According to Deutsche Bank the German housing market is likely to stabilize and experience modest growth, driven by supply shortages, easing interest rates, and more regulatory clarity

Rents are likely to reflect ongoing supply shortages, supporting sustained rental growth of 3% annually. Expect all price indices to show a bottoming out or rising prices again in Q3 at the latest.

- Stronger wage growth and inflation above the target rate could also boost rental growth in the coming years.

- Rents may also rise due to more frequent index-linked leases, which are likely to be agreed more frequently due to current market conditions and recent inflation increases.

- Proportion of short-term rentals and furnished rentals is increasing in large cities and conurbations.

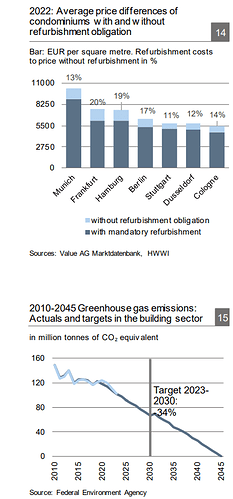

CO2 emissions in 2022/2023 have fallen more than expected which could lessen regulatory mandates

A significant portion of refurbishment costs is likely already priced in. If energy and CO2 consumption/ continues to decline, even without a major increase in renewable energy for existing buildings, this could prompt revisions to the Heating Act and the 65% target.

- Newer properties have held their value better compared to older homes, partly due to the environmental refurbishment obligations placed on less energy-efficient buildings

- Report highlights ongoing innovation in construction materials and smart-home technologies that could further reduce emissions and energy consumption, potentially reshaping future regulatory demands

- By 2030, emissions only need to fall by a cumulative 34%, i.e. around 5% p.a., which is less than in 2022 and 2023. This is undoubtedly still a major challenge.

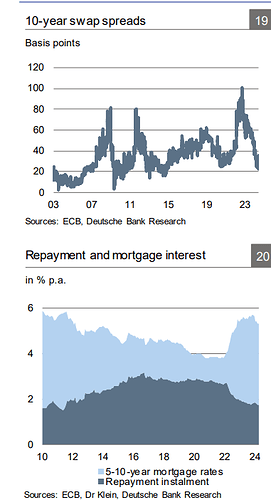

The mortgage market has shown signs of recovery in 2024, with rates expected to stabilize at around 3.8%

- 10-year swap rates and 10-year Bund yields fell almost steadily from over 90 bp in the winter of 2022/23 to the current historical average of around 30 bp.

- 5-10-year mortgage rates fell from almost 4% in Q4 2024 to 3.6% in Q2

2024 - Credit growth shifted up a gear again. It increased by 12% in Q1 compared to the previous quarter and reached its highest level since Q3 2022 with more than EUR 44 billion in new lending business.

- Repayment rate fell from 2.7% before the interest rate shock to 1.7% in May 2024, the lowest value since 2011.This means that interest and repayment in a classic annuity loan fell from 5.8% at the end of 2023 to 5.3% in 2024.

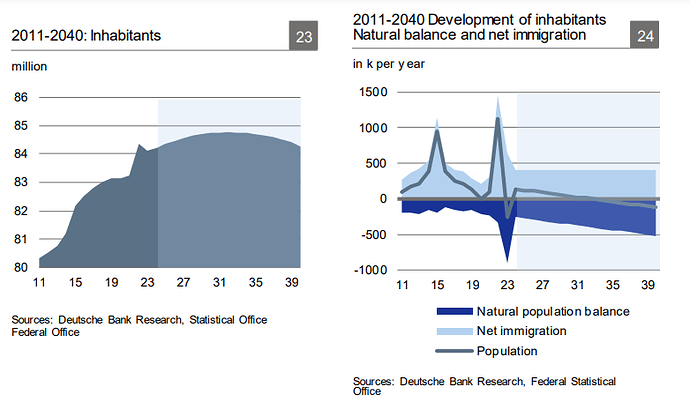

As a result of immigration and natural development, the population initially rises to 85.4 million inhabitants by 2032. The population subsequently decreases and falls below 85 million again for the first time in 2040.

- Average household size fell from 2.3 people in the 1990s to around 2 people in 2023. Expect a further decline to below 1.9 people in 2040.

- As a result, projection shows that demand for housing will increase from 42.9 million to 45.5 million homes between now and 2040.

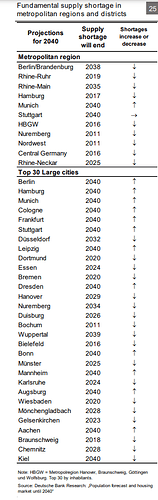

While on a national level, the shortage is not apparent, this varies by region, with some top cities experiencing significant storage that is not expected to end soon

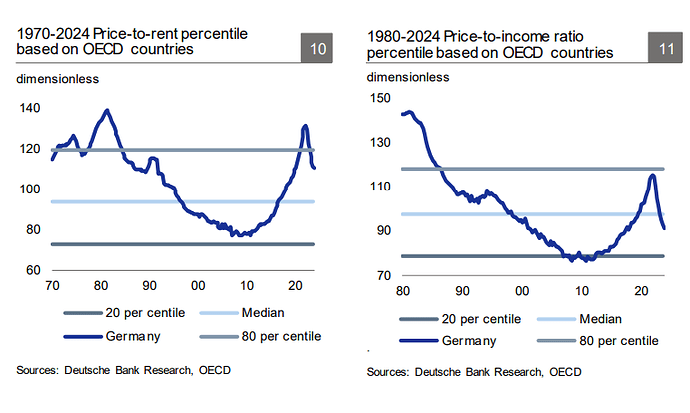

Affordability indices returning to the historical average

These national indices do neither reflect the bottlenecks in the large cities nor the relatively relaxed fundamental situation in regions with a weak infrastructure