@moritz I agree with your assessment here that a one-off charge is unlikely to impact the valuations. However, even when we exclude the 26 million debt impairment, the adjusted EBT would still be down 14.6% in Q3 while that of Vonovia was up 0.5%. If the trend continues as a result of underperformance in the development business, the exchange ratio could rise further.

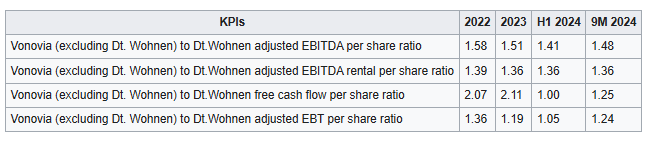

I still think that using adjusted EBITDA rental instead of adjusted EBT is unlikely since that wouldn’t provide a conclusive picture of the business. Even if that would be the case, Dt. Wohnen minority shareholders will be at a disadvantage position as shown in the table below. However, operating free cash flow ratio points towards the same direction as that of adjusted EBT. Given that free cash flow is an important metric in the DCF model, I think operating cash flow ratio is insightful.