Q4 2024 Used Vehicle Pricing Update

United States

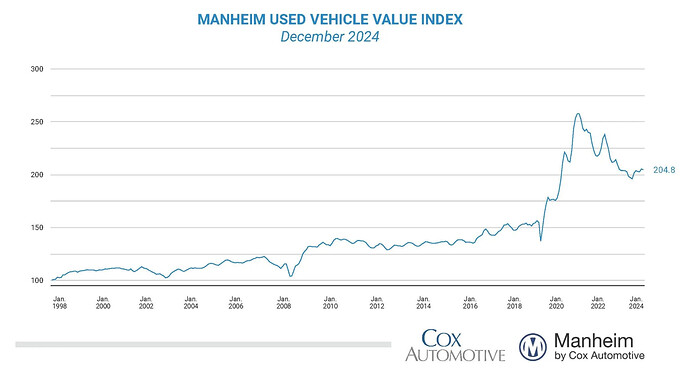

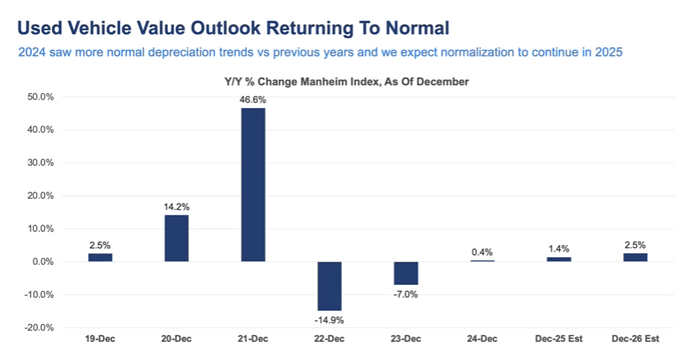

Used Car Prices have stabilized and even increased since the second half of 2024 (4.44% since June). My latest assessment for a more stable and normal environment for the next few years is playing out as expected and has not changed since then.

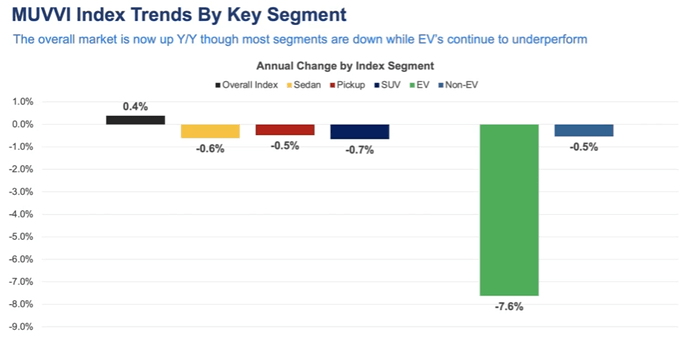

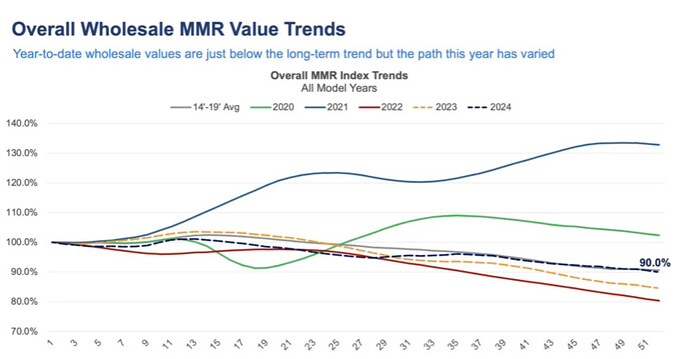

The Manheim Index ended the year up 0.4% from last year, below the long-term average increase of 2.3%.

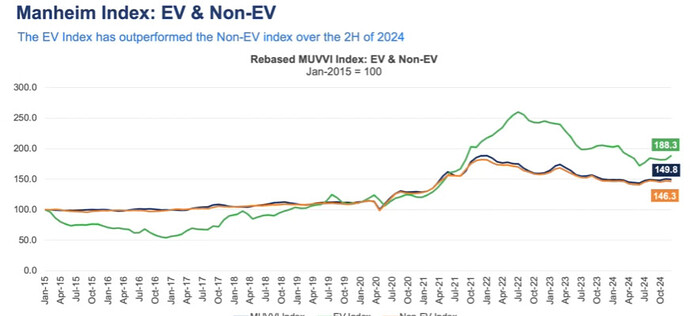

- EV used values may have found a bottom, 2H 2024 increased by 9.4% vs 4% non-Evs.

Cox expects a 1.4% increase in 2025 and 2.4% in 2026.

Inventories ended the year at 10.2% y/y, and sales 13% y/y.

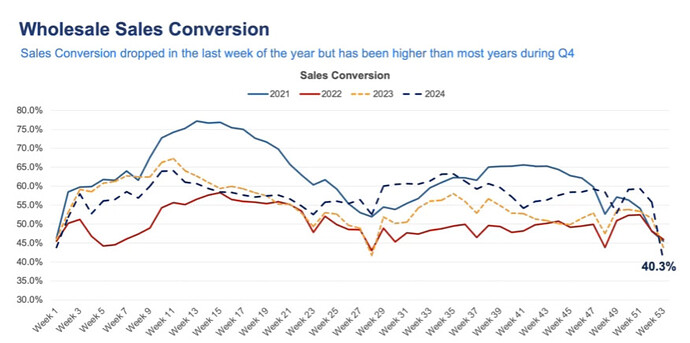

- Sales conversion increased in 2H2024, indicating buyers are now more willing to pay the prices offered

1-10 years old units depreciated by 10%, only 1 point above long-term average

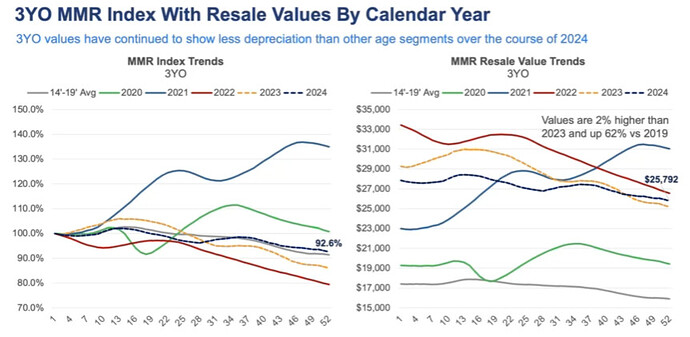

- 3-year units depreciated by 7.4%, ended the year a point higher than what is normal

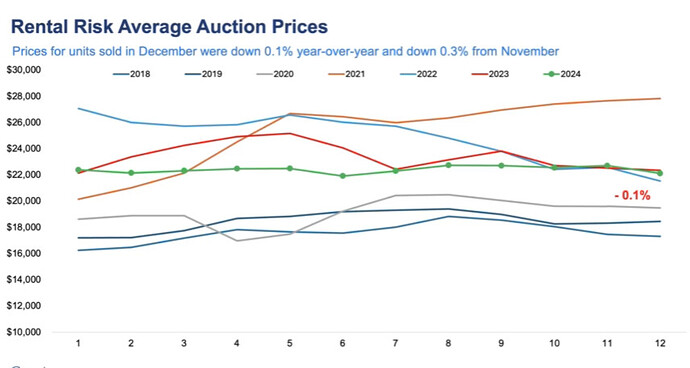

- Rental Prices were down 3% q/q, but December ended only down-0.1 y/y

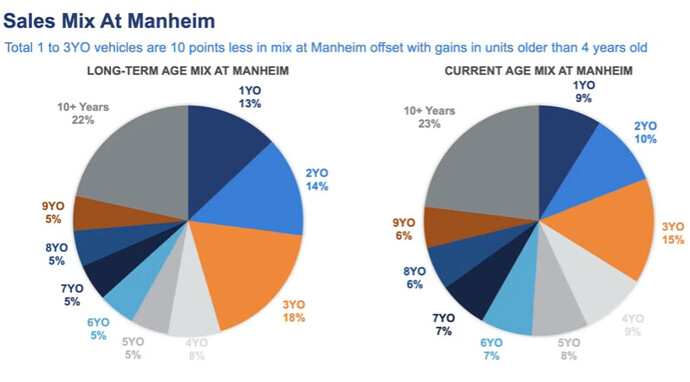

- Younger vehicle share has declined due to the shortage 3 years ago

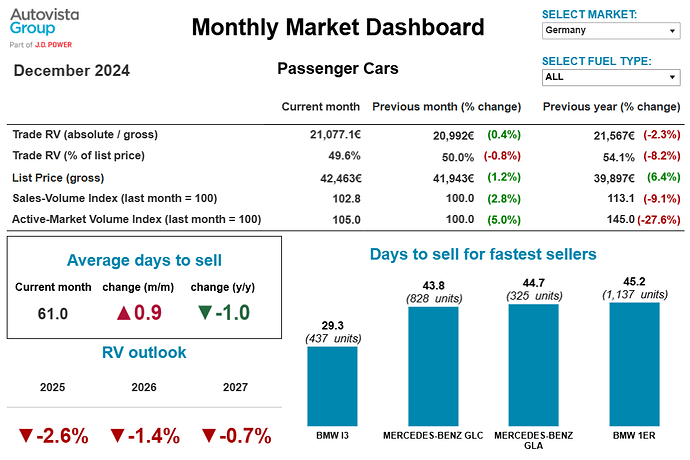

Europe

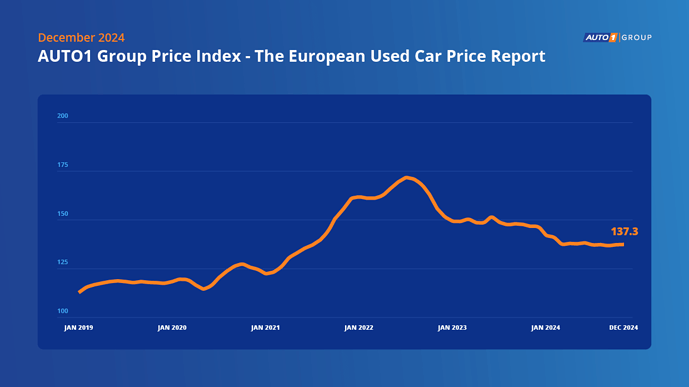

Compared to December 2023, used car transaction prices dropped 6.5% in December 2024. Despite this decline, they remain 17.1% higher than pre-COVID levels (December 2019 index: 117.3).

- Used car prices decreased by 3.3% throughout 2024 (from 142.0 in January to 137.3 in December). They have remained mostly stable all of 2024.

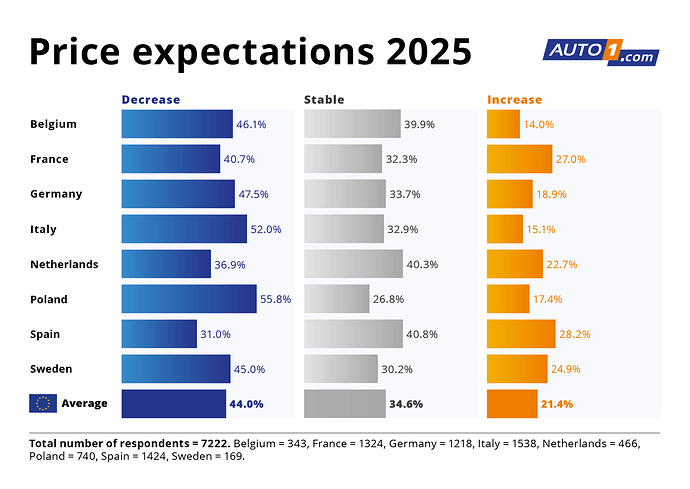

44.0% of survey respondents expect used car prices to continue declining in 2025, this figure is down from 56.9% the previous year

- Over 34.6% of dealers now believe prices will remain stable, and more than 21% expect them to rise—both figures marking a more optimistic outlook compared to last year.

- The majority of dealers (58.3%) view current prices as neutral for their operations. Marginally lower prices have improved consumer affordability, driving increased market activity.

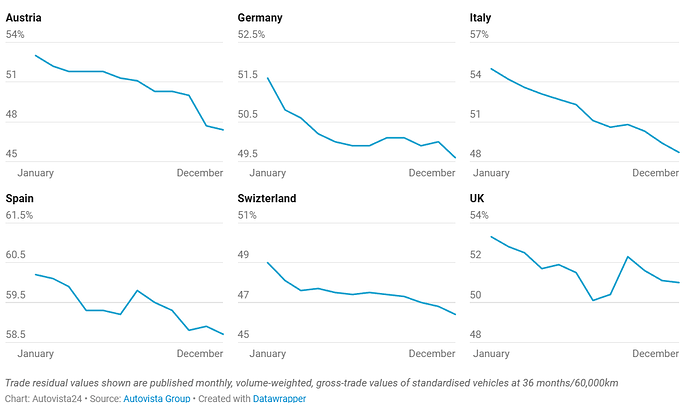

After inflated RVs in 2021-2022 and the start of stabilization in 2023-2024, RVs are forecasted to continue declining but at a slower pace. This decline is a correction toward pre-pandemic norms, driven by increased supply and moderated demand.

- RVs in countries like Germany (-2.65), Italy (-3.7%), and France (-2.9%) are expected to see sharper declines in 2025 than markets like the UK (-1%) and Spain (-1.4), where values may remain comparatively resilient due to structural factors like stronger demand or unique supply challenges.