Discussion about Germany’s economic development.

Short summary of Germany’s recent economic history and three reasons why Germany is currently falling behind.

- Loss of cheap gas from Russia

- Slowing economy esp. in China

- More protectionism in the United States

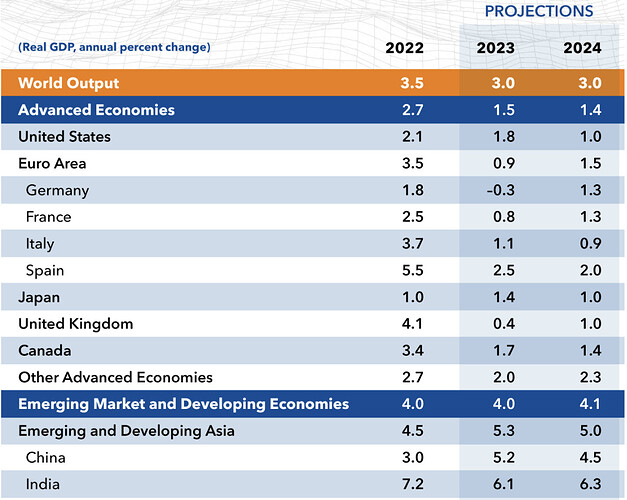

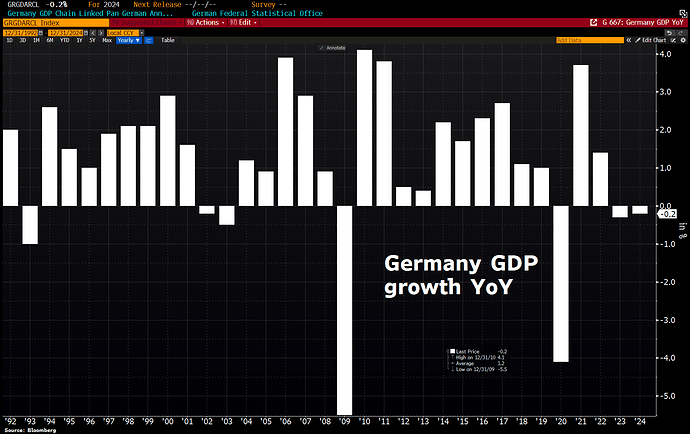

The IMF projects Germans economy to contract by 0.3% in 2023 and grow 1.3% in 2024.

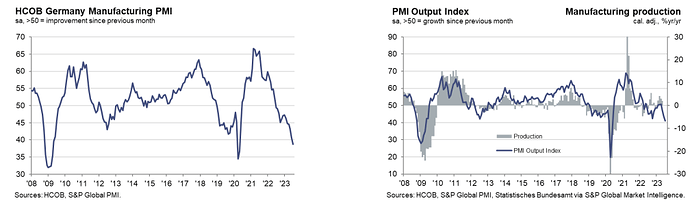

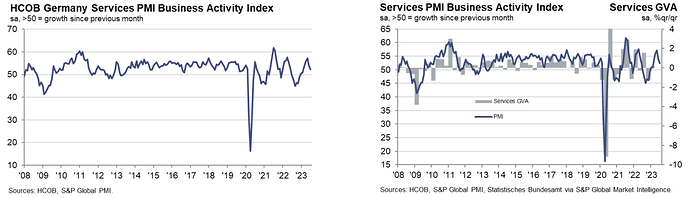

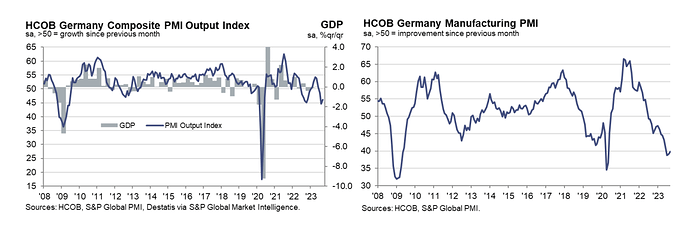

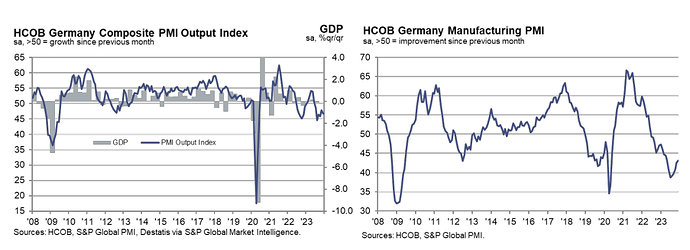

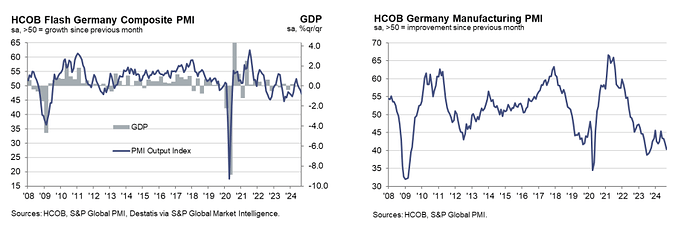

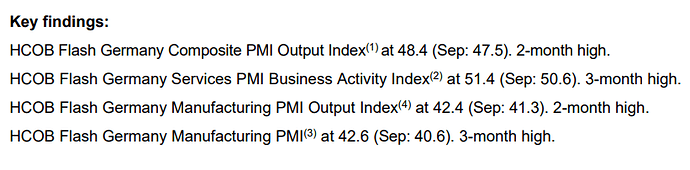

German weakness can clearly be seen in its PMI figures too, especially manufacturing, while services ,which are lagging usually and less volatile, are starting to show cracks too, but growing still.

- Business conditions continued to worsen across Germany’s manufacturing sector at the start of the third quarter with goods producers recording deepening declines in output, new orders and factory gate prices. Amid rapidly shrinking backlogs of work, expectations towards future production were at their lowest for eight months and there was a fall in employment for the first time in two-and-a-half years.

These are ugly figures. The fall in demand for German manufactured goods, as measured by the survey’s new orders index, is one of the most pronounced over roughly the last 30 years. We’re also seeing substantial cuts to both stocks of purchases and output. This is evidence of the destocking cycle being in full swing, which is typical in times of recession. Having said this, it also lays the ground for a rebound next year should firms start to rebuild stocks again.

The risks for the German economy as a whole running into trouble during the second half of the year have clearly increased.

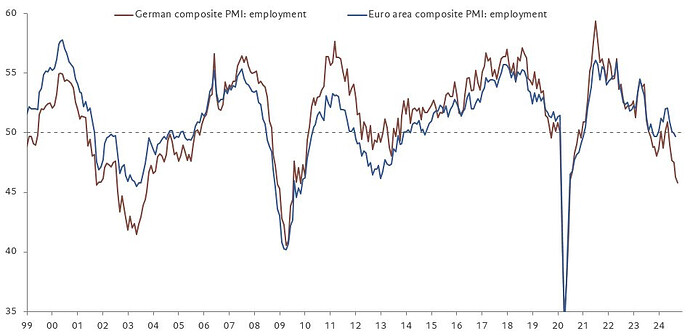

The robustness of the labour market is somewhat put into question by the latest PMI figures as the manufacturing employment index fell close to but below 50 for the first time since 2021. The weakness is led by the intermediate goods sector, where the pace of job cutting has increased to the quickest for almost three years.

- The German service sector saw a further loss of momentum at the start of the third quarter as business activity growth slowed notably for a second straight month.The slowdown stemmed from a drop in demand, with inflows of new business falling for the first time in six months. Business expectations meanwhile deteriorated, which in turn contributed to a marked slowdown in job creation

"There is some fear among services companies that employees might be twiddling their thumbs soon, as incoming business deteriorated considerably in July. This corresponds to a plunge in new export business and a drop in backlogs of work. Firms have reacted by hiring new staff at a much slower pace than they did in previous months. We expect employment growth to come to a halt over the next few months, though companies will stop short of axing jobs on a great scale.

Currently, activity in the service sector is still benefitting from the good dynamics of the first half of the year. However, growth is clearly petering out on the back of recessionary trends in the manufacturing sector. The risk of the whole economy falling into a recession in the second half of the year has clearly increased. Optimism is dwindling fast, with services companies no longer expecting activity to be higher in twelve months from now

More weakness coming from Germany in August Flash PMI. Citing a significant reduction in new orders, and backlogs.

- HCOB Flash Germany Composite PMI Output Index at 44.7 (July: 48.5). 39-month low.

- HCOB Flash Germany Services PMI Business Activity Index at 47.3 (July: 52.3). 9-month low.

- HCOB Flash Germany Manufacturing PMI Output Index at 39.7 (July: 41.0). 39-month low.

- HCOB Flash Germany Manufacturing PMI at 39.1 (July: 38.8). 2-month high.

“Any hope that the service sector might rescue the German economy has evaporated. Instead, the service sector is about to join the recession in manufacturing, which looks to have started in the second quarter. Our GDP nowcast model, which incorporates the PMI flash estimate, now indicates a deeper fall of the whole economy than it did before, at almost -1%.

Stagflation is an ugly thing. However, it’s exactly what is happening to the services economy, as activity has started to shrink while prices have shot up again, even picking up pace. When inflation cannot be tamed in the eurozone’s biggest economy, this is bad news for the ECB.”

https://www.pmi.spglobal.com/Public/Home/PressRelease/89529aecf6ec4de5bf1698ea086999fb

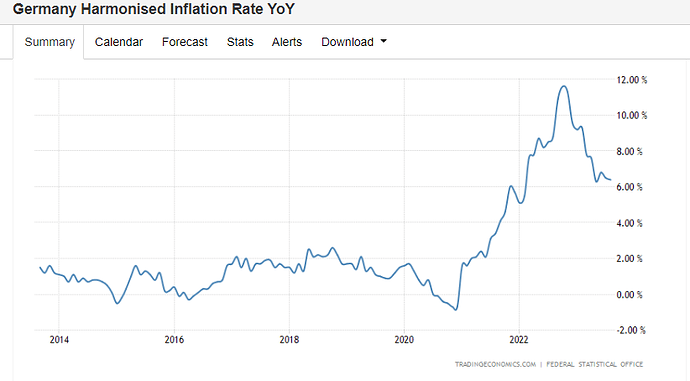

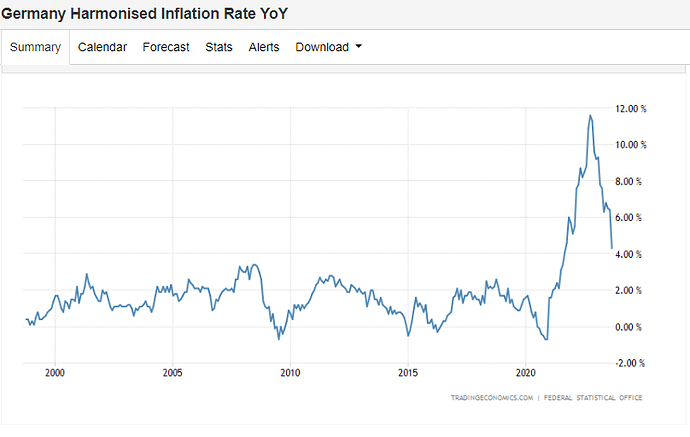

German inflation fell only slightly in August, data showed on Wednesday, but economists expect the downward trend in headline inflation to gain pace in the coming months.

- Consumer prices, harmonised to compare with other European Union countries, increased by 6.4% on the year this month, according to preliminary data from the federal statistics office. Analysts polled by Reuters had forecast harmonised annual inflation of 6.3% after a reading of 6.5% in July.

- Germany’s core inflation rate, which excludes volatile items such as food and energy, was 5.5% in August, unchanged from July.

Germany Harmonised Inflation Rate YoY - July 2023 Data - 1996-2022 Historical

German inflation eases slightly in August | Reuters

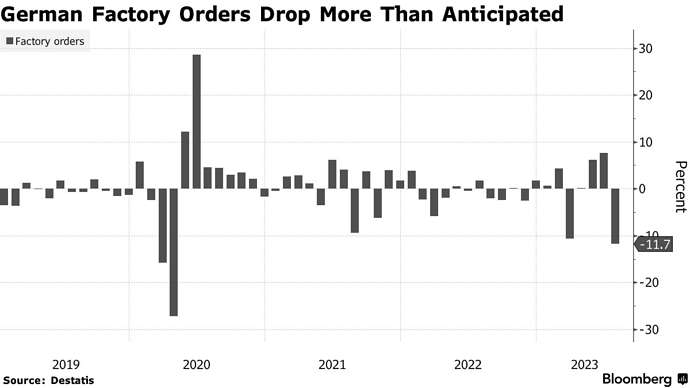

German factory orders plummeted in July, a sign that the woes of Europe’s biggest economy continued into the third quarter.

Demand decreased by 11.7% from June, far worse than the 4.3% drop expected by economists in a Bloomberg survey. That decline — the worst since the height of the pandemic in 2020 — was due to major orders, without which the gauge would have increased by 0.3%.

https://www.bloomberg.com/news/articles/2023-09-06/germany-factory-orders-slumped-11-7-at-start-of-third-quarter

Industrial production dropped for the third consecutive month in July, providing more evidence of an elevated recession risk for the German economy

German industry dropped by 0.8% month-on-month in July, from -1.4% MoM in June; the third consecutive monthly drop. For the year, industrial production was down by 2.1%.

Industrial production is now more than 7% below its pre-pandemic level, more than three years since the start of Covid-19.

In July 2023, production in industry excluding energy and construction was down 1.8% from June 2023. The production of capital goods decreased by 2.9%, the production of consumer goods fell by 1.0% and the production of intermediate goods dropped by 0.7%. Outside industry, energy production in July 2023 was up 2.2% and production in construction rose by 2.6%.

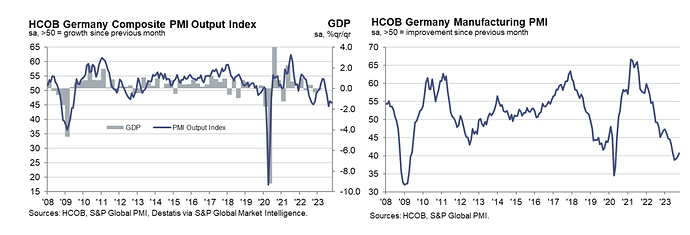

The German economy continues contracting, but at least it seems the pace of it could be slowing.

The decline in GDP for Q3 forecasted from this data is significant, a -1% decline.

Prices declining in output, but increasing in Input, this could create some pressure on margins.

Business activity across Germany fell for the third month in a row in September amid a sustained decline in demand for goods and services. The weaker demand environment saw average output prices rise at the slowest rate for over two-and-a-half years, despite an intensification of cost pressures.

Employment meanwhile fell for the first time since December 2020, albeit only slightly, as businesses reported shrinking backlogs of work and pessimistic expectations for activity in the year ahead.

- HCOB Flash Germany Composite PMI Output Index(1) at 46.2 (Aug: 44.6). 2-month high.

- HCOB Flash Germany Services PMI Business Activity Index(2) at 49.8 (Aug: 47.3). 2-month high.

- HCOB Flash Germany Manufacturing PMI Output Index(4) at 39.2 (Aug: 39.4). 40-month low.

- HCOB Flash Germany Manufacturing PMI (3) at 39.8 (Aug: 39.1). 3-month high.

"The German services PMI stopped its slump and nudged up near 50 in September. This is a pleasant surprise, to be sure. However, in terms of growth it means that activity remained broadly flat following the decline recorded in August. Therefore, our nowcast for services, which considers the PMI data, continues to signal a drag in the third quarter.

“It’s no secret that the German manufacturing sector has been going through the wringer lately. The HCOB PMIs, however, indicate that things aren’t going downhill as fast as before, with the decline in new orders slowing down. In addition, the reduction in purchasing activity is losing momentum. Still, our nowcast for manufacturing production, which includes the PMI figures, is hinting at a drop of more than 2 percent compared to the second quarter.

“The HCOB Composite PMI confirms our view that Germany has entered once again into contraction during the current quarter, after the downturn at the tail end of 2022 and early 2023. Our nowcast points to a rather deep GDP slump of 1 percent compared to the quarter before. Having said this, some important sub-indicators like new business and backlogs of work, which appear to be reaching a bottom, offer hope of an end to this slump as we hit the new year."

https://www.pmi.spglobal.com/Public/Home/PressRelease/9d4bb7c119c649239502dfb771db658b

Germany’s Inflation came in softer than expected. A significant drop from last month.

- German consumer prices, harmonised to compare with other European Union countries, rose by an annual 4.3% in September. Analysts polled by Reuters had forecast it slowing to 4.5% from 6.4% year-on-year in August.

- Germany’s core inflation rate, which excludes volatile items such as food and energy, fell to 4.6% year-on-year from 5.5% in August.

Germany Harmonised Inflation Rate YoY - August 2023 Data - 1996-2022 Historical

German inflation falls to lowest level since start of Ukraine war | Reuters

German economy with no recovery yet, current numbers could indicate a recovery until the 1H2024.

These are preliminary results, but revisions are usually small.

- Composite PMI Output Index(1) at 45.8 (Sep: 46.4). 2-month low.

- Germany Services PMI Business Activity Index(2) at 48.0 (Sep: 50.3). 2-month low.

- Germany Manufacturing PMI Output Index(4) at 41.4 (Sep: 38.7). 4-month high.

- Germany Manufacturing PMI (3) at 40.7 (Sep: 39.6). 5-month high.

Manufacturing remained the main drag, although October also saw a renewed decline in the service

sector. There further signs of weakness in activity spilling over to the labour market as employment fell for the second month running and at a slightly quicker pace. The mood among businesses remained one of pessimism.

Germany is kicking off the final quarter on a sour note. The HCOB Composite Flash PMI is still stuck in the red this October and even slipped a notch from last month. Therefore, there is much to suggest that a recession in Germany is well underway. With the HCOB PMI indices baked into our GDP nowcast, we are calculating a -0.4 percent slip in GDP this quarter, after an estimated -0.8 percent slide the quarter before. If these nowcasts hit the mark, this would result in a -0.8 percent overall growth rate for 2023. This would make the German government’s -0.4 percent shrinkage call seem pretty rosy.

Input prices in the German services sector are continuing to rise at an unusual high rate. Increased energy prices and high wage pressures are most likely at the core of this development. Firms are still managing to roll some of those inflated costs onto the customer’s tab, and October did not see much change in that. Thus, there is no reason to pull the plug on inflation concerns.

https://www.pmi.spglobal.com/Public/Home/PressRelease/bdd9a44d333a46a9bd5c66cd7fd32090

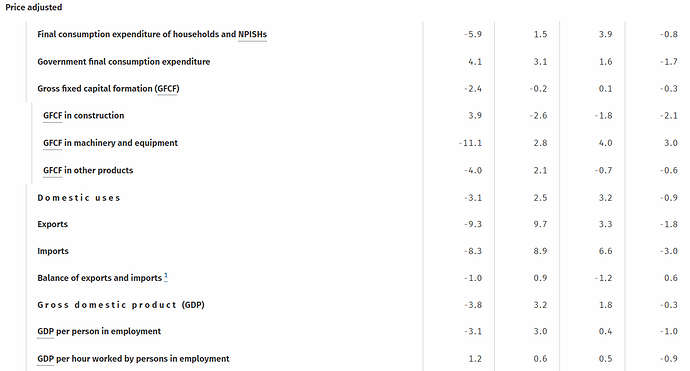

Germany’s economy fell in Q3, but it was better than expected. Significant drag was consumer spending, being offset by capital investments.

- Gross domestic product fell by 0.1% quarter on quarter in adjusted terms, the federal statistics office said. A Reuters poll had forecast the economy to shrink by 0.3%.

Year on year the economy fell 0.3%, and 0.7% was expected. \

"The German economy looks set to remain in the twilight zone between minor contraction and stagnation not only this year but also next year, ING’s global head of macro Carsten Brzeski said

“The net result, however, is that Germany’s economy is now firmly stuck in the mud,” Pantheon Macroeconomics’ chief eurozone economist Claus Vistesen said, adding the he doubts the economy will make headway in the fourth quarter.

Inflation continues to decline, but core inflation is expected to stabilize at around 3%

-

German inflation eased in October to 3.0%, the federal statistics office said on Monday. German consumer prices, harmonised to compare with other European Union countries, had risen by 4.3% year-on-year in September.

-

Core inflation, which excludes volatile food and energy prices, fell to 4.3% in October from 4.6% in the previous month.

While headline inflation is likely to ease further in the first few months of the coming year, the core inflation rate should stabilise around 3% by spring at the latest, Commerzbank economist Ralph Solveen said.

“We expect underlying inflation to remain significantly higher than the ECB would like in the coming year,” Solveen said.

https://www.reuters.com/markets/europe/german-economy-shrinks-slightly-q3-2023-10-30/

The downturn in the German economy showed signs of easing midway through the fourth quarter as business activity fell at the slowest rate for four months

Despite remaining in recession territory, the rate of slowdown has eased noticeably. Particularly heartening is the robust increase across nearly all subindices. This collective upswing fuels our growing confidence that a return to growth territory is a plausible prospect, potentially materialising by the first half of the upcoming year.

The November PMI numbers validate our assessment that Germany is currently in a recession, starting from the third quarter. But the recession may be shallower than expected. Feeding the current PMI figures into our Nowcast model reveals a 0.7% decline in GDP from October to December compared to the third quarter. This is an improvement from the previously projected -0.9%.

- Employment across the euro area’s largest economy meanwhile remained in decline, with the rate of job losses accelerating slightly but still only modest.

- On the price front, November saw faster increases in both input costs and output charges, with inflationary pressure remaining centred on the service sector.

Inflation remains alive and kicking, contrasting with wide held expectations. Input prices in the service sector surged rapidly in November, surpassing the previous month’s rate. This has been mainly fuelled by upward pressure on wages. Part of this increase is passed on to consumers, as service sector output prices are still increasing at an unusual high rate. With a rise in strike activities and some of the recent wage agreements hitting double digits, the outlook suggests that inflation is unlikely to experience a significant decrease in the coming months.

https://www.pmi.spglobal.com/Public/Home/PressRelease/4b17e45241094fa3b97a9f55e81b7e74

I=6

- German consumer prices rose by 3.2% in November, compared with 3.8% in October and lower than 3.5% estimate.

- Core inflation fell to 3.8% from 4.3% in October.

- Harmonized inflation rose 2.3% y/y, down from 3% in October and below 2.5% estimate.

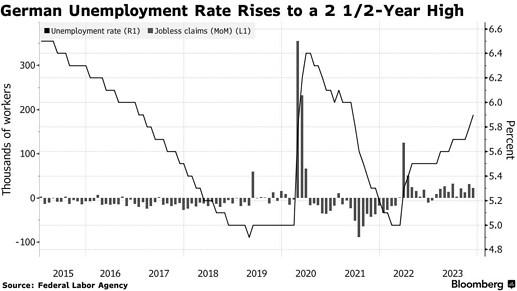

Germany’s unemployment rate unexpectedly rose to the highest level in 2 1/2 years, a sign that the weakness of Europe’s biggest economy is starting to impact its labor market.

It reached 5.9% in November, up from 5.8% the previous month. joblessness increased by 22,000, slightly exceeding the median economist estimate in a Bloomberg survey.

https://www.bloomberg.com/news/articles/2023-11-30/german-jobless-rate-unexpectedly-rises-to-highest-since-2021?utm_campaign=socialflow-organic&utm_source=twitter&cmpid=socialflow-twitter-business&utm_content=business&utm_medium=social

Germany’s private sector economy ended 2023 in contraction territory, with the country’s manufacturers and services firms each recording slightly faster declines in activity.

Weak underlying demand was signaled by sustained downturns in both inflows of new business and backlogs of work, albeit with the survey signaling a softening of the respective rates of contraction.

Increasing number of companies reporting a reduction in output in both the service and manufacturing sectors. This confirms our view of a second consecutive quarter of negative growth by the year’s close, driven by the manufacturing sector. The less-than-encouraging development could be linked to the constitutional court ruling and the subsequent discord over the 2024 budget. This has injected a significant dose of uncertainty regarding potential new burdens for the economy.

Despite a recent upturn in the manufacturing stocks of purchases index over the previous two months, December brought a setback. This does not necessarily spell doom for the inventory cycle’s potential turnaround next year, but it does hint that the journey to recovery might be bumpier than previously thought.

https://www.pmi.spglobal.com/Public/Home/PressRelease/fa670564d1d347f39bf7bfa4d0e43f6f

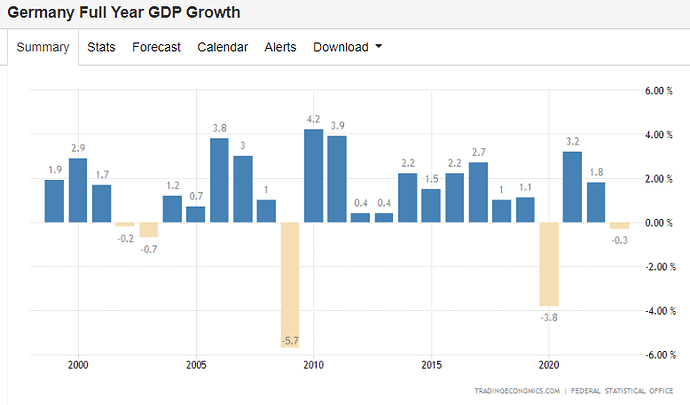

First estimates calculate that Germany GDP decline by -0.3 in 2023 compared to 2022. After adjustment for calendar effects, the decline in economic performance amounted to 0.1%.

Germany is still not “officially” in a recession since Q3 2023 was revised up to flat from -0.1.

And if not hugely revised, the IMF July forecast was pretty accurate for Germany, but the January one was still forecasting slight growth.

- Economic performance in industry (excluding construction) declined considerably, contracting by 2.0%. This was primarily attributable to much lower production in the energy supply sector

- The construction industry saw modest growth of 0.2% in 2023, after adjustment for price variations.

- Most service branches were again able to expand their economic activities compared with the previous year and helped the economy in 2023. However, their overall growth was weaker than in the two preceding years.

- Price-adjusted gross value added in the aggregated economic sector of trade, transport, accommodation and food services declined (-1.0%). This development was largely attributable to wholesale and retail trade, which contracted significantly, while motor trade and the transport sector expanded.

Despite recent price declines, prices remained high at all stages in the economic process and put a damper on economic growth. Unfavourable financing conditions due to rising interest rates and weaker domestic and foreign demand also took their toll. Therefore, the German economy did not continue its recovery from the sharp economic slump experienced in the pandemic year of 2020", Brand went on to say. GDP is 0.7% higher in 2023 than in 2019, the year before the Covid-19 pandemic hit.

Germany Economy Continues to be significantly Weak

The German economy continues to shrink, with the Composite PMI Output Index dropping to 47.2 in September (from 48.4 in August), marking a seven-month low. A PMI below 50 indicates contraction, and the index suggests a deepening decline.

A technical recession seems to be baked in. Our GDP nowcast for the current quarter, which considers the HCOB PMI among other indicators, now points to a 0.2% decrease compared to the quarter before. In the second quarter GDP already shrank at a rate of 0.1%. There is still some hope that the fourth quarter will be better as higher wages combined with lower inflation should boost not only real income but also consumption, supporting domestic demand

The manufacturing sector is driving the downturn, with the Manufacturing Output Index falling to 40.5, its lowest in 12 months. New orders collapsed, and job shedding reached levels not seen since the pandemic.

The downturn in the manufacturing sector has deepened again, evaporating any hope for an early recovery. Output plunged at the fastest rate in a year, with new orders collapsing. In a sign of resignation, companies have shed staff at a rate not seen since the COVID-19 pandemic in 2020. This comes as several major automotive suppliers have announced significant job reductions. These troubling figures are likely to intensify the ongoing debate in Germany about the risk of deindustrialization and what the government should do about it.

The Services PMI dropped to 50.6, the weakest growth in six months, signaling near stagnation. Despite marginal growth, the service sector’s contribution is weakening, and firms are cutting staff.

https://www.pmi.spglobal.com/Public/Home/PressRelease/5455a5b6d984483ebb968a52881396d8

Germany economy without any clear signs of sustained recovery, while the pace of contraction has slowed in October, output and employment continue to post very weak trends.

- Manufacturing still being the big drag on the economy, while the services sector continues to growth.

- Firms reduced staffing for the fifth consecutive month, with the fastest decline in employment since June 2020. Manufacturing job cuts were significant, while the service sector saw a slight increase in job losses.

- Average prices charged by German businesses were broadly unchanged in October. Whilst services output prices continued to rise, the rate of increase slowed to the weakest for three-and-a-half years

"The start to the fourth quarter is better than expected. With services growing at a faster pace and manufacturing shrinking not as quickly as in the previous month, growth in the fourth quarter is a distinctive possibility. Even so, GDP may stay flat for the whole year as forecasted by the International Monetary Fund in its latest projection, after a 0.3% decline in 2023. This underscores the structural weaknesses of the German economy, such as high energy costs, the increased competition from China and the labour market shortages which are all hitting the manufacturing sector hard.

“The survey figures deliver tentative signs that we may start to see light at the end of the tunnel in manufacturing. To be sure, output is still shrinking quickly and so is employment. However, the speed of deterioration has slowed down a bit compared to September. Most importantly, new orders, which fell like a stone over the last couple of months, have lost a bit of their downward dynamic. Manufacturing will most probably continue to be in a recession in the fourth quarter, but it may start the next year on a better footing, although this assessment based on a one-month improvement should be taken with caution."

https://www.pmi.spglobal.com/Public/Home/PressRelease/ad72318b927646f8b20f2ce44508c943

I=6

- The German economy contracted by 0.1% in Q4 2024.

- In the full year 2024, GDP contracted by 0.2%, in line with estimates of economists polled by Reuters.

Germany economy contracted for the second year in a row, declining by 0.2% in 2024, following a 0.3% drop in 2023.

- This marks only 2nd time since 1950 that econ has contracted for 2 consecutive yrs.

- Germany’s prospects for 2025 remain bleak: Bundesbank predicts growth of just 0.2% and warns that another contraction is even possible if US President-elect Trump follows through on his tariff threats.

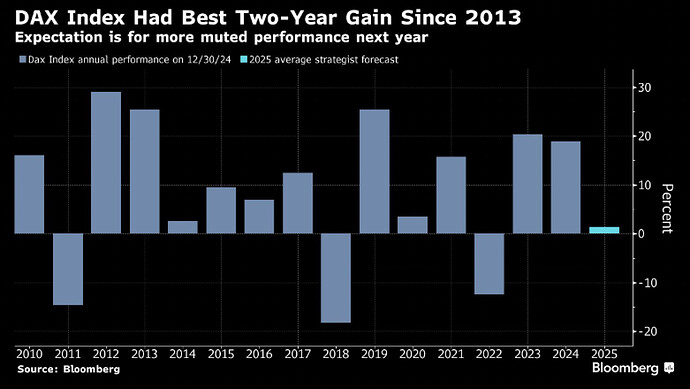

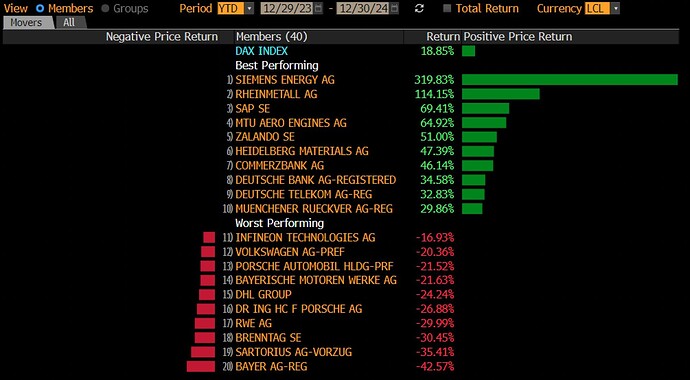

Most notably, the DAX ended the year with 18.85% gain after 20.3% rally in 2023. The index concluded its biggest 2y run in more than a decade, even though Germany’s GDP shrank.