The Average Amount Owed on Upside-Down Car Loans Hit an All-Time High in Q3 2024, According to Edmunds

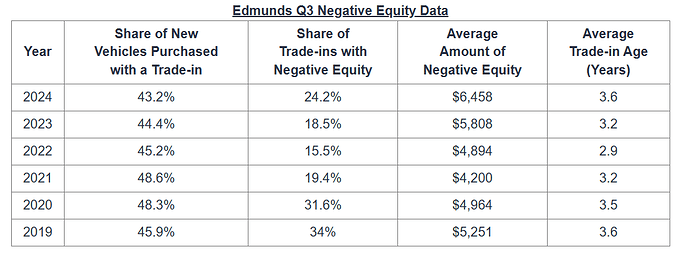

24.2% of trade-ins toward new vehicle purchases had negative equity, up from 23.9% in Q2 2024 and 18.5% in Q3 2023.

- 22% of vehicle owners with negative equity owed $10,000+ on their car loans, and 7.5% of vehicle owners with negative equity owed $15,000+.

- Negative equity is prevalent across all vehicle types being traded in. For example, in Q3 2024, midsize SUVs, compact SUVs and large trucks made up 19.5%, 17.3% and 10.3%, respectively, of all vehicles traded in with negative equity.

“Consumers owing a grand or two more than their cars are worth isn’t the end of the world, but seeing such a notable share of individuals affected at the $10,000 or even $15,000 level is nothing short of alarming. A combination of uncontrollable market factors and misguided consumer financial decisions are contributing to the rise of this troubling trend,”