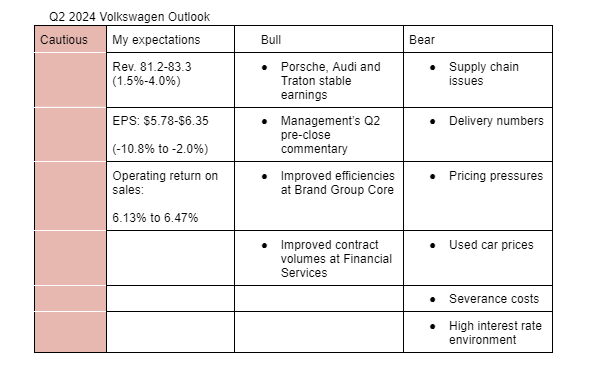

My estimates are based earnings of some of its subsidiaries, delivery numbers and pricing trends. My bullish sentiments include;

- According to analysts, management’s commentary during its Q2 pre-close conference were positive.

- I expect the measures initiated at the Brand Group Core to have further aided its performance in Q2.

- Volkswagen Financial Services will likely see improvement in the number of contract volumes in Q2 as witnessed at Renault and Mercedes-Benz.

Areas of concern include;

-

Porsche lowered its guidance for the full year due to supply chain issues. Volkswagen Group hasn’t adjusted its guidance in that respect yet and could do so while announcing its Q2 results. This could impact its share price. I forecast revenue and operating return on sales of 326.3 billion euros (+1.25%) and 6.54% in 2024 respectively.

-

Delivery numbers were weak during the quarter and there are insights that pricing pressures is growing (Renault and Mercedes-Benz felt pricing pressure during the quarter and Cox data indicates prices declined in U.S). While the subsidiaries that have reported their Q2 earnings were able to compensate for the weak sales volume by increasing prices, the Brand Group Core may not be able to do so given that it’s an economic brand.

- Used car prices continue to trend downwards in Europe and United States. That will likely affect the operating performance of Volkswagen Financial Services.

- Volkswagen Group expects to book a severance cost of 900 million euros in Q2. This will impact its operating result during the quarter.

- We are still at a high interest rate environment. As such, Volkswagen Financial Services could book a high interest rate expense in Q2 as witnessed in Q1.

N/B: Here are the analysts estimates and management guidance for 2024:

Analysts estimates for Q2

Revenue: EUR 82.9 billion (+3.56% y/y)

Operating return on sales: 6.1%

Analysts' estimates for 2024

Revenue: EUR 326.3 billion (+1.23%)

Operating return on sales: 6.6%

Management outlook for 2024

Revenue: EUR 338.4 billion (+5% y/y)

Operating return on sales: 6.5%-7.0%