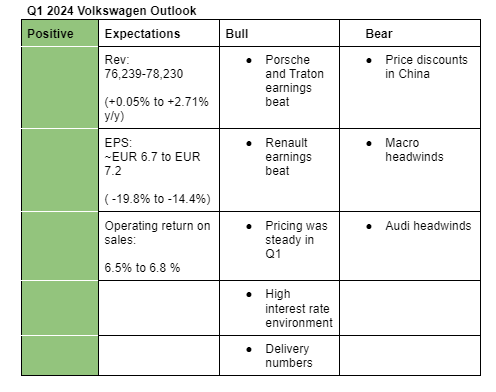

My outlook is based on a number of factors such as pricing trends, delivery numbers and earnings reports of some of its subsidiaries. For more detailed calculations see our Volkswagen model. I am bullish on Volkswagen’s Q1 2024 earnings due to the following reasons:

- Porsche and Traton reported earnings results that beat analysts’ estimates.

- Renault also topped analysts estimates aided by a 4.1 points increase in pricing.

- I expect the high interest rate environment to benefit its financial services unit. For instance, Renault said its financial unit revenue grew by 27.9% y/y to 1.25 billion euros, aided by rising interest rates and a rise in average-performing assets.

- Some analysts have seen continued strength in vehicle pricing. Volkswagen also launched some models during the period and at the end of 2023, which could contribute to better pricing.

- Volkswagen Q1 delivery numbers were in-line with management overall guidance for 2024 (+3%). The management had guided for a weaker Q1 due to supply chain delays affecting Audi and model launches.

Some of my concerns include;

- Volkswagen continues to lose market share in China due to stiff competition. As a result, it was forced to offer discounts in Q1, which would affect profitability.

- We don’t know if the headwinds which affected Audi in Q1 have been resolved. If they haven’t, they could force the management to adjust its 2024 outlook downwards hence causing the stock to drop significantly.

- Macro conditions such as the interest rates path are still uncertain though Europe is expected to cut rates soon.

N/B: Here are the analysts’ estimates:

Analysts estimates for Q1

Revenue: EUR 74.98 billion (-1.6% y/y)

Operating return on sales: 6.6%

Analysts' estimates for 2024

Revenue: EUR 326.9 billion (+1.5%)

Operating return on sales: 7%

Management outlook for 2024

Revenue: EUR 338.4 billion (+5% y/y)

Operating return on sales: 7.0%-7.5%