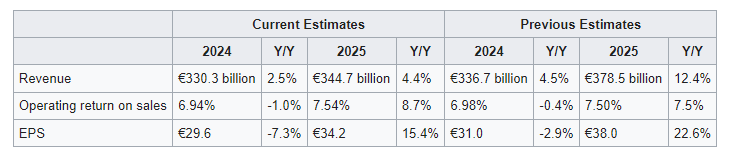

Following further research on Volkswagen’s products, especially the 2024 launches and @Magaly’s recent insights on industry estimates and macro conditions, I have adjusted my estimates for 2024 and 2025 in the valuation model.

Here are my key assumptions:

Industry growth rate:

- S&P Global Mobility forecast unit sales of light vehicles to grow by 1-3% in 2024 and 2-4% in 2025.

- Demand and supply of vehicles have come into better balance.

- Sales of medium and heavy-duty trucks are expected to contract in Europe and North America in 2024. A pick up in sales is expected in 2025 due to greenhouse regulations that take effect from 2026.

Unit sales:

- Though Porsche’s 2024 models look great, I expect a slight decline in unit sales in 2024 due to the transition from the old models to the new ones (as it has been the case). The changes in 2024 should lead to a positive unit sales growth in 2025.

- I still expect Audi unit sales in 2025 to benefit from weak comparison period (due to supply issues affecting V6 and V8 engines in 2024). However, the product changes in 2024 appear too minor for models that are considered dated. Also, the highly anticipated models, Audi Q6 e-tron and Audi A6 e-tron are pricier than its main rivals at a time when residual value of EVs is declining. Hence, I significantly lowered the 2025 deliveries estimates for Audi models.

- I don’t expect model changes at Volkswagen Brand Group Core to lead to significant sales since only few model launches (such as Passat, Golf and Skoda models) look impressive.

Pricing:

- Almost all the 2024 Volkswagen Group model launches come with a higher price compared to their predecessors.

- New vehicle prices is expected to remain elevated in 2024 and 2025. I expect price growth for VW models in 2025 to be mild though since most price changes will occur in 2024.

- Used car prices are expected to decline further in 2024 in U.S and Europe. This will impact the operating result of Volkswagen Financial Services. However, the brand expects to compensate for this through higher business volumes and contracts. I don’t have a good understanding of this brand though.

Competition:

- Though Volkswagen plans to increase its market share in China to 15% by 2030 from 14.5% in 2023, I don’t expect its current strategy in the country to boost its sales over the short-term. As search, I project that the share of its operating result in China will continue to suffer due to rising competition.

- Volkswagen Group is competitive in Europe, hence I expect its market share in the region to be stable over the short-term.

- I expect Volkswagen’s market share in North America to stay stable over the short-term, especially now that U.S has imposed 100% tariffs on China EV imports.

Costs:

- The product launches in 2024 will likely lead to higher costs in 2024 than in 2023.

- The cost-savings programs implemented last year at the Brand Group Core will likely boost its results in 2024 and 2025 since they are already paying off.

The above 2025 estimates doesn’t consider that a recession will occur in 2025. If there will be a recession, I forecast revenue in 2025 to decline by 11% to €291.2 billion, operating return on sales of 1.6% and EPS to come in at €2. These estimates are mainly based on the company’s performance in the 2009 recession.