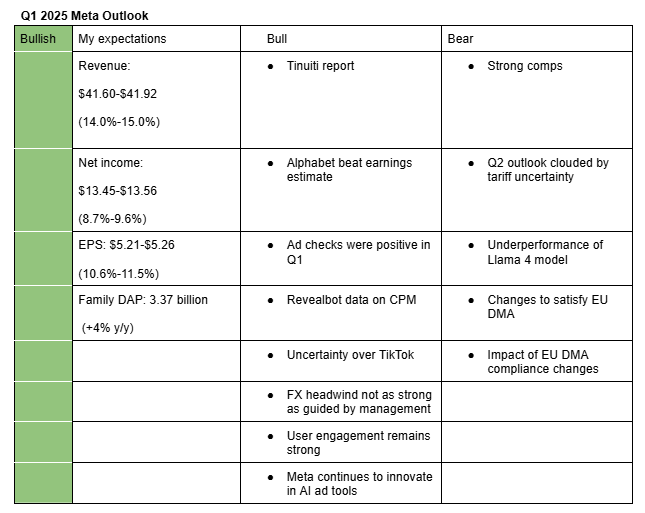

I’m positive on Meta’s Q1 2024 earnings. My estimates reflect positive ad checks, reports of growing user engagement, uncertainty surrounding TikTok, a lower-than-guided FX headwind, and the fact that the company has exceeded the upper end of its revenue guidance by an average of 1.7% in each of the past four quarters. Here is an explanation of my bullish points:

- Tinuiti report: Tinuiti’s Q1 2025 report shows that ad spend on Meta Platforms grew 11% year-over-year. Historically, Tinuiti has been a reliable indicator of Meta’s ad revenue. Based on the report, Meta’s Q1 revenue could grow in the 14%–15% range.

- FX headwind was smaller than expected: Meta guided for a 3% FX headwind in Q1, but my estimate suggests it was closer to 1%, providing a potential tailwind to revenue.

- Alphabet beat ad revenue estimates: Alphabet reported Q1 2025 advertising revenue of $66.89 billion, beating the Street’s estimate of $66.39 billion. This is a positive read-through for Meta’s ad performance.

- TikTok uncertainty benefits Meta: The ongoing uncertainty over a potential TikTok ban continues to be a tailwind for Meta. Tinuiti reported that ad spend by its advertisers on TikTok fell 11% y/y in Q1, as advertisers diversified toward other platforms. A separate Sensor Tower report found that 8 of the 10 largest advertiser categories reduced spending on TikTok in Q1 2025 compared to Q1 2024. Most of this budget shift reportedly went to Meta.

- Ad checks were strong: Multiple firms, including Piper Sandler, Evercore, and Needham, reported positive Q1 ad checks for Meta. Supporting this, Revealbot data shows Instagram CPM rose 34.5% y/y to $13.40 while Facebook CPM rose 47.2% y/y to $13.25.

- User engagement remains strong: According to Guggenheim, citing Apptopia data, Facebook user time grew 9.3% y/y (vs. 6.5% in Q4) while Instagram user time grew 5.9% y/y, rebounding from a 1.0% decline

- Meta continues to innovate in AI ad tools: Meta recently detailed its AI tools and techniques such as GEM and Andromeda that are helping drive advertiser performance.

My bearish arguments center on:

-

Q2 outlook may be clouded by tariff uncertainty: Based on analysts’ commentary, Q2 is shaping up to be highly uncertain. Notably, top Chinese retailers in the U.S.—Temu (which reportedly spent $2 billion on Meta ads in 2023) and Shein—have already cut their ad spend in April due to changes in de minimis rules and the implementation of a 145% tariff on Chinese goods.

While an FX tailwind of 1.5%–2.0% (my estimate) in Q2 (equivalent to a revenue uplift of $586–$781 million) could partially offset lost spend from these retailers, the broader impact of tariffs on SMBs and other Chinese advertisers is harder to quantify. This increases the risk that Meta’s Q2 guidance could come in below Street expectations.

As such, my revenue estimate for Q2 2025 is in the range of $42.59 billion to $43.76 billion (+9% to +12%) versus Street’s consensus estimate of $44.05 billion (+12.75%). I assign a higher probability (around 60%) to the lower end of that range.

-

Strong year-over-year comps: Q1 2024 was a strong quarter for Meta, with 27% revenue growth, which creates some risk to Q1 2025 estimates.

-

Underperformance of Llama 4 models: Following the release of Llama 4 models earlier this month which flopped, investors will be looking to management to justify their high CapEx investment. Market will potentially be looking for positive news on the AI agents and their bigger Llama 4 model, the Behemoth. Without these justifications, investors might find Meta shares less compelling under the current uncertainty.

-

Impact of EU DMA compliance changes: At the end of 2024, Meta rolled out a less-personalized free tier and reduced its ad-free subscription price by €4 in response to the Digital Markets Act (DMA). While Meta stated it expects most users to continue with the ad-supported model, Q1 2025 will be the first full quarter to reflect these changes. I believe the revenue impact will be modest, but there remains uncertainty until the actual user behavior data is released.

Here are management’s and analysts’ expectations for Q1 2025;

Management Guidance for Q1 (Revenue): $39.5-$41.8 billion (+8.4% to +14.7%)

Analysts’ Estimate for Q1 (Revenue): $41.37 billion (+13.5%)

Analysts’ Estimate for Q1 (EPS): $5.23 (+11.0%)

Recommendation

Given Meta’s continued market share gains, the strength of its advertising tools, the potential for a sharp rebound once macro uncertainty subsides, and the limited likelihood of a breakup in the FTC case, I reiterate a Hold rating on the stock.