Auto Financing Conditions Continue to Squeeze New-Vehicle Buyers in Q3 2024, According to Edmunds Experts

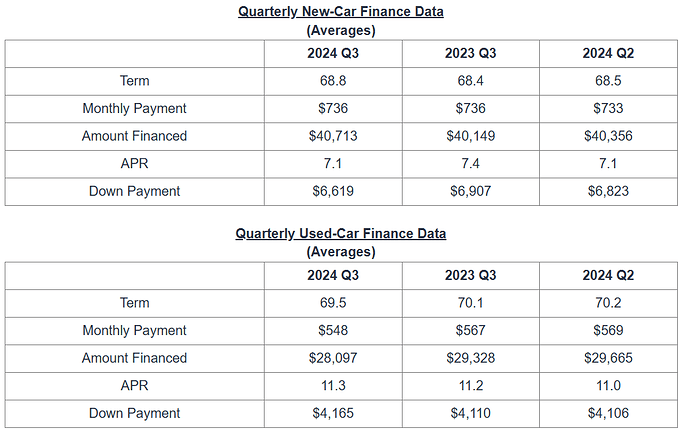

- The average new-vehicle APR in Q3 2024 remained elevated at 7.1%, which was the same as in Q2 2024.

- 0% finance deals remain nearly impossible to find (or qualify for)

- 69% of new-vehicle loans had terms over 60 months in Q3 2024, similar to a share of 70% in Q2 and 69% in Q1. Edmunds analysts note that 84-month auto loan terms are on the rise, accounting for 18.1% of new-vehicle loans in Q3 2024, compared to 17.3% in Q2 and 15.8% in Q1.

- The share of consumers taking on loans with new-vehicle monthly payments of $1,000 or more was 17.4% in Q3 2024, marking the sixth consecutive quarter that the share of $1,000+ monthly payments was above 17%.

- In a survey of consumer planning on purchasing a vehicle in the next 12 months, 62% of the respondents stated that they have held off on buying a new vehicle because of high interest rates.

“Longer loan terms might make monthly payments more palatable for consumers, but the harsh reality is that most Americans don’t want to keep their vehicle for seven years,” said Ivan Drury, Edmunds’ director of insights. “Simply put, longer loan terms put car owners at greater risk of rolling negative equity into their next auto loan.”