This topic discusses Sixt’s Q3 2024 earnings. You can find a full preview of the earnings in the wiki:

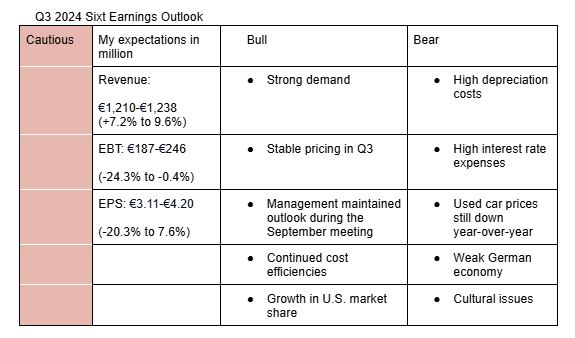

I am cautious on Sixt’s Q3 2024 earnings. My estimates take into account current industry trends, growth in U.S, recent management guidance and macro environment. Here is a description of my bullish points:

- Strong demand: Avis Budget said in their Q3 earnings call that car rental demand was robust during the quarter. Additionally, airline companies reported healthy demand for air travel in Q3.

- Stable pricing during the quarter: Sixt, Avis, and Hertz are involved in fleet rotation following a slump in residual values of used cars. As a result, I expect pricing to have been stable during the quarter. Avis said in the earnings call that pricing improved sequentially during the quarter compared to the same period last year.

- Recent management guidance: During a September 24 meeting with investors, Sixt reiterated its guidance for 2024. If things had gotten worse during the quarter, they would have likely updated the forecast.

- Cost efficiencies: I expect cost efficiencies initiated at the company such as the “Car Gates” technology to continue paying off.

- Continued market share gain in U.S: As its competitors (Avis and Hertz) rationalize fleet in U.S, Sixt gets a chance to take market share from them. For instance, they opened more branches in U.S during the quarter.

Here is a description of my bearish points:

- High depreciation costs: Sixt’s fleet rotations will probably not pay off until next year given that it usually holds vehicles for 6 to 12 months before selling them. Similarly, Avis’s depreciation of rental vehicles as a % of U.S revenue only fell to 23.22% in Q3 from 23.68% in Q2.

- Hight interest rate expenses: Though the key interest rates set by the ECB and the Fed is on a downward trend, it will probably take sometime for the effects to reflect on Sixt’s financial result.

- Used car prices: While used car prices are starting to normalize, they are still down year-over-year.

- Weak German economy: Germany’s economy hasn’t shown any signs of recovery yet. This reduces discretionary spending such as travel spend. As such, I expect its Germany revenue growth to have decelerated further during the quarter.

- Cultural issues: Sixt is experiencing high turnover in Germany. This could impact the operational performance.

N/B: Here are the management and analysts expectations;

2024 management outlook for EBT: €340-€390 million (€365 million or -21.4% at the midpoint)

Q3 2024 analysts estimate for EBT: €254.9 (3.2%)

Q3 2024 analysts estimate for revenue: €1,226 (+8.6%)

2024 analysts estimate for EBT: €355.1 million (-23.5%)

2024 analysts estimate for revenue: €3,943 million(+8.9%)

My 2024 estimates include revenue of €3,956 (+9.3%) and EBT of €354 (-23.8%)

Why are you cautious about Sixt earnings? Is it due to the fact that EBT might fall?

To me your bullish points sounds more compelling than your bearish ones but I see that you are expecting the possibility of a significant decrease in EBT while analyst don’t. Why specifically is that?

Given that Sixt does not guide for Q3 it could make sense to include some reference:

What does it likely mean for the FY guidance if Sixt comes in at the lower end of your estimates (rev €1.21 billion and EBT of €187 million) and the higher end? Could Sixt still achieve its FY EBT guidance if it comes in at the lower end of your expectations?

I would also include EPS to our overview even if management and analysts only focus on EBT. This makes it easier for us and all readers to set profitability per share in relation to the share price.

Yes, I am positive on revenue growth but cautious on EBT. Sixt residual values in U.S are highly uncertain and I think analysts are being too optimistic. If you look at Q2, Sixt’s depreciation as a percentage of revenue rose sharply quarter-over-quarter while that of its competitors declined. Also, in Q3, the decline in Avis’s depreciation as a percentage of revenue wasn’t much, implying that this ratio could still be elevated at Sixt.

Sixt didn’t give revenue guidance for 2024 as well. They only said that revenue in 2024 will rise significantly. Given that the difference between the lower range and upper range of my revenue estimate is only 28 million euros, I don’t think Q3 actual results coming in at the lower or upper range of my estimates will influence the full year revenue growth by much. If Q3 EBT comes in at the lower range of my guidance (€187 million), Sixt could still meet its full year guidance of €340-390 million since it will only have to achieve €117 million in Q4 to hit the lower range. But it will need to see significant improvement in depreciation costs in Q4 compared to Q3.

Didn’t Sixt say at one point (I think in Q1 or Q2) that they got rid of most of their EV exposure and there will be less depreciation going forward?

If this is true I think depreciations could be lower this quarter than last one (?)

€ 117 million EBT for a Q4 is extremely high for Sixt and was only once achieved in 2021 (probably due to special effects)

After all Sixt is a highly seasonal business and renting cars out in winter is not as profitable.

This means that if Sixt would report EBT at the lower range of your expectations it’s unlikely that they could reach the lower range of their FY guidance.

Given that they did not adjust guidance in the investor presentation in September their results might be better than this worst case scenario.

CFO Weinberger said in Q2 2024 that the percentage of risk EVs in the electric fleet hadn’t changed sequentially.

Yes, EBT in Q3 should be much better than in Q4, but it’s hard to make sense of it under the current circumstances. For instance, depreciation and amortization as a % of total revenue was 15% and 26% in Q4 2021 and Q4 2022, respectively. Sixt reported an EBT of €52 million in Q4 2022. If depreciation and amortization as a % of total revenue had stayed at 15%, EBT in Q4 2022 could have been €143 million (52 million +(26% of 871-15% of 871)). But yeah, probability of reaching the lower range of their 2024 EBT guidance by reporting €187 million in EBT in Q3 will require a significant outperformance in Q4. Considering this and the September presentation, I agree with you that this is the worst case scenario.

Yeah Q3 is the holiday summer quarter in which Sixt usually earns half of its yearly income.

Just looking at the “Main Summary” tab of the Sixt sheet it appears to me that they never made more than €50 million in Q4 (except 2021) and a very low depreciation expense looks unlikely.

Maybe we should actually not only predict & model Q3 in sheets but also Q4 esp. in a case like this in which we are unsure if Sixt could hit its annual goals.

Being able to predict that a company is likely going to miss its yearly guidance would be quite cool.

I would say that’s a medium priority topic if you still have time before earnings on Tuesday. (Given that I will likely not adjust my position but want to make experiences first if our predictions can indeed help to spot underperformance of a company at our current sophistication level)

Sixt tops analysts estimate for revenue but missed EBT estimate, management now guiding the lower end of its previous 2024 EBT estimate

- Sixt Q3 2024 revenue rose 10% y/y to €1,242.3 million, topping analysts estimate of €1,226 million, EBT of €246.4 million was below analysts estimate of €254.9 while EPS €3.83 was slightly lower than analysts estimate of €3.86.

- Sixt depreciation of rental vehicles in North America fell significantly. Depreciation of rental vehicles as a percentage of revenue in the region fell to 17.2% in Q3 from 30.5% in Q2.

- However, management now expects full year guidance to come in at the lower end of its previous guidance of €340 to €390 million (analysts estimate: €355 million) due to continued expectations of a substantial impact on EBT by declining residual values.

- Due to favorable purchasing conditions, Sixt increased the percentage of non-risk vehicles in Europe to 98% from 87% in Q2.

- Sixt preference shares fell 7.5% following the report.

Curious what analysts are going to say about it. My first impression based on your summary is that results are not that bad and it’s not that clear to me why the stock is down so much.

Yeah, the results are much better than I expected. Maybe the market is reacting to the lowered full-year EBT guidance. The reduced guidance for the second time could imply that management doesn’t have full visibility over how EBT will develop.

Here are the analysts’ opinions regarding the Q3 2024 results:

- Buy, €120: Analyst Constantin Hesse of Jefferies said Sixt presented solid figures for Q3 as expected. However, it narrowed its target range for 2024 EBT guidance.

- Buy, €90: Analyst Christian Obst of Baader Bank said Sixt presented record-high sales. However, the EBT was somewhat below expectations.

- Buy, €135: Analyst Marc-Rene Tonn of Warburg Research said Sixt reported strong sales growth but the higher residual value losses weighed down on the stock.

Can you start to build the expected Q4 range in the valuation model? (Q4 2024L and Q4 2024H)

This would give us an impression how the quarter has to be so that FY EBT would reach the lower end of the previous guidance.

Method

I think starting to build expectations for the upcoming quarter right after finishing with more pressing earning topics is usually a good workflow.

The high and low ranges of the previous quarters can then be hidden in the model so that we can access them for reference and to see how good our estimates have been without them convoluting the view of the model overall.