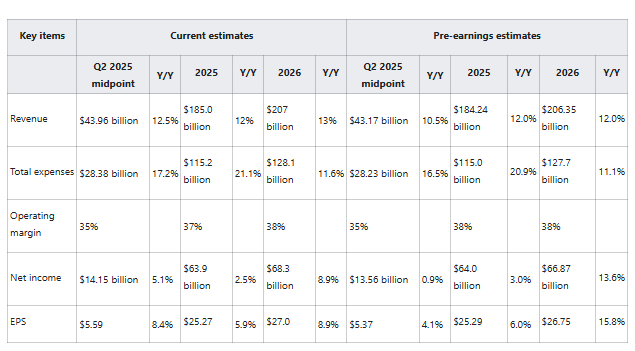

I have increased my Q2 2025 revenue estimate by approximately $1 billion, following Zuckerberg’s comments that Meta’s business is likely to remain resilient despite macro uncertainty. My new estimate now aligns with the midpoint of management’s revenue guidance. However, since Meta has historically exceeded the upper end of guidance, this still reflects a cautious stance on my part for Q2.

I have kept my full-year 2025 total expenses estimate largely unchanged at $115 billion, in line with the midpoint of Meta’s guidance range ($113–118 billion). Management’s decision to lower its Q2 OpEx guidance signals that spending may not reach the top end of the range. Notably, Meta’s OpEx came in $4 billion below the top end of its guidance in 2024, and $2 billion below in 2023, based on initial guidance from Q1 in both years.

I have also increased my 2026 revenue estimate by roughly $1 billion, primarily due to easier comps in 2025.

The projections are based on a scenario of macroeconomic softening without a recession, and they do not incorporate any potential effects from the DMA, which remains under evaluation.