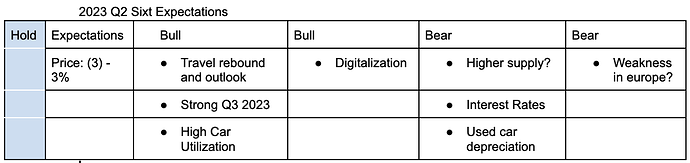

While we are seeing positive signals in Q2 and Q3 2023 for Sixt our medium-term outlook is mixed and we are not changing the position. Over the long run Sixt especially its preferred stock trades at attractive levels. Q3 needs to be observed closely as it is the most important quarter of the year.

Travel

We are seeing a strong rebound in travel after covid with more industry growth projected in 2024 and beyond.

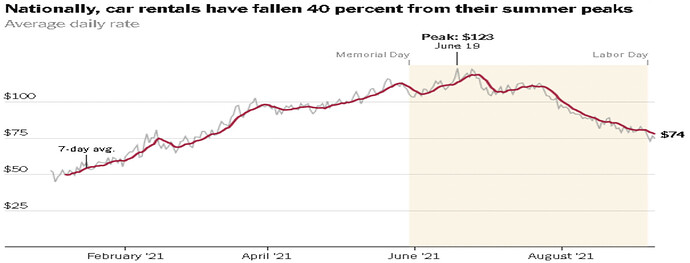

Rental prices

Rental car prices dropped from their 2021 highs as more rental cars came online. Revenues per day (RPD) stands at approx. $61 for Hertz and $70 for Avis. Both companies want to be conservative on fleet growth and achieve high utilization levels with high RPDs which is positive for Sixt.

Interest and Depreciation

Interest costs for car rental companies as well as depreciation are increasing. This is caused by falling used car prices.

Europe

There are signs of weakness in Europe like lower airfare prices. We need more research into this topic.

Mindmap

A mindmap draft of arguments can be found here.

Longterm

Longterm we are seeing potential opportunities in electric vehicles, autonomous driving, long-term rental mobility offerings, and opportunities in new markets including the USA. Areas to observe include the performance of Sixt’s CEO after the succession and the potential effects of climate change.