The topic is focused on developments in the US treasury issuance, moves in the yield curve, flows into treasuries, and analyst opinions or arguments about its attractiveness as an investment during different environments.

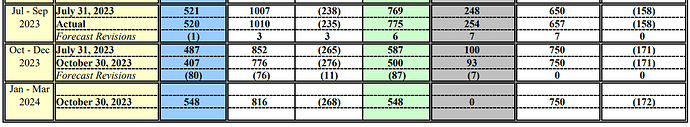

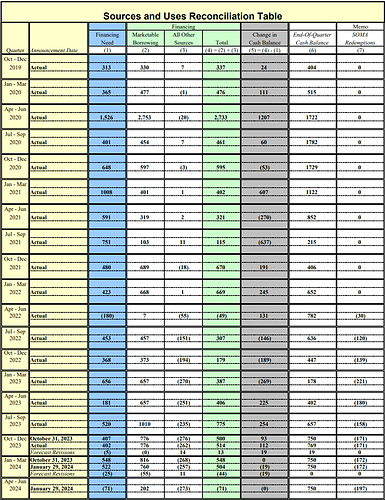

Treasury expects to borrow $776bn in the period between October and December, less than the $852bn initially forecast, and lower than the $1tn borrowed in the previous quarter, due to projections of higher receipts somewhat offset by higher outlays.

During the next 2 quarters is expected to borrow 1.592 trillion.

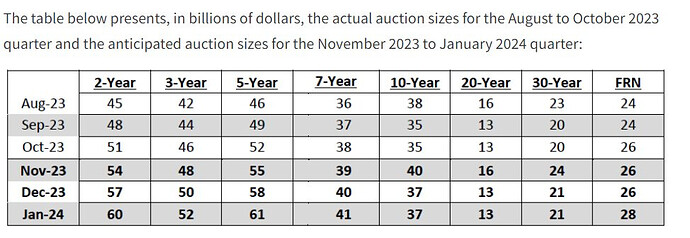

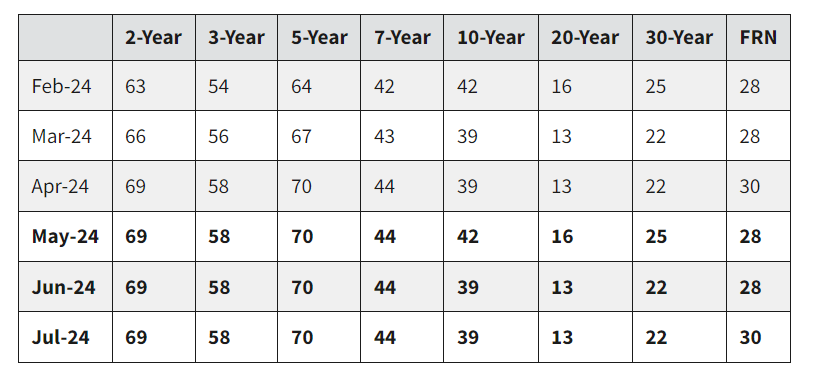

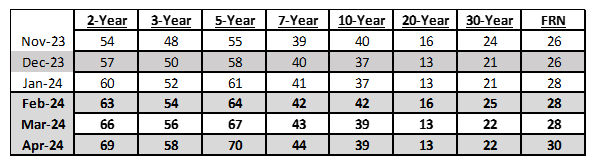

The Treasury also announced in its refunding statement that it would continue to increase issuance of shorter-dated notes at the pace it set three months ago, while slowing the pace of 10- and 30-year bond issues.

- US Treasury’s debt sales will total $112BN, which while an increase from the $103BN unveiled in August, was less than the $114BN anticipated by Wall Street bond dealers It was the second straight boost to the so-called quarterly refunding, but slightly less than expected.

- Treasury will raise the auction sizes of the two- and five-year notes by $3bn per month, with a rise in 10-year note auctions by $2bn and in 30-year bond auctions by $1bn. In August, the Treasury had increased its 10-year auctions by $3bn and its 30-year auctions by $2bn.

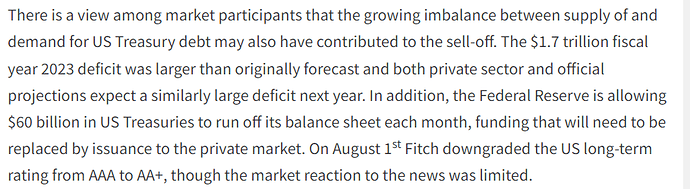

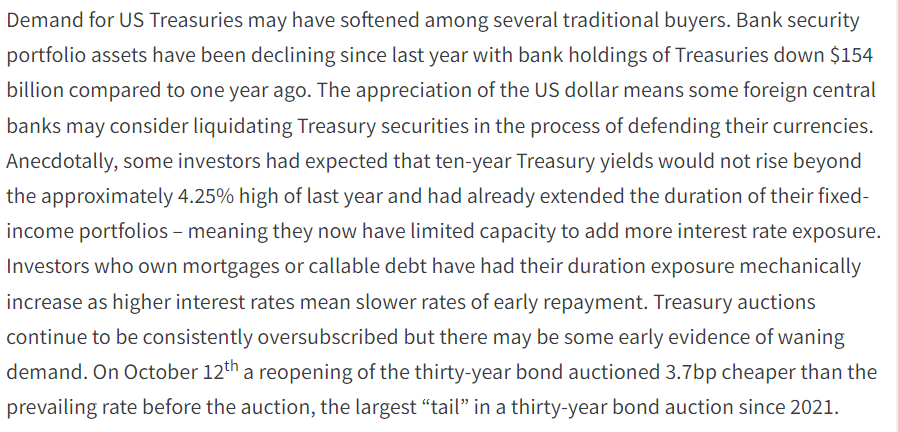

Interestingly their advisory committed is also acknowledging the demand problem for treasuries.

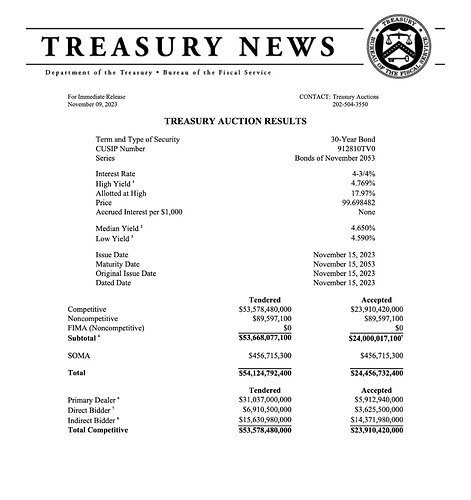

Not a pretty 30-year bond auction today again, despite the treasury announcing plans to issue less long-term bonds than expected, they still need to sell a significant amount with very weak demand, so these actions will probably continue to be high volatility events.

Foreign bidders (Indirects) tumbled from 65.1% to 60.1%, the lowest since Nov 2021, and with Directs taking down only 15.2%, banks (Dealers), who are obligated to finance whatever portion of a Treasury auction isn’t purchased by other investors, bought 24.7%, double the recent average of 12.7%, and the highest since Nov 2021.

Moody’s cuts US outlook to negative from stable. Moody’s is the last of the big 3 to still have a AAA rating on US debt.

In August, Fitch cut the rating.

“In the context of higher interest rates, without effective fiscal policy measures to reduce government spending or increase revenues,” the agency said. “Moody’s expects that the US’ fiscal deficits will remain very large, significantly weakening debt affordability.”

“Continued political polarization within US Congress raises the risk that successive governments will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability,” the ratings agency said.

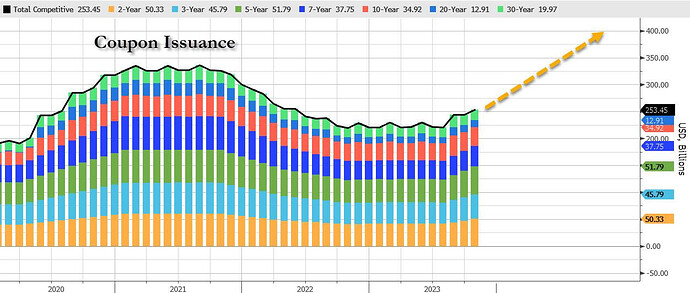

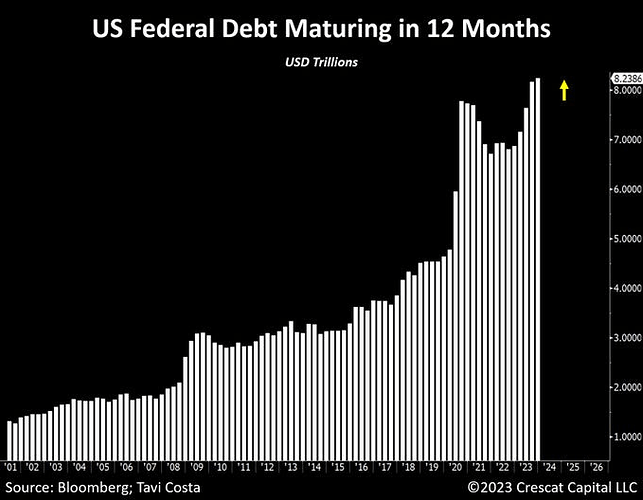

$8.24 Trillion of U.S. Treasuries will mature in the next year, 1/3 of outstanding debt. This while deficits are expected to continue growing, demand is weak, and some big players are reducing holdings. So, the pressure on rates will probably continue while this is the case.

I also, sometimes don’t understand why the treasury did not issue more long-term bonds while rates were low and liquidity ample. The way households did with mortgages and companies with some of their debt, is like they have zero planning, and never expected rates to be high ever again.

https://twitter.com/Barchart/status/1724596138840297760/photo/1

Will share if I find the whole maturity schedule later.

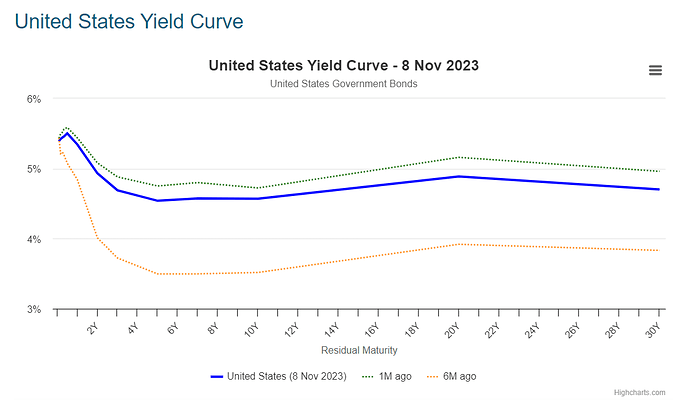

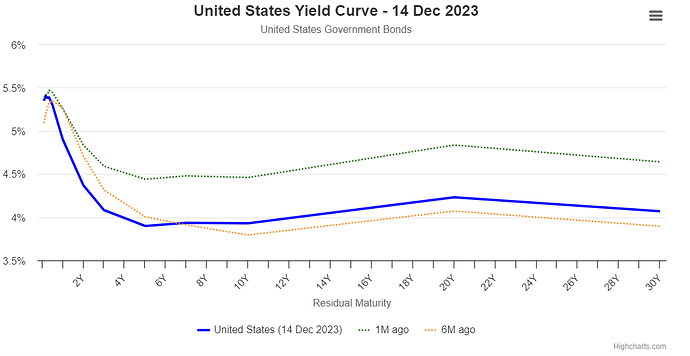

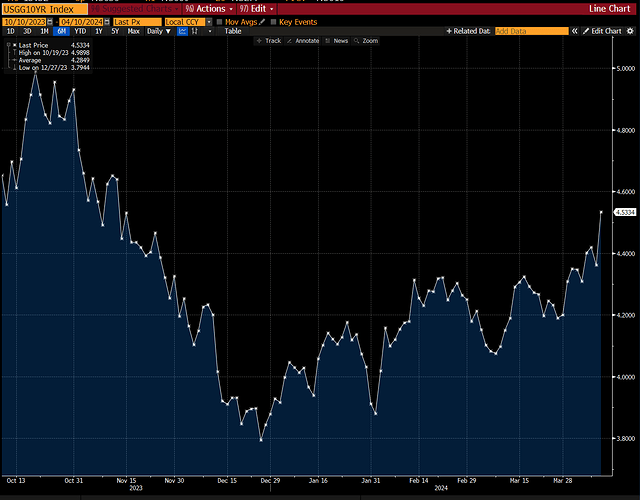

Crazy volatility in yields lately. All the previous increases since August has been eliminated, 10 years now below 4%

The 10-year Treasury yield approaches 4% again, reversing the downward trend witnessed towards the end of 2023.

The US Treasury reduced it’s estimate for Q1 2024 borrowing to $760B from 816B And estimates only 200B for Q2, with a cash balance of $750B

It also said in the fourth quarter of 2023, the Treasury borrowed $776 billion in net marketable debt, in line with estimates released in October last year. It ended the fourth quarter with a cash balance of $769 billion.

The markets reached very positively to this, causing the spike at the end of trading day.

However, the big realeased that markets are mostly expecting is on Wednesday that they will announce the composition between Tbills and Bonds.

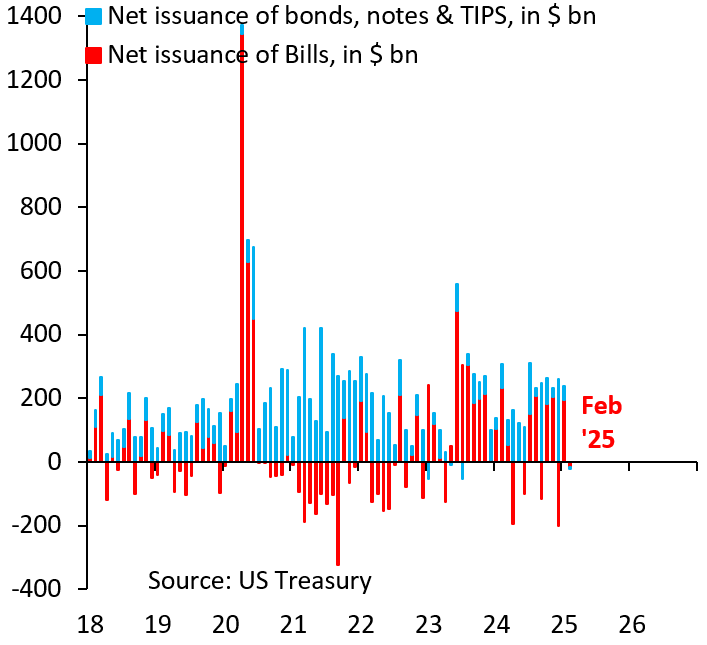

The treasury announced today that it will increase the duration in its debt auctions, and will reduce Tbills issuance. While this is not exactly bullish for risk markets, it came within expectation, and the reaction was minimal. Today NYCB earnings had more impact in yields.

The reductions in bill issuance could also slow the pace of decline of the reverse repo facility and hence delay the slowing of QT too. But at the same time increased in duration could decreased bank reserves, creating the need to slow QT.

Some of their comments are:

- Based on current projected borrowing needs, Treasury does not anticipate needing to make any further increases in nominal coupon or FRN auction sizes, beyond those being announced today, for at least the next several quarters.

- Given current fiscal forecasts, Treasury expects to maintain bill auction sizes at current levels into late-March. Treasury anticipates that this will likely result in a $300-350 billion net increase to privately-held supply over the next two months.

- By late-March or early-April, Treasury anticipates modestly reducing short-dated bill auction sizes going into the tax filing season. These reductions will likely lead to a $100-150 billion net reduction to privately-held supply during the month of April.

- n preparation for the implementation of a regular buyback program later this year, Treasury anticipates conducting several small-value buyback operations in April with a limited population of securities to test processes and infrastructure.

Quarterly Refunding Statement of Assistant Secretary for Financial Markets Josh Frost

Treasury yields have been on the rise again.

Today’s increase in 10Y yields was significant after CPI, and on top of that the 10Y auction today was bad too, adding to it.

Tomorrow we also have the 30Y auction.

- Tail was 3.1 bps vs. 0.7 bps avg of last 6 auctions

- Foreign bidders dropped to 62% from 71% in Feb.

- Bid to Cover was a 2.34 vs 2.52 recent avg

- Dealers were saddled with 24% of the auction, up from 13% in Feb.

Avoiding disruptions in treasury liquidity is probably one of the reasons the FED wants to slow QT.

A strong rise in treasury yields and implied interest cut expectations was certainly the main outcome of yesterday CPI release.

That is good news for dollar holders at least in the short term, who saw the dollar strengthening and short term yields on 2 year treasuries jump more then 20bps to almost 5%.

Yes, what is interesting is that stock indexes have not caught up to it yet as they did last year.

I am unsure what they are pricing at this point, or if there is a higher threshold in yields that will cause a reaction.

But higher levels of inflation going forward would mean you need to be in risk assets even if its volatile and have drawdowns.

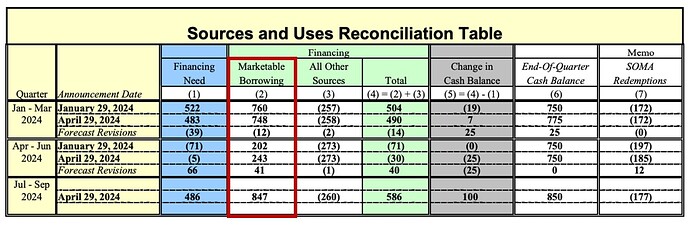

Monday, the U.S. Treasury announced its current estimates for borrowing. They expect to borrow around 1.2Trillion dollars in the next two quarters.

-

For Q2 2024, Treasury expects to borrow $243 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $750 billion. This borrowing estimate is $41 billion higher than announced in January 2024, largely due to lower cash receipts.

-

For Q3 2024 , Treasury expects to borrow $847 billion in privately-held net marketable debt, assuming an end-of-September cash balance of $850 billion.

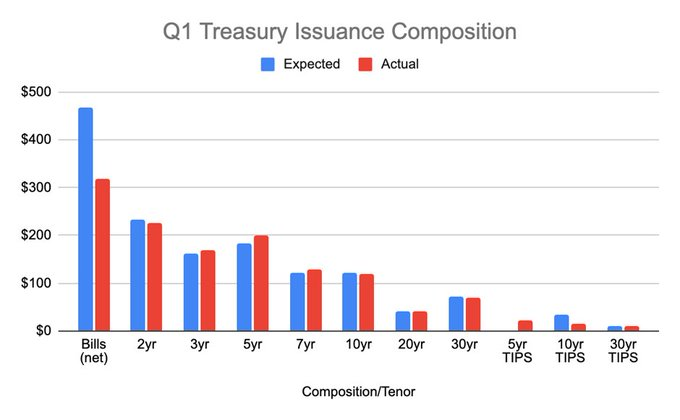

Today they announced their debt composition for the borrowing, which did not show any significant changes in long duration from the recent quarter.

The US Treasury is also launching its first buyback program since 2002, scheduled to start on May 29, 2024. The program is designed to improve liquidity in the Treasury market and is expected to run through July 2024.

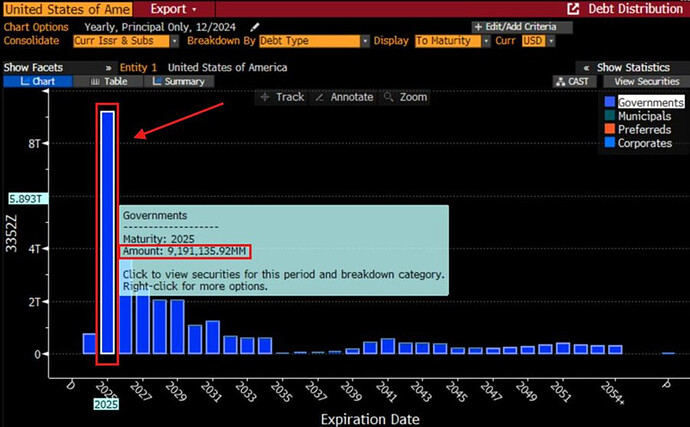

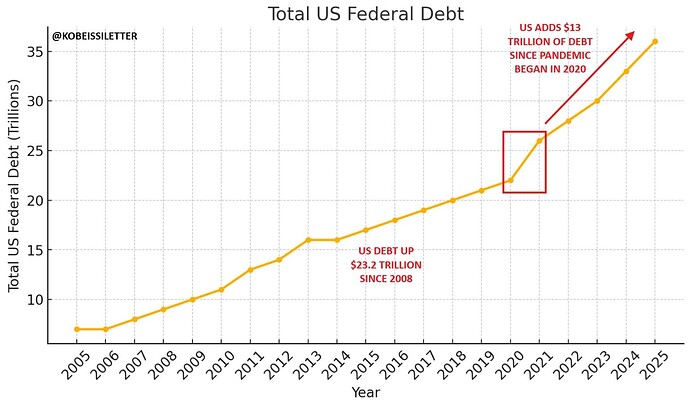

In 2025, $9.2 TRILLION of US debt will either mature or need to be refinanced.

- The US now holds $36.2 trillion worth of government debt, meaning 25.4% of the total is set to mature.

- Since 2020, total US debt is up $13 trillion or $2.6 trillion PER YEAR for 5 straight years.

- The maturity schedule for the $9.2 trillion of US government debt is heavily weighted to the front half of 2025. Between January and June 2025, nearly 70% of this $9.2 trillion will need to be refinanced.

Assessment: In my opinion this strategy to fund the goverment with mostly bills have been a really bad decision, now the treasury will have huge refinincing needs every year, and no much room to extend duration due to preasure on yields, lower demand overall for duration, and no more reverse repo either. Their refininfcing needs + new debt will also absorb a lot of liquidity, which could create more problems when liquidity is not as abundant.

New Treasury Secretary Scott Bessent has kept Janet Yellen’s strategy of maintaining long-term debt sales unchanged, despite his past criticism of her approach.

- The Treasury will sell $125 billion in the upcoming quarterly refunding auctions:

- $58 billion in 3-year notes (Feb. 11)

- $42 billion in 10-year notes (Feb. 12)

- $25 billion in 30-year bonds (Feb. 13)

- The forward guidance remains unchanged, though the Treasury Borrowing Advisory Committee (TBAC) recommended modifying or removing it due to economic uncertainty.

- Dealers expect larger long-term debt sales later in 2025, possibly in August or November, due to persistent fiscal deficits.

- TIPS issuance (Treasury Inflation-Protected Securities) is increasing, while floating-rate debt remains unchanged.

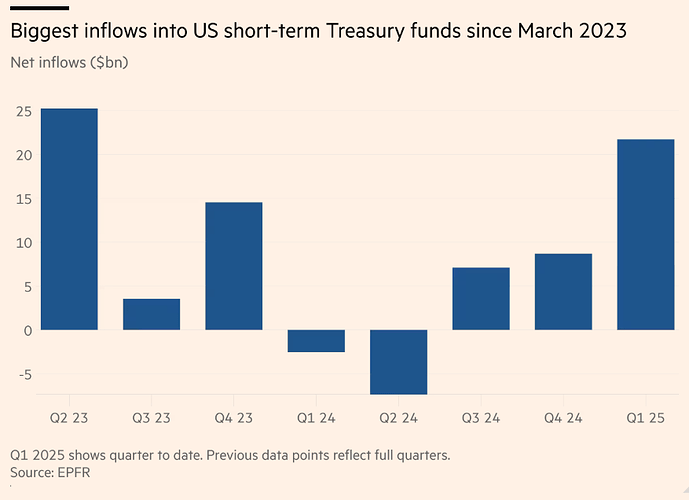

Investors pump $22bn into short-term US debt due to uncertainty

Net inflows into short-dated Treasury funds hit about $21.7bn between early January and March 14, according to EPFR data, setting the stage for the biggest quarterly flood into the vehicles in two years. Flows into long-term government bond funds were also positive for the quarter to date, but totalled a much smaller $2.6bn.

A post was merged into an existing topic: US Long Term Bonds Yields Developments