Topic to be able to discuss FED meeting implications, and developments in monetary policy

@moritz I put some notes in the article and my assessment for now

Thanks for your assessment and the notes.

Do you have observations how fast fed funds futures and therefore the FedWatch Tool is usually repricing after any announced change?

My initial interpretation of the bounce back was that the market focused on stronger-than-expected economic predictions. Your interpretation of markets not taking the hawkish shift at face value are likely more plausible though. Do you have any commentator opinions to back this interpretation?

I also thought that the segment in the press conference in which Powell highlighted high uncertainty in the Feds economic predictions and explained the Feds framework of having consistently positive real interest rates has been interesting. I saw the relevant snipped by accident on Twitter.

Do you know if this is the first time he outlined the Feds focus on real interest rates? By doing so he confirmed that interest rates would come down as soon as inflation comes down, which the market might have interpreted positively?

I also agree that visible progress on PCE and core inflation has been slow and focusing on headlines creates a misleading picture.

His comments on credit tightening and liquidity incl. RRP have been pretty interesting.

I heard some commentary yesterday that the market bounced when Powell said that the July decision had not been made and will be live, and when he said projections are uncertain. But I would have to look for them.

He has mentioned the need for real rates in other meetings, and he was actually saying that rates will come down as inflation comes down, and that’s what the projections show. But he does not expect cuts for at least 2 years, so I am not sure if that’s to be taken positively.

Obviously, this is with the assumption that the economy is headed for a soft landing, which I think has started to be again the consensus in the markets too.

- Equity market does not believe they will deliver 2 hikes

- If inflation stays high but variable, could create a lot of confusing signals and disorder in markets and economy

- Continue to think the 2% target is now too low

Powell's message to markets was 'confused and confusing': Allianz's Mohamed El-Erian - YouTube

Rate hike probability at 80%, I think that unless we have a big surprise in coming data, we can expect a hike in July.

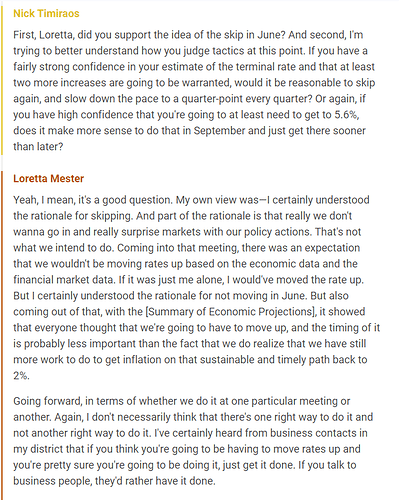

Dont understand why not hike in June since they seems pretty determined to do it again. Probably because was pricing a pause

- Fed minutes indicate more rate hikes will come but at a slower pace.

“Many also noted that, after rapidly tightening the stance of monetary policy last year, the Committee had slowed the pace of tightening and that a further moderation in the pace of policy firming was appropriate in order to provide additional time to observe the effects of cumulative tightening and assess their implications for policy.”

- Citing the lagged impact of the monetary policy and economic concerns, the members decided not to increase rates in the June meeting.

“In consideration of the significant cumulative tightening in the stance of monetary policy and the lags with which policy affects economic activity and inflation, almost all participants judged it appropriate or acceptable to maintain the target range for the federal funds rate at 5 to 5¼ percent at this meeting.”

https://www.cnbc.com/2023/07/05/fed-minutes-july-2023-.html https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20230614.pdf

Unless a big surprise in CPI, July hike seems to be almost priced in. CME FedWatch Tool - CME Group

Was not able to work much on this, so my position is still the same that a second-rate hike should not be discarded yet since the FED is pretty determined to not make another mistake. We need more additional data to be sure.

SI=0%, I=8

-

Fed hikes interest rate by 25 basis points, taking the target range to 5.25%-5.5%.

-

The rate hike was largely anticipated by the market.

-

The decision was unanimous.

-

The post-meeting statement said inflation remains elevated and that job gains have been robust.

-

The statement upgraded the pace of economic activity to “moderate” from “modest” at the June meeting.

“In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals,” the statement said.

https://www.cnbc.com/2023/07/26/fed-meeting-july-2023-.html?__source=androidappshare

Federal Reserve Board - Federal Reserve issues FOMC statement

A post was merged into an existing topic: ECB Monetary Policy

Any meaningful insights from the conference or commentary that could give us a clue if the Fed will continue? Any insight which data they will be watching closing to take the decision? Do you have an assessment about what they will do?

There was a lot of push from reporters about the need for additional hikes, but even with that Powell sounded like for now it was just a 1-month good reading, and more data (not only inflation btw) is needed to assess additional hikes or not.

Imo he is hiding behind the core being high still, economic resilience and the labor market still being tight, to justify considering more rate hikes later on. However, he offered almost zero new information, and the uncertainty continues to be the same.

Personally, I still think the probability of another hike this year is higher than what the market is pricing, unless we see considerable deterioration of the economy.

“And the June CPI report, of course, was welcome but it’s only one report, one month’s data. We hope that inflation will follow a lower path as was—that it would be consistent with the CPI reading but we don’t know that and we’re just going to need to see more data.”

“We’ll be looking at inflation and we’ll be asking ourselves does this whole collection of data—do we assess it as suggesting that we need to raise rates further, and if we make that conclusion then we will go ahead and raise rates.”

“It is certainly possible that we would raise funds again at the September meeting if the data warranted and I would also say it’s possible that we would choose to hold steady at that meeting.”

I put some notes in the article, but this meeting was less interesting IMO. Also added my assessment.

SI=0%, I=7

FOMC minutes indicate that most fed officials are concerned that inflation is still too high and more tightening may be needed.

“With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy,” the meeting statement noted.

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20230726.pdf

I=9

Fed chair Powell listed negative and positive developments and stated they will closely observe incoming data in order to decide if rates should be hold or raised.

I listend to parts of the call. To me Powell sounded relatively cautious about further rate hikes as he stressed the need for good risk management and risks of both doing too much or too little.

I think they will keep their full optionality of tightening further if they think it is necessary but will closely observe incoming data and will act carefully.

So a lot of raises don‘t look likely in the moment, which is in line with Fed funds futures.

The only two options he talked about have been hiking or holding and he reiterated the 2% target.

I have not listened to it, but the market is starting to price another hike in November, still not that high, but it is the highest probability now.

Obviously, there is a lot of data until then, but I think if the markets price it, then they will do it.

Interesting. Let us know your thoughts after you listend in.

I do agree with your assessment.

He said anything new, and chosed to maintain optionality in further rate hikes.

He mentions all the current uncertainty in the data, with some data showing some weakness, and other data showing robust growth, and why because of that uncertainty along with the uncertainty of monetary policy lags is difficult to know for sure when the goal of 2% inflation will be achieved.

I think going forward he will maintain this ambiguous position and his speeches will not add much, until their a clear answer in either direction.