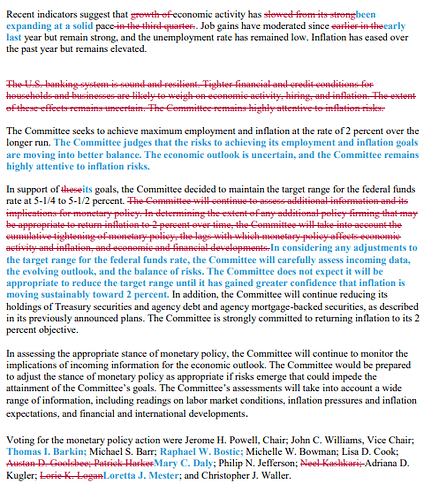

I am not his fan, but his thinking is not wrong.

I also think is a low probability currently for more rate hikes, but it would be a result that would take almost everyone by surprise.

Some other analysts that I follow closely, like Jim Bianco and to extent Lyn Alden (Lyn’s thesis is more of a 1940s scenario), have had this thesis since last year.

And tbh, data as of today supports more of these than everyone else’s, including mine, but it’s still early IMO.

In short summary this is what their thesis support:

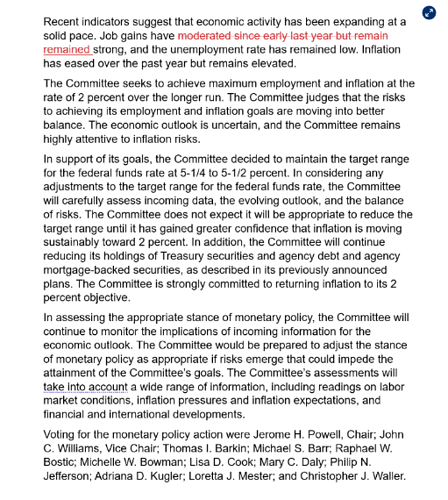

He has been making the argument the economy instead of going into recession is going to remain strong, with inflation already bottoming and remaining sticky at higher levels.

He thinks there was a secular change in the economy, and inflation after COVID, and that current rates are actually not that restrictive, because neutral rates seem to be higher now.

Lyn’s thesis is different, she thinks rate hikes, but mostly increasing fiscal deficits will be contributing to inflation because they are very stimulative to the economy. But the FED unfortunately currently only has that tool to fight it.

Ultimately she thinks another wave of inflation could happen, the nominal economy will run hotter than expected, and US economy will be in some sort of fiscal dominance.

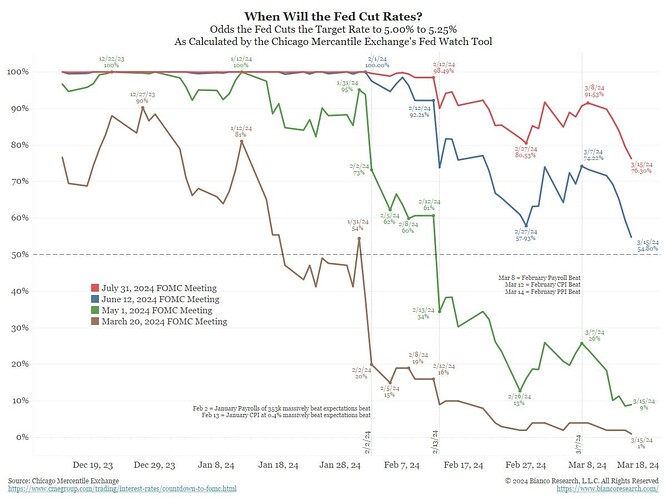

Either way, data coming like this, will maybe play into the FED physique that I am sure is probably very fearful that another 70-80’s will happen to them too.

Which at the same time could lead to the mistake of waiting too long to cut rates as necessary, and cause a severe contraction or shock.

They also have the risk that if they cut rates could lead to an overheating of the economy and inflation again, additional hikes would be necessary after that.

As I always say I would not want their job currently because data is giving all the mixed signals, even from 1 month to another.