My confidence level on the calculations for adjusted EBT from 2021 to 2018 is around 80%. The methodology used has been provided by the company. The inputs for 2022 to H1 2024 are also given in the financial reports. I only estimated the inputs for 2021 to 2018. Therefore, adjusted EBT for 2022 to H1 2024 are actuals while that of 2021 to 2018 are estimates.

Yes Vonovia said in its 2021 report that Dt. Wohnen adjusted EBITDA total contribution was 170.8 million euros. The contribution was small because integration occurred in Q4 2021.

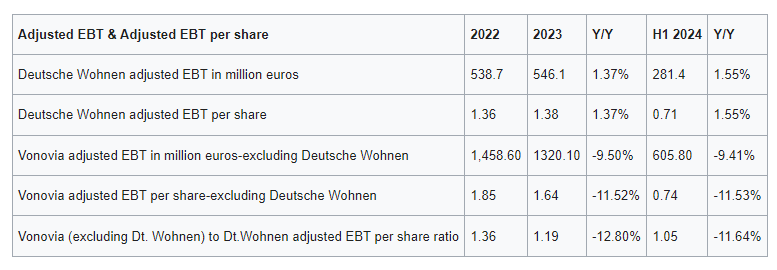

When I exclude Dt. Wohnen from Vonovia’s adjusted EBT per share, I arrive at an exchange ratio of close to 1:1 at the end of June 2024.

I think the DCF model doesn’t ignore debt completely. The fact that Vonovia has high debt presents a risk which is captured by beta.

I looked at two other Vonovia takeovers and in both cases, the offer price carried a premium over the target’s previous close.

Another reason why I think Vonovia is unlikely to cancel the DPLTA is because they term the formation of the JV as a “next step towards domination agreement.” They said that the shares held by the JV will be subject to a lock-up agreement and be entitled to an annual compensation (like any other minority shareholders). Vonovia pointed out that the annual compensation impact on its operating cash flow will be around 70 million euros.

I think buying more brings some risk while holding it presents less risk.