This topic will be focused on gathering insights and developments about automotive prices in the short and long term that can help us create and incorporate better inputs into the valuation models.

I have looked up all that some companies had to say about pricing in the Q4 earnings call.

Other than a few indications about 2024, they don’t talk or speculate much about long-term pricing.

Most of the pressure is being felt in the EV market.

I would expect from the few insights we have until now a somewhat flattish to down pricing in 2024 and 2025, with a slow recovery after that.

This is without any other significant shock in inflation.

This is a summary:

- Still have inflation on fixed cost, and have a significant headwind from the ramp-up of the 30 models. This is how we end up with the 7% to 7.5% margin.

- Most products, putting into more content. And on the other side,will be able also to lift prices.

- Low margin in Q4 2023 due to higher fixed costs

- They think they still have a very good pricing set.

- Looking into 2024 the target is to keep pricing stable, obviously means flattish.

- Will work on all levers to keep flexibility, obviously on discounting, to stay competitive in the market, but not to the extent that want to buy market share, as some others might do. Their policy value over volume applies.

- Discounting is probably the flex tool in a competitive market environment.

- Assuming lower industry pricing of roughly 2%, driven by higher incentive spending as we move through the year.

- Expect losses to widen to a range of $5 billion to $5.5 billion, driven by continued pricing pressure and investments in our next-generation vehicles.

- Going to see a lot of seismic changes in the industry because of this pricing power reality that we’ve all faced. More OEM relationships, different shifting to a buy versus a build or vertical integration, shifting in capital and generally more focus on smaller vehicles

- Think 2024 is the year where affordability is going to get back to pre-pandemic levels, where the monthly disposable income it takes to buy a vehicle should be back to about that 13% to 13.5%, which is what we saw before pandemic.

- Anticipate a market similar to 2023 with total US industry volumes of around 16 million units.

- Assume a 2% to 2.5% pricing headwind year-over-year. ( planning assumption rather than an expectation of where they see pricing)

- Used vehicle prices returning to normal throughout the year, along with earning asset growth from retail loan originations and the commercial loan portfolio

- BEV sales growth is not as strong as what some would predict. And that has an impact on the raw material price, which means the raw material price is going down, which means total production cost of BEVs is going down, which means it’s opening the road for more affordability.

- Pace of total production cost reduction of BEVs is higher than the pace of total production cost reduction of ICEs, which means we are converging.

- North America, I think what’s important to call out is we haven’t seen any radical pricing drops. People have been pretty disciplined, perhaps after everything that happened in the fall of last year, it’s in everyone’s best interest to be disciplined there.

- The place where you do see the price drops is when you look at EVs, particularly in Europe, there is a different position there.

Analysis of more than 330,000 vehicles advertised on Autoscout24, a European car sales company established that the average price of used and new cars were up 0.2% and 0.1% in Q1 2024 compared to the previous quarter respectively.

Is this for Switzerland only?

Because Auto1 Group had a 3.3% decline in used car prices for [Q1 2024.] They have a database of 4.2M cars for all of Europe. (AUTO1 Group | Press Release March 2024)

Looks like it

- Prices of used EVs fell by 18% in April compared to the same period last year in Germany, that’s according to analysis by DAT.

- Prices of used petrol and diesel cars declined by 7% and 5%, respectively.

- DAT spokesperson said that the rate of decline in the combustion engine sector is falling.

- The percentage residual values for petrol and diesel used cars now stands at 64.5 and 64.6 respectively, still above their values in the pre-Covid period which ranged at around 55.

- The percentage residual values for used EVs is now at 50.7, well below the pre-Corona level.

S$P Gloval made some comments about their expectation for pricing pressures to continue on the market but without clear forecasts. This is what they said:

US

- Expect average new vehicle prices will fall about 10% from 2023 levels over the next 18-24 months as demand shifts to used vehicles from new vehicles.

- expect used-vehicle prices to fall another 5% to 7% in 2024 (after falling about 7% in 2023) as increasingly difficult financing conditions weigh on demand while supply increases.

Europe:

- Don’t have reliable information on the evolution of transaction prices in the region, but we assume that pricing pressure is increasing, obliging OEMs to adjust their cost bases to absorb high labor, logistics, and energy costs.

- OEMs have until the end of 2024 to boost higher margin ICE combustion vehicles in their EU fleets before regulations severely tighten allowable average CO2/km towards 95, in 2025.

China

- Pricing in China continues to be challenging and will remain so until the market ends its current consolidation.

- Large-scale price competition started last year and has become more aggressive and frequent this year as producers are eager to expand volume amid falling battery prices.

- With fast electrification and EVs reaching price parity with gasoline vehicles, the market size for ICE vehicles is gradually shrinking while production capacity remains sizeable. This led to ICE vehicle price cuts by traditional OEMs that are struggling to protect market share and survive.

That’s interesting. Are you considering that @Aron and are starting to bake it into our models for Volkswagen and Sixt?

Q1 2024 Manufacturers Earnings insights into pricing:

- Chinese market competition and price pressures are very intense currently, but all regions are experiencing some pressure currently

- EV price pressures are particularly strong

- ICE market more resilient and holding up better in pricing

- The introduction of LFP battery technology is expected to reduce battery costs by one-third.

- The company expects to reduce material costs by 40% with its main platform in China, achieving cost parity with local BEV leaders in the price-sensitive compact and minor segments by 2026.

- Pricing remains slightly supportive, benefiting from the rollover effect of last year’s price increases, although it is also burdened by higher temporary sales promotions for electric vehicles.

- On the BEV side, the pricing environment remains very challenging. The company maintains that it will make sound compromises between prices, pricing, and volume to ensure a balanced approach in line with its value-over-volume strategy.

- The company observed a softening effect on pricing between Q1 and the later quarters, which will not be as pronounced when comparing Q2 or Q3 year-over-year.

- Regarding pricing levels, the company aims to maintain an average of approximately €52,000, similar to the previous year, as mentioned in their guidance. This level, presented in Q1, is expected to remain consistent in Q2, subject to minor foreign exchange variations.

- EV pricing is currently under more pressure, while ICE pricing remains solid and at healthier levels.

- Regarding pricing dynamics, the first quarter saw stable pricing due to new vehicle pricing and year-on-year escalation updates, balanced against discount evolution. The company continues its Pillar 2 strategy, prioritizing value over volume for product positioning. They employed tactical flexibility in commercial measures, resulting in a net positive outcome.

- The company is planning for a roughly 2% decrease in industry pricing, driven by higher incentive spending throughout the year. This is expected to be partially offset by top-line growth from new product launches.

- Affordability is anticipated to return to pre-COVID levels, around 13% to 14% of monthly disposable income. With increased interest rates, higher payment prices, and rising insurance and maintenance costs, industry prices may need to decrease slightly to maintain affordability for consumers.

- For EVs, the company had initially expected prices to decrease by about 20% this year, but prices fell even more. The company had to reduce its prices by 17% to remain competitive due to significant market competition. This dramatic price reduction has made it challenging to keep up with cost reductions.

- It is unlikely that electric vehicle prices will drop well below gas vehicle prices unless there is significant excess capacity pushing against demand, creating an imbalance.

- The company experienced consistent pricing trends during the quarter, with a pricing decline of about $200 million year-over-year, below the 2% to 2.5% headwind included in the full-year guidance. This was driven by strong product demand and a disciplined go-to-market strategy focused on profitability and margins. As of April, pricing has remained relatively consistent.

- The business plan and 2024 guidance account for some pricing pressure for both ICE and EVs. However, the company continues to seek additional offsets through cost performance and other efficiencies.

- The company noted a decrease in net pricing in the market, despite maintaining some of the best relative net pricing in Europe, which has experienced some pressure.

A post was merged into an existing topic: Automotive Industry: Europe

Interesting insights.

What do you think about a developing a pricing model?

This could be done by region and differentiate between evs and ice cars.

If you want you could also develop a pricing model per manufacturer.

All this data could help to correctly forecast pricing in the Volkswagen model and also gives a great high level overview how things are developing.

It could be done e.g. in the automotive industry sheet and also be visualized in tableau (in case it is possible to differentiate there between past data and projections)

Ok, I could work on it. But it will be highly speculative because the details or insights we get on this are very limited.

I probably won’t do it by manufacturer yet, I don’t understand their specific details, and don’t think we have the resources to do it yet either. But it could be something cool that could be implemented in the future.

Ok cool. It’s up to you how you implement it based on the data you find.

Insights per manufacturer could also be the kind of insights from three posts ago displayed in numbers which would make it easy to see with one glance how those companies are developing and are expected to develop.

But most of these manufacturers do not give specific numbers about their expectations, their insights are very generalized actually.

True. Maybe those insights could alternatively be captured in another tab of the sheet also organized per quarter. Then we have them in a structured way and it is easier for us to compare in hindsight how the prices actually developed vs. expectations (based on the data that we get) and get a better feeling for the reliability of the predictions.

We could also visually highlight things e.g. using colors how optimistic companies are.

11 posts were merged into an existing topic: Automotive Industry: Used Vehicles Pricing

Q2 2024 New Vehicle Prices insights from manufacturers

Summary:

- Most automakers faced pricing challenges in Q2 2024, driven by competitive markets, excess capacity, or shifting consumer demand.

- Companies are focusing on cost reduction efforts to maintain margins amid pricing pressures

- Automakers are relying on new product introductions, particularly in luxury and top-end segments, to mitigate overall pricing challenges.

- The Chinese market emerged as a key challenge for all automakers, with many referencing weaker consumer sentiment and fierce competition.

- Managing inventory levels has been another key focus area in the current environment

- Pricing turned negative in Q2, as last year’s price gains were outweighed by higher tactical pricing in a competitive market, particularly due to supply issues with six- and eight-cylinder vehicles and model changeovers.

- Mix was impacted by a weaker model selection, notably with lower sales of V6 and V8 engines in Audi and a weaker brand mix due to Porsche’s lower sales.

- Volume and price mix is expected to remain stable, with a slight positive contribution from volume growth outside Chinese JVs, though mix and pricing challenges persist.

- The mix is expected to positively contribute in the second half, but competition will remain intense.

- The changing market conditions in China pose a significant challenge, leading the group to prioritize sustainable value creation over volume growth.

- The main focus is on cost cutting.

- Prices across the portfolio in 2024 are expected to remain at last year’s average level, not just Q1. Last year’s full-year average was close to €51,000, and year-to-date we are stable at that same figure.

- In China, Q2 saw a downward trend, but we are now seeing stabilization.

- U.S. pricing momentum remains strong, with dealership supply at 31 days, compared to 55 days for the industry and European OEMs.

- Europe remains stable in terms of pricing.

- Volume and mix remain positive, with pricing stabilizing.

- BMW expects new model launches in H2 2024 to contribute positively, maintaining revenue despite global pricing pressures.

- The balance between volume and luxury models has helped offset challenges in other segments.

- Inventory buildup is due to new model ramp-ups, expected to normalize by year-end.

- Mercedes-Benz has prioritized pricing stability over aggressively pursuing market share.

- Lower volumes and a lighter Top-End share have impacted net pricing, along with negative pricing compared to strong pricing in Q2 2023.

- The company aims to maintain current pricing levels, with solid ICE pricing and competitive EV pricing.

- In China and Asia, cautious consumer sentiment is affecting luxury goods demand.

- Mercedes-Benz has focused on profitability through operational improvements and managing input costs, helping defend pricing despite inflation and FX pressures.

- They closely monitor U.S. inventory and leverage their agency model in Europe to ensure pricing stability.

- By enhancing their product mix with top-end models, they aim to mitigate pricing pressures.

- Pricing is flexible, not absolute. The company tries to position itself at the high end of the price band but adapts if competition lowers that band.

- Anticipates Chinese competitors driving prices down, requiring adjustments to stay competitive and maintain margins through cost reductions.

- In Europe, pricing pressure may be less intense due to tariffs

- In the U.S., price pressure remains, as competitors’ results show it won’t disappear soon.

- Customers are now expecting BEVs to be priced like ICEs, and it’s unrealistic to expect higher BEV pricing in the near future.

- The company is open to adjusting prices and incentives as needed, without rigid strategies.

- Inventory levels in the US were at 94 days by June, which has distorted inventories and added pricing pressure.

- The company is launching best-in-class BEVs priced under €25,000, ready to compete with Chinese rivals.

- Excess capacity will lead to more pricing pressure, consolidation, and partnerships, as planned.

- The focus for EV growth is on smaller, more affordable vehicles.

- Industry pricing is expected to drop by about 2%, driven by higher incentives, but Ford aims to offset this with top-line growth from new product launches.

- Auction values are expected to decline in the second half, along with increased return rates.

- Ford is on track to achieve $2 billion in efficiencies from materials, manufacturing, and freight, helping to offset higher labor and product refresh costs.

- Second-quarter results were driven by strong ICE performance and stable pricing, exceeding guidance.

- The U.S. incentive gap widened, with GM running 150 basis points below the industry average in Q2.

- Pricing increased by $300 million year-over-year, boosted by new models like the Chevrolet Traverse.

- Guidance expects pricing to decline 1% to 1.5% in the second half, an improvement from earlier forecasts.

- GM’s cost-reduction efforts aim to protect margins from rising input costs.

- Expected profitability in China did not materialize, with continued challenges forecasted for the year.

- Dealer inventory ended at 66 days, slightly higher.

I have created a tab to follow the insights, but still not sure how to structure it, for now just added like the general expectation for each company.

I=4

The price difference of an EV and ICE is declining in Germany as EU 2025 CO2 regulation approaches

-

According to analysis by Center Automotive Research (CAR), prices of EVs in Germany are declining as EU CO2 2025 regulation approaches.

“Electric cars are becoming relatively cheaper,” said Ferdinand Dudenhoffer, CAR director.

-

CAR said the price difference of an EV and ICE has fallen by 920 euros from the past month.

-

CAR notes that discounts EV buyers can expect a discount of 12% while ICE buyers can get a discount of 16.5%.

-

CAR takes into account the transaction price in the comparison.

Q3 2024 New Car Pricing Update

As of Q3 2024, I continue to expect further downward pressure on new car prices. While I don’t expect a huge drop, I thin we could see a gradual decline in the range of 4-8% in the next two years.

This will probably be different by region and will work on differentiation when I work more in depth on the model.

Automakers are increasingly focusing on strategies like improving their sales mix and introducing new models to combat price pressures. Although these initiatives may provide some relief, I am not convinced they will be sufficient to prevent further price declines.

These are my arguments for my expectations currently:

- Unlike the used car market, the supply of new vehicles is increasing and is expected to continue growing or at least remain at current levels. However, this trend will vary across different brands, making effective supply management an important focus for automakers.

- Consumer auto affordability and financing conditions have yet to improve significantly, which will continue to soften demand and limit sales growth in the near term.

- Additionally, the negative equity a significant portion of customers have in their vehicle (owing more on their car loans than the vehicle is worth) will constrain their ability to trade in for some, posing another headwind to demand.

- Consumers are shifting toward more affordable vehicles, and this shift in the sales mix will likely also reduce the average transaction price across the industry.

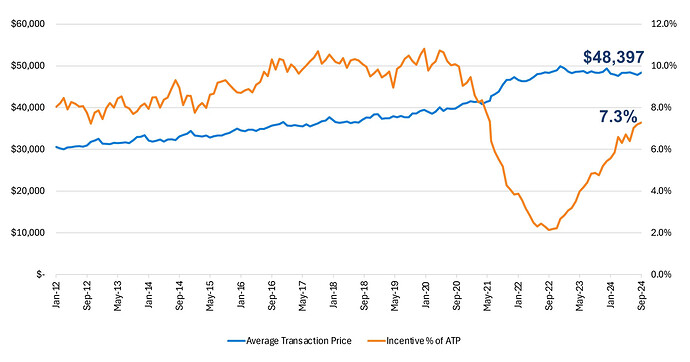

- Combination of supply increasing, days’ supply (inventory levels) rising, dealerships continuing to face higher holding costs due to elevated interest rates on floorplan financing, and soft consumer demand. All of this will likely lead to an uptick in incentives. Currently, incentives are still about 7% in the US, below the pre-pandemic level of 10%, so it would not be surprising to see them return to 10% over the coming years. This will also put downward pressure on net vehicle pricing.

- Competition in the EV segment is only beginning to intensify in my opinion, and it will likely exert continued pressure on prices, particularly in China, a historically critical market for automakers.

The main risks to my expectations are:

- A much sharper-than-expected economic downturn could impair consumers’ ability to purchase new cars even more than currently.

- Geopolitical issues significantly impacting supply chains again.

- Tax tariffs are more significant than expected, alleviating the Chinese competition even more in the US and Europe

Q3 2024 Developments

US Developments

- Average transaction price of new car in September 2024 was 48,397, is basically flat for the quarter, and only lower year over year by 0.4.

- Incentives continue to rise to 7.3% of ATP, however, remain below pre-pandemic levels of 10-11%

- In September, new vehicle prices remained nearly unchanged from January’s $48,369, increasing by less than $30.

- EV prices in September were down 0.9% year-over-year, with an average of $56,351—about 16% higher than the overall market average.

- Smaller, more affordable vehicles are gaining market share in 2024, helping to hold down average transaction prices across the industry.

Unfortunately I have not found any reliable source for other regions’ new car price developments.

Difference between prices of combustion vehicles and electric vehicles continue to narrow in Germany

- According to the Center Automotive Research (Car), the difference between price of the top 20 combustion vehicles and electric vehicles sold on the German market declined by 1,100 euros in November compared to October.

- The analysis is based on transaction prices i.e list price minus discounts.