Powell has started to sound significantly dovish, it seems to me they are starting to get worried that labor market weakness could get out of control.

He did not signal any pace of rate cuts in September or going forward, but I got the feeling that if further tweaking happens they will respond with aggressive cuts.

More than inflation data, unemployment and payrolls data going forward seems critical for this.

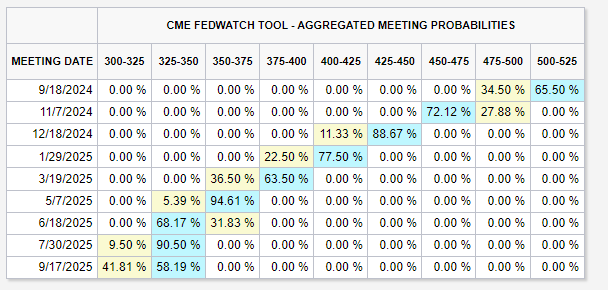

The markets increased slightly the odds of a 50bps cut in September after the speech due to this.

These are some important notes I took:

- Inflation is now much closer to objective with prices having risen 2.5% over the past 12 months after a pause earlier this year. Progress toward our 2% objective has resumed. Powell’s confidence has grown that inflation is on a sustainable path back to 2%.

- The labor market has cooled considerably from its formerly overheated state. the cooling in labor market conditions is unmistakable

- Labor market conditions are now less tight than just before the pandemic in 2019, a year when inflation ran below 2%.

- It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. Do not seek or welcome further cooling in labor market conditions.

- The upside risks to inflation have diminished and the downside risks to employment have increased.

- The time has come for policy to adjust. The direction of travel is clear and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.