US Outlook as of February 2024

Disclaimer: based on arguments that I think (my opinion) are more important based on history or implications it has. The macroeconomy is not as easy as calculating the direct relationship between 2 indicators, sometimes the indirect effects can be even more significant, which is difficult to quantify, and still figuring out how to do it

My current sentiment:

I still have a bearish tilt on the economy, I still do not think we have avoided a recession or real problems from arising, but I have been humbled that it could take much longer than anticipated, and I also did not take into account other factors before like the significant fiscal spending going on lately.

I also think we are not any more in a falling interest rate environment (at least where going to zero is appropriate) due to higher inflation risks, and the transition to a new paradigm will be more painful for the economy than is expected currently. Because, IMO, only a few rate cuts from the Federal Reserve will not solve all the debt issues accumulated in all sectors of the economy that got used and financed with zero rates since 2008, this is particularly true for the government debt.

If the FED ever got back to zero rates and QE again, IMO, will only lead to a reignition of inflation once again.

Currently, my confidence in a recession has decreased a bit lately due to growth slightly picking up in some areas of the economy which are usually leading, but I still don’t see a clear path to sustained improvement. This also does not mean I think this would lead to a soft landing, as my second most probable outcome is an environment with sticky or higher inflation.

Current Scenarios with probability:

- Continued slow contraction process, recession in 1-2 years: 50%

- Financial or credit shock leading to a severe recession: 10%

- Acceleration of the economy with inflation setting above target 3-4%: 25%.

- Acceleration of the economy with inflation increasing again (Would eventually end up in more hikes, and a more severe recession down the road): 10%

- Soft landing, the economy experiences sustained (years) positive growth, and inflation falls back to 2% without problems: 5%

Clarifications about this:

1. Market View

My current bearish view on the economy does not mean I think the markets will crash tomorrow or short term. I recognize the extremely bullish sentiment currently and have learned markets and the economy will be doing very different things longer than expected. Current bullish sentiment will most likely not change until there is a significant catalyst.

However, it is my opinion that if we were to experience an economic recession or reacceleration of inflation, a market correction around the start of it would most likely happen as it has been the case in past cycles

Also have to be careful about making implications for the economy from the current market pricing, we have seen market sell-offs starting months before a recession started (1974, 2001), and we have seen examples of stocks being at ATH or near ATH right before a recession (1990, 2008). So, no correlation there at all either.

2. Recession Timing

My bearish view also does not mean that I think everything will go downhill right away, contractions as well as expansions are a slow process, and we need to recognize them as such.

However, when weakness start to be more evident during recessions, the declines in economic activity tends to be pretty fast. That’s why is important to recognize the turning point on time.

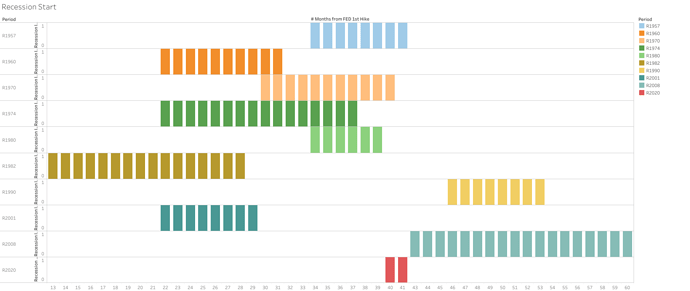

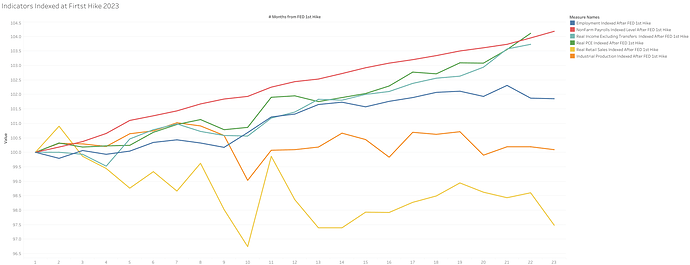

This graph shows how many months after the FED started hiking recessions started in the past. We are currently at month 23, and there are examples of recessions starting after 30+, even 40+ months. So it could take a long time.

The recession probability and timing will be more dependent on the conditions given in the economy and how they develop over time, much more than how much time has passed since FED hiking due that each cycle’s timing has been very different.

The current view for about 3 months:

The economy still looks resilient enough and in some parts, growth is picking up at the end of last year, so an imminent recession is probably not likely. (By this I mean 2/3 months max and the ugly part of the recession, since the start of recessions as NBER classifies them, are very very mild and difficult to recognize in real-time, especially since data is revised a lot)

For Q1 2024, I expect we will still receive resilient numbers for the economy (absent any significant shock), with maybe some small weaknesses becoming more apparent in the monthly data.

As of 2/20/2023, with the data released until now GDP Now from Atlanta FED is at 2.9% for Q1 2024.

1. Real GPD components:

This is the contribution of GDP components before and during recessions.

- Residential investment and non-durable spending are particularly important contributors to weakness before recessions.

- During recessions weakness is more broad between all components, led by business spending and consumer spending.

Currently, components that were weak in 2022/2023 have been picking up in growth again, but their levels are still below the peak in 2021/2022.

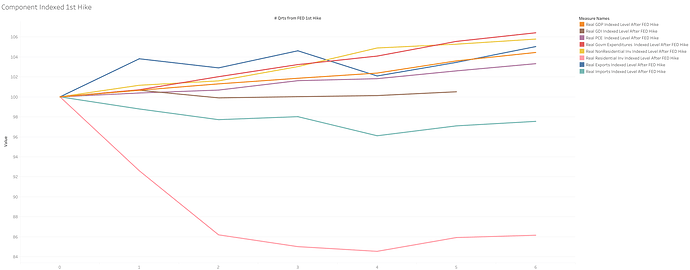

Components Indexed at the start of FED 1st Hike in March 2023

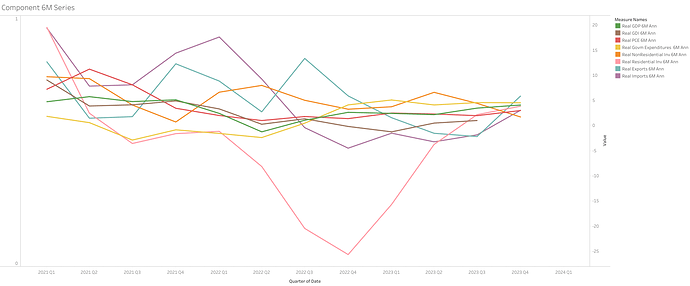

6M annualized growth rates

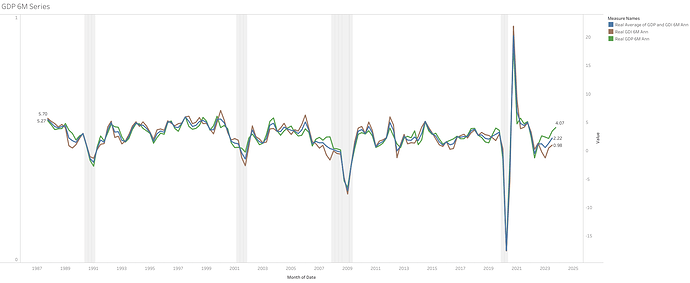

Particularly interesting is the divergence between GDP (Spending) and GDI (Income). They should be more or less the same, however, while GDP has been growing strongly, GDI has been mostly flat since 2022. IMO the reality is probably in the middle, and for this, an average of both measures is calculated by BEA.

The only gap this large was only present right before the 2008 recession, and to a less extent before the 1990 recession too.

As of Q3 2023, while GDP grew 4.07% on a 6M annualized basis, GDI only 0.98, and the average 2.22%

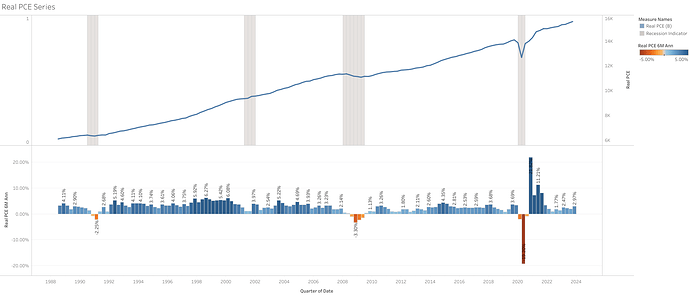

Individual components trends:

-

Consumer spending (68% of GDP) is still strong ~3% and accelerating from 2022 rates, continuing to support the economy

While spending does not have a significant decline during most recessions, its growth needs to come down from current levels to allow for one.

-

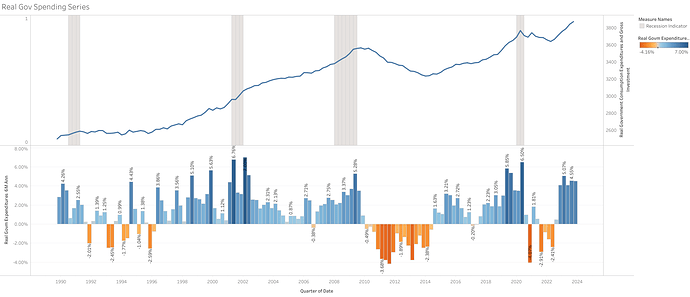

Government spending (17% of GDP) has also been a crucial part until now, with 6M annualized rates at 4% in the last quarters.

IMO, if this high level of fiscal spending continues, along with consumer spending, it will be difficult to experience a recession in the short term

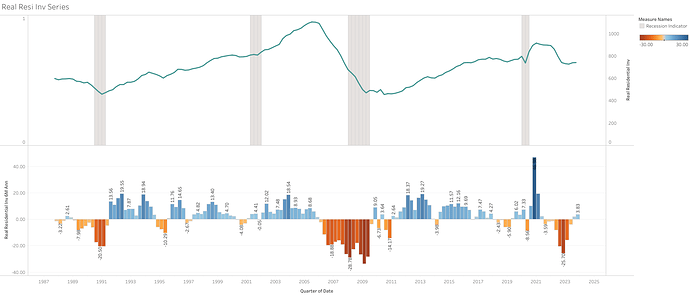

-

Residential investment (4% of GDP) have been recovering after being hit significantly hard in 2022. It is still uncertain if this recovery will be sustained since demand for mortgages and home sales remain at very low levels.

The relief in yields since Q3 could continue to give it a push near term, but the rates are still too high compared to the previous period.

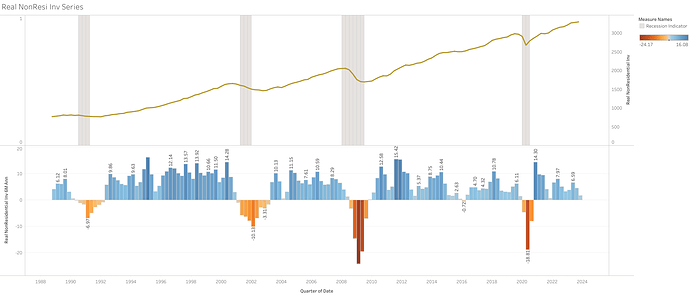

-

On the other part, nonresidential investments ( Expenditures by firms on capital, 14% GDP) growth has been decreasing, and getting to growth levels that are very slow or flat. While rates stay high and bank lending relatively flat it will be difficult to stimulate corporate investment in high levels.

-

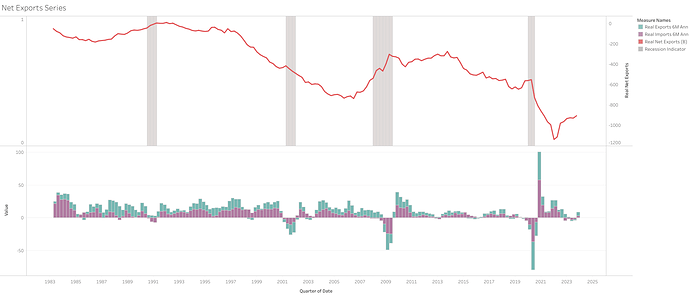

Net Trade (-3% GDP) has been recovering since 2022, exports have been growing more than imports, but weakness in some parts of the world doesn’t make this a sustainable trend IMO.

2. NBER Recession indicators:

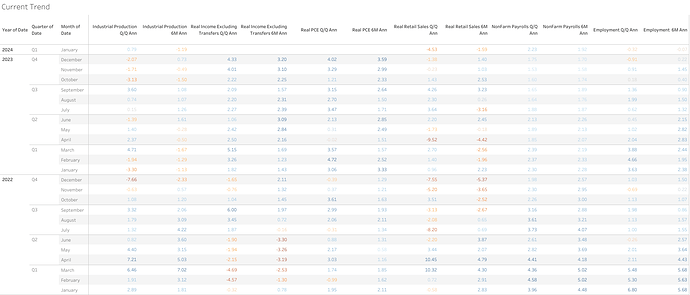

As of 2/15/2023, 3 out of the 6 indicators are beginning to look weak or showing slower growth.

- Personal Income, Consumer spending, and Nom farm payrolls are particularly strong.

IMO PCE and Income, along with employment are of particular importance to experience broader weakness. - Employment and nonfarm payrolls growth showing huge divergence. This could be explained due to the majority of employment growth has been part-time jobs (explained later on)

Levels Indexed at the start of FED 1st hike in March 2023.

6M and 3M annualized rates

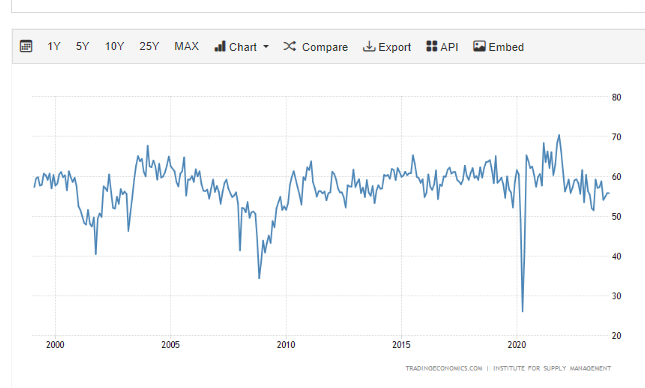

3. PMIs:

-

Manufacturing activity has been improving lately. seem to have found a bottom at least temporarily, but still in contraction.

-

Services still growing at a stable pace.

Medium to Long-term view (1+ years):

In macro looking or forecasting with certainly beyond 3-6 months is extremely difficult, since there are a lot of factors at play that could chage at any time.

But I will at least try to focus on several headwinds that I think as of now could finally weigh on the economic growth.

My current recession probability will most likely not change until I see a clear path to how these factors will be resolved without any issues or spillovers to the broader economy.

Including other factors or shocks that offset them in future developments.

Currently, the huge fiscal spending and deficits are the one factor I have most in mind that could make my forecast wrong.

And while currently, there are several leading economic indicators flashing red with a near-perfect track record of predeceasing recession, I will focus more on the conditions or factors that could change the resilience of the economy so far.

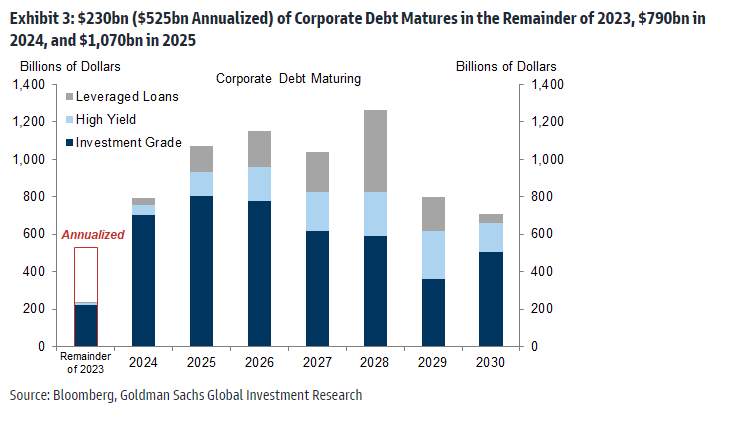

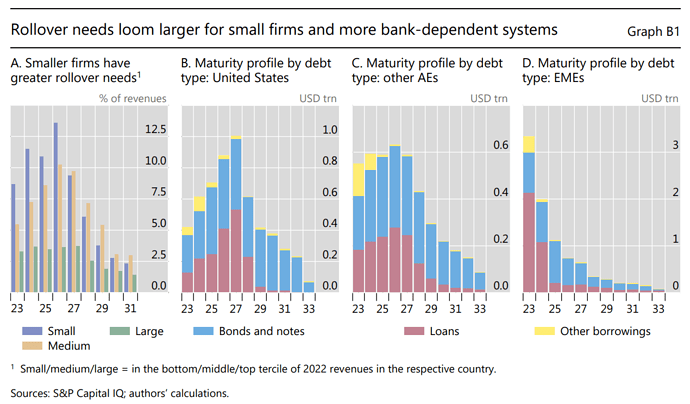

1. The maturity wall of companies, especially smaller ones, is concerning if rates continue to be high long enough.

This will force weak companies to restructure their cost base. And IMO a few rate cuts will not solve this problem.

→ Direct Impact on GDP: Consumer Spending and Non-residential investment

-

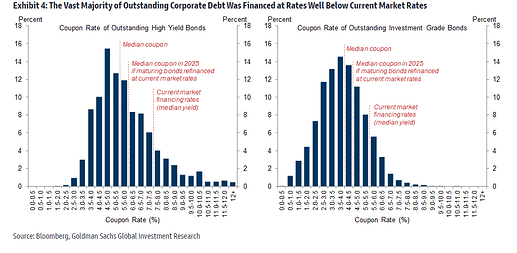

Companies’ maturities continue and will accelerate pace after 2024. Rates are now considerably higher than current coupons.

-

Maturities are more concentrated on smaller companies, which at the same time have weaker balance sheets

-

On top this small businesses employ almost half of private workforce, and they are responsible for about 63% of job creation. They have already been struggling since 2022.

-

According to Fathom Consulting,~20% of companies generate very little EBIT to cover interest payments, and companies with good financial health has been decreasing.

-

Corporate downgrades have also accelerated and exceeded upgrades for 6 consecutive quarters. Signaling deterioration in credit quality in some sectors, this will also add to additional risk premium in refinancing rates for these companies.

-

Business bankruptcies had already a significant increase in 2023. Even during a period when the economy still performed strongly.

-

Credit spreads remain very low, if more credit stress begins to appear on the markets, spreads will increase and hence the refinancing rates too.

-

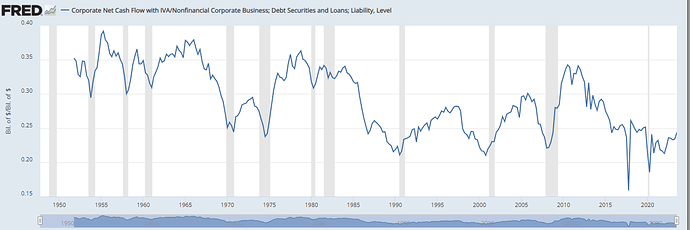

The silver lining is that corporate cash flows are at an all-time high. But remains a question for me if this cash flow is mostly concentrated in a few larger companies.

However, at the same time, free cash flow to total debt has been decreasing historically.

2. The labor market already has some underlying weaknesses

While the labor market continues to be very tight with low unemployment and significant job creation until now, underlying trends in some leading parts of the labor market signal more weakness than headline numbers could suggest.

If this continues eventually materializing in unemployment increasing, the decline in income for most of these consumers will be detrimental to their spending capacity.

-

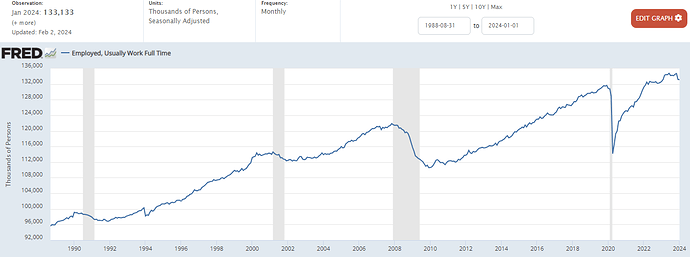

Full time jobs peaked in June 2023, since then have been on a slow decline, accelerating in recent months

-

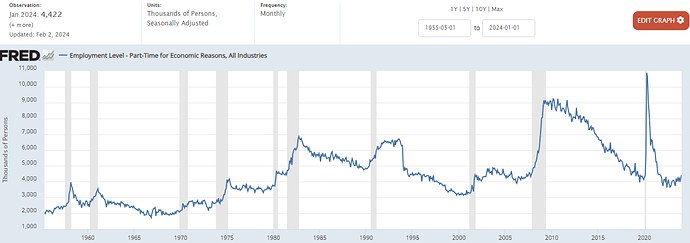

On the other hand, part time jobs for economic reasons have been increasing.

-

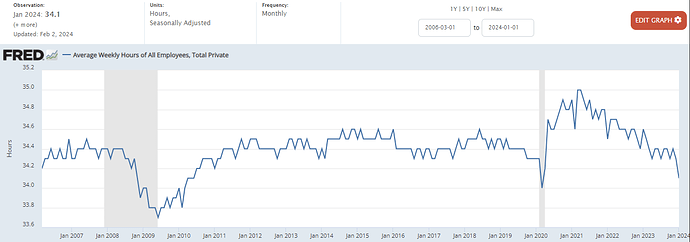

Employers until now seem that instead of laying off workers have been reducing their hours per week worked very significantly. With aggregate weekly hours being flat since January 2023.

-

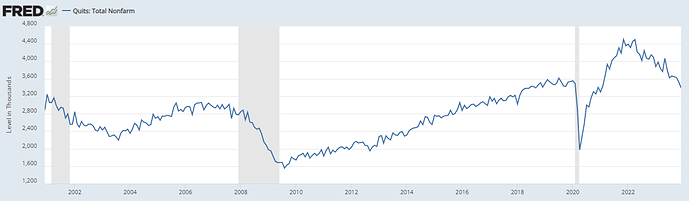

Quit rate, an indicator used to gather the confidence to change jobs easily, has been declining, with the hiring rate on the same trend.

-

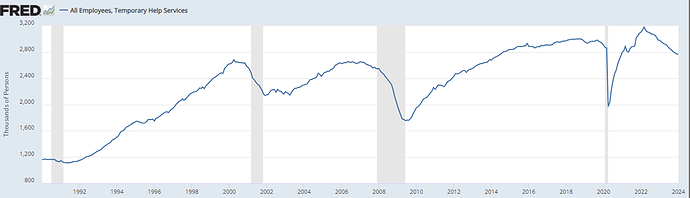

Temporary help services, one of the sectors to be let go first too, has also declined very significantly since 2022. Falling to levels not experienced since 2014.

-

U6 unemployment, which includes discouraged workers out of the labor force and part-time for economic reasons, while also remaining low has increased a bit more than the official U3 unemployment

3. Most Consumers are not as strong as they make them to be in the headlines

Their spending at current levels doesn’t seem to be sustainable, and not all are in a great financial situation as it is suggested. So an spike in unemployment could really hurt most of these consumers’ ability to spend.

However, I do see and admit their current aggregate cash levels and net worth probably make them better positioned than in other cycles and will most likely continue to support their spending growth longer than expected or until we see a significant deterioration of the labor market.

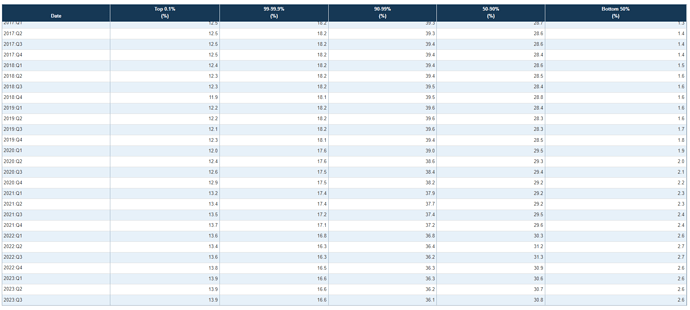

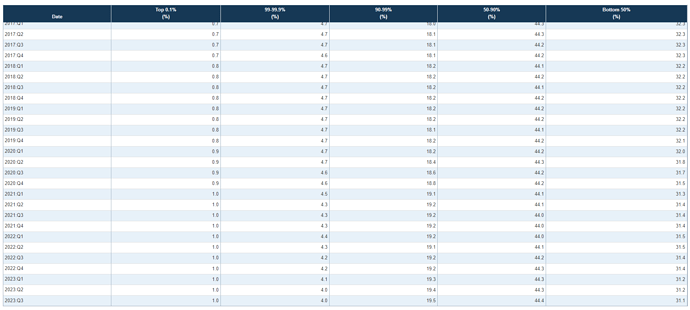

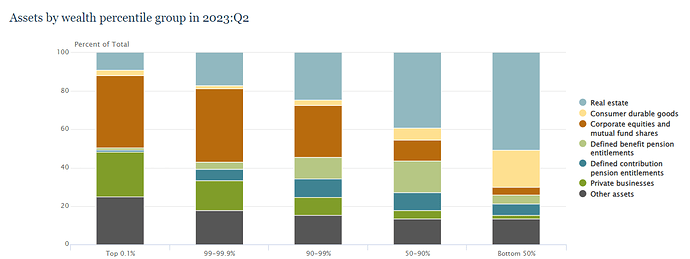

But at the same time we have to take into account that most of the wealth is concentrated in the top 10%, so any weakness in labor market will have an impact on majority of consumers.

→ Direct impact on GDP: Consumer Spending, residential investment and trade

-

Spending growth has been above income growth, which has led to a historically low saving rate. This is part of the fact that the cost of living has gone up so much since 2019, while real wages have only recently started to become positive.

-

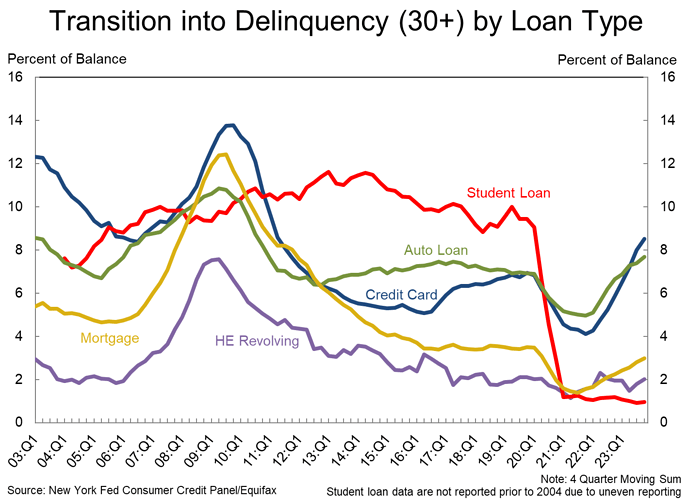

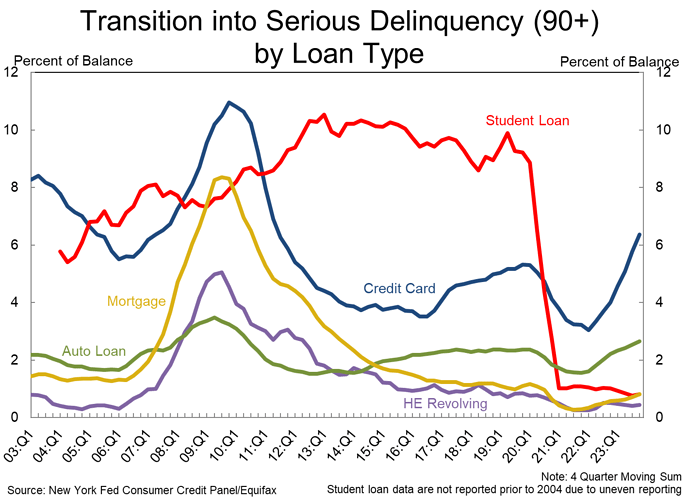

Credit card and auto loan delinquencies reaching levels not seen since 2008-2010, even when unemployment is still at record lows.

-

64% of US consumers — equivalent to 166 million people — were living paycheck-to-paycheck at the end of 2022, according to the survey by industry publication Pymnts.com and LendingClub Corp. Figures remained the same as of 2023.

-

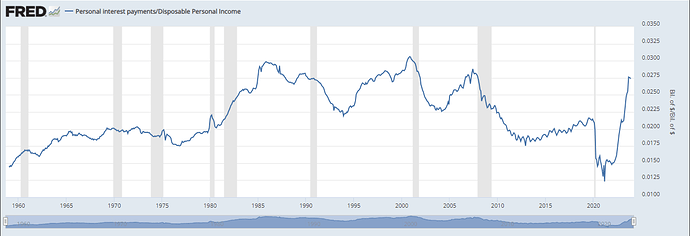

Interest payments (loans only) as a percentage of disposable income have been increasing very significantly. Mortgage payments have remained relatively low since most of them are fixed rates with long maturities.

-

Consumers are not only using credit cards at record levels to cover expenses, but they are also now starting to use options like buy now pay later more than ever, which unfortunately lack transparency in data.

-

The top 10% owns 67% of wealth in the US, and the bottom 50% owns 3%. While wealth has increased very significantly since 2019 (it is common for it to grow from cycle to cycle), most beneficiaries are the already wealthy.

-

While the bottom 90% owns only 33% of wealth, they own 75% of the total debt, the bottom 50% has 31% of total debt.

-

According to surveys, only 44% of U.S. adults would pay an emergency expense of $1,000 or more from their savings. 35% would borrow money, including 21% who would finance with a credit card and pay it off over time, 10% who would borrow from family or friends and 4% who would take out a personal loan.

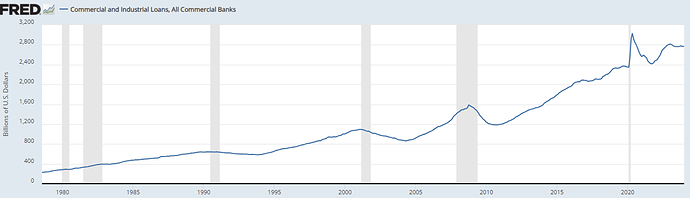

4. Bank lending growth is near zero currently, and credit stress and liquidity issues will continue to put constraints on lending growth going forward.

A credit crunch would mean that theese constrains, especially in regional banks, would limit the ability of banks to create capital and loans. And is already starting to be the case, particularly in business loans growth.

There are a lot of businesses, that need this type of capital to continue to operate or as we saw previously to refinance existing debt.

Direct impact on GDP: Non residential and residential investment, and consumer spending.

-

After the RRP depletion, bank reserves will start to be negatively affected by QT again, after the benign liquidity environment since March 2023.

-

Q4 2023 bank earnings results showed that deteriorating on credit conditions could be starting to be more evident.

-

Credit standards are already significantly tight since 2022.

-

Current commercial and industrial loans peaked in January 2023, and have been flat to down since then. Corporate investment financed by debt is not expected to significantly pick up as long as rates remain this high, and credit standards tight.

-

Growth is very low for real state loans too at ~3% y/y from 12% at the start of 2023.

-

If banks start to put more restrictions on consumer loans as delinquencies and defaults continue, it could also impact the ability to spend for some consumers. For now, revolving credit growth continues to be high (8% y/y) but it has slowed a bit from 15% in 2022, while non revolving credit (autos and student loans mostly) growth is near zero from ~8% in 2022.

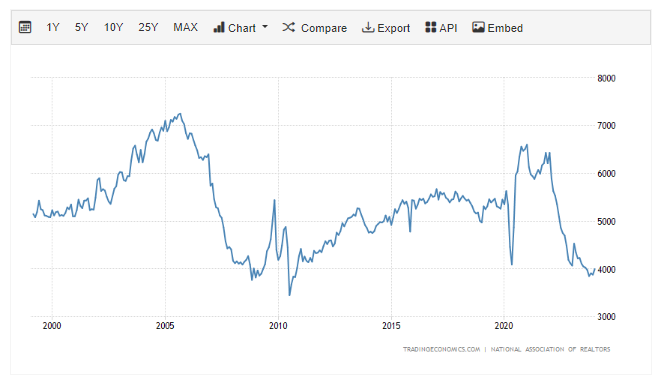

5. Real Estate problems (CRE and housing)

While the housing market seems to have a low direct impact on GDP, it has been studied and recognized as one of the most important GDP components in terms of its leading nature, and the contributions to GDP from this sector before the recession, and before recovery.

Currently with rates high, housing activity is very low, and I don’t see a clear path to recovery as long as rates and prices remain this way.

-

Existing home sales is lowest since the 2008-2009, and mortgage activity is even lowest than that. So, there is no much residential investment recovery expected for me in the near term.

-

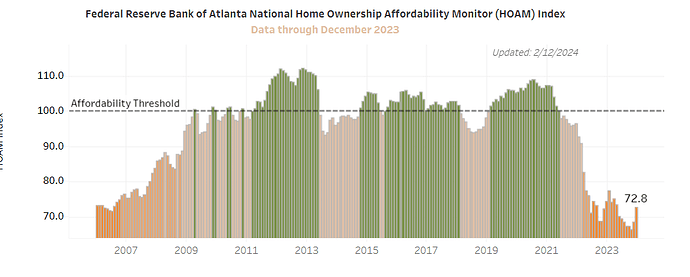

Housing prices have continued to go up due to very low supply, and housing affordability is as bad as it were during the 2008 housing bubble.

-

if the affordability issue ends up solving by a decline in home prices, the negative wealth effect it could create for most consumer is significants. The bottom 90% of consumers have most of their assets/weath in housing, particularly high for the bottom 50%. A decline in prices would most likely impac negatively the balance sheet of these households.

-

On the other hand, CRE coming maturities are also significant, 14% of loans are already on negative equity and imo this will be higher as price discovery still continues, and banks dont have enough reserves currently for these losses. So, at some point CRE losses could be a hit to banks balance sheets, probably not enough to cause a systemic event, but enough to continue constraining bank lending and liquidity.

6. Economic weakness in some important regions of the world

If global economic weakness continues in the most important countries/regions of the world, is inevitable will have spillovers to the US economy.

Financial issues spillovers could be worth monitoring too.

→ Direct impact on GDP: Trade

- European Union with flat growth currently

- Canada growth has also been relatively weak

- Japan appears to be in a technical recession

- China experiencing economic weakness with deflation, and what seems to be a financial crisis starting

- UK also fell into recession recession on Q4 2023

What factors could make my thesis go wrong, or other current risks I see (upside and downside):

1. Fiscal Spending continuing at the current pace or accelerating, will continue to push recession away due to the ongoing stimulation of the economy

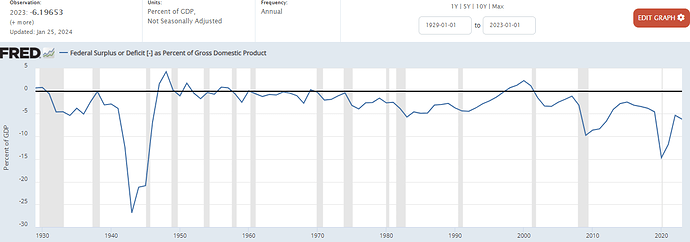

Fiscal deficits are very stimulative because this is additional money the governments will spend on goods and services (reflected in high growth in government spending in GDP), and also because consumers, businesses, and foreign entities will receive additional cash due to higher interest payments from the government.

- Fiscal deficits to GDP are over 6% of GDP currently. This level of fiscal deficit is not common to see outside recession, and even during some mild recessions.

- As studied in NBER research, the only 2 two times in history that the economy has averted a recession after a substantial residential investment weakness was due to fiscal spending ramping up offsetting the declines in GDP.

- According to CBO projections, there are no plans to reduce current government spending levels, and fiscal deficits will remain high.

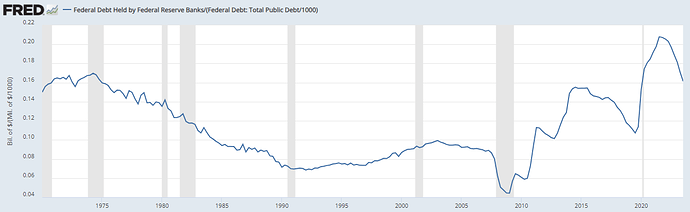

2. Treasury market disorders forcing the FED to do QE again and lower rates, overstimulating the economy again

With increasing fiscal deficits and treasury maturities coming soon, the amount of treasury supply (~10 trillion in the next year) that needs to be absorbed by the markets is significant going forward.

This is at a time when demand growth for treasuries, especially long-term, has been decreasing.

If there is an undesired significant spike on yields due to this or in other important markets like overnight repo, IMO the FED could be forced to intervene buying treasuries once again.

If the FED does not intervine they could risks yields going out of control, or a liquidity crisis on the Treasury market.

The most severe scenario would be that the US ends up on a fiscal dominance path, where the FED has to quit its inflation mandate to support the treasury market.

To me, this seems like a very real and likely possibility in the future, due to how government debt is developing. I am only still unsure, about the timing of this.

-

FED doing QT, will not be buying treasuries as long as it continues, even if it’s data slower pace.

-

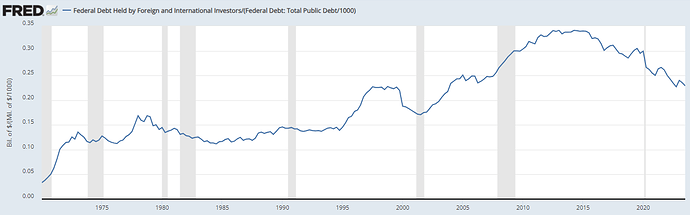

The growth of treasury holdings by foreigners has been decreasing since 2016, and the current peak remains in 2021. Their holding percentage of total debt has come down from 34% in 2014 to 23% in 2023.

-

When RRP depletes, the situation could be even more concerning as banks will need to absorb a bigger portion of the current supply, and liquidity issues could emerge due to a decline in reserves (same as in September 2019).

-

Several auctions since last year have come up worse than expected, and an indication of the current low appetite for treasuries.

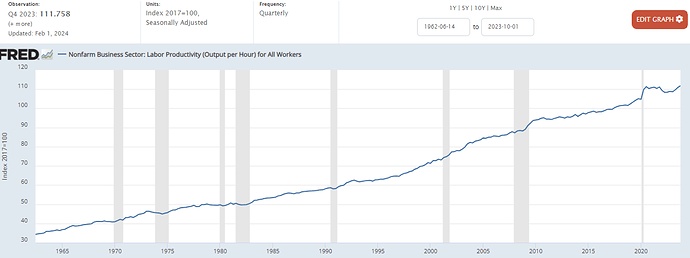

3. A sustained boom in productivity could lead to increasing growth but lowering inflation, this would allow for a sustained soft landing.

Due to the AI investments, and the fact that productivity growth was very high during 2023. There exists the possibility there is a sustained increase in productivity going forward.

I remain skeptical of this for now. While I am a believer AI will produce a significant change, I am not sure yet it will be as soon as some are expecting. Currently, we are only starting the investment phase, and IMO the full benefits of this will be felt until some years in the future.

Also high current AI costs don’t make it accesible for most small businesses in the short term.

Additionally, productivity in 2023 was only catching up to the loss experienced in 2022, gains from now on will be more important to assess if productivity is indeed on a path higher than before.

However, I must admit I haven’t analyzed for now in much detail other productivity booms in the past, and hence I don’t fully understand their full cycle developments, so I leave this as a fully real possibility that could change the path forward of the economy, even in the short term.

IMO this is the only option that could allow for a sustained soft landing for some years.

4. The current loosening of financial conditions since October 2023 could be stimulative for the economy and inflation, especially if the FED indeed decides to cut rates relatively soon

- Risks taking and appetitive increase in these environments

- Wealth effect of rising equities and housing could create a positive sentiment for consumers

5. Credit Stress or liquidity issues in banks or other less transparent financial participants could lead to financial distress and/or a credit event

Currently not even the FED knows where the appropriate level of bank reserves is, with them determined to keep QT even at a slower, they risk bringing reserves to a very low level that could cause a liquidity crisis.

In March 2023, liquidity issues emerged with reserves at ~3 Trillion, currently, they are at 3.6 T.

Since March, Bank reserves have been increasing due to the decline in the RRP, but the RRP is expected to be depleted sometime in 1H2024. On top of this, the FED is also expected to end the BTFP program, introduced to alleviate liquidity needs, in March 2024

Reserve levels are also very different between small and large banks, so small banks are the ones particularly at risk.

Additionally to this, is unclear the total credit risks on banks’ balance sheets currently, but the increase in delinquencies and defaults in several sectors of the economy, while the economy is still in a good place, do give some concerning signs of what could happen in a more deteriorated economy.

Either way, with a liquidity or credit event, IMO the Federal Reserve will intervene right away to try and avoid contagion as it has done in recent years, so I don’t think as of now that a 2008 type of crisis is that possible.

6. Geopolitical risks leading to oil or supply chain shocks. Eg. Shipping costs continuing to go up.

7. AI mania and expectations could create a massive bubble, while this does not sound good long term, it could at the same time mean we are just starting the formation of said bubble.

This is highly uncertain, as the formation and end of asset bubbles are difficult to assess and predict in real-time due to the significant weight human psychology plays on it.

Inflation Outlook

Rates Outlook

Short term

2/3 cuts for 2024 seem plausible based on current economic data and what the FED is signaling.

IMO, a case could be made that the economy does not need any cuts at all due to being in a good spot currently (could change any time)

- No one really knows where the neutral rate of the economy is currently, and if current rates are really that tight

- The FED would want to stay high for when a recession indeed happens (In 1, 2, 5 years) to have enough room to ease and stimulate

- Cutting rates could overheat the economy again since there are already signs of reacceleration on some areas

4+ cuts only if labor markets start to be weak in headline numbers, and we start to enter a recession → The Fed has said more aggressive cutting if they see deterioration in the labor market

Long term

As I mentioned in the beginning I don’t think we are anymore in an environment where going to zero rates is appropriate due to inflation risks.

However, this will also highly depend on how well growing fiscal deficits are financed and the demand for treasury debt.

If the US ever gets itself into a fiscal dominance scenario, is very likely the FED would need to keep rates artificially low to be able to keep the government afloat.

This as a consequence would create huge inflation, and is known to be used as inflating the debt.

If global real interest rates returned tomorrow to their historical average of roughly 2 percent, given the existing level of US government debt and large continuing projected deficits, the US would likely experience an immediate fiscal dominance problem. Even if interest rates remain substantially below their historical average, if projected deficits occur as predicted, there is a significant possibility of a fiscal dominance problem within the next decade.

https://research.stlouisfed.org/publications/review/2023/06/02/fiscal-dominance-and-the-return-of-zero-interest-bank-reserve-requirements#:~:text=Fiscal%20dominance%20refers%20to%20the,intentions%20to%20keep%20inflation%20low.