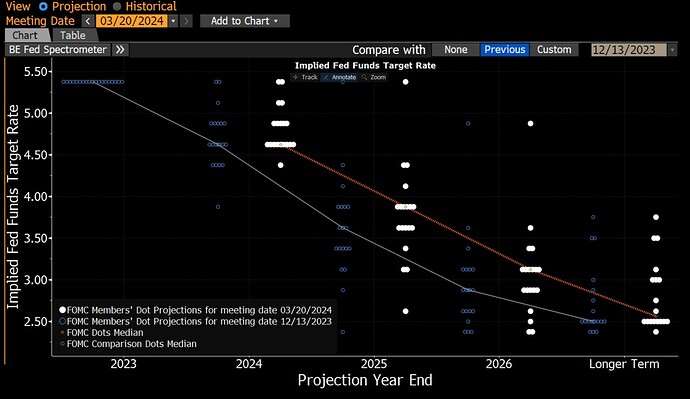

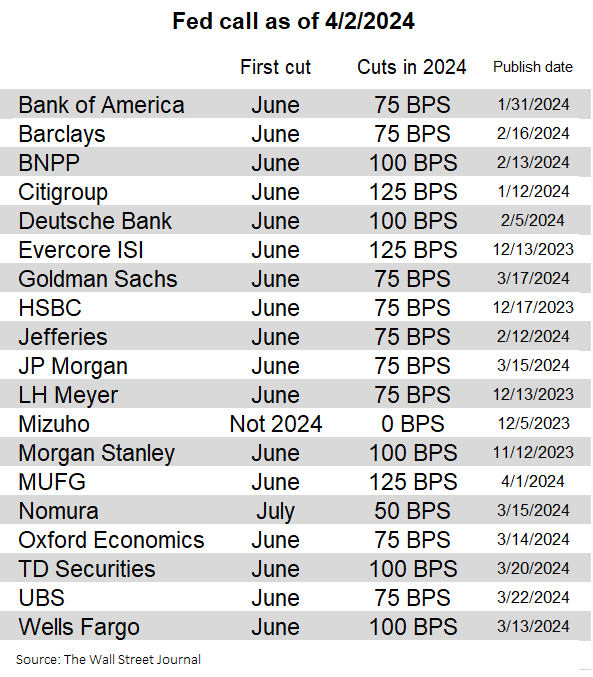

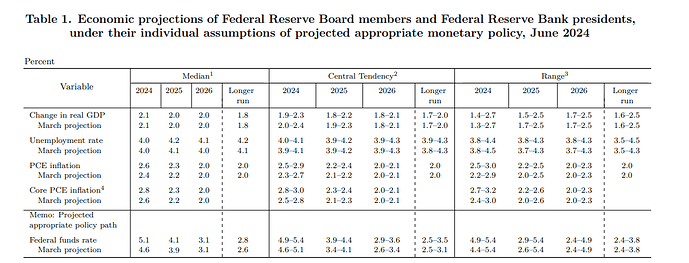

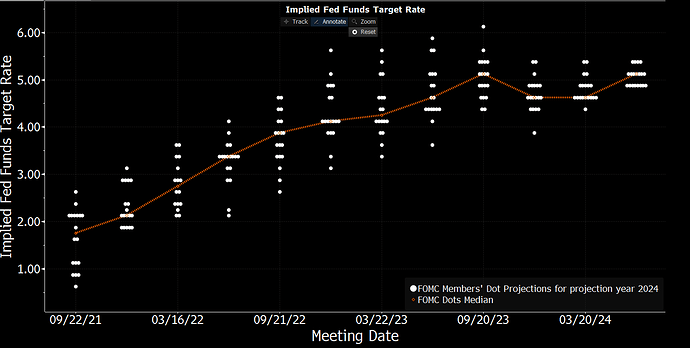

So the FED revised growth and core inflation significantly higher, but kept rates expected unchanged for 2024. Fairly dovish for the market’s momentum to continue this year.

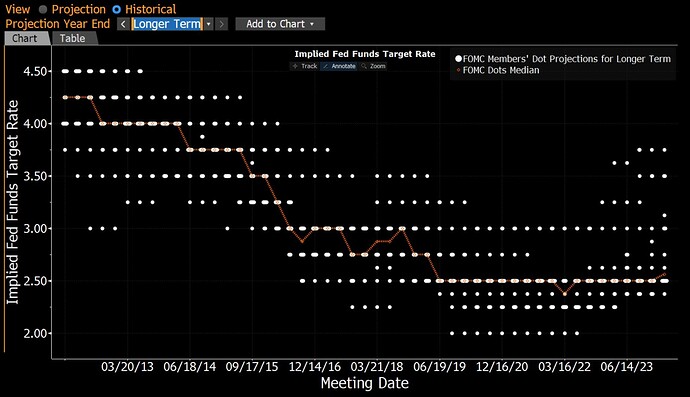

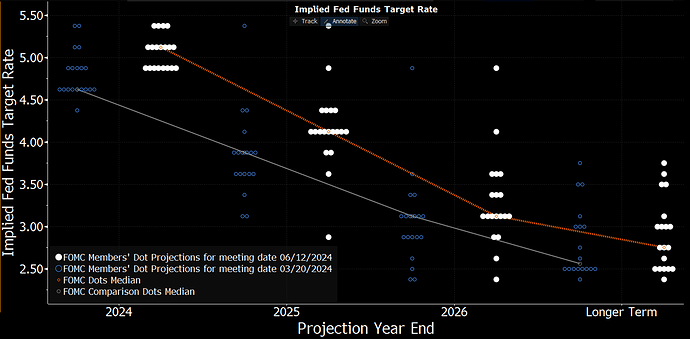

However, they increased projected fed funds for 2025 and 2026, and most importantly they raised the neutral rate (long run) that has been unchanged for long, with many more officials now above 2.5%, and 7 officials above a neutral rate above 3% from 4 in the last dot plot.

I agree with most analysts is difficult to make sense of the 2024 projections, but I think something that Mohamed said could be interesting:

The way to make sense of these projections is if the FED is accepting or tolerating higher inflation than the target for longer to be able to achieve a soft landing or maintain economic well-being.

IMO this could be playing with their credibility again, especially if it happens that inflation indeed increases again.

But FED projections are only the median of 19 forecasts and not really a collective forecast, but markets usually take it as such. Powell also did not have the best conference.

Notes from Powell:

- Powell was not able to give a good answer when asked if they are willing to tolerate higher inflation due to their projections. Only said growth and inflation were revised due to recent data, but did not say anything why rates were then unchanged for 2024.

- They continue to see risks more balanced now between unemployment and inflation.

- Dont think the history that inflation is coming gradually down to 2% has changed from the last 2 months’ inflation hotter data, it just signals the route could more “bumpy”. However, they still don’t know if these two months were only a bump, or if its something more. (So, basically they don’t know anything)

- He dont see rates coming back down to the very low levels seem before COVID, but he thinks it is still highly uncertain to know for sure when the neutral rate will settle

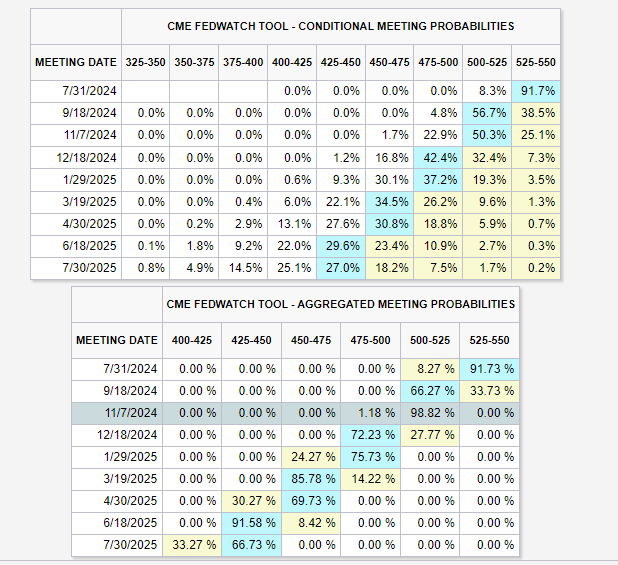

- The confidence to ease will be dependent on incoming data. Base effects from last year are low, so it could be it takes longer.

- They still see a very strong labor market, and dont see any of the cracks analysts sometimes mention.

- According to Powell, QT tapering could be coming fairly soon. Their view is that this could allow them to keep QT for longer, so not necessarily that dovish.

The banking system’s liquidity health and reserves will play a significant role in this, they want to slow QT to avoid a liquidity event.