I was able to establish with certainty that the €70m annual compensation will only go to Apollo and is based on its stake in the JV. That is an annual yield of around 6.67% assuming the “a bit more than 1 billion” valuation of Apollo stake.

Since the yield is related to the stake in the JV and not the DPLTA, we cannot confidently tell if Deutsche Wohnen minority shareholders will receive a similar compensation.

I found some interesting comments regarding the offer price:

-

Sdk, a shareholder advocate wants NAV to be used in calculating the offer price.

“In our view, the compensation offer should be based on the NAV, as this value should be realizable relatively quickly,” said Bauer.

-

Vonovia CEO Rolf Buch wants the weighted average share price to be used.

“We are aiming to base our valuation primarily on the weighted average price of Deutsche Wohnen shares in relation to Vonovia shares,” he told Handelsblatt. “The last time a similar decision was made was at the beginning of 2024 in a similar case between Vodafone and Kabel Deutschland, which has once again expressly confirmed such an approach,” he added.

-

According to Sdk boss Bauer, activist investor Elliot is unlikely to drive up the offer price any more.

“He is unlikely to drive up the compensation price any further, as this will be determined by Vonovia based on the valuation reports to be prepared by the auditors,” said Bauer.

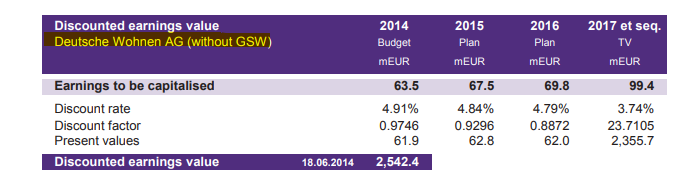

Yes, I am 100% confident that Dt. Wohnen’s earnings will be deconsolidated from that of Vonovia during valuation. This was the case in the Dt. Wohnen-GSW DPLTA (page 67-88).

Assessment

The fact that GSW earnings were deconsolidated from Dt. Wohnen’s earnings during the DPLTA is a game-changer in my estimates. Though Buch wants the weighted average share to be used, that won’t matter since the German corporate act stipulates that the highest between weighted average share price and fair value should be used to calculate the offer price. Taking these new information into account, my new offer price estimate stands at €27.67. The annual compensation is also likely to be attractive (maybe 4% to 5%) considering the around 6.7% that was offered to Apollo. As such, it might actually makes sense to buy more.