Yes, it played kind of expected, 50 bps cuts but the new projections showed fewer rate cuts than the markets were expecting.

I think the FED should have cut in July (is not like signs of labor market weakness were not present back then, they just chose to ignore it) to avoid making this big move, there were a lot of questions and skepticism about why if the economy is strong, they had to cut by 50 bps.

Powell just responded repeatedly, this is think a recalibration of the FED policy, and they seem to still be betting heavily on a soft landing. They projections show exactly this.

I don’t buy they are not concerned, I think they are just saying this to not send a warning signal, but the shift from the July meeting and June projections is significant, just after the labor market started to show more signs of weakness.

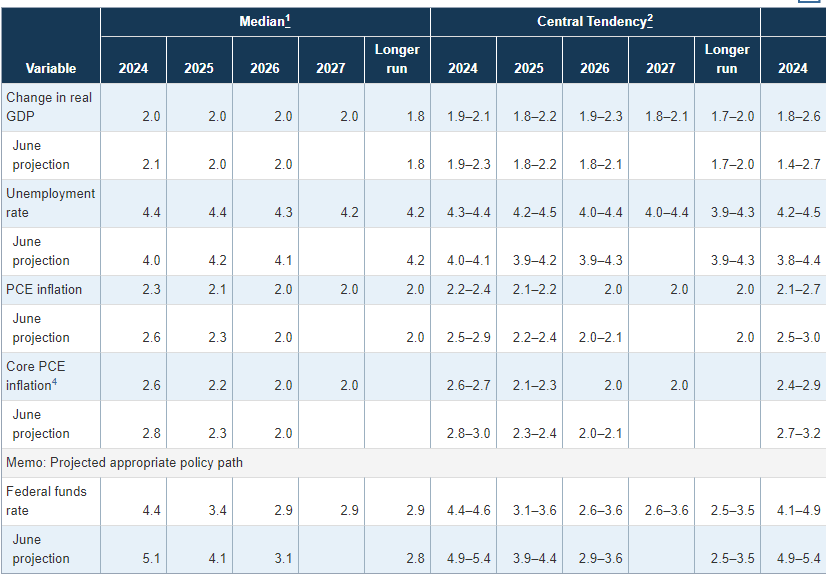

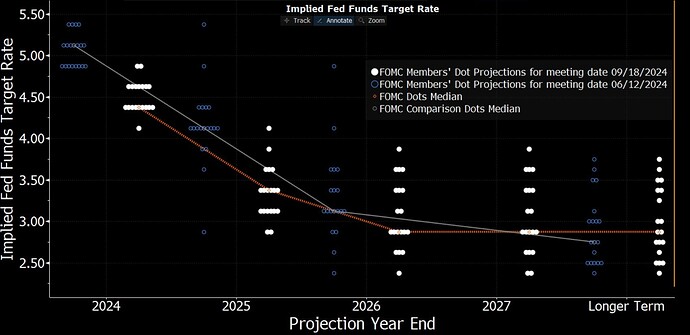

The new dot plot is showing a lot of dispersion of expectation, and the long-term rate continues to increase, but very slowly.

Some notes I took:

- Labor market reports, the Beige Book, and data revisions had weight in the decision to cut rates by 50 bps. However, this is more of a recalibration toward a neutral policy level, as the economy remains solid.

- The 50 bps hike is not a new pace for future rate cuts

- Projections are just assessments of the Committee’s current outlook and do not reflect a set policy path.

- The neutral rate level remains uncertain and will depend on how the economy evolves as easing continues. Powell believes the neutral rate is likely higher now than it was in the past.

- While the labor market is less tight than it was pre-pandemic, it remains in a strong position. Today’s decision aims to maintain this strength, with future moves being data-dependent and decided on a meeting-by-meeting basis.

- Powell emphasized that the Committee doesn’t believe it is behind the curve; this move is a commitment to prevent labor market weakness.

- Bank reserves remain abundant, so there are no plans to stop the runoff of the balance sheet.

- The Fed isn’t declaring victory on inflation yet, but they have more confidence in the progress achieved so far.

- The challenges in the housing market are largely supply-side issues, which are beyond the Fed’s control.