This topic discusses Deutsche Wohnen’s Q3 2024 earnings.

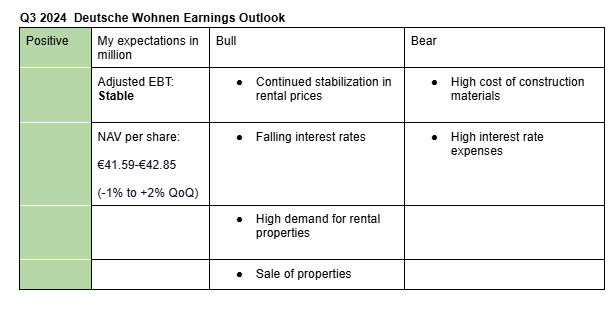

I expect Deutsche Wohnen Q3 2024 results to be stable. It’s hard to estimate the adjusted EBT (the main KPI currently used by the company) and rental revenue since they weren’t reported in past Q3 results.

My estimates for NAV are based on current trends such as declining interest rates. Here is why I am bullish on the earnings;

- Continued growth in rental prices: In Q3, rental prices in Germany continued to stabilize, particularly in Berlin where Deutsche Wohnen has major presence.

- Falling interest rates: Falling interest rates, particularly in Europe will boost net asset value by lowering capitalization rates used in the valuation model.

- High demand for rental properties: Housing demand in Germany remains high. This reduces the vacancy rate, hence boosting rental revenue.

- Sale of properties: Deutsche Wohnen is in the process of selling its nursing segment. As such, the quarter is likely to benefit from some property disposals.

Headwinds during the quarter include;

- High cost of construction materials: Deutsche Wohnen pointed out in Q2 that it expects cost of building materials to remain elevated throughout the year (page 20).

- High interest rate expenses: Though the ECB has began reducing interest rates, it will probably take a while before the effects are reflected in Deutsche Wohnen’s financing structure. As such, I expect interest expenses to still way on the earnings during the quarter.

N/B: There are currently not public analysts estimates.

Deutsche Wohnen’s NAV was stable in Q3

Deutsche Wohnen’s net asset value at the end of Q3 2024 was stable at €16,606.0 million (-0.42% quarter-over-quarter) or €41.84 per share (-0.4% quarter-over-quarter).

Are the any additional insights in Vonovias report or earnings call regarding terms of the DPLTA with Dt. Wohnen?

Here are the insights:

Deutsche Wohnen’s EBT underperformed during the quarter, core business was stable

- Deutsche Wohnen’s Q3 2024 adjusted EBT fell 32% y/y to €103 million (calculated), mainly driven by impairment on interest receivables for interest income in the amount of €26.2 million (page 12, 9M report) and a drop in adjusted EBITDA development by €10 million (page 11) .

- Adjusted EBITDA rental was up 2.6% to €159 million, in-place rent at the end of September was up 3.3% y/y to €7.91, NAV per share was down 2.2% y/y to €41.84 while the vacancy rate 0.1 basis points y/y to 1.6%.

Assessment

Overall, the core business was stable during the quarter. However, given that the adjusted EBT metric will be an important factor in valuations during the DPLTA, it’s not good to see that it dropped during the quarter while that of Vonovia was up 0.5% to €477 million. Dt. Wohnen shares are up 0.9% 10 minutes after market open.

Hmm I cannot imagine that a one time payment default of a debtor will have an impact on the fundamental evaluation of the company (This wouldn’t make any sense).

Maybe they would look at DCF or Ebitda and not adj. Ebt in the process? If they do: What would this mean for those ratios? (Can be examined in DPLTA topic the next couple of weeks)