Q3 2024 Used Car Pricing Update

As of Q3 2024, I still expect a more stable pricing environment for used car prices in the next two years at least, in both US and Europe, these are some of my reasons:

- There will be a shortage of used vehicles, particularly younger, high-quality models, due to the underproduction of new cars 2-3 years ago.

- The number of returned leased vehicles will significantly decrease between the end of 2024 and 2026.

- The average age of used cars on the market is increasing, which places additional pressure on the availability of younger, low-mileage vehicles.

- Negative equity is rising among consumers, particularly those who purchased cars at a premium 2-3 years ago. This limits their ability to trade in their vehicles, further constraining the supply of younger used cars.

- Given the high price of new vehicles and consumer affordability issues, more buyers may opt for used cars instead of new ones.

- Given that prices remain elevated compared to 2019 levels, interest rates are higher, and consumer strength has weakened since 2021/2022, I don’t anticipate that the undersupply will lead to further significant price increases, but rather to a more balanced and stable market environment

The main risks to my expectations are:

- A much sharper-than-expected economic downturn could impair consumers’ ability to purchase both new and used vehicles

- A higher-than-expected default rate and repo rates could increase supply more than expected, pressuring prices down.

- Geopolitical issues significantly impacting supply chains again.

USA Q3 report

Cox report notes:

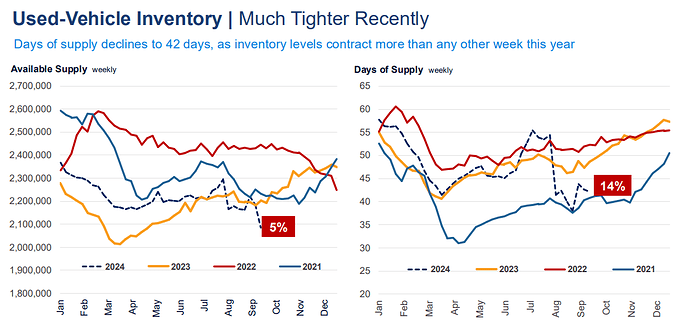

- Undersupply of used inventory will continue due to a decline in off-lease maturities, which will keep prices more stable

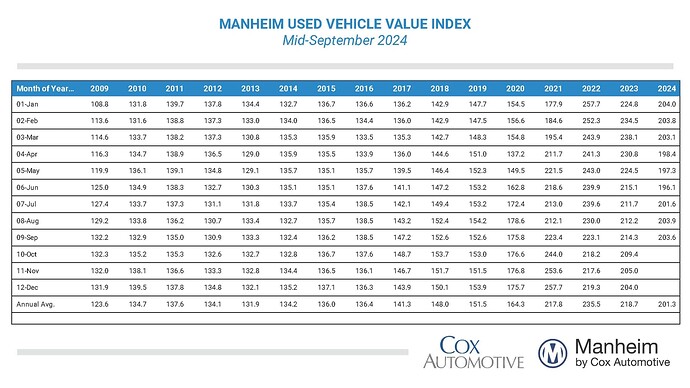

- Used inventory down 5% Y/Y, and used days supply inventory at 42 days, very low at 2021 levels (-14% Y/Y)

- Cox is forecasting now only a -0.6% Y/Y for 2024 since Q3 2023 saw more stability in pricing, they probably expect some for upside in the reminder of the year.

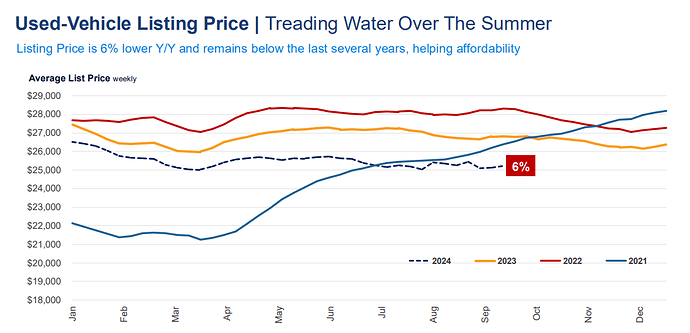

- Prices have increased since June 2023, and the pace of decline Y/Y is softening

- Used sales still 3% YTD

Europe Q3 report

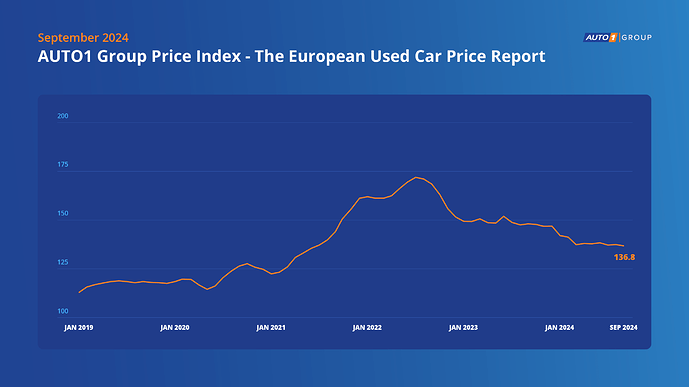

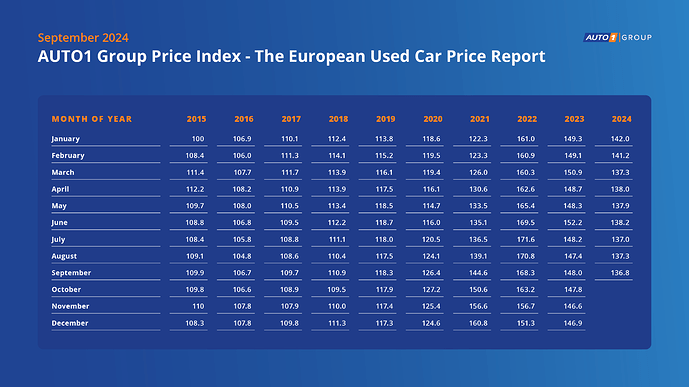

According to AUTO1, European used car prices have been stabilizing since march 2024.

- Year-to-date, the index has decreased from 142.0 in January to 136.8 in September, reflecting a 3.7 % decline.

- On a year-over-year basis, used car prices have dropped by 7.6 % from September 2023 to September this year.

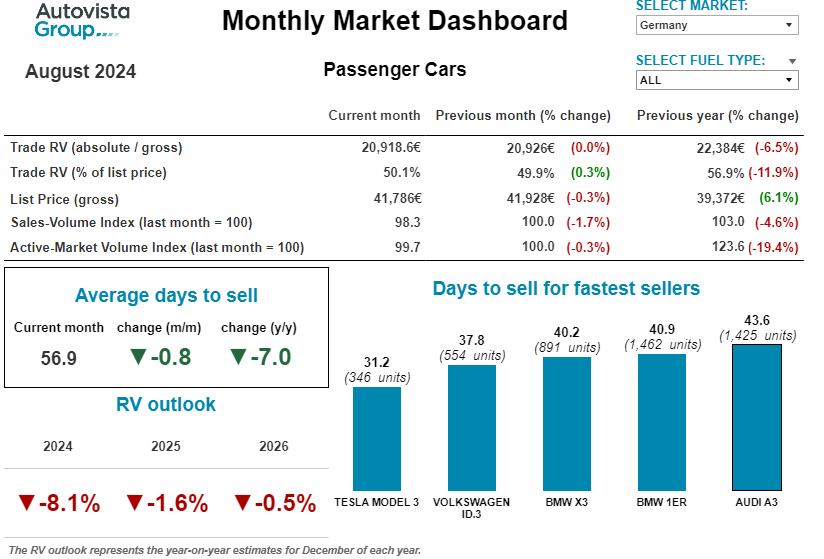

Autovista Group, sees a more stable environment for residual values in 2024 and 2025

- Germany’s Sales index dropped by 1.7% month on month and 4.6% year on year.

- Active market volume index of two-to-four-year-old passenger cars decreased by 0.3% compared to July. However, this means that the supply volume of passenger cars in this age bracket dropped by 19.4% compared to the previous year.

‘Despite weaker demand, the average RV of a 36-month-old car remained rather stable. On average, models had a %RV of 50.1%. This equated to a marginal month-on-month increase of 0.2pp, but a considerable decline of 6.8pp year-on-year, showing that pressure on RVs is increasing,’ said Madas.

‘As demand weakens and supply persists, RVs can be expected to come under even more pressure. This year, %RVs are expected to fall further, dropping by 8.1% when compared with December 2023. In 2025 and 2026, %RVs are expected to experience a marginal decrease,’ he forecast.