This topic discusses Volkswagen’s Q1 2023 earnings expectations and results. The earnings results of its competitors will also be discussed here. You can find an article on the earnings in the wiki:

-

Tesla Q1 2024 revenue fell by 9% y/y to $21.30 billion (estimate: $22.15 billion)-the biggest decline since 2012, automotive revenue fell by 13% y/y to $17.38 billion while net income dropped by 55% to $1.13 billion due to a number of factors inculding a decline in pricing and a fall in deliveries as a result of model 3 update.

-

In the earnings call, Elon Musk said they will probably launch affordable EV in earlier than expected.

“We’ve updated our future vehicle lineup to accelerate the launch of new models ahead, previously mentioned startup production in the second half of 2025, so we expect it to be more like the early 2025, if not late this year. These new vehicles, including more affordable models, will use aspects of the next generation platform as well as aspects of our current platforms, and will be able to produce on the same manufacturing lines as our current vehicle lineu,” he said.

-

Tesla shares jumped 13% following those comments.

- Traton’s sales revenue rose by 5% y/y to 11.80 billion euros in Q1, beating analysts estimate of 11.23 billion euros due to better pricing and mix effects.

- Its operating return on sales rose to 9.4% from 8.4% in the previous year, exceeding analysts’ estimate of 8.6%.

- Traton maintained its guidance for 2024 which is revenue growth of -5% to +10% and operating return on sales of between 8% and 9%.

Assessment

Traton’s revenue and operating profit only accounted for 14% and 16% of the Group’S total in 2023, respectively. But it’s still good to see that it performed well in Q1.

- Porsche’s Q1 revenue fell by 10.8% y/y to 9.01 billion euros, above 8.77 billion euros LSEG estimate.

- Operating profit fell 30.3% y/y to 1.28 billion euros, in-line with estimate- due to product launches like the new Panamera and Taycan.

- Operating return on sales fell to 14.2% from 18.2% a year ago.

- Porsche is sticking to its full year revennue guidance of between 40 to 42 billion euros and operating return on sales in the range of 15% to 17%.

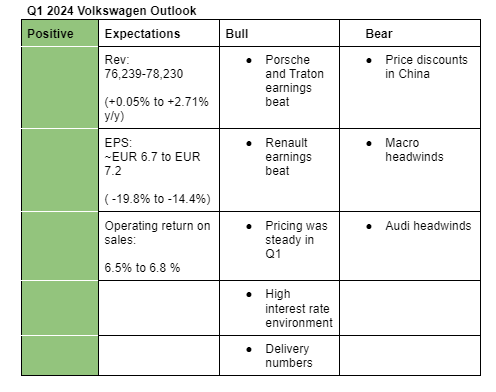

My outlook is based on a number of factors such as pricing trends, delivery numbers and earnings reports of some of its subsidiaries. For more detailed calculations see our Volkswagen model. I am bullish on Volkswagen’s Q1 2024 earnings due to the following reasons:

- Porsche and Traton reported earnings results that beat analysts’ estimates.

- Renault also topped analysts estimates aided by a 4.1 points increase in pricing.

- I expect the high interest rate environment to benefit its financial services unit. For instance, Renault said its financial unit revenue grew by 27.9% y/y to 1.25 billion euros, aided by rising interest rates and a rise in average-performing assets.

- Some analysts have seen continued strength in vehicle pricing. Volkswagen also launched some models during the period and at the end of 2023, which could contribute to better pricing.

- Volkswagen Q1 delivery numbers were in-line with management overall guidance for 2024 (+3%). The management had guided for a weaker Q1 due to supply chain delays affecting Audi and model launches.

Some of my concerns include;

- Volkswagen continues to lose market share in China due to stiff competition. As a result, it was forced to offer discounts in Q1, which would affect profitability.

- We don’t know if the headwinds which affected Audi in Q1 have been resolved. If they haven’t, they could force the management to adjust its 2024 outlook downwards hence causing the stock to drop significantly.

- Macro conditions such as the interest rates path are still uncertain though Europe is expected to cut rates soon.

N/B: Here are the analysts’ estimates:

Analysts estimates for Q1

Revenue: EUR 74.98 billion (-1.6% y/y)

Operating return on sales: 6.6%

Analysts' estimates for 2024

Revenue: EUR 326.9 billion (+1.5%)

Operating return on sales: 7%

Management outlook for 2024

Revenue: EUR 338.4 billion (+5% y/y)

Operating return on sales: 7.0%-7.5%

- Volkswagen Group Q1 2024 revenue fell by 1% y/y to 75.5 billion euros, above analysts estimate of 75.0 billion euros due to lower vehicle sales and adverse mix and exchange rate effects.

- The Volkswagen Group’s operating result fell by 20% y/y to 4.6 billion eurosc, lower-than 4.82 billion euros Factset estimate-caused by lower unit sales, unfavorable mix, high expenditures associated with new models and higher interest rate in the financial services division.

- The operating return on sales stood at 6.1%, lower than analysts’ estimate of 6.6% while net cash flow fell to -4.2 billion euros from 583 million in the previous year weighed down by reversal of exceptionally strong reduction in working capital at the end of 2023 and increase in inventories associated with the product launches in Q1.

- Volkswagen Group maintained its outlook for 2024 which includes forecast for a 3% y/y growth in deliveries, 5% y/y revenue growth and an operating result in the range of 7% to 7.5%.

- Volkswagen said its order book is currently strong at 1.1 million vehicles compared to the end of 2023.

- Audi was adversely affected by the expected supply chain issues and it ended up recording a revenue of 13.7 billion euros (-18.7%), operating result of 466 million (-74%) and operating return on sales of 3.4%.

In the earnings call;

- Volkswagen said they are in the process of fixing the supply chain situation at Audi and they expect performance to improve in Q2, with significant margin improvement in Q3 henceforth.

- They expect financial performance to improve in Q2 with margin expected to come in-line with the 2024 outlook, though they warned that the 900 million euros severance cost that will be booked in Q2 will lead to a burden in that respect.

- Overall, they expect the second half to be so strong that it compensates for the weakness in Q1 and possible slight miss in Q2, helped by volume improvements at Audi, new model launches, strong order book, improvements in material costs and benefits from core brand efficiencies.

Assessment of the earnings

Though its Q1 2024 results missed my estimates, Volkswagen reiterated a number of positives given in the previous earnings. However, the introduction of the 900 million severance cost makes the full-year guidance less certain compared to some months ago. Also, I don’t like that a large position of the good performance is pegged to the second half. In my opinion, a lot can happen between now and then.

- Sell, €100: Analyst Patrick Hummel of UBS said Volkswagen is optimistic and expect improvement in the coming quarters.

- Outperform, €140: Analyst Tom Narayan of RBC said losses from hedging transactions have been significantly lower since the start of the year than before and are likely to continue falling. He noted that Volkswagen met expectations.

- Buy, €150: Jefferies analyst Philippe Houchois said cash in flow was worse than expected.