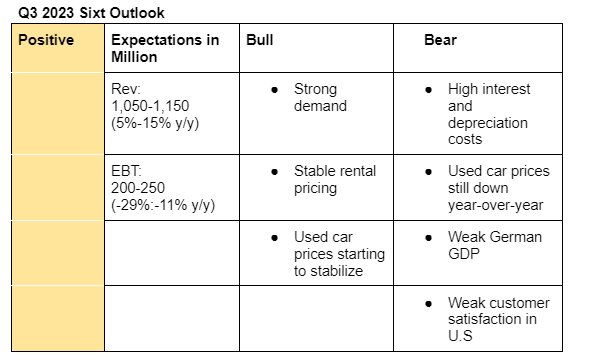

I am positive on Sixt Q3 earnings. My expectations are guestimates based on the current demand and pricing trends as well the fact that Q3 is usually a strong quarter for Sixt. However, I am also a bit cautious due to the current high interest and depreciation costs.

Here are my bullish and bearish arguements;

Bullish;

- Its competitor, Hertz, reported strong demand and stable rental pricing during the quarter.

- Airline companies also witnessed strong demand during the quarter.

- Almost half of Sixt’s annual earnings is usually generated in the third-quarter.

Bearish;

- High interest rates impacts its fleet growth while high depreciation costs lower its vehicle resale value.

- Used car prices in U.S and Europe are still down year-over-year but starting to stabilize.

- German economy is still weak.

- Weak customer satisfaction in U.S may affect demand for Sixt’s rental vehicles.