Main Article: Automotive Industry:Europe - InvestmentWiki

I will start to summarize some of my findings:

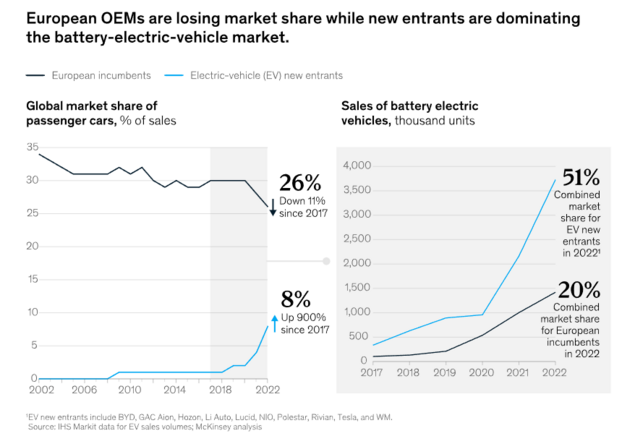

Assessment: I don’t see a good outlook short or long term for the European auto market. While maintaining market share in Europe will probably be easier (still questionable), global market share is the one I think could continue to decline significantly, especially China. It has started to do so already.

From Moody’s (post below),

Since 2019, European incumbents have lost six percentage points of market share in their home market and five percentage points in China. Meanwhile, Chinese OEMs are gaining ground in both China and Europe, reaching 45 percent market share in their home market in 2022 and octupling their market share in Europe between 2020 and 2022.

My reasons that this could/will continue:

- Currently, Europe, especially Germany, are experiencing difficulties in their economy. Lower economic activity, sticky prices, higher rates, banks tightening credit standards. Auto sales have held out pretty well, probably due to shortages in past years, but if the weakness continues they are probably going to be hit too, lowering growth short term for the industry.

- While an economic contraction or recession long term is not a huge deal, it will restrict the amount of investment specific companies, suppliers and the whole region can do for some time. Investment that I think is needed more than ever and as soon as possible to remain competitive in the EV transition.

Better said is that an economic contraction could come at the worst time for the industry, imo the more they delay investment, the more market share will be lost to other participants that have already done this initial investment. - If we are entering an environment of higher rates long term due to structural changes causing higher inflation, investments will become more difficult and costly too.

Including buying a car from the consumer’s point of view. Affordability could become a problem, and better pricing from Chinese u other competitors could become more attractive. - Just to maintain market share or competitiveness in the EV transition, there needs to be big changes in all parts of the supply chain to the manufacturers. The amount of investments, collaboration, alliances, and policy response needed is significant, and I don’t actually see huge developments in Europe in that direction currently, there are some advances but don’t seem enough (Please let me know if you do see more). And the current planned decoupling in global economies is probably not going to help with this.

- Changes in demographics are probably going to be a headwind going forward too.

I probably still have a lot of gaps in information which could change my thinking, especially about China, but I will continue to monitor all the info that I am able to find.

Obviously, this is for the whole industry, there could be individual winners within the industryz and it will probably depend on how quickly they adapt.

Summary:

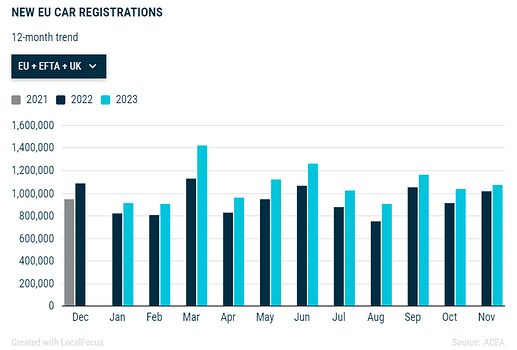

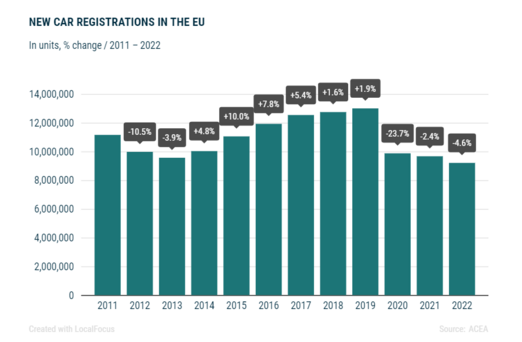

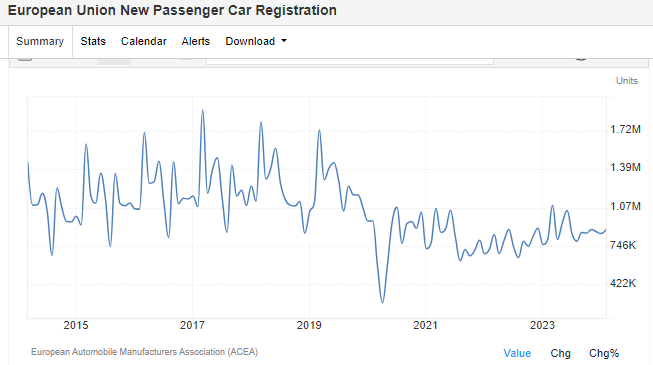

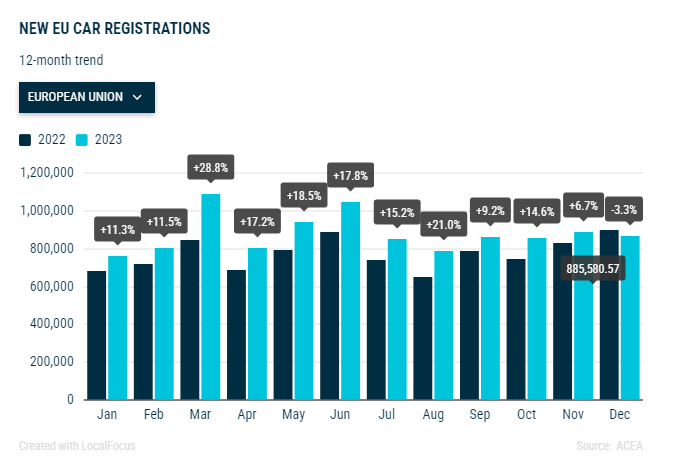

- While registrations are low compared to 2019, they are growing nicely in 2023, registering a 17.6% YTD in the EU as of July 2023. Forecasts are expected to grow 5% y/y (they have been growing more than this), but most likely still below the 2019 level.

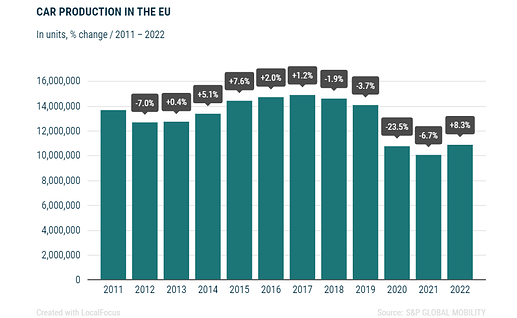

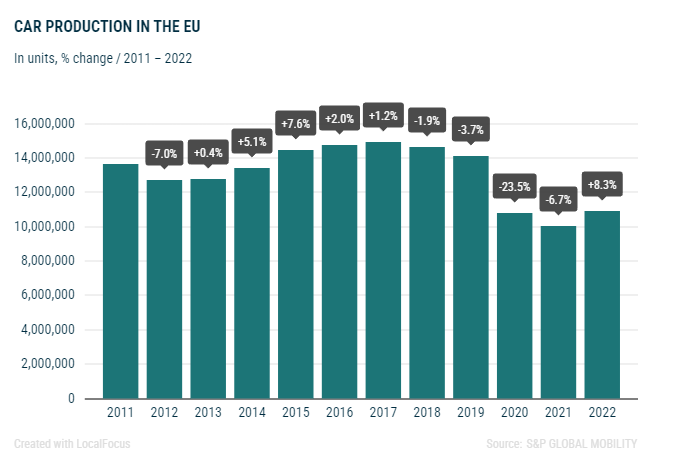

- Decline in registration is in line with the decline in production

- The turnover generated by the auto industry represents almost 8% of the EU’s GDP

- 13.0 million Europeans work in the auto industry (directly and indirectly), accounting for 7% of all EU jobs

- The automobile industry generated a trade surplus of €95.68 billion for the European Union in 2022

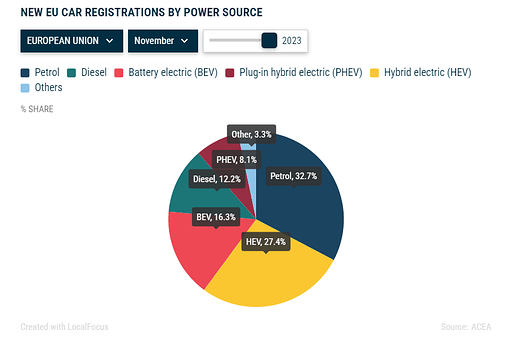

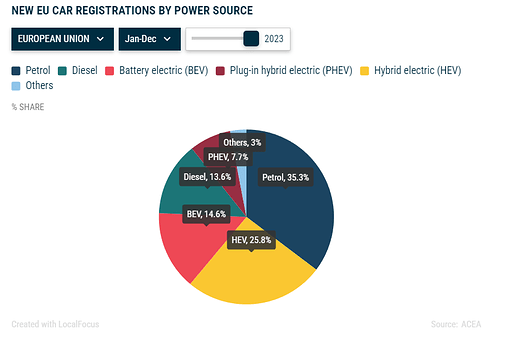

- Between 2019 and 2022, the market share of alternative energy vehicles climbed from 11% to 47%

- I unfortunately have not found data on the credit quality and developments of the auto market for now.

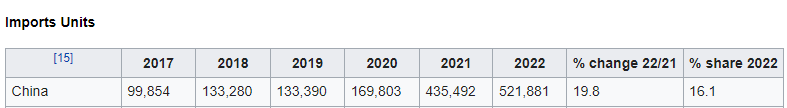

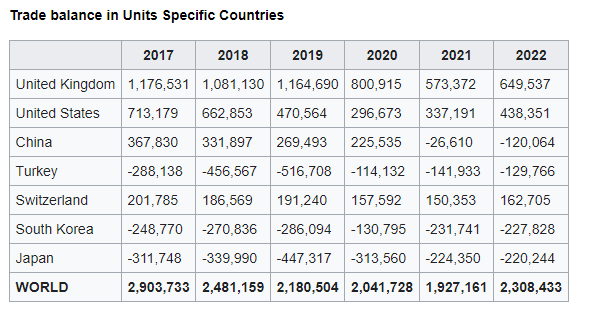

What I have found particularly interesting is the big jump in imports from China in 2021. This is in line with growing competition concerns

- China is the only country going from a trade deficit (in units) to a trade surplus with the EU. Not only imports have increased, exports have also declined a bit.

- In terms of value the EU still has a trade surplus with China, due to pricing.

- China imports represented 1.02% of registrations in 2019, and increased to 5.64% in 2022. Represented 0.95% of production in 2019, and 4.85% in 2022.

- China imports represented 2.58% of total imports in 2017 and grew to 16.09% in 2022.

- Trade balance has also deteriorated with the US. Interesting the increase in imports from Morocco too.

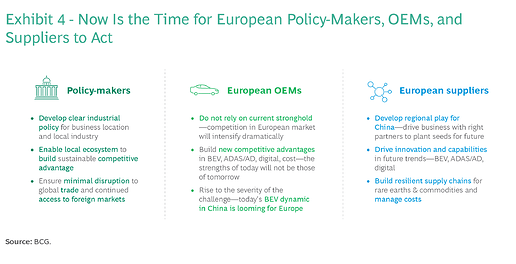

I have found some interesting research talking about the fact that if the EU does not increase investment, and collaboration, and create better policies for the EV transition, the most likely outcome is a decline in market share in the EU and China markets. I will summarize some of these in posts below.

Moody’s Research:

According to Moody’s, EU auto industry is becoming less competitive, especially since the introduction of EVs, and has been losing market share to new entrants, especially from China.

They said current research shows that successful automakers are developing cars defined by software. This will disrupt the old supply chain for the need for a completely new one.

They point out that despite current initiatives being a positive step, the projected supply and capacity are still insufficient to meet the region’s anticipated demand by 2030.

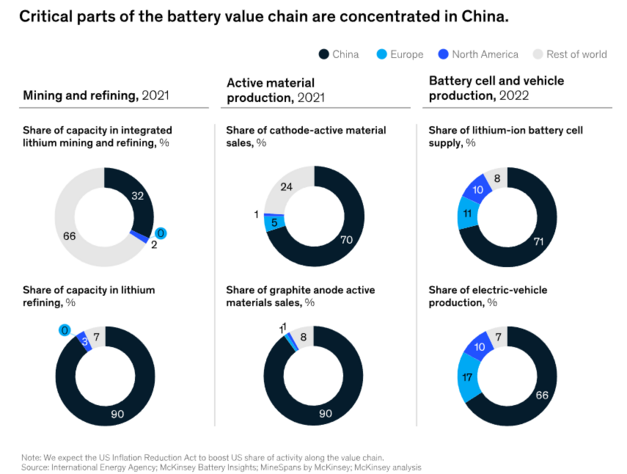

Is especially important that the current battery value chain is largely controlled by Chinese companies, in an environment where decoupling and deglobalization efforts are being talked and planned.

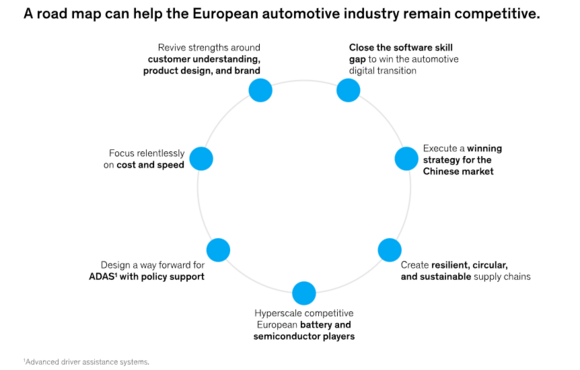

Some of the most important changes needed according to them:

- Reduce cost by adopting structural product design, vertically integrating battery production, scaling EV production, and improving productivity.

- To maintain market share in China, they need to produce vehicles more appealing and tailored to Chinese consumers’ needs and preferences, as Chinese brands are doing.

- To cover European battery demand locally, an additional 20 gigafactories, a €35 billion investment, would be needed. The continent would also need 37 new semiconductor fabs to cover local demand, requiring a €190 billion investment.

- Only 15 to 20 percent of current R&D workers at European incumbents have software skills, compared with almost 45 percent at new entrants.To shrink the gap, industry stakeholders would need to find holistic solutions

- The industry will need a cumulative €300 billion worth of infrastructure investments in electricity generation, the electricity grid, EV chargers, and hydrogen refueling systems through 2030.

https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/a-road-map-for-europes-automotive-industry#/

BCG Research

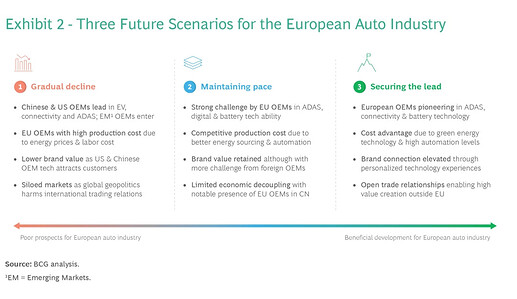

BCG is focused on the fact that the competitive advantages of the European auto market will lose their importance in the EV transition and that currently European auto sector is falling behind and struggling to keep up with other market participants in EV manufacturing process (China and US). To change this the Euro sector will need serious transformation and investments.

Threats Recognized

They calculate 3 scenarios, pointing out that scenario 1 is the current path, unless changes are made. And that limited steps will only barely get to scenario 2 of stagnation or small gains.

Consequences of each scenario

Their path to Scenario 3

I=7

- European automobile manufacturers association (ACEA) forecasts European Union car sales will grow by 2.5% in 2024, a significant slowdown from projected growth of 12% to reach 10.4 million vehicles in 2023.

- The forecast for 2023 is an upgrade from the 5% given in January.

- ACEA also said that the share of BEVs will grow from 14-14.5% in 2023 to 20% in 2024.

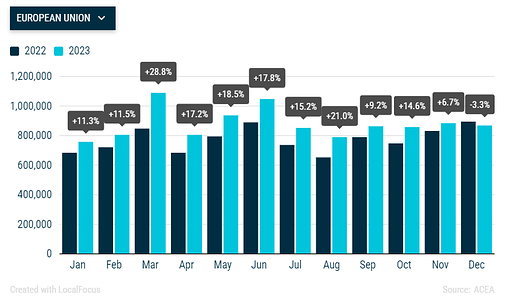

In November 2023, the EU’s car market grew by a modest but reasonably robust 6.7%. Despite a relatively low base of comparison, solid growth persisted, marking the sixteenth consecutive month of expansion.

Eleven months into 2023** , new car registrations increased by a significant 15.7%, reaching nearly ten million units.

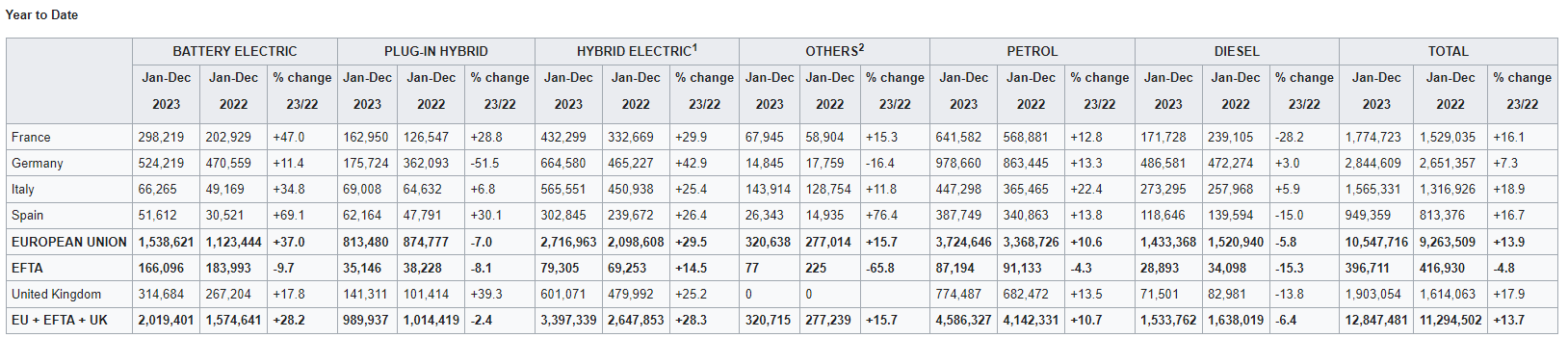

In 2023 , the EU car market concluded with a solid 13.9% expansion compared to 2022, reaching a full-year volume of 10.5 million units.

As previously reported, ACEA only expects 2.5% growth in 2024.

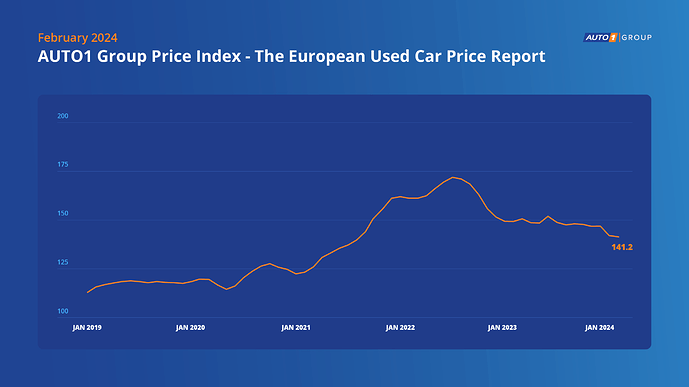

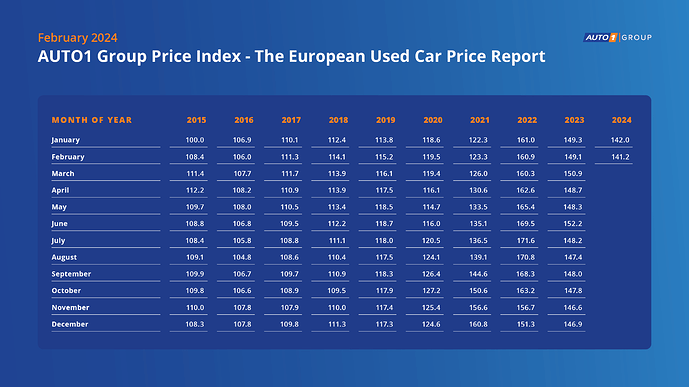

Used car prices in Europe have also continued to decline in 2024, -3.3 m/m in January and -0.6m/m in February.

Year over year, used car wholesale prices decreased by 5.3%, with the index moving from 149.1 in February 2023 to 141.2 in February of this year. Although used car prices decreased year over year, they are still 22.6% higher than before the COVID-19 pandemic compared to February 2019 with a value of 115.2.

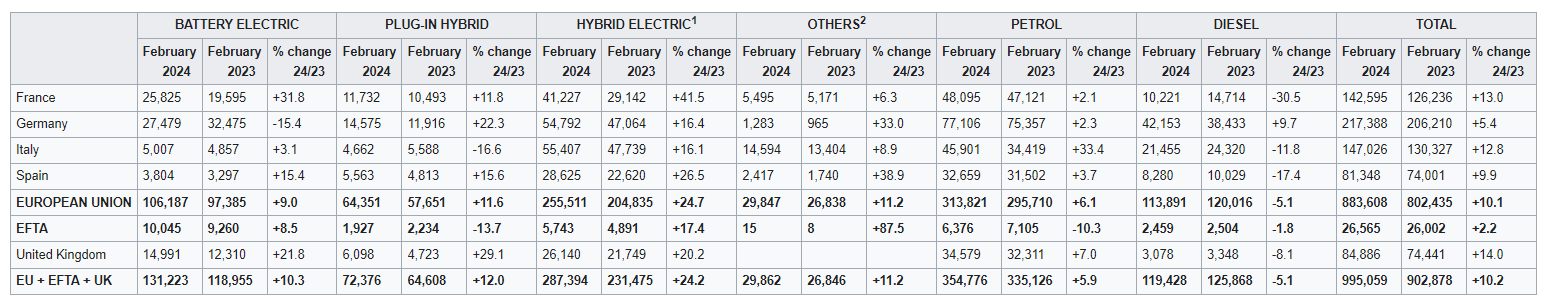

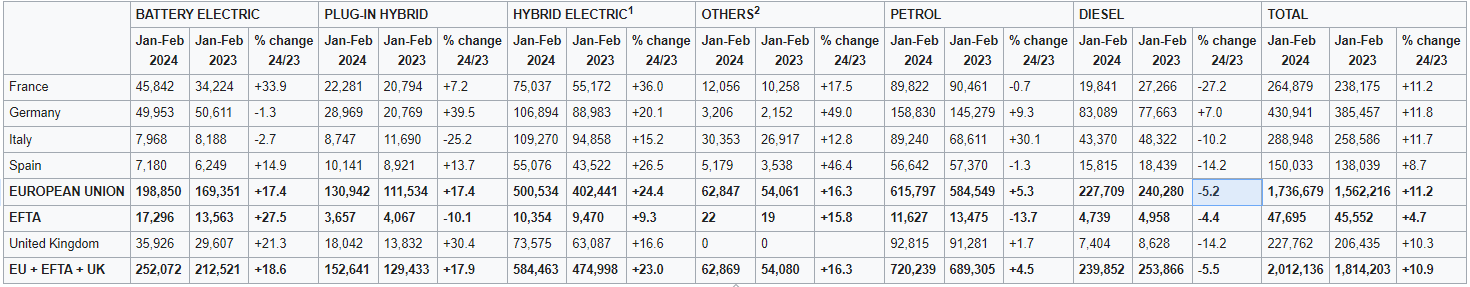

Passenger car registrations in the European Union increased 10.1% yoy to 883.6 thousand units in February 2024, following a 12.1% jump in the previous month.

Meanwhile, battery electric car registrations in the EU rose 9% to 106.2 thousand units, accounting for 12% of the market, following a 28.9% surge in January.

For the first two months of the year, car registrations climbed by 11.2% to 1.7 million units

It’s interesting how much the European car market expanded in 2023 and is still expanding at the beginning of 2024 despite the weak state of the Eurozone.

What are the strongest reasons for this? Is it the shortages of the last years that you’ve cited in your first post or also the fact that used cars are still expensive?

Do we know what “neutral rate” of newly produced cars Europe needs on an ongoing basis? Which factors are influencing that “neutral rate” the most? For example, is it correlated with the interest rate environment or not at all?

Do we follow any experts discussing those factors?

How often does ACEA update its forecast? Can we expect 2024 to become better than 2.5% growth, or was a tailwind in the beginning of 2024 expected with a more significant slowdown later on?

Ps. Good first post. I recommend reading it e.g. to understand the importance of the car industry to Europe with more information about trade balances in the Wiki.

Is probably still the fact that they are still catching up to prior to 2019 levels.

Even with last year’s high growth of 14%, the EU 10.5M registrations, are still lower than the 13M in 2019, or even 15M in 2018 and 2017.

EU Production was 12M in 2023 (11% Y/Y), vs 14M in 2019.

It did grow lower than registrations in 2023 (14% vs 11%)

I have not found anything about a neutral rate, but it was pretty consistent at ~13-14 M before COVID. But I don’t think it is as straightforward since imports/exports will play a role in this sector, so market share loss could lead to lower volumes needed going forward.

After 2009 crisis, they never went back to the level of production they had before (~17M in 2007) when China took market share.

And I don’t follow or know experts for the European auto industry other than ACEA, or some auto news sites.

And for the ACEA forecast, they updated last year’s forecast until the very end (from 5% to 12%). And I would not have high confidence they will be correct, since last year they were pretty wrong (5% forecasted in January vs 14% actual).

January and February 2023 were in the low side, so the base will become more difficult in some coming months.

Yes, very good point that production locations are shifting.

That can also be seen looking at our global overview of production.

I think what we should focus on then is the neutral demand level per region.

As an example has automotive demand (registrations) been stable in Europe in the last decades? (The longer the timelines we can find the better + we need to make sure to have Brexit consistent format)

How about the other regions? Which regions are stable? Which are still growing and how fast? Are any shrinking? (We can use the other region-specific topics to discuss those in more detail + create a comprehensive model in sheets and/or in tableau)

By going through this exercise, we can hopefully better understand the overall automotive market and expected demand in the coming decade + understand if there are any catch-up effects from easing supply chains left.

This would help us in turn to refine our Volkswagen unit sales assumptions. (In combination with our work on Volkswagen market shares)

As Volkswagen is operating in segments, the most ideal data would be by region and segment (luxury, economy, etc.), but if that is difficult to find, having plain numbers on volume would be a good start already.

When I was working on the Automotive Cyclicality article I already spent a good amount of time (hours) trying to find sales data by region that could be compared, and was unsuccessful. Even for China, I had to manually search for news for 2009 . (The US and Europe has more data available, but is not from the same source and timeline is not as long).

And by segment, I have not even seen it (for free) for the US that it is the richer data region.

I will give it another try, but at this point, I am unsure if you would be able to have all that you need.

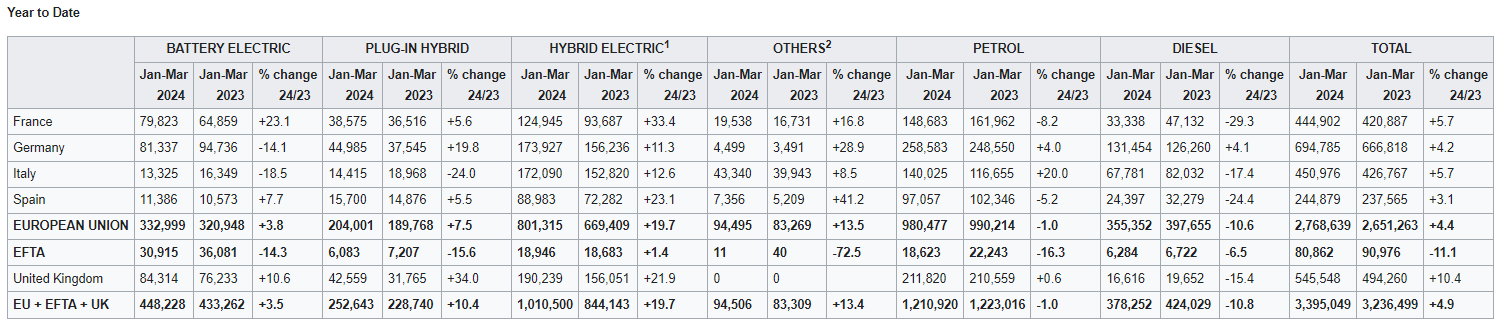

March 2024 Europe registration shows a decline, they are attributing the decline to the easter holidays.

-

EU car registrations decline by -5.2 Y/Y on March 2024, and -2.8 Y/Y for EU+EFTA+ UK.

-

Battery electric declined by -11% Y/Y, but hybrid electric showed growth of 15.4% Y/Y.

-

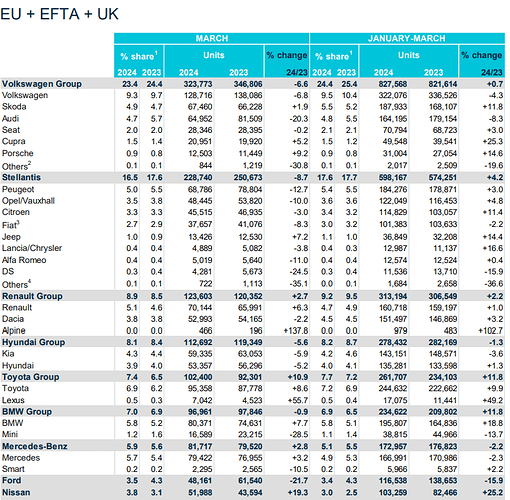

For Q1 2024, EU grew registrations 4.4%y/y to 2,769,639, and EU+EFTA+UK 4.9%y/y to 3,396,049.

-

Battery electric grew 3.5%y/y to 448,228 registrations in all Europe, and hybrid electric grew 19.7%y/y to 1,010,500

-

These were registrations by major manufacturers.

A post was merged into an existing topic: Automotive Industry: Pricing

4 posts were merged into an existing topic: Trade Tariffs

A post was merged into an existing topic: Automotive Industry: Pricing

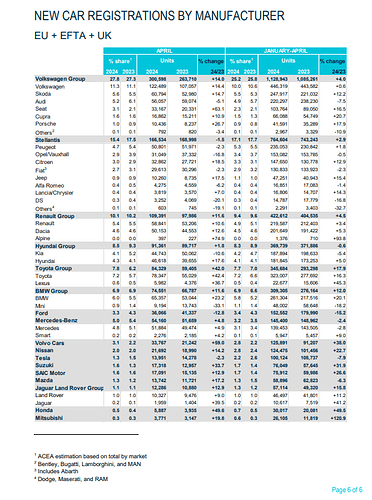

- EU new car registrations rose by 13.7% to 913,995 units in April, driven by strong increase across all markets.

- BEV registrations grew by 14.8% to 108,552 unit while Hybrid-electric car registrations was up 33.1% to 265,992 units.

- Here is how each manufacturer performed in April:

https://www.acea.auto/files/Press_release_car_registrations_April_2024.pdf

A post was merged into an existing topic: Trade Tariffs