Slowing QT by the FED could maybe be closer?

Christopher Waller (FED governor), recently said balance sheet run-off could start to slow when bank reserves get to 10-12% of GDP, this would mean ~2,75 -3.4T reserves, currently at 3.52 T. So not much run away really.

In March 2023, when liquidity issues started in some banks, their reserves were at ~3T, and got as low as 2.83T in January 2023.

“We’ll start slowing as we approach maybe reserves being 10% to 11% of GDP,” Waller said at a Council of Foreign Relations event in New York. “And then we’ll kind of feel our way around to see where we should stop.”

The complete draining (or getting to a low level) of the reverse repo facility could add to this possibility because banks would need to absorb more treasury supply, draining their reserves again, which have been currently increasing since March 2023.

The FED is also going to the BTFP program created in march 2023 to help banks with liquidity in March 2024.

The FED has not said anything official about reducing QT, so tomorrow’s meeting and the subsequent meeting will be increasingly important to get a signal either way.

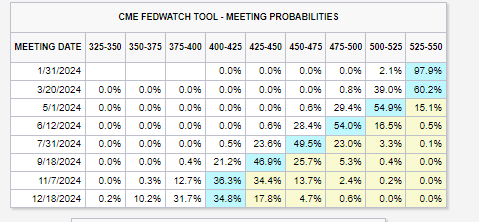

For tomorrow’s meeting no cut is expected, and cuts are expected to start now in may 2024, with a total of 5-6 in 2024.