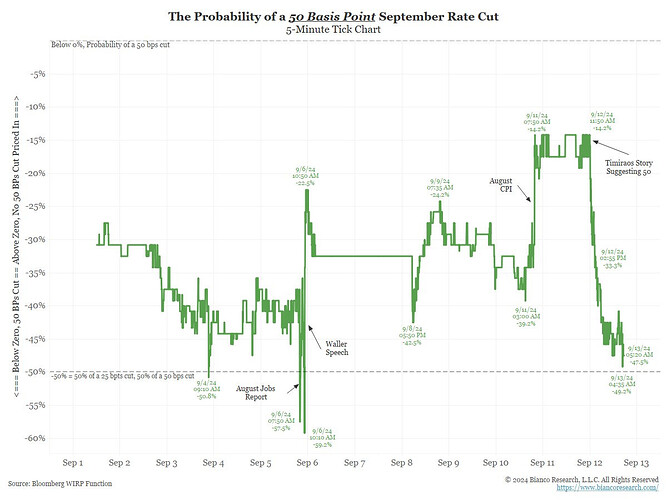

Yes, I noticed the shift occurred between Friday and the weekend. Interestingly, this change happened without any significant news or any Fed speakers following the CPI release on Wednesday.

The culprit seems to have been a Wall Street Journal article by Nick Timiraos, which suggested or make a bigger case for the possibility of 50 bps cuts. This changed market expectations.

On Friday, I heard on Bloomberg News that Timiraos is regarded as a ‘Fed whisperer,’ often used to guide market expectations when they diverge from the Fed’s intended actions.

Also, Bill Dudley ( president of the Federal Reserve Bank of New York from 2009 to 2018) came out and said he thinks the FED will go with 50 bps

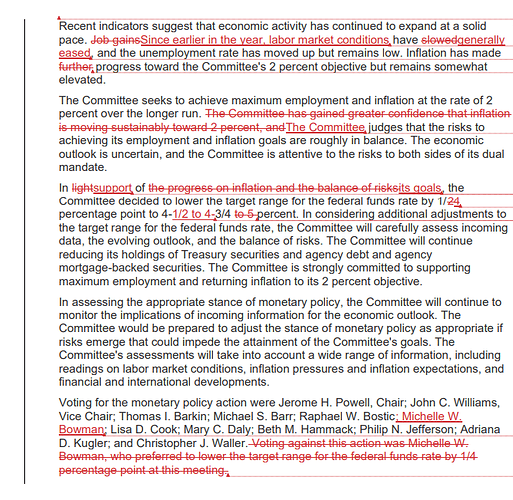

I expect the Fed will do 50. I believe Chair Powell favors an aggressive approach: In his speech at Jackson Hole last month, he pointedly observed that a further weakening of the labor market — which seems to be happening — would be “unwelcome.” Monetary policy is tight, when it should be neutral or even easy. And a bigger move now makes it easier for the Fed to align its projections with market expectations, rather than delivering an unpleasant surprise not warranted by the economic outlook.

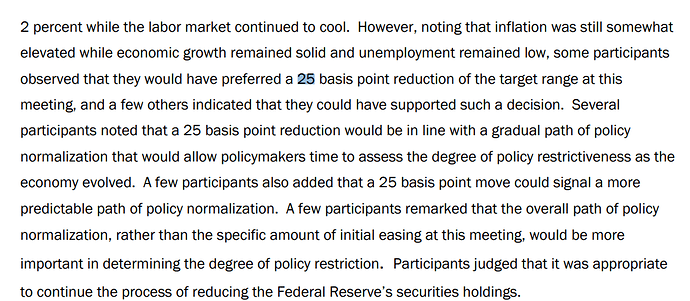

Given this context, and considering that the Fed indeed avoids surprising the markets always, a 50 basis point hike seems like the safer assumption. However, my confidence in either direction is not high at this moment.

I always thought 50 bps was the right move due to the weakening in the labor market, but did not think before the FED was willing to do it because of inflation fears and to not send a wrong signal about growth and being late, but Powell did sounded pretty dovish on Jackson Hole.

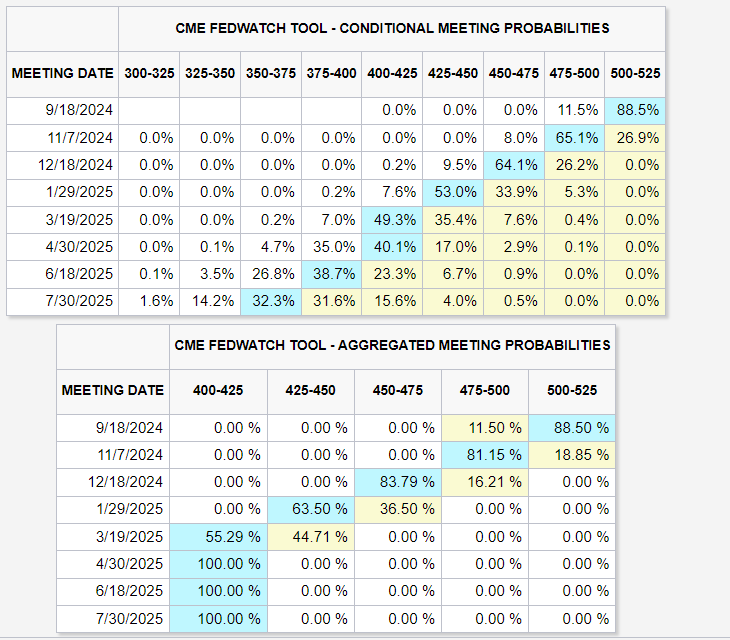

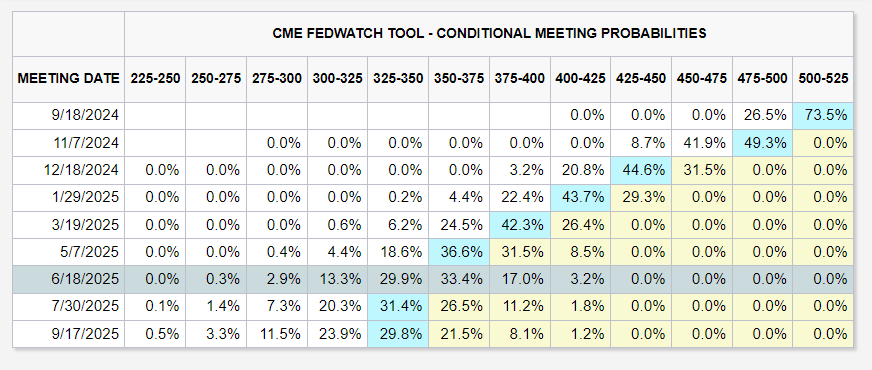

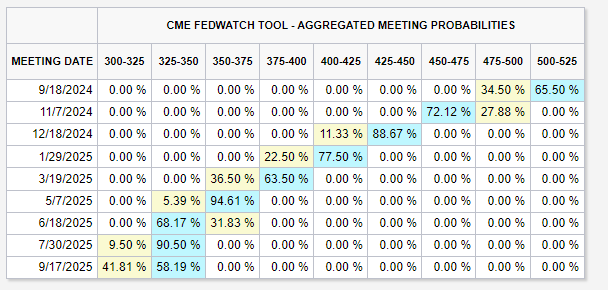

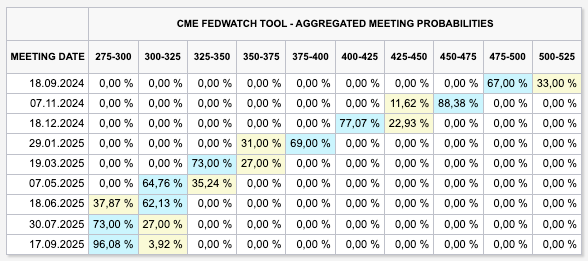

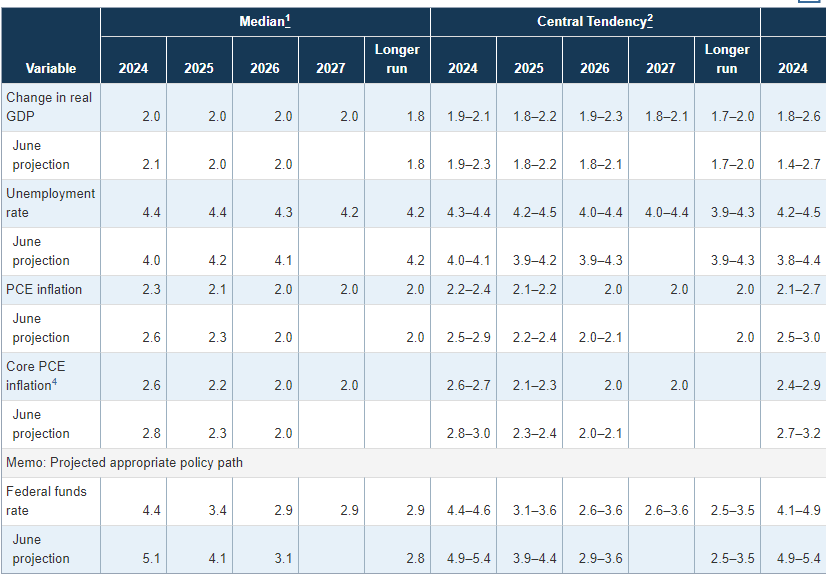

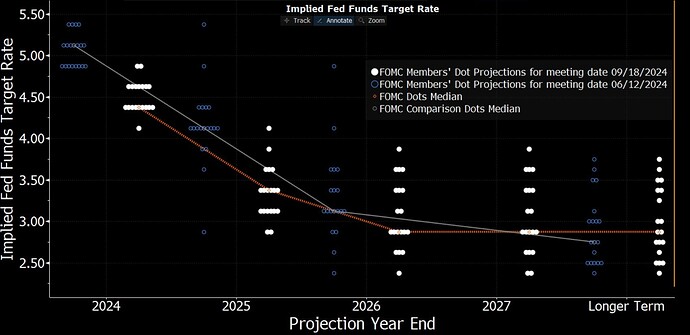

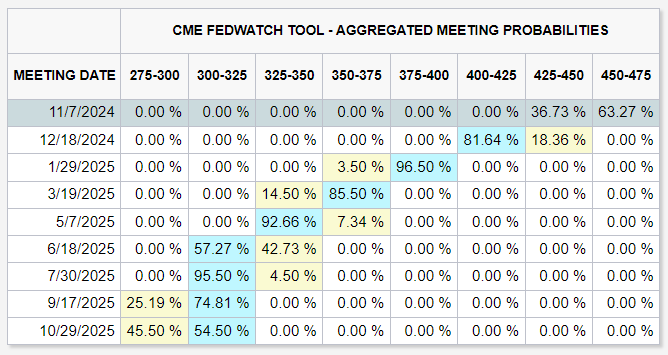

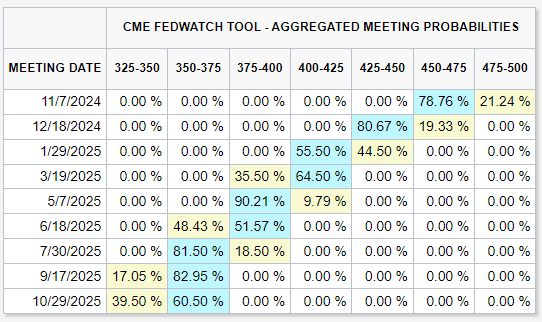

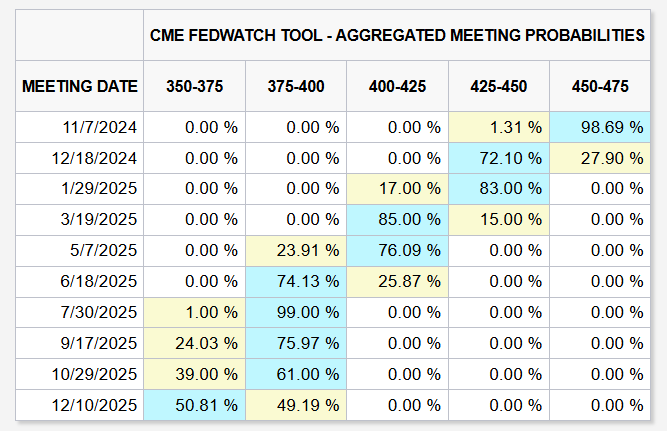

As for long-term expectations, the aggressive market pricing only makes sense if there is a recession, (which is my expectation). However, the current slowdown is very slow to expect that much easing that soon (even 125bps cuts only in 2024) unless there is a shock that accelerates everything.

The problem I have with the market pricing is that the markets expect significant easing very soon, but at the same time expect relatively good GDP, and earnings at 10% in 2024 and 15% in 2025.

These expectations seem misaligned, in my view, and I don’t believe all three will materialize at the same time. If we do see that level of significant easing, it would likely indicate that the economy is in a much weaker position than anticipated

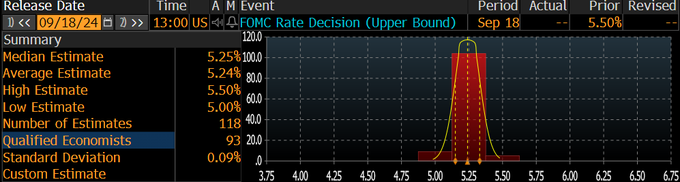

But either way, tomorrow is most likely going to be very volatile, because I don’t remember the market being this split on a decision for a long time (listening to Bloomberg yesterday, most guests were still expecting 25bps, same as CNBC small survey), so there will be a part of the market that will be surprised.

And, also because we get new FED projections, I expect the FED to show more cuts than previously (4.1 as of 2025), but less than what the market is pricing most likely.

*While I think a model for rates is needed too, a model for GDP, inflation and unemployment will need to happen first, since rates are a function of these."