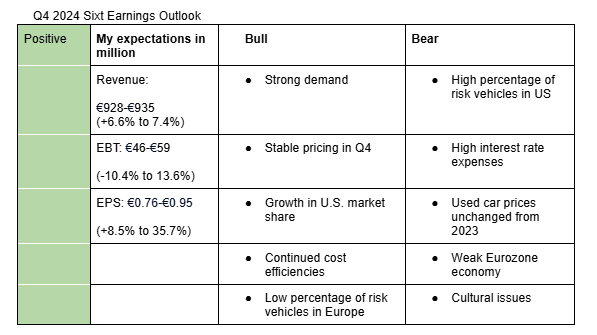

This topic discusses Sixt’s Q4 2024 earnings. You can find a full preview of the earnings in the wiki:

Here is a summary of Avis Budget Group Q4 2024 results;

- Avis Budget Group Q4 2024 revenue fell 2% y/y to $2.71 billion (analysts estimate: $2.73 billion) while EPS came in at -$0.23 versus analysts estimate of -$0.96.

- The outgoing CEO Joseph Ferraro said demand was strong during the quarter and that they saw a continuation of a strong leisure demand in January.

- Pricing was down 2% y/y but improved sequentially throughout the quarter, and is expected to be down slightly in Q1 as well.

- Its vehicle depreciation and lease charges rose 37.6% y/y, a deceleration from 55.9% growth in Q3, but is expected to remain elevated in Q1.

Here is a summary of Hertz Q4 2024 results;

- Hertz Q4 2024 revenue fell 6.6% y/y to $2.04 billion (analysts estimate: $2.12 billion) due to reduced volume as they remain discipline on capacity and driving utilization while adjusted EPS came in at -$1.18 versus analysts estimate of -$0.72.

- CEO Gil West said the strong demand continued into Q1, thanks to MLK and upcoming President’s Day.

- Gil west pointed out that pricing was down 1% y/y in Q4 but there was a 150 basis points improvement from Q3.

- CFO Scott Haralson said used vehicle prices dropped below the forecasted values in Q4, driving their depreciation numbers above the top-end of their guided range but they have seen improvement in 2025.

I am positive on Sixt’s Q4 2024 earnings. My estimates take into account the strong demand, stable pricing, reduced number of risk vehicles, especially in Europe and continued expansion in North America. Here is a description of my bullish and bearish points:

Bullish sentiments:

- Strong demand during Q4: Competitors such as Avis Budget and Hertz witnessed strong demand during the quarter that has continued into Q1, thanks to the holiday season. Similarly, growth in tourist visits in Europe and North America was stronger in Q4 compared to Q3.

- Stable pricing: Avis Budget and Hertz witnessed stable pricing during the quarter. For instance, Hertz saw a 150 basis points improvement in pricing in Q4 compared to Q3 while Avis said pricing improved sequentially throughout the quarter.

- Strong growth in the US market: Sixt has been growing strongly in the US market. The financial issues that faced its competitors, especially Hertz provides it with an opportunity to further take up market share. In an interview with BTN, Sixt head of North America Tom Kennedy sounded very positive about their growth trajectory in the US.

- Continued cost efficiencies: I expect the cost efficiencies such as the ‘Car Gates’ to help the company further in Q4, especially when it comes to personnel costs.

- Low percentage of risk vehicles in Europe: Sixt’s percentage of risk vehicles was reduced to only 2% in Q3 2024. This means that the number of vehicles that Sixt needs to dispose of in Europe in order to achieve favorable conditions is now low. As such, growth in depreciation costs in Europe is likely to decelerate significantly in Q4 from Q3.

Bearish sentiments

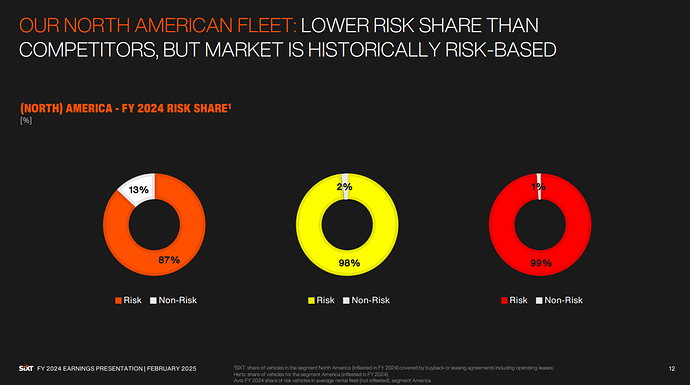

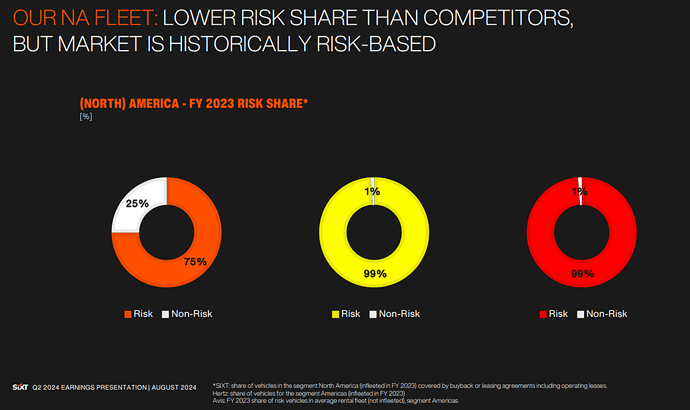

- High depreciation cost in the US: Sixt has a high percentage of risk vehicles in the US compared to Europe. At the end of Q2, the percentage of risk vehicles in the US stood at 75%, though the company said (page 15) there was a significant improvement in Q3.

- Used car prices were unchanged compared to 2023: Used car prices in the US only stabilized in Q4 2024 compared to the same period in 2023. In Europe, used car prices are still down year-over-year. Similarly, Hertz and Avis reported depreciation costs in Q4 that is still elevated. High percentage of risk vehicles in the US coupled with no much improvement in the prices of used cars means Sixt is likely to report high depreciation costs in the region again.

- High interest rate expenses: Interest rates in the US, currently standing at a range of 4.25%-4.5%. Although, it has moved down to 2.75% in Europe, it will probably takes some time for for the effects to reflect on Sixt’s financial result.

- Weak Eurozone economy: Germany’s GDP contracted again in Q4 by 0.1% while Euro area GDP showed no growth. This is likely to weigh on Sixt’s revenue growth in Q4.

- Cultural issues: The recent departure of Sixt’s CMO Tobias Seitz may indicate that the cultural issues we identified last quarter are still there. Reports indicate that Seitz creative freedom at the company was less than he had anticipated. Such cultural issues may affect the operational performance of the company.

N/B: Here are the management and analysts expectations;

Q4 2024 management outlook for EBT: €58 million (+12.3%)

Q4 2024 analysts estimate for EBT: €56.3 million (8.9%)

Q4 2024 analysts estimate for revenue: €919.6 million (+5.6%)

2025 analysts estimate for EBT: €464 million (+37.2%)

2025 analysts estimate for revenue: €4,236 million(+7.3%)

Sixt tops revenue estimate in Q4, misses EBT guidance by €5 million

-

Sixt Q4 2024 revenue rose 11.4% y/y to €969.6 million (calculated), topping analysts estimate of €919.6 million while EBT rose 3% to €53.3 million, missing management guidance of €58 million and analysts estimate of €56.3 million.

-

For 2025, Sixt is guiding revenue growth in the range of 5% to 10% (analysts estimate: +6%), and EBT margin of 10%, up from 8.4% in 2024 (analysts estimate: 11%).

"Moving forward we expect the significantly improved purchasing conditions to provide a strong tailwind for our earnings from summer 2025 at the latest,” CFO Franz Weinberger said.

-

Sixt’s revenue from Germany rose 1% to €277 million (my estimate: €282 million), revenue from Europe rose 15% to €356 million (my estimate: €313 million) while that from North America rose 18% to €336 million (my estimate: €337 million).

-

Sixt shares were down 1% in pre-market but rose 5% when the market opened.

Assessment

The fact that Sixt’s Q4 2024 EBT didn’t deviate much from expectations confirms management’s comments that residual values are improving. The 2025 guidance also largely met estimates. However, the guidance for a deceleration in revenue growth in 2025 indicates low visibility on the economic situation in Germany and Europe.

- Buy, €90: Analyst Christian Obst of Baader Bank said Sixt’s 2025 revenue guidance is above expectations. He pointed out that discounts for car rental companies on purchases are likely to increase over the course of the year. He also added that losses on residual values are likely to decrease over the course of the year, and personnel and IT costs should become more favorable. He also noted that Sixt is usually cautious when making forecasts.

- Buy, €110: Analyst Constantin Hesse of Jefferies said Q4 results were solid though pre-tax result slightly felt short of expectations. He pointed out that 2025 guidance is in-line with expectations and expects a slight positive reaction.

- Buy, €135: Analyst Marc-Rene Tonn of Warburg Research said Sixt has forecasted a solid growth in sales and margins in 2025.

Sixt’s percentage of risk vehicles in North America rose to 87% from 75% in 2023