This topic discusses the upcoming Q1 2025 Meta Platforms earnings. It will include our final assessment and decision before the earnings release. We will also summarize the results here. You can find our earnings preparation and full summary of the results in the Wiki:

@Aron I wonder how large the fx tailwind for Meta due to the weaker dollar will be for their Q2 2025 outlook. Are you able to estimate that using their financial reports and insights how much of their fx exposure is hedged vs unhedged? (Or also other sources, analysts estimates, ai etc.)

I tried to compute it here. I arrived at foreign exchange (FX) tailwind of between 1.5% to 2.0% (revenue addition of $586-$781 million). Meta does not disclose revenue by individual country within Asia Pacific (aside from China) or Rest of World, so my estimates rely on third-party sources and GPT-4o Deep Research projections of ad revenue share by country. As a result, I would not rate my confidence in this estimate as high—I’d place it around 60%. Bofa estimates FX tailwind for the full year to be in the range of 2%-3%.

Meta does not hedge against FX fluctuations.

“At this time, we have not entered into, but in the future we may enter into, derivatives or other financial instruments in an attempt to hedge our foreign currency exchange risk,” Meta stated in its 2024 annual report, page 80.

Tinuti Digital Ads Benchmark report signals Meta’s Q1 2025 revenue could grow at 14%-15%

- Ad spent growth on Meta Platforms by Tinuiti advertisers decelerated from 15% y/y in Q4 2024 to 11% y/y in Q1 2025— largely due to strong comps, impression rose 6% down from 9% in Q4 while CPM grew 4% (Q4 2024: +5%)— though many advertisers saw bigger increases.

- Ad spend on Facebook rose 11% y/y in Q1, same growth witnessed in Q4 while impression and CPM were steady at +10% and +1% respectively.

- Spend on Instagram ads grew 7% y/y in Q1 (Q4 2024: +20%)— largely due to strong comps, impression declined 6% y/y (Q4 2024: +5%) while CPM rose 14% y/y (Q4 2024: +15%).

- The share of Advantage+ shopping campaigns’ (ASCs) rose to 38% in Q1 2025, up from 24% a year prior despite some advertisers getting frustrated with it in some circumstances.

- Ad spend growth on TikTok fell 11% y/y in Q1 (Q4 2024: +13%), impressions rose 27% (Q4 2024: +4%), while CPM fell 30% y/y (Q4 2024: +8%) as advertisers diversify their ad investment in other platforms due to the uncertainty surrounding TikTok in the US.

- Ad spend on Google Search rose 9% y/y in Q1 2025 (Q4 2024: +10%), click through rate (CTR) rose 4% (Q4 2024: +1%) while cost per click (CPC) was up 5% (Q4 2024: +9%).

- Temu’s share of Google shopping ad impressions fell to zero in April 14th as the Chinese retailer cut its presence in Google auctions due to the tariffs.

Assessment

Over the most recent five quarters, Meta’s reported revenue growth has outperformed Tinuiti’s Meta ad spend growth by an average of 10.96%. However, in Q4 2024, the deviation narrowed significantly to 6%, likely due to strong year-over-year comparison effects reaching their peak. Based on the Tinuiti report, which has historically been a reliable indicator of Meta’s revenue growth, Meta’s Q1 2025 revenue could grow at 14%-15%.

It’s encouraging to see Advantage+ Shopping performing well, despite earlier negative reports from some advertisers.

TikTok’s declining ad share could serve as a tailwind for Meta, especially during periods of uncertainty related to tariffs.

Alphabet tops revenue and EPS estimates, driven by strength in search advertising

-

Alphabet Q1 2025 revenue rose 12% year-over-year to $90.23 billion, topping analysts estimate of $89.23 billion while EPS came in at $2.81, above analysts estimate of $2.01- driven by strength in search advertising.

“Search saw continued strong growth, boosted by the engagement we’re seeing with features like AI Overviews, which now has 1.5 billion users per month,” CEO Sundar Pichai said.

-

Google Search & other revenue rose 9.8% year-over-year to $50.7 billion, slightly above analysts estimate of $50.4 billion, YouTube advertising revenue came in at $8.93 billion , in line with analysts estimate while cloud revenue came in at $12.23 billion, also in line with analysts estimate of $12.27 billion.

Alphabet expects changes to de minimis rules to cause a slight headwind to their ads business this year, reiterates CapEx spending guidance for 2025

-

On the earnings call, Alphabet reiterated its expectation to invest approximately $75 billion in CapEx this year.

-

CFO Anat Ashkenazi emphasized that the company plans to proceed with this investment even amid macroeconomic uncertainty, citing strong opportunities across the organization. However, she noted that Alphabet will still factor in internal and external developments when making capital allocation decisions.

-

Chief Business Officer Philipp Schindler stated it is too early to assess the full impact of tariffs, though changes to the de minimis exemption are expected to pose a small headwind to the ads business in 2025.

“With regard to Q2, we’re only a few weeks in, so it’s really too early to comment. I mean, we’re obviously not immune to the macro environment. But we wouldn’t want to speculate about potential impacts beyond noting that the changes to the de minimis exemption will obviously cause slight headwind to our Ads business in 2025, primarily from APAC-based retailers,” he said.

https://seekingalpha.com/article/4777993-alphabet-inc-goog-q1-2025-earnings-call-transcript

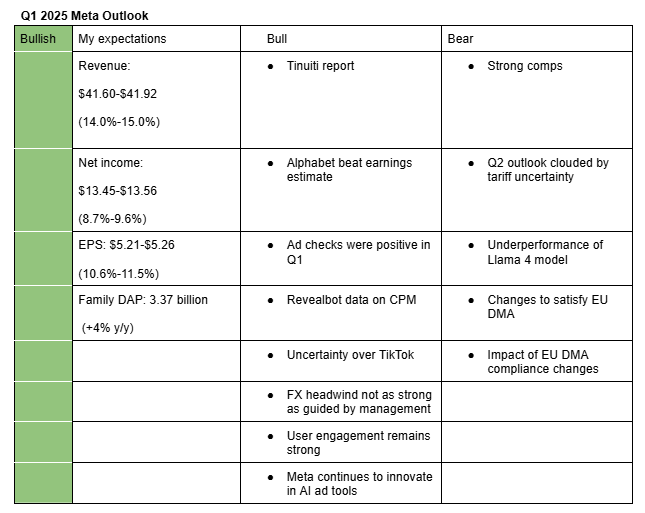

I’m positive on Meta’s Q1 2024 earnings. My estimates reflect positive ad checks, reports of growing user engagement, uncertainty surrounding TikTok, a lower-than-guided FX headwind, and the fact that the company has exceeded the upper end of its revenue guidance by an average of 1.7% in each of the past four quarters. Here is an explanation of my bullish points:

- Tinuiti report: Tinuiti’s Q1 2025 report shows that ad spend on Meta Platforms grew 11% year-over-year. Historically, Tinuiti has been a reliable indicator of Meta’s ad revenue. Based on the report, Meta’s Q1 revenue could grow in the 14%–15% range.

- FX headwind was smaller than expected: Meta guided for a 3% FX headwind in Q1, but my estimate suggests it was closer to 1%, providing a potential tailwind to revenue.

- Alphabet beat ad revenue estimates: Alphabet reported Q1 2025 advertising revenue of $66.89 billion, beating the Street’s estimate of $66.39 billion. This is a positive read-through for Meta’s ad performance.

- TikTok uncertainty benefits Meta: The ongoing uncertainty over a potential TikTok ban continues to be a tailwind for Meta. Tinuiti reported that ad spend by its advertisers on TikTok fell 11% y/y in Q1, as advertisers diversified toward other platforms. A separate Sensor Tower report found that 8 of the 10 largest advertiser categories reduced spending on TikTok in Q1 2025 compared to Q1 2024. Most of this budget shift reportedly went to Meta.

- Ad checks were strong: Multiple firms, including Piper Sandler, Evercore, and Needham, reported positive Q1 ad checks for Meta. Supporting this, Revealbot data shows Instagram CPM rose 34.5% y/y to $13.40 while Facebook CPM rose 47.2% y/y to $13.25.

- User engagement remains strong: According to Guggenheim, citing Apptopia data, Facebook user time grew 9.3% y/y (vs. 6.5% in Q4) while Instagram user time grew 5.9% y/y, rebounding from a 1.0% decline

- Meta continues to innovate in AI ad tools: Meta recently detailed its AI tools and techniques such as GEM and Andromeda that are helping drive advertiser performance.

My bearish arguments center on:

-

Q2 outlook may be clouded by tariff uncertainty: Based on analysts’ commentary, Q2 is shaping up to be highly uncertain. Notably, top Chinese retailers in the U.S.—Temu (which reportedly spent $2 billion on Meta ads in 2023) and Shein—have already cut their ad spend in April due to changes in de minimis rules and the implementation of a 145% tariff on Chinese goods.

While an FX tailwind of 1.5%–2.0% (my estimate) in Q2 (equivalent to a revenue uplift of $586–$781 million) could partially offset lost spend from these retailers, the broader impact of tariffs on SMBs and other Chinese advertisers is harder to quantify. This increases the risk that Meta’s Q2 guidance could come in below Street expectations.

As such, my revenue estimate for Q2 2025 is in the range of $42.59 billion to $43.76 billion (+9% to +12%) versus Street’s consensus estimate of $44.05 billion (+12.75%). I assign a higher probability (around 60%) to the lower end of that range.

-

Strong year-over-year comps: Q1 2024 was a strong quarter for Meta, with 27% revenue growth, which creates some risk to Q1 2025 estimates.

-

Underperformance of Llama 4 models: Following the release of Llama 4 models earlier this month which flopped, investors will be looking to management to justify their high CapEx investment. Market will potentially be looking for positive news on the AI agents and their bigger Llama 4 model, the Behemoth. Without these justifications, investors might find Meta shares less compelling under the current uncertainty.

-

Impact of EU DMA compliance changes: At the end of 2024, Meta rolled out a less-personalized free tier and reduced its ad-free subscription price by €4 in response to the Digital Markets Act (DMA). While Meta stated it expects most users to continue with the ad-supported model, Q1 2025 will be the first full quarter to reflect these changes. I believe the revenue impact will be modest, but there remains uncertainty until the actual user behavior data is released.

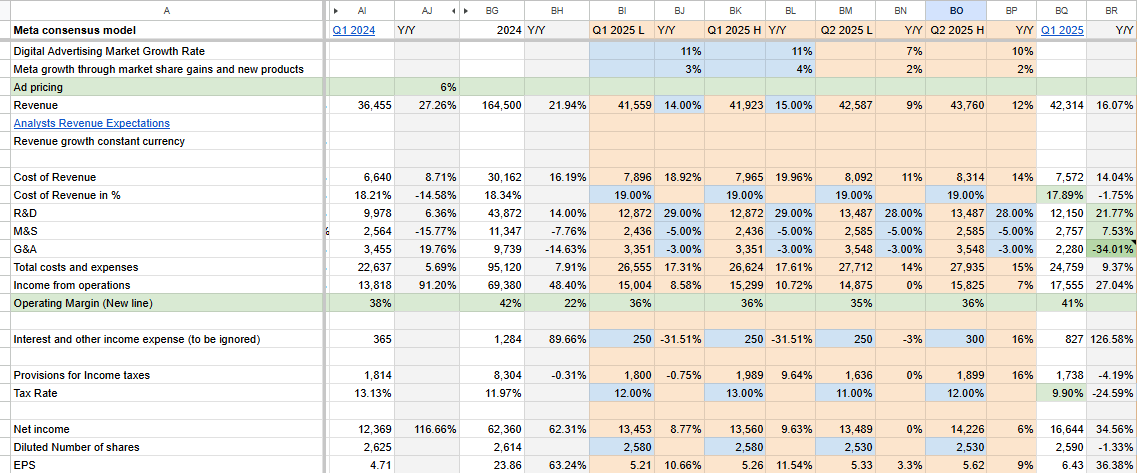

Here are management’s and analysts’ expectations for Q1 2025;

Management Guidance for Q1 (Revenue): $39.5-$41.8 billion (+8.4% to +14.7%)

Analysts’ Estimate for Q1 (Revenue): $41.37 billion (+13.5%)

Analysts’ Estimate for Q1 (EPS): $5.23 (+11.0%)

Recommendation

Given Meta’s continued market share gains, the strength of its advertising tools, the potential for a sharp rebound once macro uncertainty subsides, and the limited likelihood of a breakup in the FTC case, I reiterate a Hold rating on the stock.

Cool, good overview.

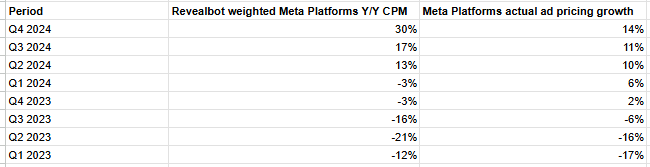

Do you have any take how much of a signal reveal bots CPM numbers have been in the past? Those y/y changes look crazy.

Yes, Revealbot’s data has sometimes been significantly higher than the actual figures. I only use it to track trends in ad pricing. Here is a comparison between Revealbot’s CPM year-over-year growth and Meta’s reported ad pricing year-over-year growth.

Snap shares shed more than 12% after it declined to provide Q2 guidance, citing macro uncertainty

- Snap Q1 2025 revenue rose 14% y/y to $1.36 billion, in line with analysts estimate of $1.35 billion.

- Global daily active users came in at 460 million, above 459 million estimate.

- Snap shares shed 12%+ after the company failed to issue guidance for Q2, citing macro uncertainty.

Just a small feedback: I think headlines should focus always on the most important insights so that if someone only reads the headline they get the big picture. I think a very tiny beat like in this case should not be the first part of the headline at least and it is even questionable if we should call it a beat or in line with expectations.

Meta Q1 beats across the board; raises CapEx outlook, and flags DMA risk for Q3

-

Meta Q1 2025 revenue rose 16% y/y to $42.31 billion, above management’s upper guidance of $41.8 billion and analysts estimate of $41.37 billion, EPS came in at $6.43 versus analysts estimate of $5.23 while operating margin of 41% exceeded analysts estimate of 38%.

-

Family daily active people (DAP) rose 6% y/y to 3.43 billion, above analysts estimate of 3.38 billion, ad impressions grew 5% y/y (analysts estimate: 7%), while average price per ad increased 10% y/y (analysts estimate: +7%).

-

Meta’s capital expenditures during the quarter was $13.69 billion, below analysts estimate of $14.32 billion.

-

Meta is guiding Q2 2025 revenue in the range of $42.5-45.5 billion billion (analysts estimate: $44.05 billion)-which assumes FX tailwind of 1%, 2025 total expenses in the range of $113-118 billion (lowered from $114-119 billion) and CapEx in the range of $64-72 billion (increased from $60-65 billion).

-

Meta flagged the rising risk from EU’s DMA, pointing out that it could significantly impact its business as early as Q3.

“Based on feedback from the EC in connection with the DMA, we expect we will need to make some modifications to our model, which could result in a materially worse user experience for European users and a significant impact to our European business and revenue as early as the third quarter of 2025. We will appeal the EC’s DMA decision but any modifications to our model may be imposed before or during the appeal process,” Meta said in the press release.

Giving that the EPS was so much higher than expected let’s drill down into the details here.

What is the valuation model saying you what caused that? Any surprises, one off factors or additional insights here?

Note: Looking into this after earnings and highlighting anything that stands out is always a good work-flow but esp. in cases like this when there is a large beat or miss.

Always comparing our projections with actuals is also important to deepen our understanding and refine projections in the future.

No, there were no special effects. The main drivers of EPS were likely the G&A which fell 34% y/y (or around $1.2 billion) due to reduced legal-related costs and revenue which was about $1 billion higher than consensus estimate. R&D was probably another thing as it rose 22% y/y versus my expectations for it to increase by 28%.

The screenshot below shows how the actuals deviated from my estimates.

FX headwind was $1.2 billion (or 3%) during the quarter. Excluding this, Meta’s revenue could have grown 19% y/y to $43.5 billion. I had projected FX headwind of 1%.

Great thanks. I think the next steps should then be to immediately update all our projections based on those new insights.

It goes without saying that this very important processes should always be done immediately to ensure that our models are as accurate as possible.

Probably also worth it to discuss major updates and changes here in the forum maybe directly within this topic and mentioned in the valuation model topic as well

Here are the main takeaways from Meta’s Q1 2024 earnings call as well as my assessment;

-

CEO Mark Zuckerberg said he thinks they are well-positioned to navigate the macro uncertainty.

-

CFO Susan Li said there is macro uncertainty and that the $3 billion in the guidance range aims to factor it in. She added that they have started ad spend in US pullback from China-based advertisers.

“We have seen some reduced spend in the US from Asia-based e-commerce exporters, which we believe is in anticipation of the de minimis exemption going away on May 2nd. A portion of that spend has been redirected to other markets, but overall spend for those advertisers is below the levels prior to April. But our Q2 outlook reflects the trends we’re seeing so far in April, which have generally been healthy. So it’s very early and hard to know how things will play out over the quarter, and certainly harder to know that for the rest of the year.”

-

Li said even with the capacity they are bringing in 2025, they are having a hard time meeting the compute demands across the company. She added that CapEx situation is dynamic and they continue to find a lot of good use cases to put capacity towards their AI ranking and recommendations work.

-

Zuckerberg said that in building Llama 4, they focus on low latency and context window, which are important in Meta AI voice conversation and personalization efforts respectively.

-

Zuckerberg said in the last six months, improvements in the ads recommendations have led to a 7% increase in time spent on Facebook, a 6% increase on Instagram, and 35% on Threads.

Assessment of the earnings and their AI strategy

Meta’s Q2 2025 revenue guidance ranges from $42.5 billion (+9% y/y) to $45.5 billion (+16% y/y). The lower end is in line with my own conservative estimate and remains a realistic target given the current macro uncertainty. However, the fact that Meta is confident enough to guide to the top end of that range underscores the resilience they are seeing in their ad business.

Based on management’s comments, compute capacity remains scarce. With five months of the year already behind us, and given Meta’s continued emphasis on improving ad recommendations and Llama models, I would not be surprised to see 2026 become another year of heavy CapEx investment. That said, the ROI Meta is achieving—particularly through enhanced ad targeting and conversion efficiency, may justify this level of spend.

Zuckerberg’s remarks in the earning call and in his interview with Dwarkesh Patel have strengthened my confidence in the company’s AI strategy and execution. His statement that Llama models are being designed specifically for Meta’s products reduces the relevance of comparing Llama to peer models based on generalized benchmarks. Instead, the focus should shift to real-world metrics like latency and context window, which are relevant to Meta AI personalization strategy.

I was starting to doubt Meta’s credibility following reports that Llama was optimized for leaderboard performance on LmArena. However, Zuckerberg’s clarification suggests that these optimizations are intentional and aligned with how the models will ultimately be deployed in Meta AI products. While this may limit their utility for third-party developers, it does not diminish their value within Meta’s own ecosystem. The recent launch of the Llama API should help address some of the performance and optimization gaps experienced by developers in third-party ecosystems.

Importantly, third-party validation has also helped. Artificial Analysis independently replicated Meta’s published results and concluded that the Llama 4 Scout and Maverick models are indeed among the best in their respective classes.

A post was merged into an existing topic: Meta Platforms Valuation Model

Analysts remain bullish on Meta after the earnings

-

Mark Mahaney of Evercore said Meta is proving it can get ROI on ad spend.

-

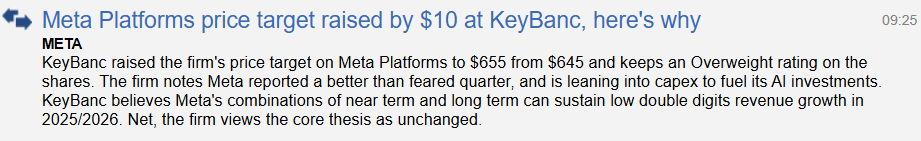

Overweight, $645->$655: Keybanc believes Meta’s combinations of short-term and long-term can sustain low double digits revenue growth in 2025 and 2026.

-

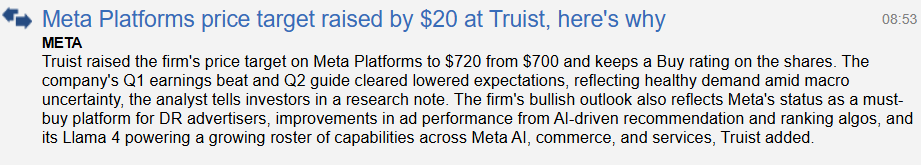

Buy, $700->$720: Truist said Meta’s guide for Q2 cleared lowered expectations, indicating healthy demand in light of macro uncertainty.

-

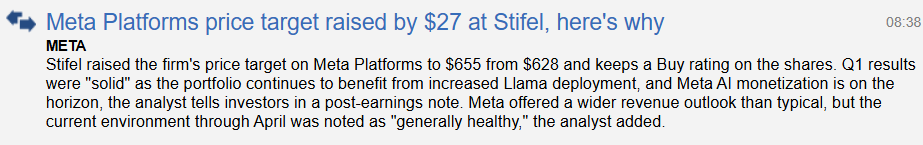

Stifel, $628->$655: Stifel said Meta continues to benefit from increased Llama deployment. It added that Meta provided a wide revenue guidance than typical.

-

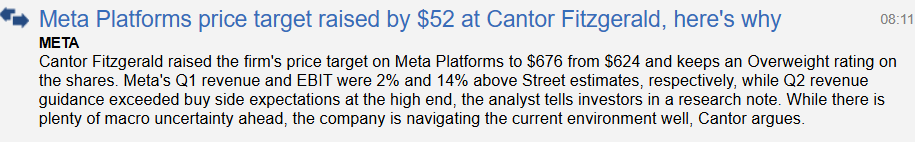

Overweight, $624->$676: Cantor Fitzgerald said Meta is navigating the current macro uncertainty well.

-

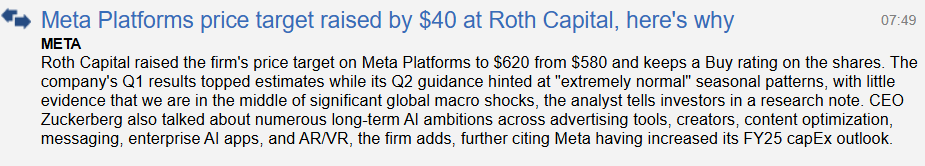

Buy, $580->$620: Roth Capital pointed out that Meta’s Q2 guidance provided little evidence that we are in the middle of significant global macro shocks.

-

Overweight, $615->$650: Morgan Stanley said Meta’s quarterly report demonstrated how its innovation is driving durable engagement and revenue growth.

-

Overweight, $610->$675: JPMorgan said Meta provided clarity on its AI roadmap. It continues to believe Meta is well positioned to navigate macro uncertainty due to its scaled advertiser base, highly performant platform and “vertical agnostic” inventory.

-

Overweight, $640->$705: Barclays said Meta’s resilience is not something to worry about.