Yes, I don’t think the FED is political, I just think they have bad models and follow the wrong indicators.

But I think a level of coordination between all important central banks do happen, most likely.

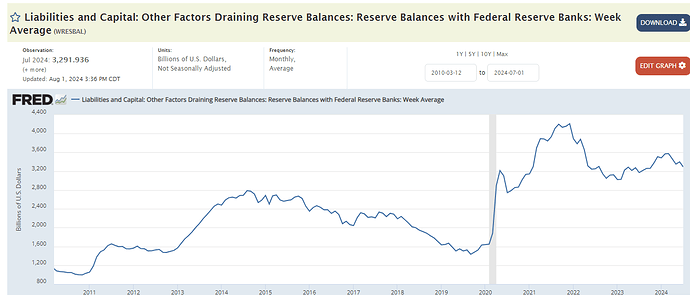

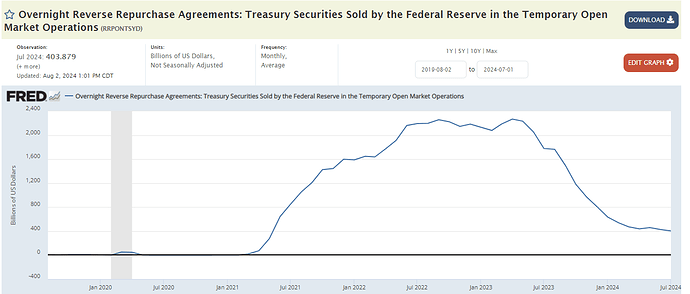

There was a significant liquidity improvement last year that I did mention about before, as the RRP was drained bank reserves increased by ~500B (~16.5% increase) , obviously still not the huge level increases we saw in 2020/2021.

But this year this has stopped for the most part (bank reserves are again decreasing, ~300B less since March 2024 local peak), and is the main reason the FED has to slow the pace of QT this year, since they got worried bank reserves would get to very low levels again very fast. (reserves were ~3T when banks liquidity problem appeared in 2023)

But to be fair, I think his thesis is that most of the liquidity is coming as a reaction to the economy slowing.

Other than this, I was just reminded about the Eurodollar system, I always see it mentioned when talking about global dollar liquidity, and I admit I don’t know much about it, but I have saved a task under liquidity to get to it at some point in the future.