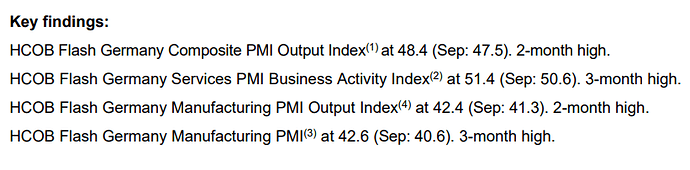

Germany economy without any clear signs of sustained recovery, while the pace of contraction has slowed in October, output and employment continue to post very weak trends.

- Manufacturing still being the big drag on the economy, while the services sector continues to growth.

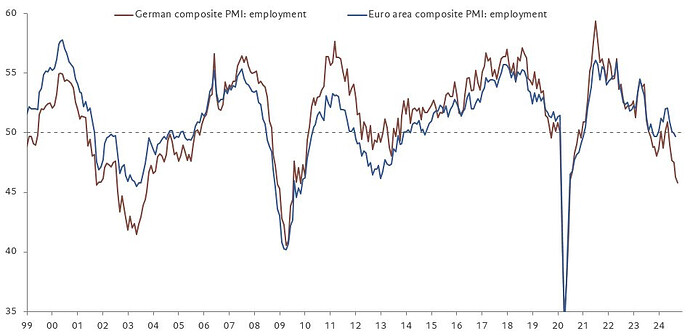

- Firms reduced staffing for the fifth consecutive month, with the fastest decline in employment since June 2020. Manufacturing job cuts were significant, while the service sector saw a slight increase in job losses.

- Average prices charged by German businesses were broadly unchanged in October. Whilst services output prices continued to rise, the rate of increase slowed to the weakest for three-and-a-half years

"The start to the fourth quarter is better than expected. With services growing at a faster pace and manufacturing shrinking not as quickly as in the previous month, growth in the fourth quarter is a distinctive possibility. Even so, GDP may stay flat for the whole year as forecasted by the International Monetary Fund in its latest projection, after a 0.3% decline in 2023. This underscores the structural weaknesses of the German economy, such as high energy costs, the increased competition from China and the labour market shortages which are all hitting the manufacturing sector hard.

“The survey figures deliver tentative signs that we may start to see light at the end of the tunnel in manufacturing. To be sure, output is still shrinking quickly and so is employment. However, the speed of deterioration has slowed down a bit compared to September. Most importantly, new orders, which fell like a stone over the last couple of months, have lost a bit of their downward dynamic. Manufacturing will most probably continue to be in a recession in the fourth quarter, but it may start the next year on a better footing, although this assessment based on a one-month improvement should be taken with caution."

https://www.pmi.spglobal.com/Public/Home/PressRelease/ad72318b927646f8b20f2ce44508c943