I am cautious regarding 1&1’s Q3 2024 earnings. My estimates takes into account regulatory effects, competitive pressure and network failure at the end of Q2 2024 among others. Here is a description of my positive points above:

- The telecommunications sector is considered immune to inflationary pressures since people cannot do without it. As such, the decline in Germany’s economy is unlikely to have much impact on the sector.

- 1&1 network buildout seems to be now progressing well. There aren’t any recent reports on network buildout delays or special effects associated with it. For instance, 1&1 added 450 antenna sites in Q2, bring the total to 1,781. At this rate, 1&1 should be able to meet its 3,000 target for 2024. As such, I expect comments on network buildout progress to be positive when the results are released.

- A recent report by Teltarif indicates that customer migration from O2 to 1&1 network has began again. Its calculations based on O2’s Q3 numbers indicate that 1&1 could have migrated 39,000 customers in Q3. This process is important since 1&1 has until the end of 2025 to migrate its customers from O2’s network. Also, the start of customer migration signals that the problem associated with network failure at the end of Q2 are likely over.

I am cautious because of the following:

- Regulatory effects: Customer cancelations as a result of halving of mobile termination fees at start of the year are still pronounced. For instance, O2 largely blamed its 1.8% y/y decline in its service revenue in Q3 to this regulatory effect.

- Further contract cancelations due to network failure in Q2: It’s possible that there were further contract cancellations in Q3 as a result of the network failure in Q2.

- Competitive pressures and strong pricing comps: O2 pointed out that they are seeing competitive pressures at the rock-bottom offers. Similarly, 1&1 is facing strong pricing comps in Q3 due to the price increase in Q2 2023.

- Some notable analysts such as Keval Khiroya of Deutsche Bank, are cautious about 1&1’s earnings.

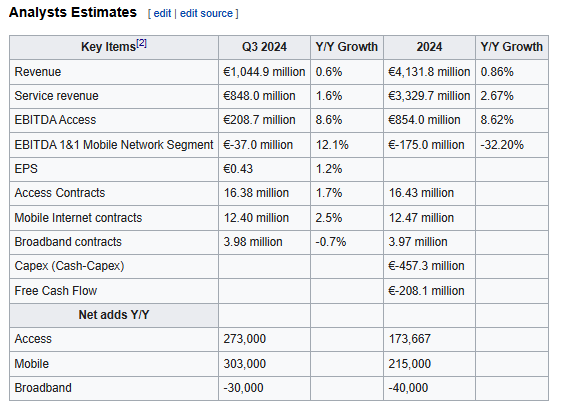

Here are the analysts estimates for Q3 2024 and full year 2024: