I will start to summarize some of my findings:

Assessment: I don’t see a good outlook short or long term for the European auto market. While maintaining market share in Europe will probably be easier (still questionable), global market share is the one I think could continue to decline significantly, especially China. It has started to do so already.

From Moody’s (post below),

Since 2019, European incumbents have lost six percentage points of market share in their home market and five percentage points in China. Meanwhile, Chinese OEMs are gaining ground in both China and Europe, reaching 45 percent market share in their home market in 2022 and octupling their market share in Europe between 2020 and 2022.

My reasons that this could/will continue:

- Currently, Europe, especially Germany, are experiencing difficulties in their economy. Lower economic activity, sticky prices, higher rates, banks tightening credit standards. Auto sales have held out pretty well, probably due to shortages in past years, but if the weakness continues they are probably going to be hit too, lowering growth short term for the industry.

- While an economic contraction or recession long term is not a huge deal, it will restrict the amount of investment specific companies, suppliers and the whole region can do for some time. Investment that I think is needed more than ever and as soon as possible to remain competitive in the EV transition.

Better said is that an economic contraction could come at the worst time for the industry, imo the more they delay investment, the more market share will be lost to other participants that have already done this initial investment. - If we are entering an environment of higher rates long term due to structural changes causing higher inflation, investments will become more difficult and costly too.

Including buying a car from the consumer’s point of view. Affordability could become a problem, and better pricing from Chinese u other competitors could become more attractive. - Just to maintain market share or competitiveness in the EV transition, there needs to be big changes in all parts of the supply chain to the manufacturers. The amount of investments, collaboration, alliances, and policy response needed is significant, and I don’t actually see huge developments in Europe in that direction currently, there are some advances but don’t seem enough (Please let me know if you do see more). And the current planned decoupling in global economies is probably not going to help with this.

- Changes in demographics are probably going to be a headwind going forward too.

I probably still have a lot of gaps in information which could change my thinking, especially about China, but I will continue to monitor all the info that I am able to find.

Obviously, this is for the whole industry, there could be individual winners within the industryz and it will probably depend on how quickly they adapt.

Summary:

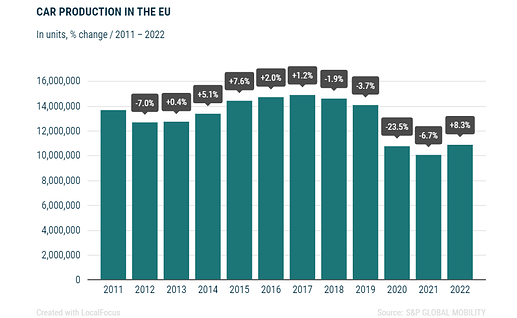

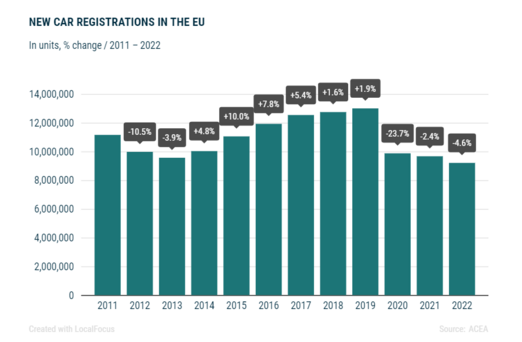

- While registrations are low compared to 2019, they are growing nicely in 2023, registering a 17.6% YTD in the EU as of July 2023. Forecasts are expected to grow 5% y/y (they have been growing more than this), but most likely still below the 2019 level.

- Decline in registration is in line with the decline in production

- The turnover generated by the auto industry represents almost 8% of the EU’s GDP

- 13.0 million Europeans work in the auto industry (directly and indirectly), accounting for 7% of all EU jobs

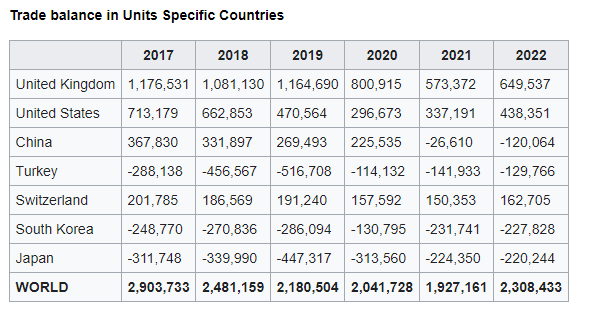

- The automobile industry generated a trade surplus of €95.68 billion for the European Union in 2022

- Between 2019 and 2022, the market share of alternative energy vehicles climbed from 11% to 47%

- I unfortunately have not found data on the credit quality and developments of the auto market for now.

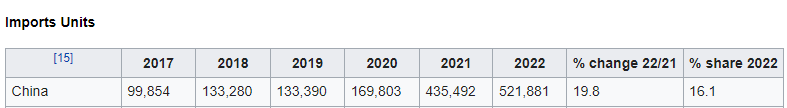

What I have found particularly interesting is the big jump in imports from China in 2021. This is in line with growing competition concerns

- China is the only country going from a trade deficit (in units) to a trade surplus with the EU. Not only imports have increased, exports have also declined a bit.

- In terms of value the EU still has a trade surplus with China, due to pricing.

- China imports represented 1.02% of registrations in 2019, and increased to 5.64% in 2022. Represented 0.95% of production in 2019, and 4.85% in 2022.

- China imports represented 2.58% of total imports in 2017 and grew to 16.09% in 2022.

- Trade balance has also deteriorated with the US. Interesting the increase in imports from Morocco too.

I have found some interesting research talking about the fact that if the EU does not increase investment, and collaboration, and create better policies for the EV transition, the most likely outcome is a decline in market share in the EU and China markets. I will summarize some of these in posts below.