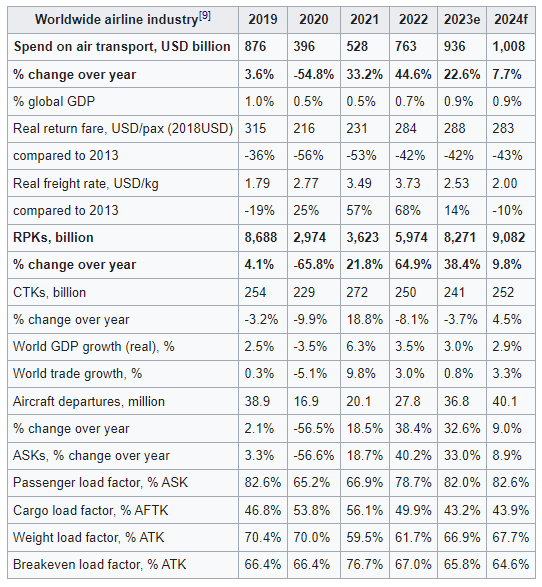

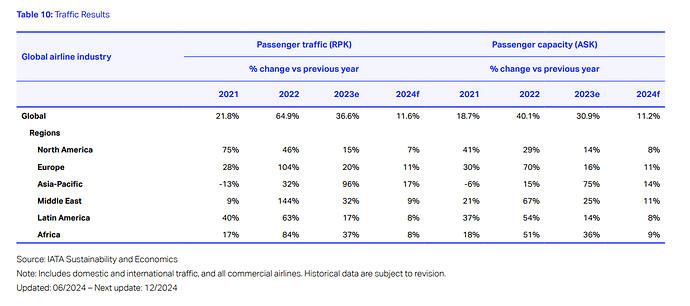

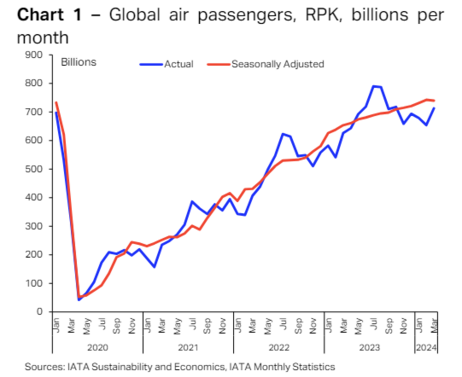

As for Air passengers, according to IATA:

Global demand for air travel remained strong in 2023, with the industry steadily approaching 2019 levels of passenger traffic. Following a significant 64.9% YoY upturn in 2022, industrywide passenger traffic, measured in revenue passengerkilometers (RPKs), surged by 40.1% in the first nine months, but growth will slow in 2024.

https://www.iata.org/en/iata-repository/publications/economic-reports/global-outlook-for-air-transport---december-2023---report/

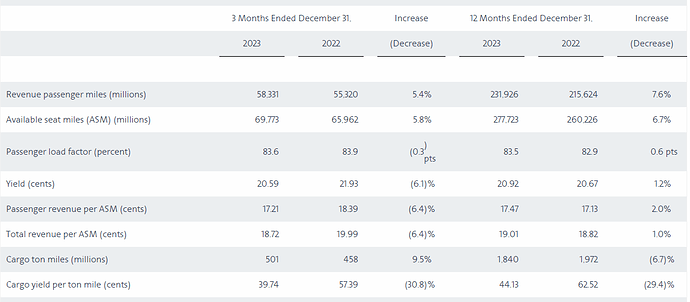

Airlines Q4 2023 results:

Delta

Delta closed out the year by doubling its quarterly profit as travel demand, particularly for international trips, helped drive record revenue in 2023.

Still, the company cut its full-year profit outlook from a previous forecast, and the stock fell 9% on earnings.

“With our outlook for continued revenue growth, we expect March quarter unit revenues to be flat to down 3 percent over 2023,” Glen said. “The midpoint of this outlook implies a two-point sequential improvement in unit revenues on a year-over-year basis. The March quarter includes a headwind from higher international mix, the normalization of travel credit utilization and lapping a competitor’s operational challenges in the year ago period.”

But according to them travel demand continues strong.

travel experiences continues to outpace overall GDP by 2 to 3 points. We expect solid growth in business demand with nearly 95% of respondents in our recent corporate survey expecting to travel as much or more in 1Q than 4Q. This is a double digit improvement in travel intentions from our last survey.

We expect demand to remain strong, particularly for the premium experiences that Delta provides. Consumer spend is continuing to shift from goods to services, and our customer base is in a healthy financial position with travel remaining a top priority. And corporate travel continues to improve with demand accelerating into year-end. On supply, industry growth is normalizing after several years of network restoration.

United Airlines

United Airlines Q4 adjusted earnings fell 18.7% to $2.00 per share. Revenue growth slowed for the third consecutive quarter, increasing 9.9% to $13.63 billion.

United Airlines also signals strong demand continues.

Domestic demand remains strong with increases in business traffic volumes year-over-year in addition to stronger pricing thus far this year, and we expect domestic year-over-year PRASM to be positive for the quarter.

Bookings and yields for Atlantic fly in early 2024 are also strong and we expect these trends to continue into the second and third quarters.

https://www.united.com/en/aw/newsroom/announcements/cision-125313

American Airlines

American Airlines reported a 75% drop in adjusted earnings to 29 cents per share, but still came in well above FactSet forecasts of 11 cents per share. Total revenue eased 1% to $13.06 billion, just above estimates of $13.01 billion, marking eight quarters of declining sales growth.

Demand remains strong, and we’ve seen robust bookings to start the year as travel trends have begun to normalize across entities. We’re also very encouraged by the trends we’re seeing in business travel.

https://americanairlines.gcs-web.com/news-releases/news-release-details/american-airlines-reports-fourth-quarter-and-full-year-2023

https://www.investors.com/news/united-airlines-earnings-due-amid-soft-expectations-for-the-industry/

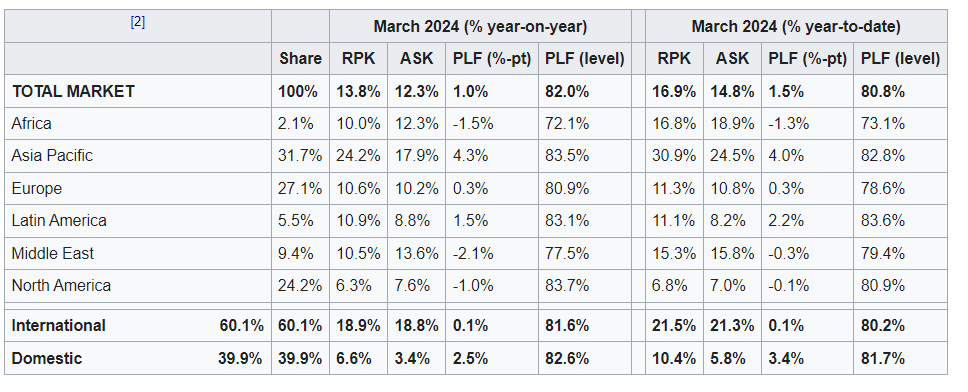

Only IATA has new numbers for Q1 2024:

IATA like most airlines don’t report total passengers, their demand or traffic measure is Revenue Passenger Kilometers(number of paying passengers by the total distance traveled in kilometers.)

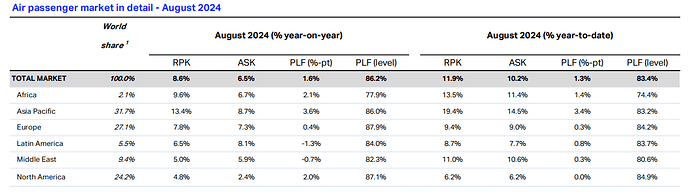

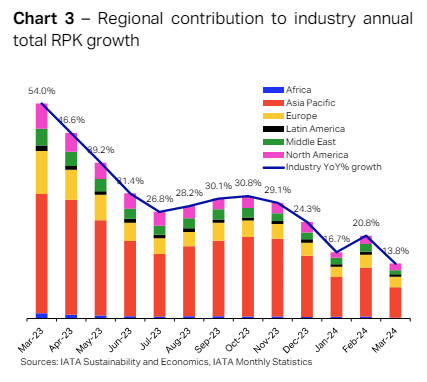

Demand continues to grow at a relatively good pace, with a 16.9% Y/Y in Q1 2024.

- North America and Europe with slower growth, but still positive, 6.8% Y/Y and 11.3Y/Y respectively.

- According to IATA levels are already at or even above 2019 levels.

“Demand for travel is strong. And there is every indication that this should continue into the peak Northern Summer travel season. It is critical that we have the capacity to meet this demand and ensure a hassle-free travel experience for passengers” said Willie Walsh, IATA’s Director General.

Airlines’ comments in their earnings call, also support the healthy demand trend:

Demand continues to be strong and we see a record spring and summer travel season with our 11 highest sales days in our history, all occurring this calendar year.

Business travel demand has taken another meaningful step forward this year with growth accelerating into the mid-teens over last year.

On demand, we see continued positive momentum and bookings across all customer segments from the most price sensitive customers to domestic road warriors and up to the premium global customer.

For Q2, we continue to see strong domestic and Atlantic demand with positive RASM results tempered by the Pacific where we expect a negative result year-over-year.

Domestic leisure has been really strong. Now business demand is clearly continuing to come back and that’s wind in our sales from a relative perspective.

we see exactly the same demand backdrop that everyone else sees, a healthy U.S. economy which is so key to us. Strength coming from the Sunbelt, and growing spending on experiences over other forms of merchandise or goods.

… we see strong demand, and we’re going to revenue manage appropriately. But the marketplace, domestic international looks very strong.

We see demand coming back. It’s strong again this year, and that’s favorable for American Airlines because that demand is also coming in the places that we are strong

- Rental prices were cheaper this summer than last year, that’s according to the booking platform Billiger-Mietwagen.de analysis of prices in the 20 most frequently booked countries and 40 cities between July 15 and August 31.

- The platform notes that rental prices fell by 9% to 46 euros in Germany.

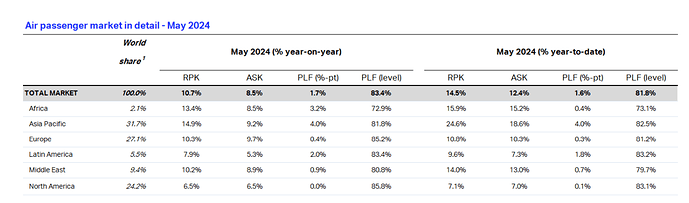

Q2 2024 Update: The travel industry continues to perform with relatively strong growth rates

As of May 2024, RPK increased by 14.5% YTD, (16.9% in Q1 2024)

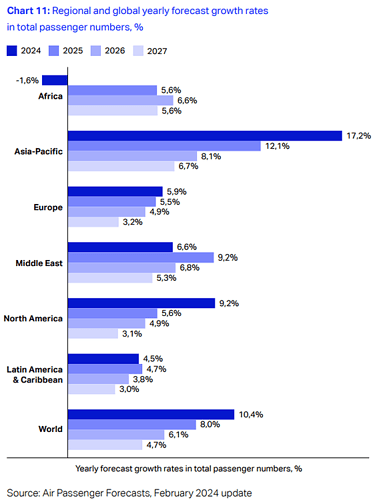

- 11.2% growth forecasted for 2024.

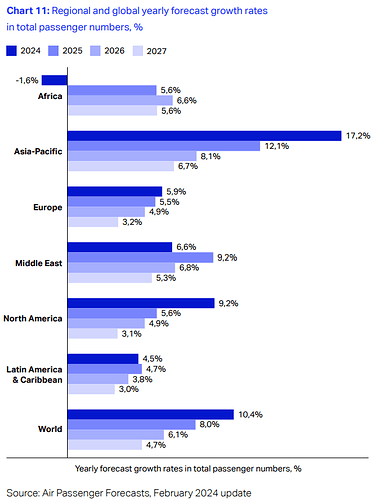

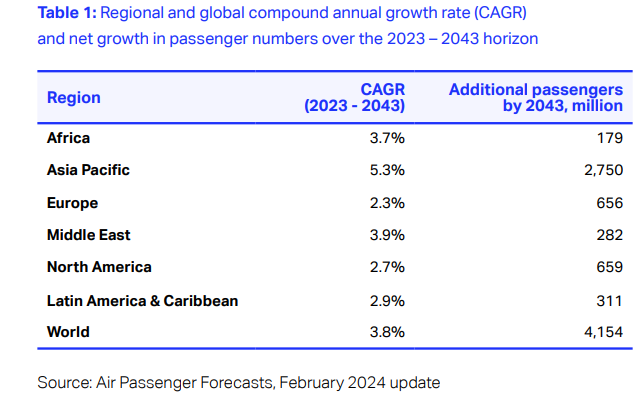

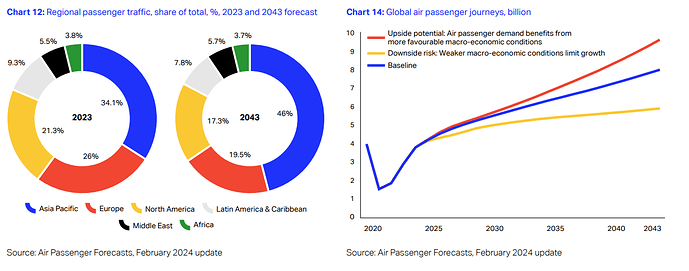

IATA, forecasts a positive but slowing growth rate for the next 4 years, and a 3.8% GAGR until 2043, with 4 billion more passengers.

- North America and Europe slower growth forecasted at ~2.5.

- Total travelers are expected to reach 4.96 billion in 2024—a record high.

https://www.iata.org/en/iata-repository/publications/economic-reports/global-outlook-for-air-transport-june-2024-report/

https://www.iata.org/en/iata-repository/publications/economic-reports/air-passenger-market-analysis-may-2024/

Traffic by Region

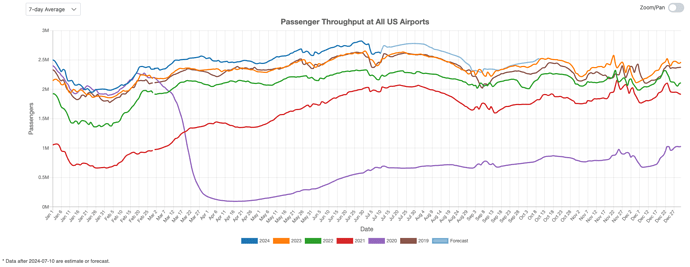

US

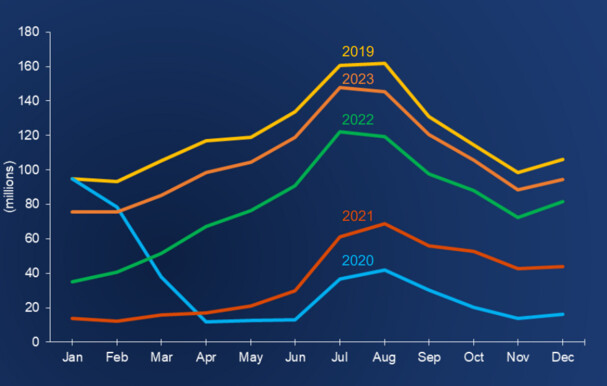

In 2024, US airport traffic showed robust growth, with daily passenger numbers consistently exceeding previous years’ figures by 5-10% throughout June. Starting from mid-February 2024, US air traffic surged to its highest levels in five years. Forecasts indicate this growth momentum is expected to continue through the summer.

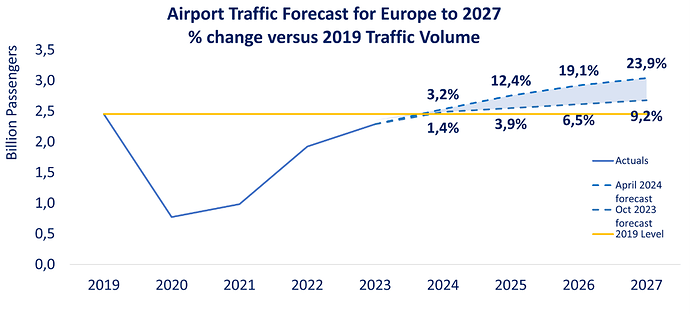

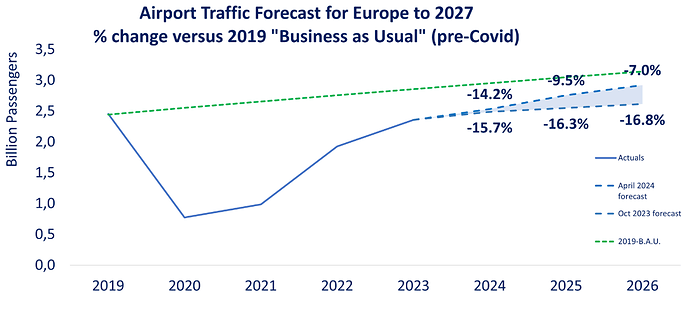

Europe

- Traffic growth expected to slow from just below 10% 2024 vs 2023 to around 8% year-on-year in 2025

- Traffic this year to fall -14.2% below the projected traffic for 2024 pre-Covid trendline

- Passenger traffic in 2024 will surpass 2019 levels by +3.2%. This is a significant improvement compared to the October 2023 forecast (+1.4%)

Q3 2024 Travel Update: Strong but slowing growth rates within the travel industry continue in 2024

As of August 2024, RPK increased by 11.9% year to date (13.4% in Q2 2024), while ASK grew by 10.2%.

IATA passenger numbers forecasted continue to be the same. A positive but slowing growth rate for the industry as the industry stabilizes after the pandemic shock.

Air Traffic by Region

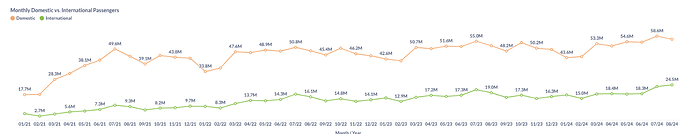

US

In August 2024, domestic passenger numbers dropped from 58.6 million in July to 56.4 million, though this still represented an 8.8% increase compared to August 2023, when 51.9 million passengers were recorded. Meanwhile, the international sector experienced growth, with passenger numbers rising from 23.3 million in July to 24.5 million in August 2024.

Europe

Passenger traffic across the European airport network increased by +9% in H1 compared to the same period last year, with the pace of growth in Q2 (+8%) remaining very dynamic – although easing somewhat compared to Q1 (+10.2%).

International traffic kept being the main growth driver in H1 (+10.3%), expanding at more than twice the rate of domestic traffic (+4.2%).

This brought H1 passenger volumes at +0.4% above H1 2019 levels – finally confirming a full recovery from the Covid-19

Q3 2024 Airlines report still healthy demand for travel

Overall results

- Delta’s net income rose 15% from a year earlier to $1.27 billion with total revenue up 1% to $15.68 billion.

- United Airlines posted revenue of $14.84 billion, up 2.5% from a year earlier and above analysts’ estimates. It reported net income of $965 million, down 15% from a year ago.

- American Airlines revenue rose 1.2% to a record $13.65 billion, but posted a net loss of $149 million, narrower than the $545 million loss it reported a year earlier. Unit revenue fell 2% in the quarter.

Travel demand continues to be healthy

- Delta: core customer base is in a healthy financial position with travel remaining a top spend category.

- Delta: Unit revenue improved sequentially in all geographic entities reflecting the strength in travel demand and an improving industry backdrop.

Corporate travel also continues to improve

- Delta: Corporate travel sales were up 7% during the quarter, led by double-digit growth in coastal hubs with broad-based strength across sectors.

- Delta: recent corporate survey indicates a positive outlook for business demand with 85% of respondents indicating they expect their travel spend to grow in 2025.

- United Airlines: Corporate demand acceleration was nice to see in September across all regions and is expected to continue into Q4.

- United Airlines: Contracted corporate revenues were up 13% in September, at 95% of 2019 revenues, which is 13 points higher than July and August.

Q4 2024 demand is expected to continue to be strong

- Delta: continuing to shift travel to Europe, in particular, from July and August peak to a September and October peak.

- American Airlines: fourth quarter, I do see strong demand overall, but it’s a quarter in which a strong October, and I think a strong December has some noise in it.

- American Airlines: how bookings have progressed, I see that October very strong, December very strong. And as we look out into 2025, same holds true for what we have on the books for January as well.

- Delta: The improved unit revenue trends we saw in the month of September are continuing into the December quarter with healthy bookings for the holiday.

However, softness in demand is expected close to the US elections

- Delta: historically, domestic travel demand is impacted in the weeks surrounding the election, resulting in an expected 1 point impact to system unit revenue for the quarter.

- American Airlines: expected softness in demand around the election, around Halloween.

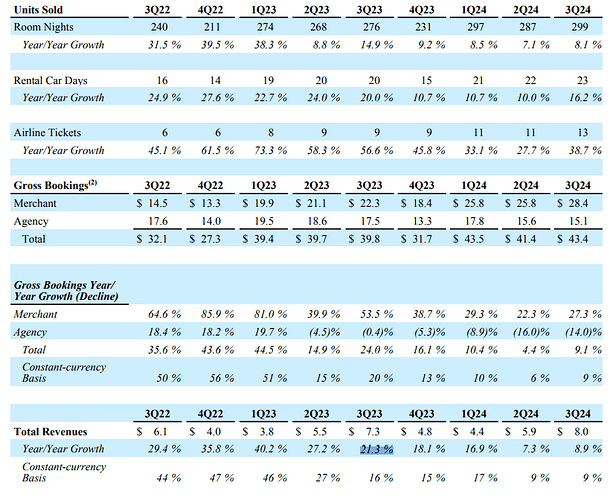

Booking Holdings reported resilient travel demand and an acceleration in rental car days growth

- Saw rental car days booked on our platforms increased 16% in the third quarter, driven by strong growth at Booking.com.

- Rental car gross bookings increased 15% and 5% year-over-year during the three and nine months ended September 30, 2024, respectively, due primarily to rental car days growth, partially offset by lower average daily car rental prices.

- The growth rates for airline tickets and rental car days were both better than our expectation and both accelerated from the second quarter.

Europe is primarily responsible for the growth

- Observed an improvement in our room night growth in Europe in the third quarter, which was the primary driver of the sequential increase in our global room night growth.

- In the U.S., we see relatively stable levels of growth in our business so far this year, which we think continues to outpace the broader U.S. accommodation industry.

- In Asia, we continue to perform well with another quarter of double-digit growth

For Q4, Booking anticipates sustained demand resilience.

- We expect fourth quarter room night growth to be between 6% and 8%

- Gross bookings to grow between 7% and 9%, driven in part by healthy room nights and higher flight ticket sales.

https://seekingalpha.com/article/4731221-booking-holdings-inc-bkng-q3-2024-earnings-call-transcript

Q4 2024 Travel Update: Strong but slowing growth rates within the travel industry continue in 2024

All metrics point to a continuation of solid growth in Q4 but with slower growth expected on 2025

1.4 billion international tourists (overnight visitors) were recorded around the world in 2024, an increase of 11% over 2023, or 140 million more. vs 34% in 2023 (recovered (99%) prepandemic levels in 2024)

- Q4 recorded growth of 8.7 y/y vs 6.6% in Q3.

- Europe had 747 tourists in 2024, a 5.5% vs 16% in 2023. (Q4 at 5.1% y/y vs 3.0% in Q3 2024)

- North America had 137 tourists in 2024, a 8.1% vs 24.4% in 2023. (Q4 at 7% y/y vs 6.6% in Q3 2024)

- International tourist arrivals are expected to grow 3% to 5% in 2025 compared to 2024.

Passenger traffic at Europe’s airports exceeded 2.5 billion in 2024, a rise of +7.3% year-on-year, with volumes edging +1.8% ahead of pre-pandemic 2019 levels.

- International passenger traffic, up +8.8% on 2023, with domestic passenger traffic up +2.5% y/y but still -6.3% below pre-pandemic levels.

- Forecasting a +4% growth in passenger traffic for 2025, but forecast under review, considering the overwhelming global political and economic uncertainties.

In 2024, total revenue passenger kilometer increased by 10.4% YoY. More than half of that momentum was carried by Asia Pacific airlines

- Europe growth at 8.4% in 2024

- North America growth at 4.6% in 2024

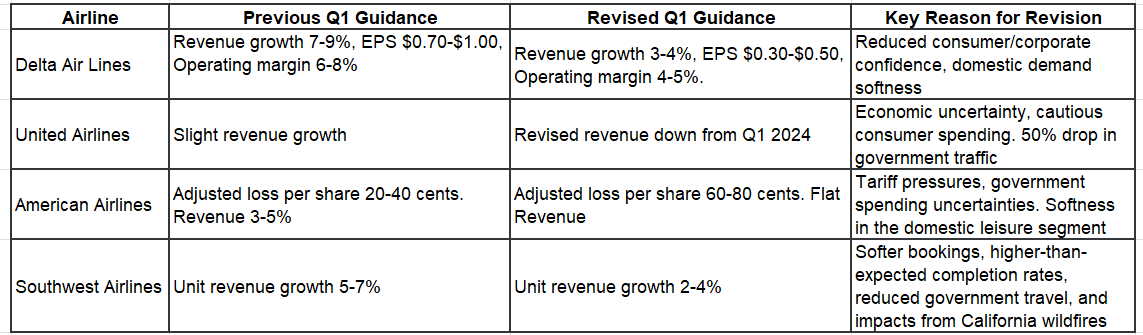

Airlines Revised Down their Guidance for Q1 2025

These revisions suggest consumers, especially lower-income ones, are cutting back on travel currently due to economic uncertainties. Travel is often seen as a non-essential expense, and its decline could support broader economic slowdown picture for coming months due to consumer getting more defensive.

Summary Revisions

https://www.investors.com/news/delta-air-lines-cuts-q1-2025-guidance-demand-delta-stock-dal/

https://www.investing.com/news/transcripts/united-airlines-at-jp-morgan-conference-navigating-challenges-and-opportunities-93CH-3921120

https://www.investing.com/news/transcripts/southwest-airlines-at-jp-morgan-conference-strategic-shift-to-boost-revenue-93CH-3921624

Sixt shares rise 3% after Delta Airlines said people are starting to travel again and reinstated their 2025 guidance

-

Delta Air Lines’ CEO said travel demand is rebounding now that tariff policies have become clearer.

“People are starting to understand with clarity where things are headed and that allows them to start making plans, whether to travel or invest in a business,” CEO Bastian said. The current environment, he said, “is incredibly stable.”

-

Its Q2 2025 revenue and EPS of $15.51 billion and $2.10 topped analysts estimates of $15.48 billion and $2.05, respectively.

-

Delta Airlines withdrew its 2025 guidance (EPS: $7.35) in 2025 citing macro uncertainty but it now expects adjusted EPS in the range of $5.25 to $6.25, the midpoint exceeding analysts estimate of $5.35.

-

Delta Airline said international premium and loyalty travel remain bright spots.

-

Sixt shares up are up 3% as a result. Avis and Hertz shares rose 8% and 11%, respectively.

I=6, Jul 16 2025

United Sees Earnings Upside for 2025 as CEO Signals Stabilizing Demand

- United Airlines revenue came in at $15.24 billion, slightly below $15.35 billion estimate.

- Premium revenue rose 5.6% y/y while basic-economy class revenue was up 1.7% y/y.

- United Airlines guided 2025 adjusted of between $9 and $11 compared to analysts estimate of $10.

- CEO Scott Kirby said uncertainty had diminished and that if demand stays as it is today, there is “upside” to their earnings forecast.

United Airlines issues new 2025 forecast as CEO says 'world is less uncertain'.

Europe passenger traffic rose 3.9% in Q3 2025, below +4.5% and +4.6% registered in Q1 and Q2 respectively- ACI reported