Powell sounded a bit hawkish today, he especially pointed out that recent revisions to GDP and GDI remove some downside risks in the economy

Some comments:

- Revisions to GDI remove downside risks to the economy: With Gross Domestic Income (GDI) and Gross Domestic Product (GDP) now aligning after revisions, which indicates robust economic growth, reducing concerns about prior discrepancies.

- The updated data shows income growing faster than spending, which alleviates previous concerns about the sustainability of consumer spending. This revision reduces another downside risks to the economy.

- While there remains a gap between employment figures and spending trends, the increased confidence in spending data is encouraging. However, labor market data remains a stronger predictor of potential economic downturns compared to GDP.

- The committee is not inclined to rush into rate cuts and is taking a wait-and-see approach, allowing upcoming data to guide their decisions.

- Although shelter inflation may take longer to return to pre-pandemic levels than previously expected, the stabilization of new rent leases suggests that shelter inflation will eventually decrease over time.

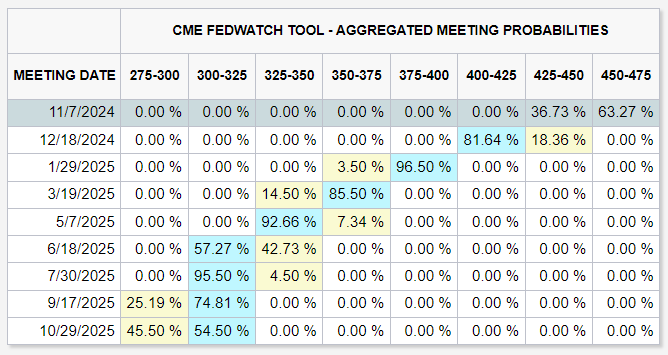

This is the current pricing for the market, it changed slightly after the speech, since another 50 bps in the November meeting had a much bigger probability before.