It does not seem to be due to additional weakness in the real estate market, from everything I have checked the market in Q3 2024 remained weak compared to historical levels but is stable, and showing early signs of slow recovery.

Is expected to remain stable for the rest of the year, though the recovery is expected to be slow since the German economy is not yet in a good place.

The normalization is expected to continue, especially as the ECB does additional rate cuts, real estate becomes more attractive.

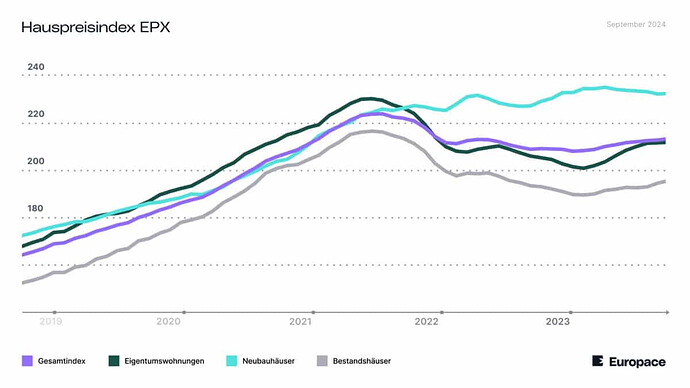

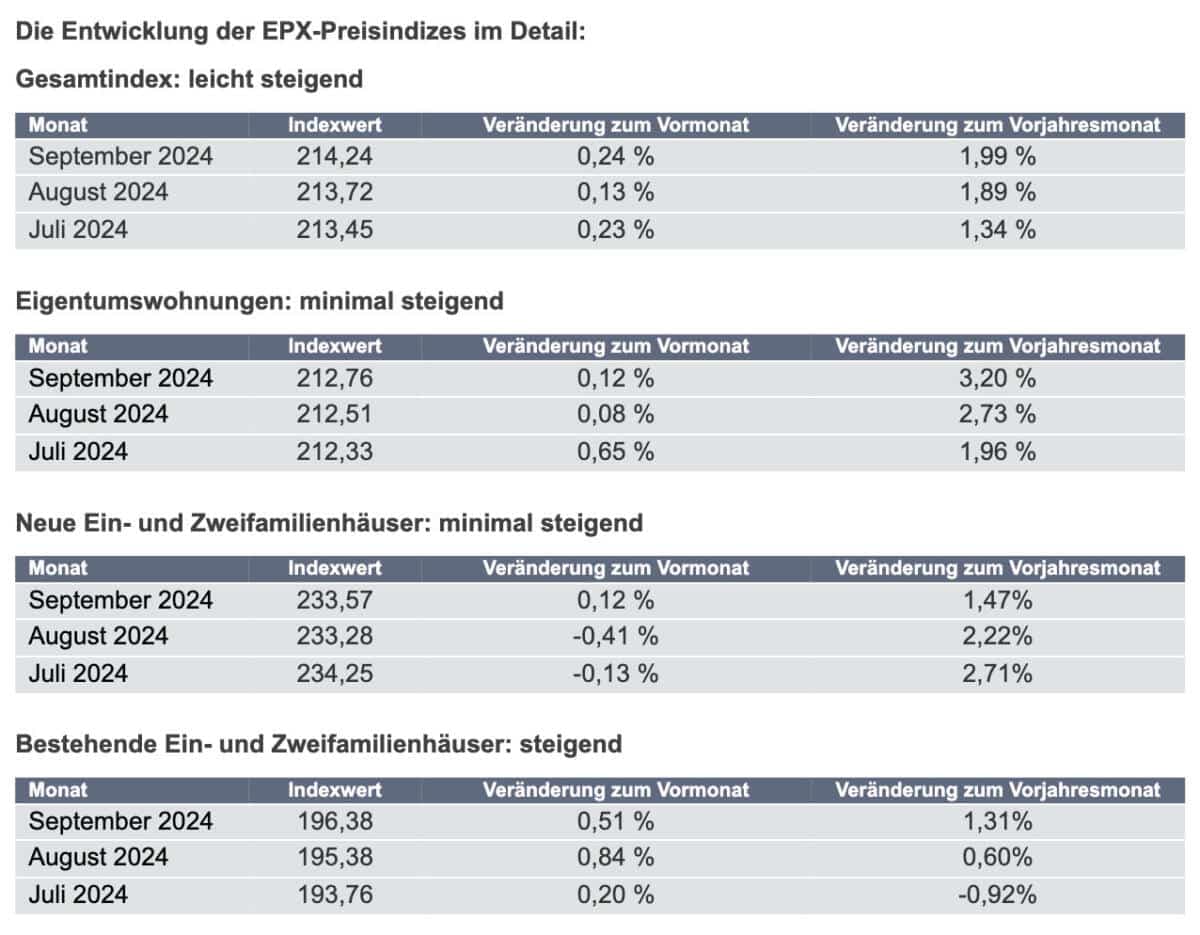

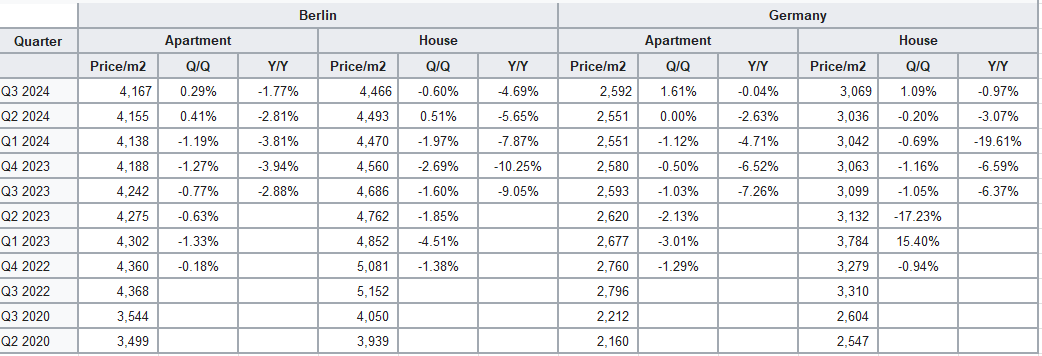

Prices seem to be stabilizing and even increasing in recent quarters, in both Berlin and Germany.

- Overall, the overall EPX index recorded a cost increase of 0.24 percent and reached 214.24 points in September 2024. Compared to the same period last year, prices increased by 1.99 percent.

- Data from Immoscout24 confirms a similar trend in prices in last 2 quaters, however still negative y/y

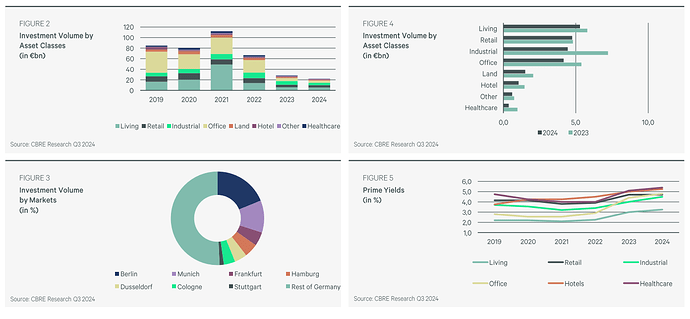

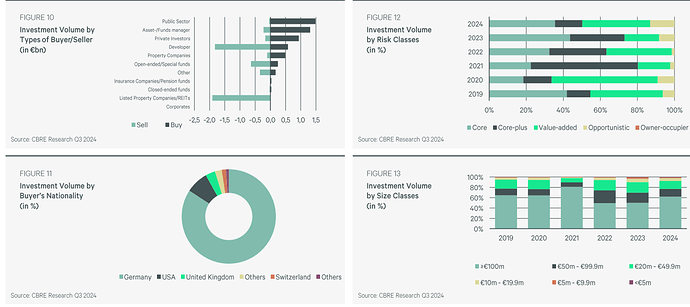

Investment transaction volumes remain low and volatile, but year-to-date are up y/y, which means demand/supply is starting to balance more.

- German investment market reached €22.2 billion in the first nine months of 2024, up 9% YoY.

- Q3 2024 saw a 6% decline compared to Q2 2024.

- Total 2024 volume is expected at ~€33 billion, implying ~€11 billion in Q4.

- Residential investments (50+ units) totaled €5.3 billion in the first nine months of 2024, up 16% YoY.

- Prime yields stabilized at 3.40% in the top 7 cities, though yields on existing properties continue to rise.

- 2024 outlook is more optimistic compared to mid-year projections. The combination of portfolio adjustments and closing of refinancing gaps suggests that transaction volume could reach around €8 billion for the year.

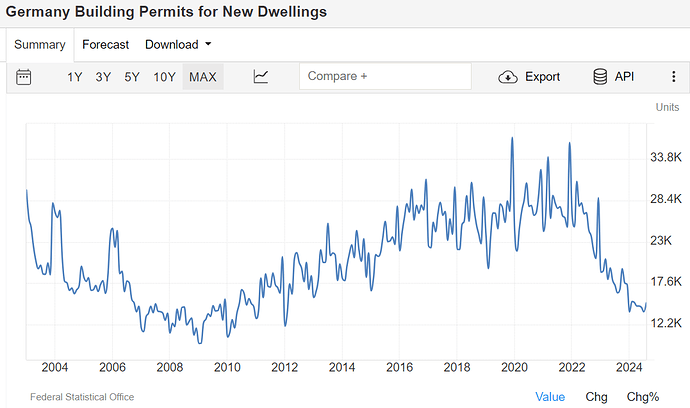

What remains extremely weak without clear signs of recovery is the construction activity, however this will support rent increases going forward due to the housing shortage and population increase.

- From January to August 2024, 141,900 apartments were approved, down 19.3% (33,900 fewer) compared to the same period in 2023. These results include building permits for apartments in new residential and non-residential buildings as well as for new apartments in existing buildings.

- From January to August 2024, 116,800 new apartments for residential were approved, 21.2% or 31,400 fewer than in the same period last year.